If you want a simple, all in one place to build diversified wealth then Raiz is a great option

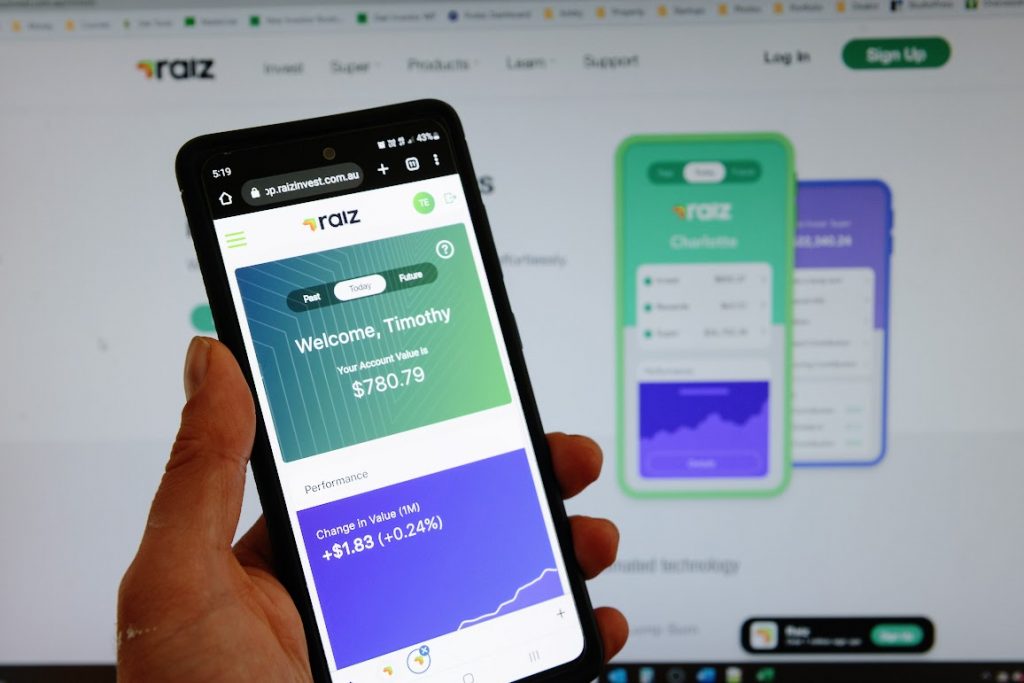

Some would say this is the original investing app. The one that used to be known as Acorns in Australia.

I've been using Raiz since early 2016. I remember when because I joined about a week before my son was born. It wasn't until I was killing time in the hospital after he was born that I finally had a real look into it.

The Raiz app was colourful, and simple and wasn't like any broker or stock market tool I'd used before.

I connected it to my bank account and used the roundup feature (more on that soon) to add money to it over the first year and saw some good returns. Was like watching a savings account grow.

From there I got a bit more focused on it, started to drop large amounts and a few years later I used the balance to help pay for a property which was a great feeling.

In a way I feel like Raiz has helped me build wealth quicker, getting me to my financial goals sooner. So let's look into how it works and what features I really rate in this Raiz Review.

Raiz review: My Verdict

The very first Australia investing app is one I highly regard and recommend to those interested in simple, uncomplicated investing.

Benefits

- Need little money to start with

- All in one / set and forget option

- Sustainable options

- Investing automatically either by a set amount or by rounding up your purchases

- Select from a broad range of well-built portfolio

- Build your own fund via Raiz Plus using a mix of ETFs, ASX stocks, Bitcoin

- Buy fractional shares so can invest immediately

- Rewards Program

Considerations

- Costly if the balance is under $7.5k

- Easy to make changes (maybe too easy)

- Limited to invest in predetermined portfolios, or selected ETFs

What is Raiz Invest?

Raiz invests money on your behalf through a collection of ETFs (or more if using Raiz Plus) that are commonly bought and sold on the ASX.

Prior to it being known as Raiz Invest, it was Acorns. Acorns Australia was the original investing app in Australia. It was an offshoot of the American version which still exists today as that name.

In Australia, it's Raiz Invest which is an Australian-listed company on the ASX.

Raiz is what I call a “do it for me” investment product. A bit different to picking stocks or actively investing.

Once set up, it will do all the work for you so you can set and forget (like your super).

