If you feel stuck trying to work out how to setup or stick to a budget, then this article is for you.

Even though budgets might be the last thing we want to do, they are the foundation of a good financial system. Over the years, I've gone through trial and error to realise that there four key areas you need to focus on to start winning with money management.

In this article I'll be going in-depth into four aspects of budgeting I consider the most relevant to anyone's situation

- Gain awareness with what you earn and spend

- Create and use a spending plan

- Automate your money

- Behave over time

Great! Let's get into it and work out how we can make a budget work for us.

How do you figure out budgeting?

The problem with budgets is that they are drainers. They are not fun and try to make you feel like a failure if you go outside its rules.

They are horrible by name and by nature.

Traditional budgets have you listing every expense for the month ahead then tracking your costs at the end of the month so they meet up.

For those of you who are “budgeting” is it working for you?

- Are you stressing about fitting costs into a spreadsheet?

- Have anxiety when you make a purchase?

- Is it more stress than its worth?

It can feel like you have to live in a spreadsheet. Every time you spend money on something you write it down and assign it to a category. Who wants to live like that?

It also conflicts with the way you behave.

You might get nervous when you make a purchase and try to convince yourself it's necessary. You feel confined and are too afraid to spend money if you did not plan for it.

What budgeting should be

I’ve gone through what's probably dozens of “new budget” phases in my adult life but through these I’ve finally worked out what budgeting really is.

It's a system that has me

- Aware of where my money goes

- In full control of where my money will go

- Able to enjoy spending money

Build a better budget

In this guide I'll take you through the key aspects of a financial system I have in a place that make creating and living with a budget a success.

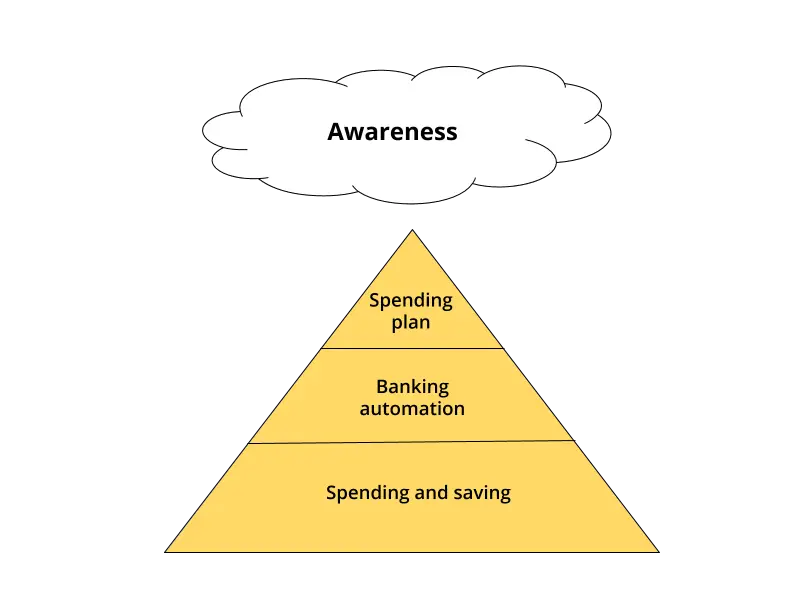

Here's a diagram to explain

I base this flow from my own learned experiences, mistakes and successes with budgeting. I’ve gone from thousands of dollars in debt, to buying property, having a family, living on one income with that family and even moving cities.

In the rest of this article I will explain how each of these steps work.

Intro done! Let's get into the four most important aspects I believe are in a successful budget.

Step #1 to a Better Budget: Get Awareness of your current situation

The best treatment for budget woes is awareness, but many of us in a way like to keep oblivious of our financial situation.

We avoid action because we get fearful of what they might uncover.

Before we look to the future, we need to rip back the veil of your financial life and understand what is going on.

I’m talking about reviewing how much money you make from work (your income) and much you spend (your expenses).

Take stock of today

It's time to create a balance sheet. What that means is we will:

- List our regular expenses (bills, insurances, monthly subscriptions)

- List our income (salary, wages)

- List out irregular expenses (coffees, holidays)

Find all the things you have paid for in the last few months and add it to a list. This includes things you pay for monthly (like phone bills), annually (like insurance) and infrequently (like clothes).

We also want to add our regular income from salary, investments, partners salary or bonusses.

It might take some time but search through your emails for receipts or invoices of services there.

The best way to do this is to open your bank account/s and bring up all your transactions over the last month.

Wait – Is there a good budgeting template for this?

I get asked this a lot – show me your budget template or what's a good budget template?

Spreadsheet? App? The tool DOES. NOT. MATTER. What matters is finding something you feel comfortable using and adding to when needed. A pen and pencil are fine if that works for you.

