Micro-investing is an option for anyone thinking they don't have enough money to invest with.

You only need as little as $5 to start investing and with even little knowledge of how investing works. Today there are investing apps for every investor level that will guide you through the process rather than use big words and financial lingo.

Not only can you use them to start investing with little money, but by using micro-investing apps you can be a more confident, informed investor as you get going and understand how it can build your wealth.

I've been using them myself for years and appreciate the simplicity, ease, and low effort needed to make money with my own money.

There are many benefits for you to using micro-investing – especially if you are starting small but want to do something with your money. Let's break it down from the start though work out how you can invest with little money.

Is investing worth it with little money?

Yes, investing with a small amount or little money is a great way to put your money to work and build wealth. Even as a beginner investor, putting $5, $100, or $1000 into an investment on a regular basis over time can grow to thousands of dollars. Investing small is also a great technique for beginners as it can grow your confidence and your knowledge of investing which all adds to your financial independence.

You won't earn much at first but over a time frame of 5-10 years onwards, you will see your money make money on a regular basis. Investing with little money also gives you the advantage of reducing risk while growing quicker than a savings account.

How much will investing $5 a day grow to in 10 years?

The answer is $27,823. This includes 18,250 from your own regular deposits plus the $9,573 you compound on top of that over time.

How do I invest a little bit of money?

Micro-investing apps and fractional investing are two modern ways for anyone to invest with little amounts of money. For $5 you can create an account and start investing with tools like Raiz or Spaceship which are micro-investing apps. Online Brokers such as Stake allow you to fractionally invest in individual US stocks or ETFs with a minimum deposit of $50.

If you are considering investing a little bit of money, the best way to picture the experience is by thinking long-term. The most successful investors would say money invested in shares needs to be there for 5-10 years before you see good results. A great way to speed up the results is to invest regularly so even if it is a little amount, doing it more and more will just add to the results you get.

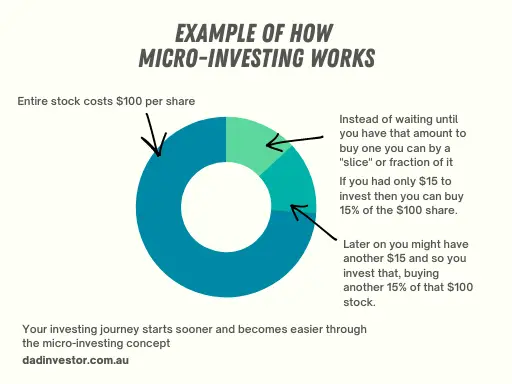

What is micro-investing?

Micro-investing is a concept of investing where you can use small amounts of money to invest in shares fractionally. Rather than needing to have enough money for one whole share that might cost $100 each, you can use what you have – such as $20 – and buy a fraction of that $100 share. Think of it like being able to buy one hot dog roll instead of the entire pack of 6 if that's all you have the money for.

Micro-investing also changes the way you pay for investing. Instead of needing to pay each time you buy or sell a stock, you get charged a monthly fee that covers as much trading as you like. These fees range from $2.50 onwards a month or $30+ a year. The benefit here is if you want to invest $5 a day then you can do so without incurring additional costs.

This moves the needle from being in the stock market's favor to the investor's. No longer do you need to have a large amount of money available to start and invest regularly. Your ability to include regular investing as a part of your financial life becomes much easier.

Who is micro-investing for?

Micro-investing is a great way for beginner investors to begin their journey. It's also a fine way for regular investors to simplify and automate their investing process. The apps you can use for micro-investing are built for set-and-forget investors who want their money to grow but don't have the knowledge, confidence, or time to be an active investor.

If you are the kind of person who loves using their phone for banking and general money management then a micro-investing app might be an easy option to consider.

What are micro-investing apps?

Micro-investing apps work by investing amounts of money into a diversified portfolio of shares and other assets. These apps look to invest in commonly held stocks and ETFs that they package together into a number of portfolios for you to pick from. The most popular investing apps in Australia will charge users a monthly fee of around $2.50-$4.50 but it gives users the ability to invest small amounts in a simplified way that removes the complications of traditional stockbroker investing.

I'll list out all the benefits below, but the main ones are that you don't need much money to start. The apps work as investment services to help you understand and take that first step you might have otherwise feared.