If you are needing some support with investing ETFs or want to become a successful investor in the stock market, check out my course on building an investment portfolio.

How much can you make on Raiz?

The amount you can make on Raiz depends on factors like your investment contributions, the performance of your chosen portfolio, and market conditions.

While Raiz aims to grow your investments over time, it's important to remember that returns are not guaranteed, and investing always carries risks.

How to use Raiz

Think of Raiz as a savings platform for the long term (like 10-plus years). But instead of money going into a savings account, it goes into the stock market via ETFs.

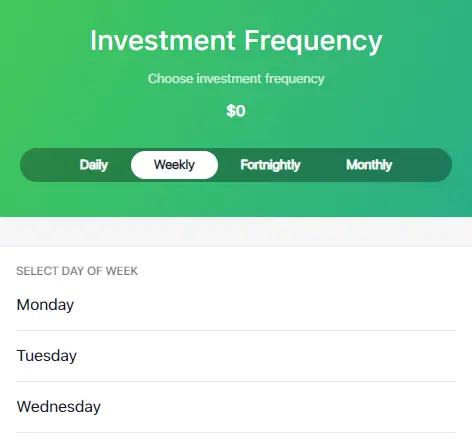

One of the first considerations to make with Raiz Invest is how you will add money to it. There are two ways.

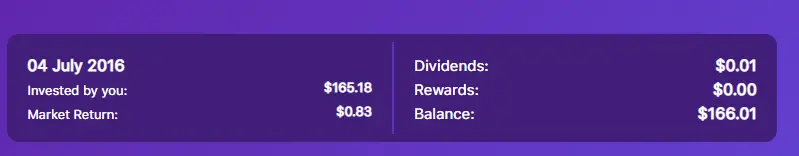

Raiz Round-ups

Raiz gained popularity through what's called the “round-up” feature. Today many banks offer this feature, but back in 2016, it was rare Raiz had a unique selling point with it, and was one reason I started using it.

When purchasing anything on a nominated account, for example, a coffee for $3.50, the cost is rounded up to the nearest dollar. So if you spend $3.50 then 50 cents is sent to Raiz. This is helpful if you are doing several purchases on a particular card. You'll find over time the pot is filling up.

This is how I started adding to Raiz's account. I don't do this anymore as I contribute a set amount on a fortnightly basis instead but it's easy to turn on and off this feature which is not mandatory to use.

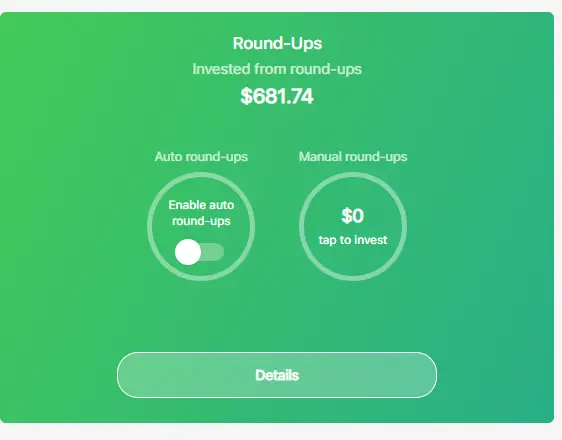

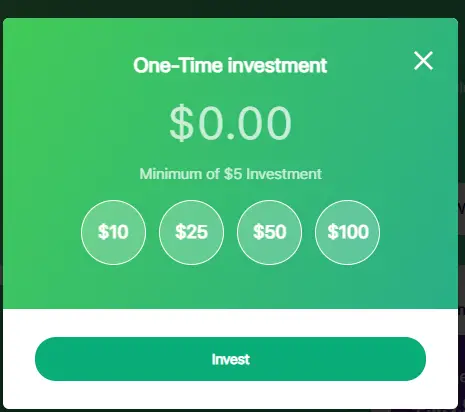

Deposit money

You have the option to add additional payments from your bank account to your Raiz investment account.

This can be done manually or automatically via recurring payments (eg. weekly, monthly).

In both situations, you'll need to link a bank account for your money to be taken to. Unlike bank transfers, you can't send money to Raiz any other way than via the Raiz app.

Investing with Raiz

Raiz is a powerful investing platform that can help you grow your wealth quicker than a bank account. This is due to the higher returns of the stock market, which is what Raiz uses to invest his money.