I use and recommend the MoneySmart Budget Planner. This is perfect for this exercise and is very easy to insert all your figures.

Action step: Note down all of your expenses no matter how big or small. It’s helpful to know everything you are paying so we can plan your spending (which we’ll do later).

This might take a bit of time but listing out these kinds of expenses will paint you a brilliant picture of how much you spend on each.

Don’t just note your bills, but any saving, investing, debt repayments or transfers you contribute to regularly– this can be done in the insurance and finance section of the budget planner page .

Find your surplus or deficit

If you used the Money Smart Budget planner, you can scroll to the bottom section and see a chart full of all your inputs.

See what I circled? That is the number we are looking for. Your surplus(or deficit). This is your income minus all the expenses you entered.

This is your awareness.

In my example, there is a surplus of over $11k for the year.

Yours could be anything – $100, $1000, $10,000 or more.

If you are in the positive, you can allocate this money to something else, like saving, spending or investing.

No matter what your profit/loss number is, We can move forward and build systems that can improve and stabilise this.

When I did this for the first time; I was in the red.

Because of this, it forced me to put together a plan that allowed me to avoid further debt, while maintaining some freedom to spend.

This is what we are about to set up – your new system and spending plan.

For those that have more expenses than income, now is your time to plan your next move. I would suggest that you forgo a mix of savings and wants while you look to decide expenses to a manageable percentage, if that is your situation.

Let's address a couple of questions and comments you might have already…

Wow, I had no idea how many expenses I had. It’s easy to have additional costs creep into your lifestyle whether or not you intentionally want them to. If you feel like you spend more than you’d like or that you have too many costs don’t feel like you need to do everything at once. Start by reviewing your three biggest expenses: housing, transportation and food.

How often do I do this step, every month? Personally, I do this process every 3-6 months. Do it more often if your situation changes (like moving house or changing job) but otherwise the less you change the less often you need to review. The Money Smart Budget planner has is an option to set a reminder.

Spend time to challenge some costs. It might seem like your needs are “fixed” costs, but that’s not always the case. Things like insurances, internet and phone plans can be negotiated or you could change providers. For yearly costs like insurances, make sure you review other places for quotes before you renew as there may be better deals.

Smooth your bills if it helps. For things like utilities that might get charged in unusual intervals – like gas every two months or electricity every 3 – there may be an option for you to smooth your bills. This is a way to turn these bills into a monthly charge so you get a consistent bill each month, which can be easier to budget for.

Change the dates of bills. Many businesses are flexible in resetting your due date, especially credit card companies or banks. I have set up my system so that most of my bills get charged a week after my first payday for the month (if monthly charge) or two days after pay (if fortnightly or weekly).

Recap – What have we learned so far?

- What you spend money on

- How much money you have coming in

- How much big ticket items like food, shelter, transport is costing you

- What is the surplus or shortfall you have each month

Step #2: Build a better budget with a spending plan

This is where we are pivoting away from a traditional budget.

Rather than continuously do the step we just did and track all our expenses each month, we will put in a plan that determines where our money will move forward.

We are using some inspiration from the Zero Based Budget system that is popular, with an explanation on how that works here.

We will allocate our money into some easy to follow categories and refer to this as a plan. It saves time, money, and keeps you aware because each dollar you earn has a plan on how its spent or saved.

Can I just download a budgeting app? I see these questions in Facebook groups all the time. We are desperate for an app to do all the heavy lifintg for us. While it feels like a time saver I’ve found they are the opposite and demand a bit of work. I’ve used apps in the past like Money Brilliant, PocketSmith, Pocketbook that all aggregate your accounts and give you the one picture of your accounts. They just needed me constantly refreshing, categorising and matching up costs which in the end wasn't worth it for me.

What if I'm on a low income? No worries! I wrote this guide for those on any income – even those with irregular pay cycles. It’s also why I like using percentages to cover the mix of needs, wants, expenses when budgeting. It can be a challenge to keep costs down when you are on a low income, so its even more important to uncover what you are really spending money on.

Build your spending plan

The question to ask yourself now is – where do you want your money to go?

- We already know we have some fixed costs in place, which are our needs.

- We know what we spend money on things we want

- There also might be some bigger things – like holidays or a new bike that we will need to save for

Use you work in the first step to review and see what your percentages you currently put towards fixed costs or needs.

These would be things like food, shelter, transport and utilities. Pretty much the essential items of your lifestyle. This will probably make up a significant amount of what you spend each month.

- List out each of these expenses and how much you’ll be spending on them each month. Make sure you include annual expenses, so just divide that cost by 12 to work out the monthly cost.

- After that add up all these expenses and work out the percentage these make up of your entire income.

