Investment apps have revolutionised how we interact with the stock market.

Gone are the days of needing a fancy broker—now all you need is your smartphone.

Micro-investing apps have been launching in Australia since 2016, but with so many options out there, how do you know which app is the one for you?

But which one should you use? And what might be best for your situation?

By the end of this article, you'll have a clear picture of the best investment apps in Australia.

I'll help you work out which best lines up with your financial goals, making the journey into stock investing a whole lot smoother.

This article will take you through three popular investing apps in Australia that I've been using for years and believe are great options for a range of investors from beginner to experienced.

- Raiz – Diversified portfolios made up of multiple ETFs

- Commsec Pockets – Simple, low-cost online broker for DIY trading of ETFs

- Spaceship Voyager – Simple, transparent funds that are tech-focused on a slick app

The Investment App Landscape in Australia

Investment apps have seriously disrupted the traditional way of doing things.

No longer do you need to schedule a meeting with your suit-and-tie stockbroker or sift through complicated spreadsheets.

These apps have boiled down the complexities of the stock market into a user-friendly experience that fits in your pocket.

Your leftover dollars and cents from buying a coffee can go directly into your investment account.

These platforms often use a “round-up” feature that takes your purchases, rounds them up to the nearest dollar, and invests the difference.

Micro-investing also means you don't need huge sums of money to start.

In Australia, micro-investing is gaining traction as a way to invest with little money.

Investment apps have shaken up the traditional finance world, making investing a game that more people can play.

And trust me, you'll want to get in on this action.

How do these investing apps work?

Just like any app, you download it onto your phone.

Because it's a financial investment product you will need to create an account and enter some personal details.

You will need to set up a connecting bank account as well so the app can directly debit money when you want to invest.

To start investing money you will need to select which portfolio or investment option your money goes into.

Each app has its differences as to what you can select to invest in, which does limit the abilities of each app but also makes it easier to comprehend.

In terms of cost, you will pay a fee to either make a trade (buy or sell an investment) or pay a percentage fee based on your balance each month.

Are investment apps worth it?

While they look flashy and might feel gimmicky, you can use these as a serious way to build wealth.

I've spent the last few years using and trying them out and have found them great alternatives to the online broker option.

One good thing about these apps is that they are targeting new investors so make it easy to get going plus help you out with some educational content.

Also, you can get started with very little money – like $5 and work your way from there. It's like a savings account but different.

What Makes a Good Investment App?

So, what turns an average investment app into a great one?

Here are some things to keep in mind:

- Ease of Use: An easy-to-navigate interface is crucial. You should be able to perform key actions like buying and selling stocks without needing a manual. Seriously, if you can't figure it out in a few minutes, it's probably not the best investing app in Australia for you.

- Reliability: Imagine this—you're ready to make a trade and bam! The app crashes. Not cool. That's why it's super important to find the most reliable investing app. Look for apps that have been around for a while, so you can invest without worrying about technical hiccups.

- Costs: Fees, charges, more fees! They're everywhere. You've got to be vigilant about costs. Even a small fee can eat into your profits over time. Always read the fine print to know what you're getting into.

- Features: This is the fun part. Some apps come with bells and whistles like auto-investing, round-ups, or even educational resources. Keep an eye out for features that align with your investing strategy.

- User Reviews: Before you dive in, take a dip in the reviews section. It's the real-world testing ground where you'll see if an app lives up to its promises or if it's just hype.

By keeping these factors in mind, you're well on your way to picking an investment app that suits your needs to a T.

Let's start looking at some of the best investing apps in Australia as of 2023.

Top Investing Apps in Australia

Based on my own experience using several investing apps, I want to take you through three popular investing apps in Australia right now.

Even though each of the apps looks and feels similar in how they work there are some key differences.

Click to jump to a summary of any of them

- RAIZ can have you invest in a mix of ETFs, ASX stocks, and portfolios that you add in as little or as much as you like when you like

- Spaceship is like a managed fund where the team picks stocks actively and you invest in a more hands-off way

- CommSec pockets are more like a typical broker where you select an ETF to invest in and buy or sell as many as you like.

