Ethical investing has gained popularity in recent years as more people seek to align their financial decisions or investing with their values.

A simple way of breaking down what “ethical investing” is is that it involves incorporating social, environmental, and governance (ESG) factors into the investment decision-making process.

By choosing companies or funds that prioritise these factors, investors aim to make a positive impact on society and the environment while also achieving good financial returns.

In Australia, four in five Australians consider environmental issues important when it comes to investing their money.

This has led to a rise in the number of ethical investment options available, from sustainable super funds to socially responsible banking to new ESG ETFs.

For investors like you and me, it's essential to evaluate different ethical investment options carefully and understand how aligning investments with values can lead to better financial and social outcomes.

Key Takeaways

- Ethical investing involves incorporating ESG factors into investment decisions to make a positive impact on society and the environment

- The popularity of ethical investing in Australia has led to a rise in more investment options and products to choose from

- To successfully invest ethically, it's crucial to carefully evaluate different ethical investment options and their potential for both financial and social returns

Understanding Ethical Investing

The Concept of Ethical Investing

Ethical investing, also known as sustainable or responsible investing, is the process of directing your funds toward companies and projects that adhere to environmental, social, and governance (ESG) criteria. This means you are supporting businesses fostering positive change while avoiding those involved in harmful industries.

What does the ESG components mean exactly?

- Environmental sustainability: Reducing carbon emissions, conserving resources, and promoting clean energy technologies.

- Social responsibility: Promoting diversity, fair labour practices, and community engagement.

- Corporate governance: Maintain transparent operations, maintain ethical board practices and executive compensation, and ensure stakeholder interests are met.

Benefits of Ethical Investing

Here are some of the reasons why ethical investing is growing in stature:

- Aligning your investments with your values: You can invest in companies that share your environmental and social concerns, ensuring your money supports causes you care about.

- Driving positive change: Ethical investing encourages companies to adopt responsible practices by rewarding them with increased investment.

- Long-term growth potential: Research shows that companies with strong ESG performance can potentially deliver higher financial returns and have better risk management.

- Mitigating risks: By avoiding investments in companies engaged in harmful industries, you may potentially reduce the risk of sudden drops in share prices due to scandals or regulatory changes.

Remember, utilising ethical investing principles doesn't necessarily mean sacrificing your financial performance.

In fact, it can help you build a balanced and sustainable investment portfolio that reflects your values.

Types of Ethical Investments

There are two simple ways I think most of us can start investing ethically. Not to say these are the only way but most common and easiest to understand for those new to this world.

Ethical ETFs

Ethical ETFs are a popular choice for investors looking to align their investments with their values.

By investing in an ethical ETF, you can easily build a diversified, yet values-aligned, portfolio.

These ETFs focus on companies that meet specific Environmental, Social, and Governance (ESG) criteria.

Some examples of ethical ETFs available in Australia include the BetaShares Australian Sustainability Leaders ETF and the iShares Global Green Bond ETF.

These are a couple of examples and not a specific suggestion.

Some ethical ETFs might have a broad approach, while others might focus on a specific cause or theme, such as clean energy or animal welfare.

Sustainable Super Funds

In Australia, you have the option to invest in sustainable super funds that prioritise ethical investments.

These funds often incorporate ESG analysis into their investment process, ensuring that your superannuation savings contribute to positive social and environmental outcomes.

The funds may avoid companies involved in controversial industries like tobacco, fossil fuels, and gambling, or actively seek investment opportunities with positive impact.

Some examples of sustainable super funds in Australia are Australian Ethical Super, which follows a rigorous ethical investment process, and Future Super, which considers ESG factors when selecting investments.

These are two ESG specific funds but there are also a growing number of ethical etfs and investment options available within more traditional funds.

To find a suitable fund, compare the options available and be sure to understand their ESG approach and investment performance.

To sum up, where you can invest, you can do so ethically through both ethical ETFs and sustainable super funds.