There are two stand-out features that make Raiz such an accessible and simple way to invest in shares.

Through ETFs or exchange-traded funds

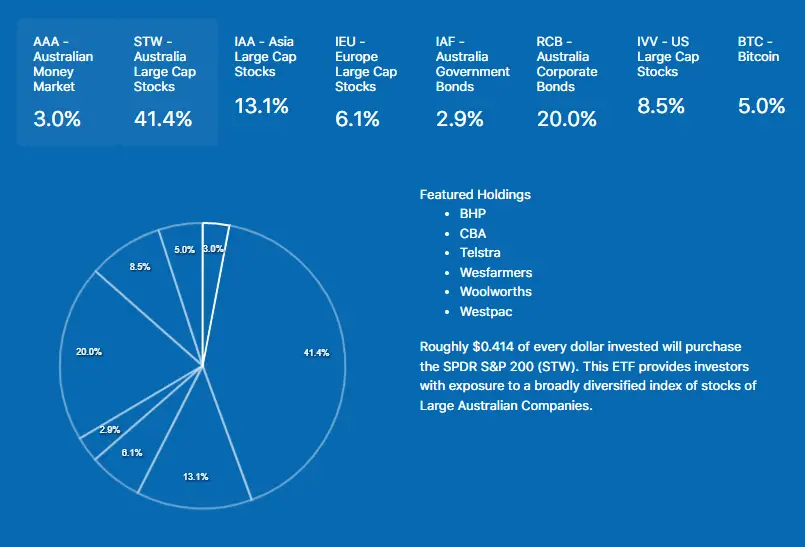

Your Raiz account will be dedicated to a group of mainstream ETFs that have good track records of performing.

Here are some examples of the ETFs Raiz uses

Australia Large Cap Stocks (ASX:STW)

Asia Large Cap Stocks (ASX:IAA)

Europe Large Cap Stocks (ASX:IEU)

US Large Cap Stocks (ASX:IVV)

Composite Bond ETF (ASX:IAF)

Corporate Bond ETF (ASX:RCB)

High Interest Cash ETF (ASX:AAA)

Fractionally

The beauty of using Raiz to invest is that they will take any amount of cash and invest it, which means they will buy a fraction of a share for you. No more do you need to wait until you have the exact price of the share to buy, you can do it straight away (starting even just $5).

Online brokers have a minimum investment of $500, meaning you need that much to invest and then it is unlikely to be that exact amount as your investment needs to match the price of the shares by the amount of units you want.

So you can treat Raiz like a bank account and allocate consistent amounts regularly to it.

One of the first steps you need to take with your new Raiz investment account is which portfolio to invest in.

You do that by picking a pre-built portfolio in Raiz Standard or build your own in Raiz Plus.

Raiz Standard

Raiz has 8 prebuilt portfolios to pick from if you want to go with something easy and done for you.

Each of the pre-built portfolios is a collection of Exchange Traded Funds (ETFs) that represent different sectors of the global economy.

This diversified approach aims to mitigate risk: even if one sector or ETF performs poorly, others may do well, providing a balance to your investment.

They are titled so

Conservative (lowest risk)

Moderately conservative

Moderate

Moderately Aggressive

Agressive

Emerald Portfolio

Sapphire portfolio (highest risk)

- Raiz Property Fund

Each portfolio has a different balance of stocks and bonds from the conservative option (22% stocks) to the aggressive growth option (90% stocks). This type of naming convention is similar to what you see for your superannuation.

There is also the Sapphire portfolio which includes 5% bitcoin, with 69% in stocks and the rest in bonds. Probably one of the easiest most diversified ways to get crypto into your investment portfolio but then again the risk is much higher.

The Raiz Property Fund offers investors a way to tap into the Australian residential property market. If you have a Raiz Investment Account, you can indirectly get exposure to this market via the Raiz Invest Australia Fund. ‘

This fund aims to give you potential capital growth by investing in a diverse range of Aussie homes. The Raiz Property Fund isn't listed on any stock exchange and can only be accessed via Raiz.