It's still early days for all of them in terms of history.

First came Raiz in around 2016, then Spaceship back in 2018 and since then CommSec Pockets was launched in 2019.

I'll go into each and explain what they offer, then provide some reasons one or the other might be suitable for you.

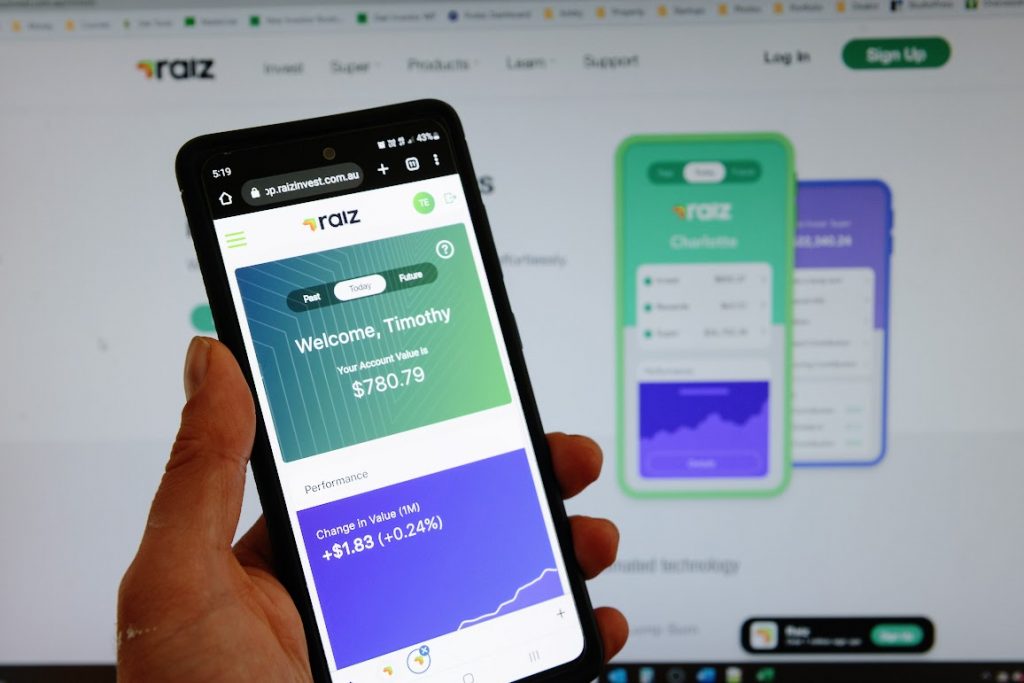

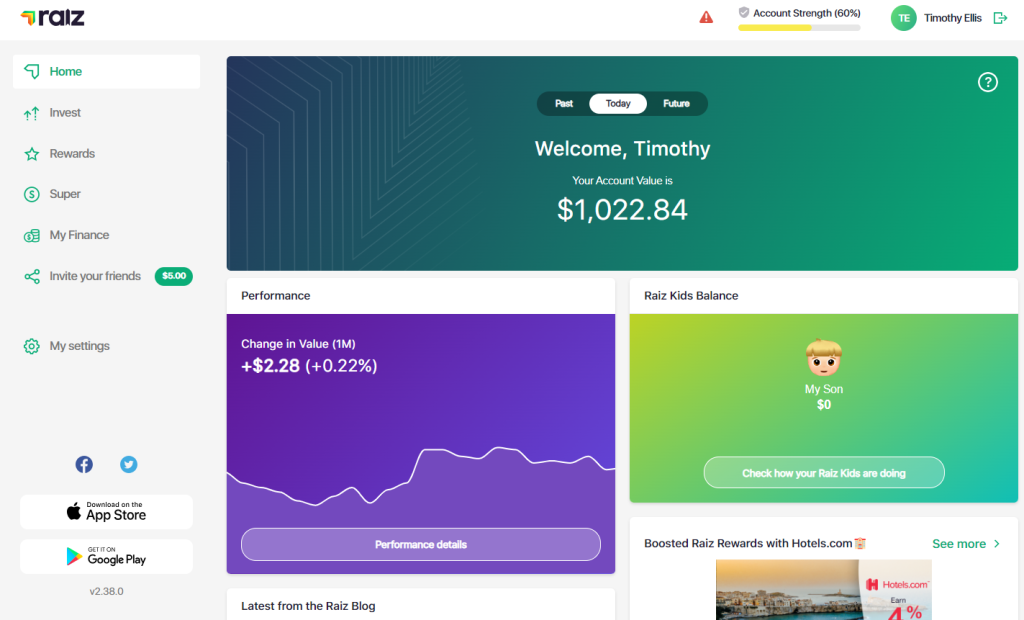

Raiz Breakdown

If you want a simple, all-in-one place to build diversified wealth then Raiz is a great option. Great for beginners wanting options or experienced investors who want simplicity with ETF investing.

- Minimum deposit: $5

- Fees: $3.50-$4.50/mo or .275%/yr of the balance for accounts over $15k

- Options: Portfolios of ETFs, custom portfolios, fractional investing, crypto

- My full review of the platform is available here

Raiz is what I call a “do it for me” investment product.

You set up an account, pick a portfolio (or build your own), and add money to it.

You can automate this all, so Raiz literally does it all for you.

Raiz's portfolio options

Raiz has 7 prebuilt portfolios to pick from as well as an option to build your own custom portfolios (which is what I personally do).

The preset portfolios are made up of well-established ETFs that are a mix of local, and global stocks and bonds, and cash.

Each portfolio has a different balance of stocks and bonds from the conservative option (22% stocks) to the aggressive growth option (90% stocks).

There is also the Sapphire portfolio which includes 5% bitcoin, with 69% in stocks and the rest in bonds.

One of the easiest most diversified ways to get crypto into your investment portfolio.

Raiz Plus

Raiz Plus allows you to build your own custom portfolio that can include a mix of ASX stocks, ETFs, and the above-mentioned pre-built portfolios.