By carefully selecting investment options that align with your values and conducting thorough research, you can build a portfolio that reflects your commitment to a better world.

Evaluating Ethical Investments

Assessing ESG Performance

When considering ethical investments, it's crucial to assess the Environmental, Social, and Governance (ESG) performance of the companies or funds in which you'd like to invest.

Evaluating is essential because it helps you ensure that your investments align with your values and contribute to a sustainable future.

Here are some key aspects to consider when reviewing ESG performance, whether it be through a specific ETFs product page or a description of an investment option on a superannuation product page:

- Environmental: Analyse how companies manage their carbon emissions, waste disposal, and energy efficiency. Companies with strong environmental policies are more likely to be responsible and sustainable in the long run.

- Social: Evaluate how companies treat their employees, suppliers, customers, and the communities they operate in. A company with a strong focus on social responsibility is more likely to maintain a well-motivated and loyal workforce, as well as a positive brand image.

- Governance: Assess the company's board structure, ethical policies, and corporate transparency. Good governance practices can help prevent scandals and ensure the company is managed in the best interests of all stakeholders.

You can get insights into ESG performance by researching publicly available information, such as company sustainability reports, or by consulting specialised ESG rating agencies.

It's also fairly simple to get in direct contact with an ETF provider or super fund to talk about their ethical investments.

Researching Fund Holdings

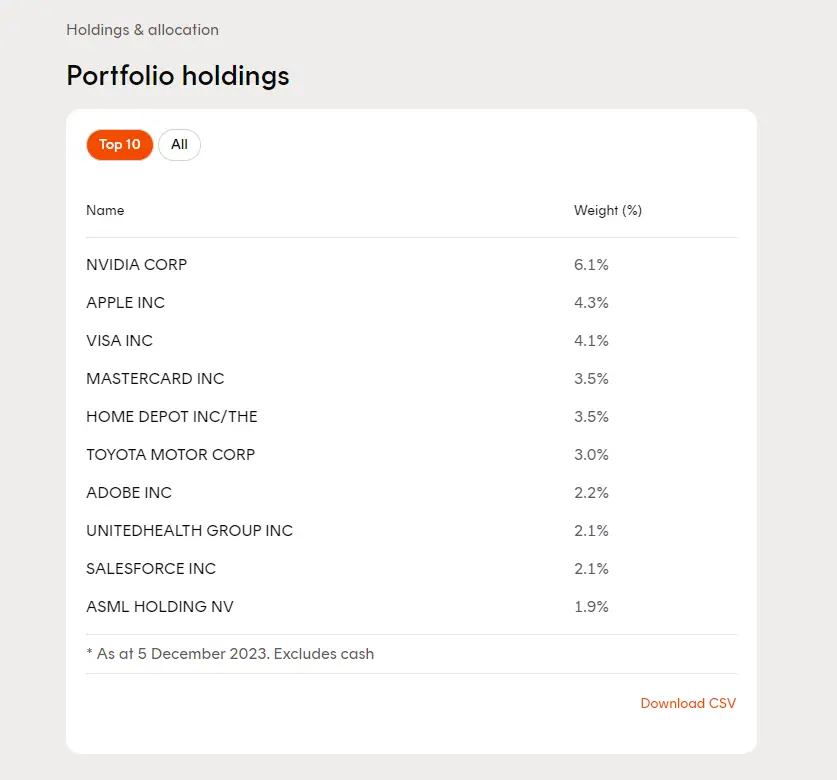

Before investing in ethical exchange-traded funds (ETFs) or ESG ETFs, it's important to research the companies included in the fund, as well as the fund management team's criteria for selecting investments.

By examining fund holdings, you will gain a clearer understanding of the companies you're supporting and have confidence that they meet your ethical investing criteria.

To research fund holdings, you can:

- Visit an ETF or fund's website and look for detailed information on their investment strategy, stock selection criteria, and their view on controversial industries such as fossil fuels.