If you feel like micro-investing apps seem like a new thing that's because they are. I've been using them since 2016, but for most people, it wasn't until 2020 that they started to take off.

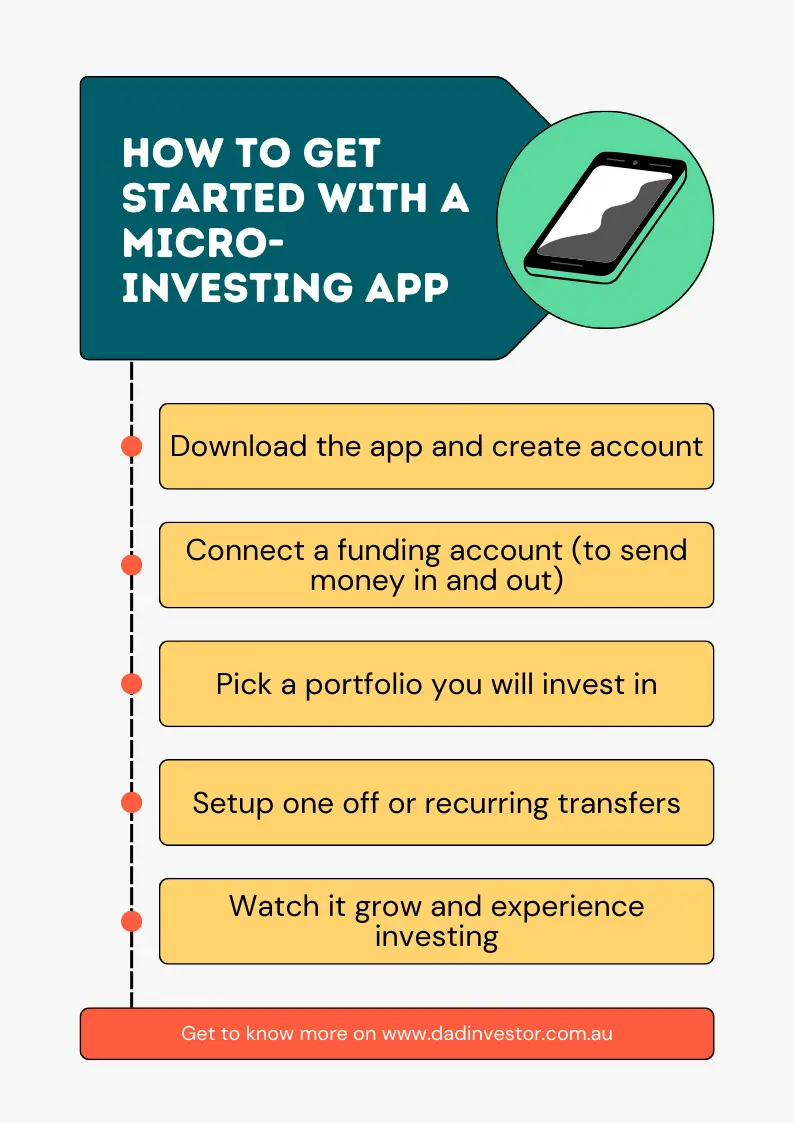

How do investment apps work?

Micro-investing apps work by offering you an account that invests for you in a portfolio of assets (such as ETFs or individual stocks). You can decide which portfolio or fund you want to invest with and then you can set up ongoing or one-off transfers into that portfolio through the app. To start adding money to the app you connect a bank account so you can have money taken out when investing or money sent to it when withdrawing from the app.

Once you start and set up your account as well as which portfolio you'll be investing in, there is very little to do. Like a savings account, all you need to think about is sending money into it and after a while when to take it out. Depending on the app you might be able to change the portfolio you invest in as you change your mind.

Micro-investing apps work as a sort of middleman between you and the stock market. Years ago the only way for you to invest in shares was to buy them directly and this was intimidating to a lot of people. That and needing a lot of money to start and continue to purchase stocks. Micro-investing apps remove those two main barriers to entry and provide a much easier way to invest in shares.

Are investing apps good?

Micro-investing apps are a great option for beginner investors or even more experienced investors who want a set-and-forget approach. These apps simplify investing in shares so that you only need to pick one portfolio and then choose how much and how often you will invest. The returns are also in line with market returns that are commonly seen by investing directly in index funds and ETFs through the stock market, so if you like that but in an easy-to-use package then investing apps are a good option.