You build and all in one portfolio with a combination of the following

- 23 ETFs – Diverse Exchange Traded Funds to choose from (see list below).

- 50 ASX Stocks – Handpick from renowned Australian stocks.

- Raiz Property Fund – Get a taste of the Australian residential property scene.

- Bitcoin – A max of 5% allowed to be allocated

It is a great tool for individuals wanting some freedom with regard to asset allocation but aren't interested in stocks individually.

It's a fantastic mix of being in more control of where your money is invested but reducing the need to buy and sell the number of options individually.

For example, you could have a portfolio of IOO, IVV, Telstra, CSL, Woolworths, Property, and Bitcoin in one portfolio.

Some of the ETFs you can pick from include

- AAA – Cash ETF

- STW – Aus Large Cap Stocks

- IEU – Europe Large Cap Stocks

- IAF – Aus Bonds

- IVV – US Large Cap Stocks

- RARI – Aus Socially Responsible

- ETHI – Global Socially Responsible

- FAIR – Aus Sustainable Leaders

- NDQ – Nasdaq 100

- VGE – Emerging Markets

- IOO – Global 100

- IXJ – Global Healthcare

- VSO – Australian Small Companies

- and Bitcoin (but no more than 5% of overall portfolio)

For the full list of ETFs available in the Raiz Plus option read my tips on picking a Raiz Portfolio.

There are higher costs for this portfolio type (an extra $1 a month) but feel it is a very cheap micro-investing app service, saving me time as well.

You can change this portfolio option at any time and always go back to the preselected portfolios or change your ETF/percentage mix as you go.

Raiz's Fees

Raiz makes its money from charging you a monthly fee, as opposed to brokers that charge you when you buy or sell stocks.

I feel that this makes it helpful for those who want to add in smaller amounts or more regular investments.

