For a month in 2020 I was technically unemployed.

What did that mean?

It means I qualified to take out up to $10k from my super through the special release exemption.

This scheme was brought in earlier in the year to allow those who qualify access to the super stored in their super fund.

Because of the rush to get this process in place, there were very broad rules for eligibility requirements.

The ATO says its for those adversely affected financially, but reading through the specifics, they associate eligibility with your circumstances rather than assets or income.

You don’t need to go through any asset or income test to apply you just need to be:

- Unemployed

- Eligible for a select number of Centrelink payments

- Made redundant

- Hours of work cut by 20% or more

- Business was suspended and revenue was affected.

As it turns out I fall into more than one of these categories, so with that being the case, I applied.

Application for early access to your super

The form was dead simple. All I had to do was login to MyGov, tick which eligibility requirement I met from above and then enter the bank details I wanted my money added to.

5 working days later I got the money in my account.

So why did I do it?

Even though this early release exemption was brought in to help those affected financially by COVID, It wasn’t because we needed the money.

As a family, we have saved up a year of expenses in cash, our portfolio and offset are where we want them to be, so having 10k to use for everyday expenses was not the reason.

It was all to do with opportunity.

The opportunity to access money that I had saved. Money that I could use before I turn 60 (my preservation age) should we want to.

I saw this as an opportunity to take $10k from super and remove the age based limitations of using it.

That was it. I just wanted to move my money to an account that I can access before I'm 60.

What did I do with it?

I didn’t take the money out to spend. We don’t need the money to cover expenses.

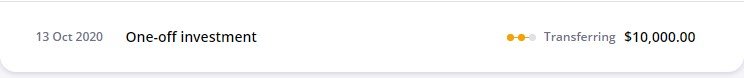

What I did was immediately reinvest it. I received the money Monday and by Tuesday it was gone.

Where? I put all of it in Spaceship Voyager, the investing app.

This was obviously a personal choice. Other considerations were to add it to my ETF portfolio of IOO, VGS or even IOZ but I like Spaceship and if I’m going to write in depth articles like this one, I’m going to have to be an active user of these app platforms.

That’s where the money will sit for now. It might be that it sits invested until I’m 60, BUT I now have the option of taking this money out should I want to.

There were certain circumstances that allowed me to make this decision.

This was not a decision I made last week.

I made this call nearly three months ago. I only executed the decision in the last week. This is how I operate with investing (which I might get into another time).

Here are the set of circumstances that helped me feel comfortable making this decision:

- I have a decent super balance. Taking $10k out of the fund is not a significant change to the overall value of my account, in fact, it was just scraping off the returns from this calendar year.

- I have been salary sacrificing since my mid-20s, so in a way, I am withdrawing some money I have sacrificed voluntarily since then.

- The money will remain invested, it's just that it goes from the Super fund to a managed fund

- I’ve worked in the Superannuation industry, I have my RG146 compliance so feel comfortable making decisions in this area

There you go, that's my “taking money out of super” story. In a way it's a basic tale of how someone moved money from one account to another.

If you do feel motivated with investing, then I always point people to my article on building an investment strategy to use that motivation to get things down on paper.

Also, If Superannuation is now on your mind I have an article on the 5 steps to take so you can set and forget it.