Are you an Australian who wants to start trading US stocks and ETFs?

Maybe even options, pre or post-market trading.

If you are, you might be interested in a trading platform called Webull Australia.

I've started using Webull for my US trading and I found it easy to use and full of useful features. Having explored the platform for a short while I can see the range of tools and resources that Webull Australia has to help investors make good decisions and trade with confidence.

In this article, I'll be giving you a review of my experiences using Webull Australia so far. I'll cover the key features, fees, and benefits that I think are most useful to Australian investors.

Whether you're new to investing or you're experienced and looking for a better and cheaper way to trade, this review will give you all the information you need to decide whether Webull Australia is right for you.

Webull Australia Pros and Cons

Pros

- Commission-free trading on stocks, options, ETFs, and fractional shares (for first 30 days)

- Ultra-low ongoing commissions and fees

- Paper trading

- Can trade on the ASX (with your own HIN)

- Pre and post day trading

- Advanced research tools, including technical analysis, charting, and real-time market data.

- Educational resources and tutorials for beginner investors.

- Real-time market data and news to help you stay informed and make informed trading decisions.

- Options trading available.

- The mobile app is user-friendly and has a clean interface

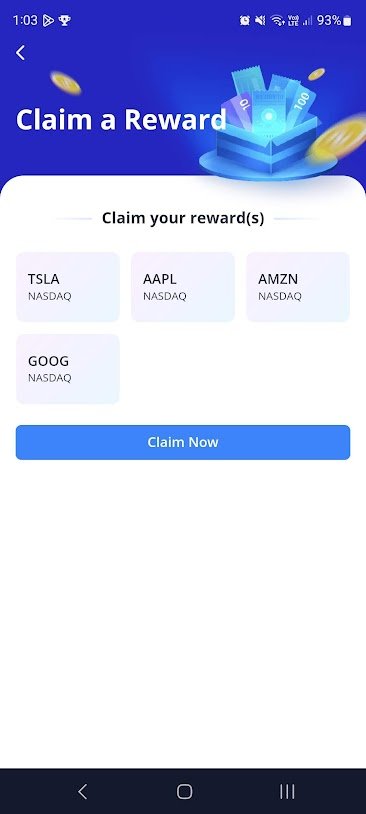

- Free stock rewards for new users and referring friends.

- Earn up to 2% interest on uninvested funds (cash management) or ~5% in a money market account via MoneyBull

Cons

- Very sophisticated and potentially overwhelming for beginner investors

- Limited product offerings compared to some other trading platforms.

- Limited customer support options compared to some other trading platforms.

- Margin trading can be risky and may not be suitable for all investors.

- Limited availability of customer support.

- Limited range of order types.

Overall, Webull Australia is a powerful trading platform with a user-friendly interface, and advanced research tools for investors of US stocks, options, ETFs, and fractional shares. It has a well-built app that is always evolving and is a great option for investors who are looking for a reliable and affordable way to start trading.

What is Webull and is it available in Australia?

Webull Australia is a trading platform that allows beginner investors to trade US stocks, options, ETFs and fractional shares with no commission (for the first 30 days). The platform offers advanced research tools and real-time market data to help investors make informed trading decisions. It's a tool that focuses on all types of investors – from beginners to intermediates to advanced traders.

Webull is available in Australia, and it offers trading on US markets. However, it's important to note that Webull is regulated by the Australian Securities and Investments Commission (ASIC), which oversees the financial services industry in Australia.

Trade US Stocks and ETFs

Webull Australia provides the ability to trade US stocks and ETFs fractionally for Australian investors. Fractional shares allow investors to purchase a portion of a share rather than having to buy a whole share, which can make investing more accessible and affordable for beginner investors with limited capital.

By allowing fractional share trading, Webull enables Australian investors to invest in US stocks and ETFs without needing to purchase a whole share, which can be especially helpful for more expensive stocks. This can help investors to diversify their portfolios and gain exposure to the US stock market, which is one of the largest and most influential in the world. This can help investors to diversify their portfolios and potentially increase their returns.

Trade US Options

Webull Australia also provides the ability to trade US options contracts on their platform. Options are financial contracts that give buyers the right, but not the obligation, to buy or sell an underlying asset (such as a stock or ETF) at a certain price on or before a specific date. When you trade options, you can either buy or sell (also known as “write”) options contracts, and you can choose between call options (which give the buyer the right to buy the underlying asset at a certain price) or put options (which give the buyer the right to sell the underlying asset at a certain price).

Options contracts have a limited lifespan, and if the price of the underlying asset doesn't move in the direction you expected, you could lose your entire premium. It's important to understand the risks and rewards of options trading before you start trading. With Webull, you have the ability to trade options in addition to stocks and ETFs, giving you more flexibility in your trading strategies.