For the 7 premixed portfolios (everything but custom and Sapphire) It's $3.50 a month when under $15k, then .27% of your balance for those holding more than $15,000. Sapphire is $3.50 a month for all balances or $42 a year.

$3.50 a month is a lot if you have only a chump change in your account. You really need to get to at least $7500 as quickly as possible.

For example, if you have $500 in Raiz, the fees would be $42 a year or 8.4% of your money that will go to fees.

The fees for custom portfolios are higher, with balances below $20,000 being charged $4.50 a month, and balances above $20,000 costing .275% pa.

Fees are due each month and charged from a bank account you setup in the app.

Raiz is completely transparent with its pricing and while they do infrequently increase its fees, it is still an affordable option as you do not have to pay to trade (add or withdraw money) and it keeps your portfolio well balanced.

Other features

Raiz also has a rewards program. You buy something through the apps from one provider and a percentage of that purchase gets sent back to your account. I never use this or think about it but know some people who have done well utilising this. Things like surveys or cashback from online stores are pretty common rewards included.

Benefits

- Investing automatically either by a set amount or by rounding up your purchases

- Select from a broad range of well-built portfolios

- Buy fractional shares so can invest immediately

- Rewards Program

- Sustainable options

- All in one / set and forget option

- Need little money to start with

Considerations

- Costly if the balance is under $7.5k

- Easy to make changes (maybe too easy)

- Limited to invest in predetermined portfolios, or selected ETFs

Uniqueness factor

- Fractional micro-investing (any amount of money you have can be invested)

- Rebalancing

- Reinvestment (automated investing)

This means Raiz will allow you to invest with whatever money you have, will make sure your portfolio is balanced the way you prefer, and reinvest any dividends for you.

I believe Raiz is the cheapest way to have the three things done automatically for you.

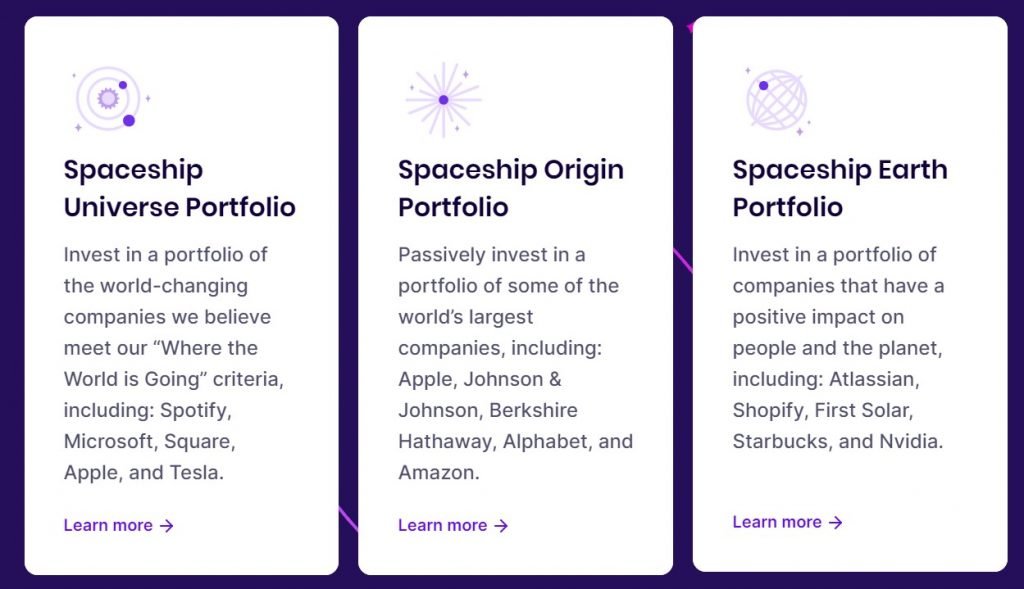

Spaceship Breakdown

If you are looking to invest in an actively managed fund of growth stocks, then Spaceship is a great option. Suited to investors who want to try micro-investing out for free or specifically invest in tech or planet-focused stocks.