Raiz Plus

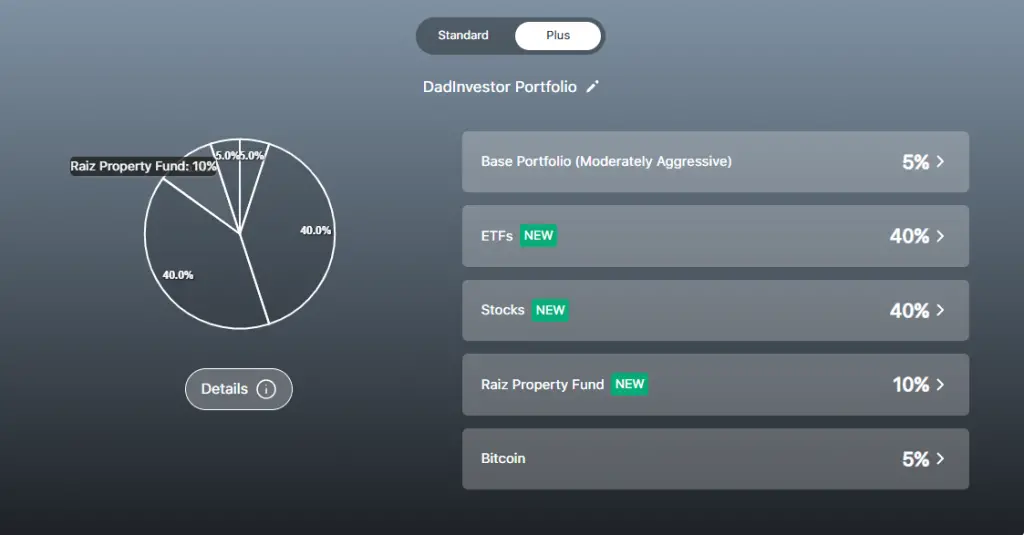

In 2023 Raiz upgraded its Custom Portolio feature and relaunched it as Raiz Plus.

Raiz Plus offers you the chance to craft a bespoke portfolio, tailored to your financial aspirations (which I personally think is fantastic).

It allows you to hand pick from selected ETFs, ASX stocks, Bitcoin and Property to build your own mix that you can allocate and invest in as your all in one portfolio.

How Raiz Plus Works

Raiz Plus costs $5.50 a month ($1 more than a Standard Raiz portfolio).

When selecting Raiz Plus the platform will ask you to pick a Raiz Standard portfolio.

From there you can add allocations towards

- 23 ETFs – Diverse Exchange Traded Funds to choose from.

- 50 ASX Stocks – Handpick from renowned Australian stocks.

- Raiz Property Fund – Get a taste of the Australian residential property scene.

- Bitcoin – A max of 5% allowed to be allocated

It is a great tool for individuals wanting some freedom with regard to asset allocation but isn't interested in stocks individually.

It's a fantastic mix of being in more control of where your money is invested but reducing the need to buy and sell the number of options individually.

For example, you could have a portfolio of IOO, IVV, Telstra, CSL, Woolworths, Property, and Bitcoin in one portfolio.

To invest in all those assets you'd only need to add money to Raiz who splits up the money you added around those investments. This saves time and effort as it means you no longer need to use multiple platforms and manually trade.

Do note that with more control, you need to be more aware of the risks you take on.

What ETFs are available through Raiz?

When building Raiz Plus portfolio you can now select from 30 different ASX-listed ETFs plus Bitcoin and a property fund. These include:

- IOO – Global 100

- IAA – Asia Large Cap Stocks

- IEU – Europe Large Cap Stocks

- IVV – US Large Cap Stocks

- ETHI – Global Socially Responsible

- NDQ – Nasdaq 100

- VGE – Emerging Markets

- WDIV – Global Dividend Fund

- QUAL – International Quality

- IWLD – World Markets excluding Australia

Australian ETFs

- STW – Aus Large Cap Stocks

- RARI – Aus Socially Responsible

- FAIR – Aus Sustainable Leaders

- VSO – Australian Small Companies

- VETH – Ethically Conscious Australian Shares

- SYI – Australian High Dividend

Fixed interest and cash ETFs

- AAA – Cash ETF

- IAF – Aus Bonds

- RCB – Aus Corporate Bonds

- VEFI – Ethically Conscious Global Bonds

- VCAF – Aus Corporate Bonds

Trend, themed and sector focused ETFs

- IXJ – Global Healthcare

- Bitcoin (but no more than 5% of overall portfolio)

- IFRA – Global Infrastructure

- ERTH – Climate Change innovation

- HACK – Global Cybersecurity

- ACDC – Battery Tech & Lithium

- QAU – iShares Gold Bullion

- RBTZ – Robotics

- SEMI – Semiconductors

- ROBO – Robotics and Automation

Property

- RPF – Raiz Property Fund (not a listed ETF)

Up until this was launched I owned many of these ETFs individually through SelfWealth and CommSec Pockets.