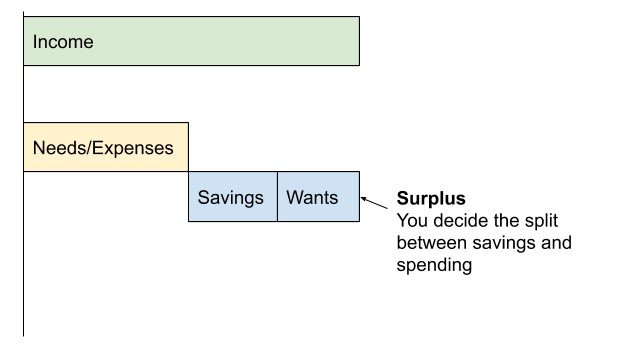

For example in the below diagram we have 60% of spending allocated to the need expenses.

Your next decision is to determine how much of your income goes towards your non-essential spending (wants) and savings).

You can do this by working out how much that 40% left is in dollar amounts, then how much you want to save of that and how much you want to spend.

For example, you want to save $1000 a month for car, holiday, etc combined. For an income of $5000 a month this is 20%. That would mean your remaining 20% is left over for spending on your wants.

The good part is you can move back and forth with these percentages. Say you want to save more then you can reduce that non essential spending. Maybe you don’t then you can turn up the spending.

It’s all up to your plan.

It’s a target that you can set for yourself to make your money work more deliberately.

Over time, you can work to both cut costs and make more money. This can help reduce your % of money going towards needs and more towards saving or spending.

See how we are not looking back, but looking forward? That’s the idea of a spending plan. You feed into it what you know you need to spend money on then add the things you’d like to spend and save on.

If you don’t align completely with your plan each month, that’s ok. Go again next month. Progress not perfection.

What to do with your spending plan

This plan now becomes your reference to what it costs to live the way you do each month.

Make sure that you do what you intend to do with your dedicated money each month. That is, spend your income to cover expenses, move to savings or sped on what you love. The next step will help automate this for you.

Note that the money allocated to spending should be considered guilt free. I never review the money I spend in the wants category.

I come back to this plan whenever changes in expenses or income happens, as that changes what is available to allocate to each category.

Recap – After following this step, you should have

- An idea of how you want to allocate your money

- An understanding of how your money is spent

- A plan built your situation (with an indication of where you want it to be)

- Feeling of confidence that you can still spend money and save at the same time

Step #3: Create an automated banking structure

It's time to get to the tools.

We have our history; we have our plan, we now need to make sure our system can enact this plan with as little hassle as possible.

I’ve gone full circle from clean simplicity to advanced dozens of accounts back to as few accounts as possible.

What your banking setup might look like

Many people start off with the basic setup of two accounts with the same bank

- Transaction account (income comes in, money goes out)

- Savings account (money comes from first account)

I’m not a fan of this setup. Only because you can do so much better.

The problems with this setup is that any savings you have will be

- Staring you at the face every time you look at your bank account, asking to be spent.

- Easily transferable to the transaction account for use immediately

There is also a chance you have not setup money to be automated so you need to login or use your card often which warms you up to spending and using even more money.

Let’s find a better way.

Good banking systems should do these things

Here is what a good banking setup should do for you:

- Have the necessities paid for without thinking

- One or more savings accounts filling up

- Money for spending and fun at my disposal

It should also be a system that you used to oversee or review what is happening in your financial life, not a place that you need to be active in.

I’m talking about logging on once a month to nothing is out of check rather than logging in to pay another bill.

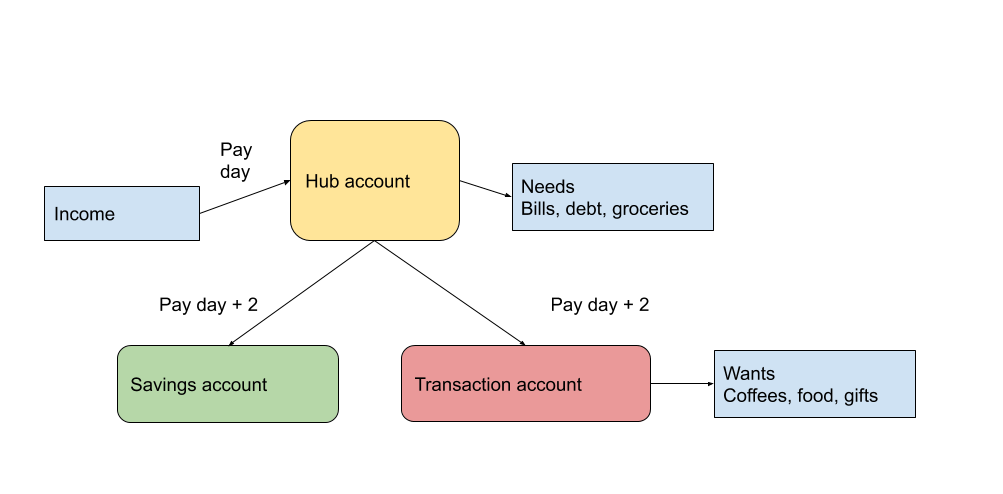

Here's a diagram to help explain the ideal flow.