- Minimum deposit: $5

- Fees: $2/mo for any balance over $100 ($0 if under $100) PLUS 0.15% – 0.50% of the value of your amount invested.

- Options: Three active funds managed by the Spaceship investing team

- My full review of the platform is available here

Their philosophy is to look towards “where the world is going” so are big on tech companies across the world. You've all heard of these names Amazon, Adobe, IBM, Google, A2 milk, AfterPay, Tesla are all prominent.

They are very transparent in how they operate which makes it easy to understand their offer, which is that it's a managed fund of selected stocks (As opposed to a group of ETFs).

Investing with Spaceship

The app is very similar to Raiz in that you add money to your account and it gets invested on your behalf.

You can set up a recurring investment or manually add one. There is no round-up option like Raiz so it is a much simpler interface to manage.

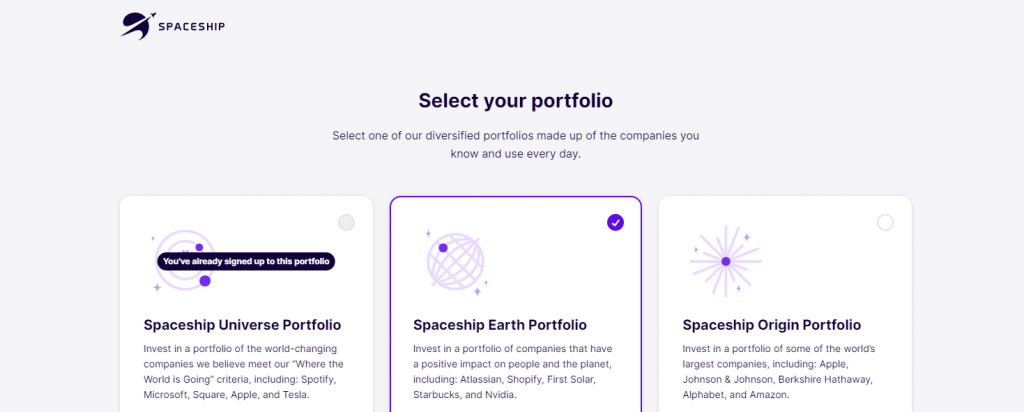

Spaceship's portfolio options

There are three investment options to pick from

- Spaceship Origin tracks ~200 companies passively following an index

- Spaceship Universe which is actively selecting ~100 companies that change often (higher risk, higher return)

- Spaceship Earth which contains companies that provide a positive impact to the Earth (according to the Spaceship team)

You don't select which companies are in but put your money towards one of the three funds and the company determines what is included in each.

Spaceship allows you to pick more than one portfolio to invest in, meaning if you like all three then you can invest in all three.

It’s helpful that they are transparent as they outline all the stocks included in each option on their website. You can look at the performance for each pick in a nice-to-digest way (good for when you research).

Note that all portfolios are 100% stocks.

What are Spaceship's Fees?

The ongoing fee structure is $2 per month for balances above $100.

The following fees are applicable on top of the $2 per month account fee for each portfolio.

- Spaceship Origin Portfolio: 0.15%

- Spaceship Universe Portfolio: 0.50%

- Spaceship Earth Portfolio: 0.50%

On paper, the Origin Portfolio is the best deal for fees, but the other two have more potential for stronger returns.

Let's run some examples of how the fees might look for two scenarios:

Spaceship Origin Portfolio costs per year

- $1,500 invested will cost $26.25 a year

- $10,000 invested will cost $39 per year

- $100,000 invested will cost $174 per year.

Spaceship Universe Portfolio costs per year

- $1,500 invested will cost $31.50 a year

- $10,000 invested will cost $74 per year

- $100,000 invested will cost $524 per year.

As you can see once your balance starts growing so do the fees.

This should play a part in whether you invest in Spaceship long term or with a higher balance because at these fee rates, there are a lot of other options to consider for the same amount of cost – such as Raiz, or DIY investing through a broker.