You need to understand though that while investing apps are supportive and helpful for beginners, the concept of the stock market is to hold long-term. If you need the money in a year, then you are better off in a bank account. Compare it to buying a house. It's very unlikely you'd sell the house in the first year if you weren't happy with how much it was worth then.

What are the best stock apps for beginners?

In Australia, Raiz and Spaceship are positioned are two of the best investing apps for beginners as they are low-cost and easy to use while needing only $5 to start with. Spaceship has three simple portfolios to choose from and is free to use until you have $100 in your account (then $2.50 a month). Raiz has a broader range of portfolios to pick from and allows customisation and will cost $3.50 – $4.50 a month depending on what you pick.

Both are great options to start off with for new investors as you can keep the amounts you invest small, and reduce your risk but also start to understand the way investing in shares works. Both apps are great at supporting beginner investors through their content and explanation of investing terms through the experience.

Other micro-investing apps such as CommSec Pockets, Sharesies, and Pearler are similar, but all have individual differences. With the low cost and effort to start, it could be worth trying them out to see which one is the one you'll stick with.

What is the safest stock app?

No one investing app is the safest for your money as they are all invested in stock markets around the world that are known for volatility in the short term. When investing in Australian or Overseas shares a good rule of thumb is to estimate that you will get a negative return 3 times in a 10-year period. That means most years will be positive (and likely outweigh the negatives) if you invest for the long-term which is 7-10 years.

In Australia, you must have a financial services license (AFSL) to conduct a financial services business – which includes investing apps. This means the apps and the businesses behind them have obligations to provide efficient, honest, and fair financial services.

Investing in shares does have its risks, and while investing apps can help guide you make your investment decisions there are no guarantees of performance. To check if an investing app has an AFSL, check at the bottom of its website or terms and conditions. You can also check ASIC which awards licenses to see if they have been granted one.

Can you use multiple investment apps?

You can sign up for multiple investing apps and use many at the same time. Most micro-investing apps only let you set up one account per individual and within that account, you can only select from one portfolio or investment option at a time. To keep it simple, micro-investing apps also do not offer joint accounts or accounts you can share.

If you are looking to open and use multiple investing apps, then consider how you will use them. If it's to compare the performance, then understand most are built to offer long-term returns which equate to 7+ years of use. If it's to compare the experience and process, then consider the fees you may be paying while you have them all open.

Do micro-investing pay dividends?

Yes, you will receive any dividends paid from the underlying investments you own, but how they are paid out to you may differ. An investing app like Raiz or Spaceship will automatically reinvest the dividends back into the portfolio you selected. Online Brokers like Stake send dividends back to your online trading account which you can then withdraw or invest manually. Investment dividends are paid either monthly, quarterly, bi-yearly, or annually depending on what you are invested in.

As your investment journey starts or if you are investing with little money you will not see much return from your dividends. Dividends are commonly a small percentage of the stock price, such as 2-5%. So if you're investing $5 a day for a year your balance of $1825 may only receive $54.75 in dividends if it was 3%. It's still something but not life-changing so might be worth reinvesting it so it can continue to grow.

Benefits of using micro-investing apps

There are amount of reasons why micro-investing apps are the right choice for investors. They have become a real game changer in the investing industry that's allowed more people than ever to start building wealth through shares. I know this because I'm one of them and have found a growing list of benefits to using them:

Invest with small amounts and little money

Most brokers need you to put $500 into an investment to get started and even then there are fees on top of it. These apps reduce barriers. With Raiz or Spaceship, you only need $5 to get started. You also don't need to be consistent with what you invest either. Apps like Raiz offer round-ups which mean for each purchase you make in your funding account, Raiz will round that up to an even dollar and put the value of that into an investment for you. For example, if you spend $4.50 on a coffee, Raiz rounds up to $5 and puts 50 cents into the investing app.

Another benefit of micro-investing is the way it does fractional investing. This means rather than wait for you to have $100 to buy a certain share (like ASX IOO for example) you can put your amount into the stock and get a fraction of its purchases. So you can buy half a share or even 10% of one. This helps get you in the market sooner and smooth out the way you invest.

I personally love fractional investing and use it regularly when investing in US stocks via Stake.