Trade ASX shares

So, you're interested in trading ASX shares, right? Well, Webull has now has ability for you to trade AU stocks as well.

Here are some of the key features that make trading ASX shares on Webull so compelling:

- $.0003 x trade value (eg. $6 for $20,000, min $4.90)

- You can take control of your investments with your own HIN, ensuring your shares are safe and secure at all times.

- You can start with 30 days of free trading – a great incentive for beginners.

- You have the opportunity to invest in local brands you know, so it's easier to track your investments.

- There are no monthly fees or minimum deposits. Just remember that some regulatory fees may apply after the 30-day promotional period.

- For research buffs, Webull provides real-time ASX market data, smart research tools with technical indicators, and even extended trading hours for the US market.

- Plus, all AU stocks on Webull are CHESS sponsored, and you can sign in and place a trade with Face ID for added security.

Webull has made it so easy and accessible for us to invest in ASX shares, and I really believe that it's a great platform to grow our wealth. With its robust features and an emphasis on user security, it seems to me like Webull could be an useful choice for anyone looking to venture into the world of trading as you now have ASX and US stocks available on the same platform.

Is Webull legit and safe to use?

One of the most common concerns about Webull is its legitimacy and safety for investors. Webull is a regulated broker-dealer that is registered with the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). In Australia, Webull is also regulated by the ASIC. This means that Webull is a legitimate and safe platform for beginner investors.

How much does Webull Australia cost?

Webull offers commission-free trading on its platform for the first 30 days, which means that beginner investors can trade stocks, options, ETFs and fractional shares without paying any commissions. Once that period is over you will find the fees are very low. Brokers typically charge commission fees and foreign exchange (FX) fees for trading in international markets.

US Stocks/ETFs

| Items | Charges | Charged by |

|---|---|---|

| Commission | Regular and Extended Hours 04:00 am – 08:00 pm (ET) $0.00025 X Trade Value Overnight Hours 08:00 pm – 04:00 am (ET) $0.0003 X Trade Value | Webull |

| Regulatory Transaction Fee (Sell Trades Only) | $0.0000278 X Total Trade Amount (Min. $0.01) | US Securities and Exchange Commission (SEC) |

| Trading Activity Fee (Sell Trades Only) | $0.000166 per Share (Min. $0.01, Max. $8.30 per Trade) | US Financial Industry Regulatory Authority (FINRA) |

Examples of what costs might look like once fee-free trading period ends:

- If you buy US$100 worth of stocks, your commission fee will be US$0.025.

- If you sell US$500 worth of stocks, your regulatory transaction fee will be US$0.04, and your trading activity fee will be US$0.73.

Compared to other Australian brokers this is a very, very low cost to trade and one of the reasons why I'm using WeBull now to trade US Stocks.

US Options

| Items | Charges | Charged by |

|---|---|---|

| Commission | $0.50 X No. of Contracts | Webull |

| Regulatory Transaction Fee (Sell Trades Only) | US$0.0000278 x Total Trade Amount (Min. US$0.01) | US Securities and Exchange Commission (SEC) |

| Trading Activity Fee (Sell Trades Only) | US$0.000166 per Share (Min. US$0.01) | US Financial Industry Regulatory Authority (FINRA) |

| Options Regulatory Fee | US$0.02685 x No. of Contracts | Options Exchanges |

| Clearing Fee | US$0.02 x No. of Contracts (Max. US$55 per Trade) | Options Clearing Corporation (OCC) |

Example:

- If you buy one options contract, your commission fee will be US$0.50, and your options regulatory fee will be US$0.03.

- If you sell three options contracts, your commission fee will be US$1.50, your regulatory transaction fee will be US$0.01, your trading activity fee will be US$0.00732, and your clearing fee will be US$0.06.

Webull Australia currently does not charge any inactivity account fee (unlike its US version)

Webull Features

Webull Australia offers several features that are designed to help beginner investors make informed trading decisions. Here are some of the key features of the platform:

Low cost trading for US Stocks, ETFS and Options

Webull Australia offers commission-free trading on its platform for the first 30 days, then a minuscule cost after that compared to other Australian brokers. It means that you can trade stocks, options, and ETFs without having to factor in recuperating too much value lost in trading costs. In addition, investors can begin their investment from US$5 in fractional shares.

Paper trading

Paper trading is a feature that allows investors to practice trading without risking any real money. Essentially, paper trading simulates a real trading environment using virtual money. This feature can be valuable to investors because it allows them to test their investment strategies and get a feel for the market without incurring any actual losses. This can be especially helpful for beginner investors who are just starting out and may not have a lot of experience with investing.