You also need to factor in the performance of the funds and think about whether taking .15% of .50% from the overall returns is worth it for you.

Other features

One thing Spaceship does well over the others is educating you on investing.

It has a helpful learn section and there is a good feed on investing support and help within the app.

It can help you feel confident and supported, with the app being more than just a balance on your screen.

Benefits

- Free for first $100 (try before you buy)

- Lowe fixed ongoing fee

- Simple three portfolios to pick from

- Well diversified

- Helpful content and education on investing

- Can start with only $5

- Can be automated

Considerations

- You need faith in the Spaceship investment team

- Options are actively managed rather than passively

- Portfolios are 100% stocks

Uniqueness

- The hand-picked mix of stocks and companies with a tech focus.

- Cheap and easy to get started and get knowledge on investing.

- Very transparent in the companies included in your portfolios

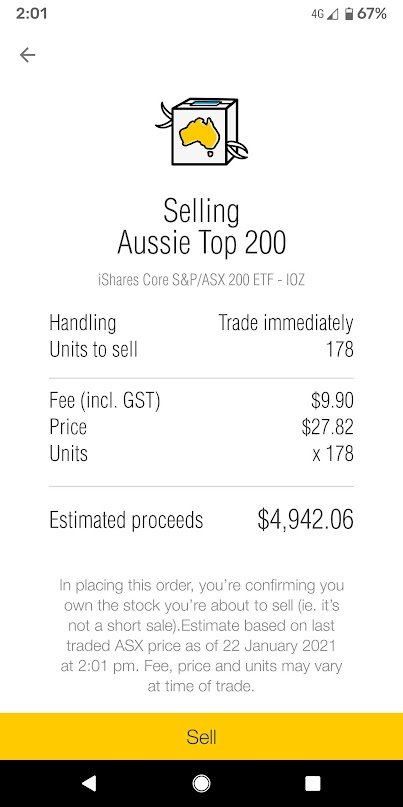

CommSec Pockets Breakdown

If you feel confident with investing and want to pick specific ETFs to add to your portfolio then CommSec Pockets is for you. Suited for investors who want to buy and sell ETFs ad hoc or have larger amounts to invest.

- Minimum deposit: $50

- Fees: $2 to buy or sell an ETF up to $1000 in value, no ongoing costs

- Options: Brokerage, ETF investing, mobile-only

Connected with CommSec, Pockets is a new way to buy ETFs at a low cost via an easy-to-use app.

Find more details about the investing app in my full review here

Pockets are more DIY than Raiz or Spaceship, but a still cheap and convenient. Pockets act like low-cost brokers where you can buy and sell a selected mix of ETFs.

Investing with CommSec Pockets

You need to have an existing CommBank account or CommSec account to open an account with Pockets.

It is also an app-only platform – there is no way to use it via the desktop.

What's a bit confusing is that Pockets is completely separate from CommSec standard.

This means your CommSec standard and CommSec Pockets investments show separately if you have both.

Another point of difference from Raiz or Spaceship is that once you transfer money in it is not invested automatically by default.

The process works like this

- Transfer money from your bank to CommSec account

- Manually select an option to invest in via the app

- Complete trade

Very much like a traditional broker experience.

CommSec Pocket's ETF options

You have seven ETFs that are available to buy like any other broker on the ASX.

These ETFs are similar to what Raiz uses to make up their pre-built portfolios, but in this case, you pick them individually.

In a way, you are building your own portfolio so it's the equivalent to a Raiz custom portfolio.

- IOZ – 200 Australian companies

- IOO – 100 Global companies

- ETHI – Global sustainability leaders

- IXJ – Global Healthcare

- IEM – Emerging markets

- NDQ – Global tech companies

- SYI – High Dividend Yield Fund

Personally, I like all these ETFs. It's all you need for a well-diversified portfolio.

The reason why IOZ was picked as opposed to VAS or A200 is the price per share.