The problem with that was if I wanted to invest in them I had to manually do that on an individual basis. So if I wanted to add money to 5 different ETFs that would cost me for each of those trades.

Now with Raiz, I can put my investing money straight into the portfolio via the app and it gets cut up and then sent to all the selections I want.

There are higher costs for this portfolio type but feel it is a very cheap investing service, saving me time as well.

You can change this portfolio option at any time and always go back to the preselected portfolios or change your ETF/percentage mix as you go.

Raiz's Fees

Raiz makes its money from charging you a monthly account fee, as opposed to brokers that charge you when you buy or sell stocks.

BUT consider the work that Raiz does for you to provide their service.

- No trading costs

- Rebalancing included

- Can reallocate or change portfolios at any time

Raiz is completely transparent with its pricing and while they do infrequently increase their fees, it is still an affordable option as you do not have to pay to trade (add or withdraw money) and they keep your portfolio well balanced.

Standard Portfolios

For 7 premixed portfolios (everything but Property and Sapphire) it's $4.50 a month when under $15k, then .275% of your balance for those holding more than $20,000.

That's $54 a year.

Plus Portfolios

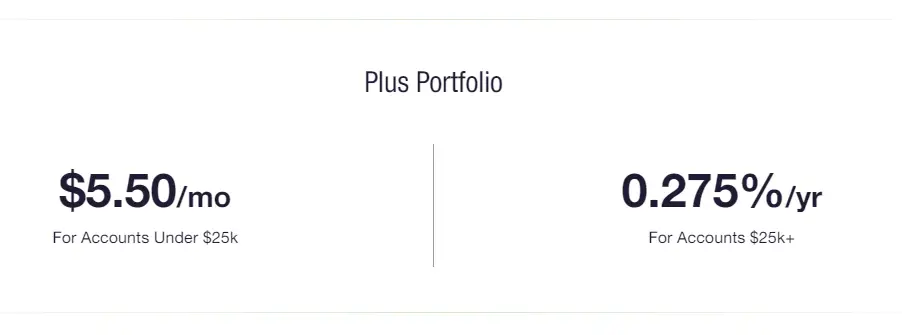

For Raiz Plus portfolios it's $5.50 a month when under $25k, then .275% of your balance for those holding more than $25,000.

That's $66 a year.

Sapphire Portfolio & Property Portfolio

The account costs for the Sapphire Portfolio and Property Fund is a monthly fee PLUS a percentage of the balance. This is $4.50 on top of .275% of the balance.

For a balance of $25,000 this would mean you are charged around $135 a year.

It would seem if you liked the features of Saphire or Property in Raiz that you build a Raiz Plus portfolio within the app to reduce costs there.

Performance

Investing in shares is good for long-term returns.

It’s likely that some users of the Raiz app are not familiar with stock markets. Not that share prices could drop or rise. If you look at the Raiz app every day you might get a bit emotional about it.

ETFs are regarded as safer investment options as they buy large stocks with diversified risks.

The portfolios returned between 4.9%pa and 12.44% pa for the 3 years up to the end of mid-2021.

Other features

Raiz Rewards

Raiz presents offers through partner shops where you get a cut of your purchase sent back to your Raiz investment account.

It's ok if you are buying the product anyway but I've never used the service and find its mostly non essential items that are on offer.

They do offer rewards for surveys though so likely worth having a look through.

Raiz Super

Raiz has a super fund, which invests in the same portfolios (minus the Bitcoin option).

Personally, I don't have my super in Raiz and feel that there is nothing significantly different or better than most industry super funds out there to consider it.

Raiz Kids

Investing for kids is a common thought for newer parents and Raiz Kids is a pretty basic offer to this.

You can set up a dedicated account linked to your Raiz Account, specifically for your children.

You can then choose what they are invested in and even set up what control they can have on the account or whether you just do it all.

The important aspect here is any earnings are deposited on the parent's behalf until the children turn 18. Another consideration is capital gains tax on transfers to an 18-year old. Then the trustee of the funds will treat the transaction like a sale of your shares, and therefore make no difference to using Raiz Children's features.