Pre- and post-market trading of US stocks

Webull Australia allows investors to trade US stocks during pre- and post-market hours, which are the periods before and after the regular trading hours. Pre-market hours typically run from 4:00 a.m. to 9:30 a.m. Eastern Time in the US, while post-market hours typically run from 4:00 p.m. to 8:00 p.m. Eastern Time US.

If you are in the Australian Eastern Standard Time (AEST) timezone and want to trade US stocks, the regular US market trading hours would be outside of your usual business hours.

- The regular US market trading hours are 9:30 a.m. to 4:00 p.m. Eastern Time

- Pre-market trading hours for US stocks on Webull are from 4:00 a.m. to 9:30 a.m.

- Post-market trading hours for US stocks on Webull are from 4:00 p.m. to 8:00 p.m.

Trading outside of regular market hours can come with additional risks, such as increased volatility and lower liquidity, so it's important to carefully consider your trading strategies and goals before engaging in pre-market or post-market trading.

Advanced research tools

The Webull app provides advanced research tools that allow you to analyze market trends and make informed trading decisions. These tools include technical analysis, charting, and real-time market data.

Educational resources:

If you're new to trading, the Webull app provides educational resources and tutorials to help you get started. These resources cover a wide range of topics, from basic trading concepts to advanced trading strategies.

Real-time market data: The Webull app provides real-time market data, including stock prices, news, and financial reports, which allows you to stay up-to-date on market trends and make informed trading decisions.

Options trading: Webull offers options trading on its platform, which allows you to trade options contracts with minimal commission or fees.

Overall, the features of Webull make it a powerful trading platform for beginner investors who are looking for a reliable and convenient way to trade stocks, options, and ETFs. Whether you're a seasoned trader or a newcomer to the world of investing, Webull has something to offer.

Transferring to Webull Australia

Webull isn't able to support any transfer-in or transfer-out of US shares at the moment. For now the offer is to purely deposit in cash via bank deposit.

Webull app

Webull Australia offers a mobile app that provides a user-friendly interface and advanced research tools to help investors make informed trading decisions. The app provides real-time market data and advanced charting tools, including technical analysis, to help investors analyze market trends and make informed decisions. In addition, the app allows you to trade stocks, options, ETFs, and fractional shares on the go, making it a convenient option for all sorts of investors.

Currently, the Webull Australia experience is app first, meaning you will need to join via the app. Desktop access is also now available and helpful for investors looking at charting and more detailed research.

New beginners may find the array of information overwhelming. There is a distinct emphasis on data, new,s and information relating to the investing world. It can be a helpful place to find information, which is on top of what you are there to do (buy and sell stocks).

I found the app reasonably easy to pick up and navigate, creating a wishlist and starting trading. There are some places where I found some broken English and do think the gamification is a sign of it being a Chinese-run operation.

Moneybull by Webull

Moneybull is a clever feature from Webull designed for people who have US dollars (USD) in their trading account but aren't actively using them for trades.

Think of Moneybull like a savings account for your idle cash.

How Moneybull Works:

- Automatic Investment: Moneybull takes your unused USD and automatically invests it in something called a money market fund. These are like special baskets of investments that are generally safer and more stable than stocks.

- Earning from Idle Cash: By putting your idle cash in these funds, Moneybull aims to earn you a higher return than what you’d get if the money just sat in your account. Currently, it offers a potential return of 5.3% per annum.

- No Extra Fees: The great thing about Moneybull is that there are no additional costs for using this service. It’s a way to make your money work harder without any extra fees.

- Maintaining Buying Power: Even though your money is invested, it’s still counted as part of your total balance for trading purposes. This means you can earn interest on your funds and still have the full power to trade as you usually would.

Your funds in Moneybull are held securely, following strict financial regulations.

Webull, as the provider of Moneybull, adheres to the rules and guidelines set by regulatory authorities, ensuring a safe and transparent environment for your investments.

Moneybull is available to Webull account holders, offering an easy way to potentially increase earnings from their unutilized funds.

Your invested funds in Moneybull are still considered when you want to trade, giving you flexibility and the benefit of earning from your idle cash.

For more details on how Moneybull can enhance your trading experience, you can visit Webull’s website or their customer support section.

Webull Australia vs Stake

Stake is another popular low cost broker platform that is worth considering for beginner investors. Stake is focused on traditional investing in ASX and US markets, while Webull Australia offers the same. Additionally, Stake doesn't offer options trading, while Webull does. Ultimately, the choice between Webull and Stake will depend on your individual needs and preferences as an investor.