Note that there is no option for defensive ETFs like bonds or fixed interest which would really make this app become all in one for DIY investors. You can of course buy these at other brokers or hold money in bank accounts to add “defense”.

CommSec Pocket's Fees

Fees are simple and clear.

- $2 per trade if under $10000

- If over $1000 then it's .20%

- eg. if you invest $1500 the cost is $3

There are no ongoing fees (like the other apps) so if you were to invest semi-regular then this might be a cheaper option.

While $2 is cheap, if you are buying or selling often it might not be the best option.

If you were buying fortnightly or monthly basis like I do – you might rack up costs of $52 a year if fortnightly or $24 a year if monthly.

Other features

The app is quite nice to use. It is clean and easy to manage.

The tone of voice is helpful to new investors and every step of the trading process has information to help you understand what is happening.

One thing that I love is that it does not give you daily changes in your balance.

Most brokers once you sign in will show you exactly what your balance did for that day.

This isn’t helpful as it grabs at your emotions telling you you’ve won or lost. You really need to be looking at investments long-term (that's why I use Sharesight).

Benefits

- As a DIY investor, rather than a set-and-forget type, you can have more control over exactly what you are investing in.

- You can select specific ETFs based on what’s important to you.

- Whether it be a region like global or Australia, which sector, or even a high dividend-paying ETF.

- It is a convenient step up if you already have a CommSec account, but may be too basic if you already invest.

- If you want to build a simple investment portfolio yourself, this is a handy way to start.

- You pay per trade rather than a recurring fee, so if you want to drop a large amount in then it is a better option as you pay once.

Consideration

- While you can invest from $50, the $2 fee would make it costly for trades less than $200. I recommend $500 plus a trade if you want to keep things low-cost

- To a new investor, it may not be obvious what to pick from, so researching of the ETFs and how to build a portfolio is recommended

- All investments are 100% stocks – no diversification across asset types

- You cannot buy fractionally so you need the exact amount to cover the cost of the shares

Uniqueness

- Build a DIY ETF portfolio through the one app.

- Select your own individual ETFs at a fraction of the cost.

- Set up recurring investments through a broker.

Investing Apps vs. Online Brokerages

With the modern era of digital investing, there's a difference between these sleek new micro-investing apps and traditional online brokerages.

Apps like Raiz, Spaceship, and CommSec Pockets have made investing as simple as a few taps on your phone. They offer automated investing, fractional shares, and round-up features tailored for beginners with limited capital.

On the flip side, online brokerages such as Stake and Webull provide a more hands-on approach to investing, appealing to those who seek a broader range of investment choices like individual shares, comprehensive market data, and advanced trading tools.

These platforms often cater to a more experienced audience who value in-depth analysis and the flexibility to craft a more personalised investment portfolio while being more hands-on or manual in the process.

Then there's Vanguard, known for its long-standing reputation in low-cost index fund investing, which bridges the gap by offering robust online brokerage services alongside its traditional fund offerings.

This option is handy for investors looking to build long-term wealth with a provider that has a solid track record.

While investing apps boast convenience and ease of use, online brokerages stand out for their depth and range.

It's important to consider factors like transaction fees, investment options, platform reliability, and educational resources when choosing between an app or a brokerage.

Your decision should align with your investment goals, level of expertise, and the level of control you desire over your financial portfolio.

Read more about online brokers and how you can find the best one for you.

Some differences in micro-investing apps and traditional online brokers

- Investing Apps: Typically, investing apps like Raiz and Spaceship charge a monthly fee, which can be appealing for those making regular small investments or you want to invest on a regular basis.

- Online Brokerages: Platforms such as Stake and Webull, on the other hand, may offer one off fees for trading of stocks or ETFs, which is attractive for active traders. They make money through other channels such as payment for order flow or interest on uninvested cash. Brokerages might charge trading costs for international markets, though; for example, Stake charges a foreign exchange fee for trading US stocks.