Easy to use

You can literally download an investing app right now and sign up on the spot. Many of them use plain English and encourage new investors, so make it easy to understand. I like to tell people it's like a savings account – you can send money in, and after a while take money out. The longer you wait the more it'll grow (according to long-term history).

The apps themselves are bright, colorful, and intuitive to use. There's minimal jargon and everything is there in a neatly packed way for you to understand.

Example of Raiz app

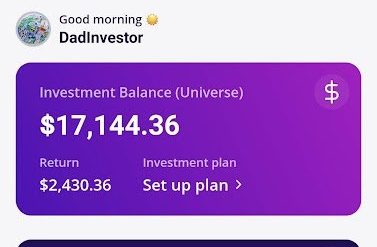

Example of what Spaceship looks like

Micro-investing can help you reach your financial goals sooner

I used Raiz to help save for my house deposit. It was that simple. Instead of keeping my money in a savings account, I put it into a tool that would outperform that using the stock market. Yeah, I had to wait a while but over time it was worth it and something that got me to achieve my goals sooner.

Low Costs

Some brokers charge $20,$30, and $40+ per trade. Even then it's a minimum of $500 to get started. Micro-investing apps were built with low costs in mind. Starting with $5 you can deposit and invest

Invest differently

Micro-investing replaces the need for old-school full-service stockbrokers. No longer do you need to wait until you have enough money to buy a certain stock or pay when you put money into an investment? The concept is a service as much as a product. Work goes on behind the scenes so that investors are in control.

If you have a small amount to invest, then that's fine. A micro-investing app will help you do that. The stock market is a beast to those without much confidence and these apps bridge a gap so that you can feel more comfortable with stock market investing.

Alternative to property

Owning property is not for everyone. Not only do you need a lot of money saved to hand over as a deposit but you also need to fork out money for maintenance and rates while you own it. Then if you want to sell your property it costs more money and you might not even get back what you paid for it.

Investing in shares on the other hand is something that can scale to your situation. If you can only put in $5 that'll work. As you earn more and find more then you can add that to your investing app. Then if your situation changes you can cut back on investing so much, leaving your money already in there to grow and grow.

Over time, what you put and leave in a micro-investing app can grow into a significant asset that becomes the equivalent of owning a property. Giving you the security and safety that many of us look for in financial independence.

Ability to learn through experience

These investing apps cater to the fact many of their users are first-time investors. Because of this, the apps are very supportive and informative to those learning the investing ropes. Through the language used (no jargon) and helpful articles or explainers.

New investors feel supported with helpful cues, tips, and updates from some apps that give you confidence and comfort around the investing process.

Low effort – automated

Set up recurring investments and get automatic rebalancing done, which you can't do through traditional brokers

For example, you can set up $100 to invest in your app of choice every fortnight or month. This gets automatically invested and goes to work like your savings account word. It's like setting up a scheduled payment transfer

This is what I did for years – putting money into an investing app instead of a savings account. Through the good years, investments will grow faster than a bank account will.

How investing with little money over time looks

How does it look when you invest a certain amount into a micro-investing app on a regular basis? Let's do the calculations and work it out.