We have here a hub account pushing money out to where you want it to go (according to your spending plan).

Your main account is a hub where your income goes into

It is also where you setup automatic transaction for money to go to your savings accounts and spending money.

You should also look to set up automatic transfers to send money out of this account. Most bills can be direct debited so you can set that up (and even determine what date they come out).

Suggestion – keep 1.5 times your regular pay in this account as a buffer in case of extraordinary costs or bills pop up. Eg. If you make $1000 a fortnight, keep $1500 in this account as a minimum (it’s not to spend).

Money for spending and savings goes to two separate accounts

Yep, so you have your hub account. You then have two different accounts ideally from idfferent banks that you push money to.

Why different banks? You want to make it hard for your savings to become spending.

This account is helpful especially if you are trying to resolve any spending issues, or focussed on paying down debt,

Being deprived of spending is hard, so with this account we want you to spend but with a hard cap. This cap is your percentage allocated to needs (such as 30%).

You will set up these accounts to receive money each pay cycle.

How this works regularly

Aligning your banking setup with your pay cycle

Most of this system is a set and forget. You set it up once and from there its all automated.

I keep just the card for my transaction account in my wallet (and a credit card which I detail below).

Setting up a new system like this will take some time. It is easier than ever before to create and run new bank accounts, but it took me a few days to restructure things once I worked out this was the system for me.

What if I have a credit card? Consider it a bill you need to payoff each month and setup a direct debit for that. If you are struggling from spending too much from it, take it out of your wallet.

How do I pay for groceries if it comes out of my hub account which has no card? If you have a credit card you can use that to pay for groceries and get the cost debited with the rest of your credit card costs (out of the hub account). If no credit card you can put the money you are thinking of groceries are and move it to the spending account, including it in that bucket. I personally have a separate card for groceries. It’s not a percentage but a fixed amount that we transfer to an account with a card every Sunday. This card is used for Supermarket shopping.

What if I run out of money in my transaction account and really need to buy something? It depends. Is it an emergency? If so, then you can move money out of your hub account – easy to do if you have a buffer setup. If its not an emergency you should wait until your spending account gets filled up next. You will get used to when this happens as it will feel like payday, except you are the one paying yourself.

What if I have a mortgage and offset account? That’s handy. Use your offset account as your hub account. You’ll get a better interest rate and likely your home loan is already setup to be deducted from that. Some banks allow you to setup multiple offset accounts. Have a look as you can potentially setup a few accounts for saving goals that get a good interest rate as well. I personally use my offset as my hub account, pushing out spending, saving and investing money elsewhere after each pay cycle.

After following this step, you should

- Be setup to run an automated banking system

- Using the right accounts for incoming money, spending and savings

- Avoiding the management of money as much as possible

Step #4: Behave

With a new spending plan and automated banking system in place, we want to make this work as much as possible.

Rather than a piece of paper or one off checkpoint, your budget is a living system that you need to tend to occasionally.

You’ll benefit the most if you do some regular maintenance to keep yourself honest and on track.

- Every month do a quick review to make sure things seem as they should

- As your lifestyle changes go through the first two steps again

Keep realistic about it

No one is expecting you to suddenly flip a switch and change your financial life over the weekend.

What this process is trying to do is steer you on the right path. A path where you know how much money you have, spend, and save all while living an enjoyable life.

If you are new to budgeting, it will take time to adjust, but a system in place helps you be more deliberate and when you are deliberate, you are in control.

If you have budgeting before and it has not worked out the way you like, just consider this moment as a step closer to what you need to do. You are making substantial progress by thinking about this.

It is not a straight line up into the clouds of financial freedom. The line down over and over, which will feel like things aren’t working.

That is until you look at your bank accounts in a year or two from now and see genuine savings, no anxiety about what money is going where all while still enjoying to do the things you love irrespective of costs.

The Wrap Up

I’ve gained a lot from budgeting in my adult years and it’s given me a foundation on which I’ve been able to free up my finances and enjoy the way I use money in my life.

Let’s go over what I’ve covered in this budgeting guide.

- Reviewed current financial situation (listed out your expenses and income)

- Decided on how you want to use your money

- Setup a spending plan for your money

- Put your bank accounts in order so that your plan is all hands off

- Kept realistic (and hopefully optimistic) that changes like this will make life better.