One major difference between the two platforms is their location – Stakes is based in Australia, while Webull is based in the United States. Additionally, while both companies are privately owned, Stakes was founded a year earlier than Webull, with an inception date of 2016 compared to Webull's inception date of 2017. Webull's founder, Wang Anquan, is originally from China.

Both platforms offer the ability to trade US stocks and ETFs, as well as fractional share trading. Both also have mobile apps that provide a better experience for desktop.

The basic summary is that Webull is cheaper in every way compared to Stake, while offering more features to the intermediate investor as well as paper trading.

| Trading Fees (US stocks or ETFs) | Stakes | Webull |

|---|---|---|

| Trades under $30,000 | $3 brokerage fees | $0 commission fees (first 30 days) and then $0.00025 x total trade amount |

| Trades of $100 | $3 brokerage fees | $0 commission fees (first 30 days) and then $0.00025 x total trade amount |

| Trades of $1000 | $0.10 brokerage fees (0.01% of trade amount) + $7.00 foreign exchange fees | $0.25 commission fees (0.00025 x trade amount) + $2.50 foreign exchange fees |

| Trades of $5000 | $0.50 brokerage fees (0.01% of trade amount) + $35.00 foreign exchange fees | $1.25 commission fees (0.00025 x trade amount) + $12.50 foreign exchange fees |

| Foreign exchange fee | 70 basis points with a minimum of $2 | 25 basis points |

Personally I invest in US Stocks through Webull Australia now, having left Stake purely due to the fees. I trade often on the US markets so the cost to do that regularly is important.

For aspects that are not about numbers, WeBull also offers additional features that Stake does not right now such as paper trading, pre and post market trading plus a lot more features for advanced investors.

Q&A section

Here are some common questions that beginner investors may have about using Webull in Australia:

Can non-US citizens use Webull in Australia?

Yes, non-US citizens can use Webull Australia, but they must provide identification documents to comply with anti-money laundering regulations. You will need to provide your proof of address in Australia via a utility bill or similar as well as a photo of your Australian drivers license or passport when signing up.

Can you trade options on Webull in Australia?

Yes, Webull offers options trading on its platform in Australia. The cost is only US$0.50 for each number of contracts, as well as the usual regulatory fees.

How can you trade US shares from Australia?

To trade US shares from Australia, you can use a trading platform such as Webull Australia that offers trading on US markets. You'll need to comply with any regulatory requirements in Australia, such as providing identification documents, to open a trading account. After that you will need to deposit some money either via USD or AUD to your Webull account. Once cleared you are able to trade US shares from Australia.

What is similar to Webull?

Some trading platforms that are similar to Webull Australia include Stake, Interactive Brokers,eToro and CMC markets. All offer similar options for investing in US markets. Not all provide the same features such as stock options or fractional shares and many are overseas based.

Conclusion

Webull is a trading platform that offers advanced research tools and real-time market data to beginner investors. It's a safe and legitimate platform that is regulated by the ASIC in Australia. The Webull app provides a user-friendly interface that makes it easy to trade US stocks, options, and ETFs on the go.

While there are some fees associated with using Webull, they are relatively low compared to other trading platforms. If you're an intermediate or advanced investor who is looking for a reliable and convenient trading platform for the US and ASX markets here in Australia, Webull Australia is definitely worth considering.

References

- Webull. (n.d.). About Us. Retrieved from https://www.webull.com.au/about

- Australian Securities and Investments Commission. (n.d.). Home. Retrieved from https://asic.gov.au/

- Webull. (n.d.). Fees. Retrieved from https://www.webull.com.au/pricing

- Webull. (n.d.). Webull – Stock Market Trading. Retrieved from https://www.webull.com.au/us-stocks

- Stake. (n.d.). Invest in US Stocks and ETFs. Retrieved from https://hellostake.com/

- Webull. (n.d.). FAQ. Retrieved from https://www.webull.com.au/help

Hi Tim, do you think its worth opening a WeBull account?Cheers, Capt.

Definitely depends on what you need in a broker. If you are keen on getting heaps of data, researching within a trading app and particular in how much everything costs then WeBull is worth a look. For me though I prefer the simplicity and UI of Stake so am still with them (and they are also Australian based). WeBull does add features a lot quicker but won’t take you long to work out if like the experience once you sign up (at least to get some free stock and trades).

Hi Tim, thank for this nice post, but… I have a hole in the information and in internet I can’t find any answers. Does webull stop loss/take profit in their app on Australia?

I appreciate your comments.

Hi Andres,

Looking on the app can confirm they offer (when you sell)

Limit (sell at fixed price or higher)

Market (inc. when wanting to trade fractional shares)

Stop (stop price lower than current price)

Stop limit (same as above but you set a fixed limit not current price)

Trailing stop (when market increases, the stop price is highest price of trail you set)