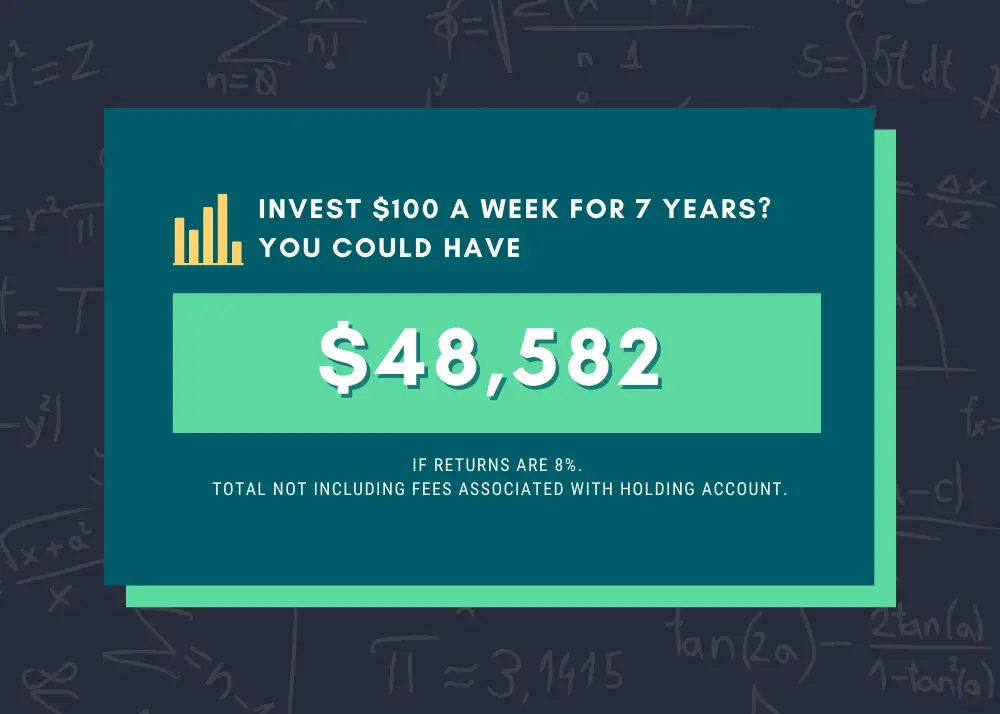

As you'll see the more you can save and the longer you do it for will pay off

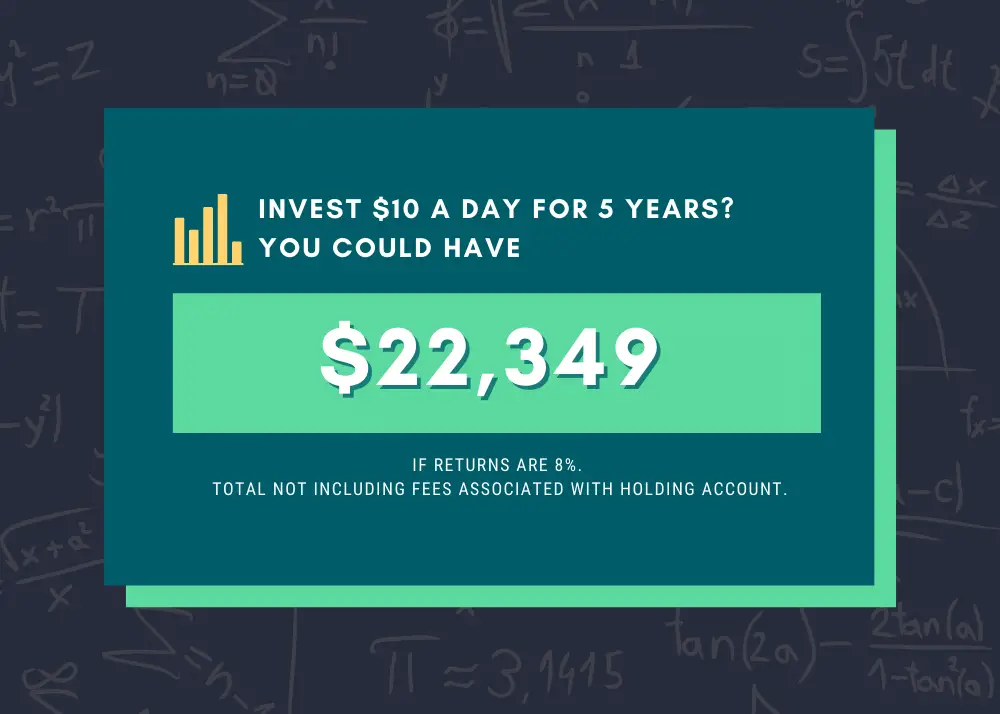

How much will investing $10 a day be worth in 5 years?

How much will investing $100 a week for 7 years be worth?

How much will investing $1000 a month for 10 years be worth?

How about that? Solidly investing $1000 a month for 10 years turns into something bid. You can use that for a house deposit, or continue to save.

Obviously, the hard part is getting $1000 a month to invest and then waiting 10 years but at least that can paint a picture for you.

And that's the beauty of these micro-investing apps. They are all built to accommodate whatever you can afford to invest. You might start off pumping in $10 a day. If that gets too hard you scale back, or you get a good tax return so you put that in. The flexibility to put in what you can is a great benefit.

Conclusion

Micro-investing apps are great options for beginner investors and anyone looking to invest with little money.

The tiny effort needed to create an investment portfolio is a key reason why it is worth at least trying out.

You do need to understand that building wealth does take time.