- Traditional Firms like Vanguard: Vanguard's brokerage services might have no account fees or commissions for trading their own ETFs and offer a wide range of investment options with competitive expense ratios, making them a fit for cost-conscious long-term investors.

What is the #1 Investment App?

The best investment app for you depends on your personal investment goals and how hands-on you want to be.

Raiz is superb for beginners with its easy interface and micro-investing capabilities.

Spaceship offers a focus on technology and innovation sectors, which could be great if you're into future-forward investments.

CommSec Pockets is top-notch for those who value the security and reputation of a well-established bank.

What is the Most Reliable Investing App?

If reliability is your main concern, CommSec Pockets stands out due to its association with the Commonwealth Bank of Australia. The app provides a sense of security and trustworthiness that's hard to beat, given that it's backed by a major financial institution.

It offers a straightforward investment process, underpinned by the bank's robust infrastructure.

Which App is Best for Newbie Investors?

Raiz is hands-down the best investment app for newcomers to the stock market.

It's user-friendly, offering automatic round-ups and a variety of portfolios to fit different risk tolerances.

It offers educational resources tailored for beginners, making it easier for you to understand the ins and outs of investing.

What is the Best Round-up Investment App in Australia?

For round-up investing, Raiz is the top choice.

Its platform automatically rounds up your everyday transactions to the nearest dollar and invests the spare change.

This feature allows you to start investing with as little as a few cents, making it ideal for those new to investing or on a tight budget.

Is Raiz or Spaceship Better?

Choosing between Raiz and Spaceship boils down to what you want in an investment app.

Raiz is better for those who are new to investing and like the idea of “setting and forgetting” their investments.

Spaceship, on the other hand, offers more control and focuses on specific sectors like technology and healthcare, making it suitable for those with a bit more experience and interest in these areas.

Do People Make Money on Investing Apps?

Yes, people can make money on Raiz, but it's not a guarantee.

The platform offers a variety of portfolios that have seen varying degrees of success over the years.

However, as with any investment, there are risks involved, and it's essential to be aware that past performance is not indicative of future results.

What are the downsides of the best investing apps?

Investing apps have democratized finance in many ways, but they're not without their drawbacks. Let's unpack a few:

Limited Investment Choices

One of the main downsides is the limited investment options.

Traditional brokerages offer a broad range of assets like individual stocks, bonds, mutual funds, and more.

Many investing apps offer a more limited scope, like pre-selected portfolios or ETFs, which may not suit advanced investors looking for a diversified portfolio.

Fees and Costs

While many apps promote “low fees,” these can still add up, especially for small accounts.

Some charge monthly fees, others have trading fees, and some have both.

These costs can eat into your returns over time, making your investment less profitable than it appears at first glance.

Less Control Over Investments

If you opt for an app that automates your investments, you're giving up some control.

For some, this “set it and forget it” method is perfect.

But for those who like to be hands-on and make informed decisions based on market conditions, this lack of control can be a drawback.

Limited Educational Resources

Some apps offer limited educational materials to help you understand investing.

While this might be fine for seasoned investors, beginners could find this lack of information a significant disadvantage.

Understanding the basics of investing is crucial to making informed decisions, and not all apps are geared toward educating their users.

Psychological Risks

The ease of use can also be a double-edged sword.

Because these apps are so user-friendly, there's a risk of over-trading or making impulsive investment decisions.

Without the traditional barriers to entry like paperwork and human interaction, some people may make rash decisions that they later regret.

While investing apps offer a great entry point for new and seasoned investors alike, they come with their own set of challenges that should not be overlooked.

So which investing app will you choose?

Getting started is important, and these apps can help you with that.

They can be a fast way to get started investing in the market. You can also invest frequently, and get confidence in what you know and do.

Realise that even if you do get started with an investing app you can move on to other investment options or tools.

Also, know that these apps are fantastic ways for you to make considerable wealth. There is nothing they can’t do that will stop you from investing long-term.

If you’re not already investing, and have some money available to invest either regularly or once-off then consider these investing apps.