Uniqueness factor

How does Raiz compare to other investing apps in Australia?

For me its the ability to have these three features all in one platform:

Fractional investing (any amount of money you have can be invested)

Re-balancing

Reinvestment (automated investing)

This means Raiz will allow you to invest with whatever money you have, will make sure your portfolio is balanced the way you prefer and reinvest any dividends for you.

The roundups feature is a bonus for me. It got me going with the product, but you need to do more than that to truly build wealth.

Who is Raiz designed for?

There's a large range of people who are suited to Raiz.

Those who save regularly.

Instead of sending money to savings accounts, you can send it to Raiz and potentially get a better return.

Those that want to invest in shares

The money sent to your Raiz Account is put into ETFs which are traded on the ASX, or the stock market.

Those that want access to socially responsible investing

The Emerald Portfolio provides investments in the ESG stocks which are full of companies that mark well environmental, social, and governance.

Those that want it done for them

Raiz is a managed investment scheme. It will invest money on your behalf into your chosen portfolio. All the heavy lifting of investing in shares is done for you. No brokers, no trading, just send money to the Raiz app once set up.

Is Raiz good for beginners?

Yes it is because

The minimum investment is $5

Raiz provides helpful information to educate investors

You can deposit and withdraw money with easy

The Raiz App is simple and clear to use

Can you lose money with Raiz?

It's possible the money in your Raiz account could increase or decrease. There is no guarantee for the return or your return may result in money loss. Depending on the rates of return, the future earnings can sometimes vary from how Raiz performed in the past. The risk of your investments varies depending on age, time period, and other investments.

At any time though you can withdraw your funds via the Raiz app. Withdraws are not instant and can take a few days for your investments to be sold and money sent to your nominated account.

Is it safe to invest with Raiz?

Raiz holds an Australian Financial Services Licence, is overseen by ASIC, and is listed on the Australian Stock Exchange.

The ETFs that Raiz buys on your behalf into your portfolio is not owned by you or Raiz, but by an independent custodian. If Raiz goes bust, then the custodian will return to you for you to manage (but without the awesome Raiz app!).

Does Raiz pay dividends?

Your ETFs will earn dividends on a regular basis. These dividends are automatically reinvested back into your portfolio. There is no way to have them paid to your account, but you can withdraw funds from it at any time.

Is Raiz investment worth it?

Raiz can be a worthwhile investment for individuals looking to start investing small amounts of money. By investing spare change automatically into diversified portfolios, Raiz allows users to grow their investments over time. However, whether Raiz is worth it depends on your financial goals, risk tolerance, and the performance of the chosen portfolio. Keep in mind that all investments carry risks and returns are not guaranteed.

Does Raiz have a monthly fee?

Yes, Raiz charges a monthly fee for its services. Fees vary depending on the account balance and subscription plan chosen. Make sure you understand the fee structure before signing up to ensure it fits your financial situation.

What happens if Raiz goes broke?

If Raiz were to go bankrupt, the investments held in your account would not be part of Raiz's assets and would remain separate. In such a scenario, a liquidator or bankruptcy trustee would likely facilitate the transfer of your investments to another brokerage or return them to you.

Is Raiz better than a savings account?

Raiz and savings accounts serve different purposes. While Raiz aims to grow your investments through exposure to the stock market, a savings account provides a low-risk option for storing money with modest interest earnings. Raiz may offer potentially higher returns, but it comes with higher risks. Consider your financial goals and risk tolerance when deciding between the two.

Does Raiz have withdrawal fees?

Raiz does not charge withdrawal fees. However, it may take a few business days to process withdrawal requests, and market fluctuations during this period could impact the final withdrawal amount.

Why am I losing money with Raiz?

Losses in a Raiz account can occur due to market fluctuations and the inherent risks of investing in the stock market. The value of the investments in your portfolio may decrease as a result of poor market performance or changes in economic conditions. It's important to remember that investing carries risks and returns are not guaranteed.

In summary: Raiz Review

Raiz was my first experience using an all-app experience to invest in shares.

I've been using it ever since I created an account in 2016 and think its become one of the most strongest and obvious ways to get into the share market without barriers.

I've mentioned the benefits of fractional investing, rebalancing, and reinvesting that Raiz provides.

Considering you can start with only $5 it's a cheap way to start your investing journey, but also a solid platform to build some serious wealth.