- Review the top 10 or 20 holdings listed on the fund's factsheet, and perform your own ESG assessment on these companies.

- Examine the fund's track record, including historical financial performance, as well as any changes in the underlying holdings over time.

By undertaking thorough due diligence on ESG performance and fund holdings, you can make informed decisions when investing in ethical ETFs and ESG ETFs, ensuring your investments align with your values and contribute to a better world.

Popular Ethical Investment Options in Australia

Here are popular ethical investment options available to Australian investors.

Top Ethical ETFs in Australia

Several financial institutions offer ethical ETFs in Australia, including

- BetaShares

- Russell

- Global X

- VanEck

- and Vanguard

Some of the top-performing ethical ETFs over the past 12 months include

- BetaShares Global Sustainability Leaders ETF

- VanEck Vectors MSCI International Sustainable Equity ETF

- and Russell Investments Australian Responsible Investment ETF

With these products, your funds are invested in a wide range of ethical, environmentally conscious, and socially responsible companies.

Investment Apps and Ethical Portfolios

Investment apps, such as Raiz Invest, offer convenient and user-friendly platforms to invest ethically.

Raiz has a portfolio called “Emerald,” which aims to invest in companies that meet high ESG criteria.

This portfolio gives you exposure to Australian and international ethical companies by using a mix of ETFs.

Additionally, robo-adviser Stockspot recently introduced sustainable portfolios for those seeking to invest in responsible companies.

These platforms make it easier than ever to manage your ethical investments on the go and stay well-informed about where your money is being invested.

As an Australian investor, you have various options to align your investment strategy with your values. Whether you choose to invest in ethical ETFs or use investment apps, it's important to research and select the best choice that fits your ethical priorities and financial goals.

Frequently Asked Questions

What constitutes an ethical superannuation fund?

An ethical superannuation fund is one that invests in companies and industries that promote environmental, social, and governance (ESG) values. These funds tend to avoid investing in businesses involved in harmful practices or industries, such as fossil fuels, tobacco, and gambling. They seek to generate returns while also considering the broader impact on people, society, and the environment.

Which stocks are generally considered suitable for ethical investment?

Stocks suitable for ethical investment are from companies with strong ESG practices and performance. These companies usually have positive impacts on the environment, treat their employees well, and have responsible governance practices. Industries like renewable energy, healthcare, and social enterprises are often viewed as good candidates for ethical investments.

Can you recommend any authoritative books on ethical investing?

Some authoritative books on ethical investing include:

- The Ethical Investor's Handbook by Terry-Ann Jones

- Investing for Good: Making Money While Being Socially Responsible by Mark Manning

- The Sustainable Investor's Guide by Paul Hawken

These books provide insights, frameworks, and strategies for building ethical investment portfolios.

How do ethical investment funds perform in comparison to traditional funds?

Ethical investment funds have historically performed comparably to traditional funds, with some even outperforming their conventional counterparts. Factors such as ESG criteria, investor preferences, and market trends all influence the performance of ethical funds. With the growing interest in responsible investing, many ethical funds have been experiencing steady growth and returns.

What are some benefits and drawbacks of choosing to invest ethically?

Investing ethically has several benefits, such as aligning your investments with your values, supporting sustainable business practices, and potentially providing favorable long-term returns. However, there are also drawbacks. For example, your investment options might be limited, since some industries and companies do not meet ethical criteria. Additionally, the performance of ethical investments can vary, and some funds may underperform when compared to traditional investments.

Are there specific ethical investment options that are well-regarded in Australia?

Yes, there are several ethical investment options that are well-regarded in Australia. Some examples include the Australian Ethical Super fund and the BetaShares Global Sustainability Leaders ETF. Furthermore, companies like Vanguard, VanEck, and UBS also offer ethical ETFs to cater to the growing demand for responsible investment opportunities in the country.