When it comes to investing in shares, there are two options: passive investments like managed funds or ETFs, or active investments where you hand-pick individual stocks across all available markets and sectors.

However, actively investing requires a significant amount of time and effort to research, assess, understand, and make decisions.

That's where digital technology comes in, and Simply Wall St is one of the best tools available to help investors research, measure, and select stocks for their portfolios, whether they are passive or active investors.

In this article, I will share my experience using Simply Wall St as a way to help my invest in shares. I'll run through some of the key features to help you decide if it is the right tool for your investment needs.

Simply Wall St Review: My verdict

Since I started using it back in 2019, Simply Wall St has become my go to when researching or analysing individual stocks.

It's biggest draw for me is the way it aggregates and presents information.

It's clear, consistent and reduces the time and energy I need to be assessing stocks. Cannot stress how much time this saves and also how much it has improved my impulsiveness as an investor.

Simply Wall Street Pros and Cons

The platform is quickly evolving and looks so different to when I started using it, but the core offer is still the same

Pros

Unique and in-depth visual reports for over 100k stocks worldwide

Clearly identify stock valuations, management, performance, future

Screen stocks based on dozens of filters such as sector, size, performance, price, value, future forecasts.

Save hours (seriously hours) of collecting organisational data to make safe and informed decisions.

Stay informed about the major changes to your holdings, the markets or the economy.

Cons

Decent learning curve to comprehend platform

Suited purely for investors who are actively researching or picking stocks

Not a investment decision service

Ok that last one isn't really a con but if you are a here and think Simply Wall St will pick stocks for you, no that isn't the case. It is a wonderful tool that will help you make investing decisions quicker so let's jump in.

What does Simply Wall St do?

Simply Wall St is a platform that performs various quantitative checks of investable companies using different evaluation criteria. These tests use widely accepted and tested investments standardised to evaluate investment performance.

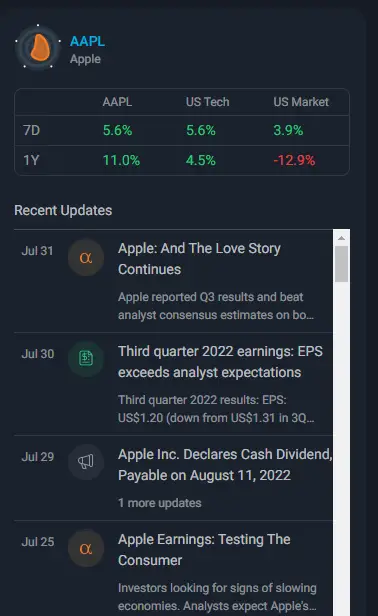

Each company has its own individual page that summarises many metrics that investors like to find.

All that technical data is there so you don't need to find an annual report, filing or click 100 tabs on Yahoo money.

You'll see info such as the PE ratio, EPS, Gross Margin, Debt/Equity ratio, Price to earning, ROE, ROCE all listed.

Not only do you get these numbers aggregated in the one spot, but also some context as to why.

You're either chomping at the bit right now or thinking, woah that's a lot.

And it is, there is a bit of a learning curve to work out what is actually going on so give it some time.

Here's a little side note on my personal investing strategies.

The four rules to picking stocks that I follow.

I found some similarities in the mantras shared by a few successful investors and worked a way to package them into four types of rules.

Invest in companies and funds you know of and understand. These are companies that will be around in 20 years, have a good moat from their competitors, and decent management. These factors are subjective, but ideally, you'd be more comfortable than not with the stock you are buying into.

Invest in trends and solutions that solve problems for billions. Areas like healthcare, AI, batteries, temp staffing, energy, and the internet are all in demand and should be valuable to the mass population for the long term. It's much easier to justify investments in areas you see the obvious value in.

Think of the investment as if you were buying the business. Focus on the value, buy into it at below sticker price then stockpile it. When you own act like the owner – and keep knowledgeable on it.

Invest intending to hold – time horizon is decades. This is very much a sit-and-hold type of investment which is a minimum of 5 years. You should sell only because of better opportunities, changes, max valuation, and moat breaks – aiming for at least a 20%+ profit gain.

Key features of Simply Wall St that I use

I use Simply Wall St like some kind of investor's social media. I flick through it like a news feed of investor information. Nerdy, but yeah I'm all in.

Here's what I regularly use the platform for:

Institutional quality financial data

That reads like a mouthful but it is the most on-point way to say the data inside the platform is quality.

Think of it like a large aggregator of all the data available in company-provided reports both recently and historically.

You'll also find that its not retail investors like me who use the tool but professionals and institutional investors as well. They appreciate the convenience and simplicity as much as I do.

Information presented in infographics I can read easily

The consistenly clean look of how information is provided is a key feature as well.

Each listed stock or company provides its annual report and public documents in its own individual way. Yes, the data is similar but it might be in a unique order, size, position, and hard to find.

Simple Wall St collates that information and has it all presented so it's clearly labeled and easy to review each company effectively.

This all helps eliminate emotional thoughts from the decision-making process.

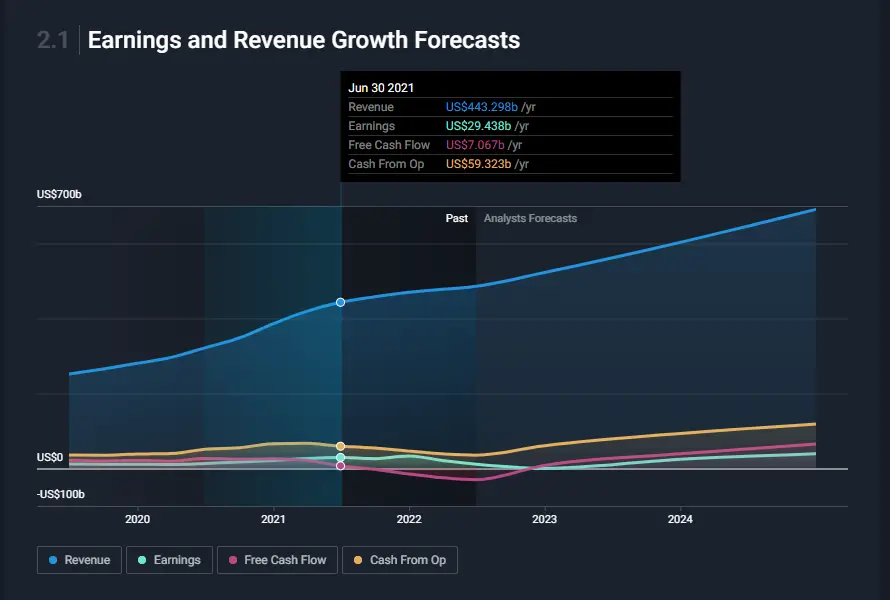

Charts are bright, clear, and interactive so investors can quickly and effectively do your analysis.

The data analysis can go as deep as what is publicly available.

Benefits and risks are presented at the highest level, then you scroll down the company page and find all the key metrics most analysts look for when assessing companies.

Discover opportunities aligned with Your Investment Style

You might have some companies or stocks in mind that you want to analysis, but what if you don't but want to do some research?

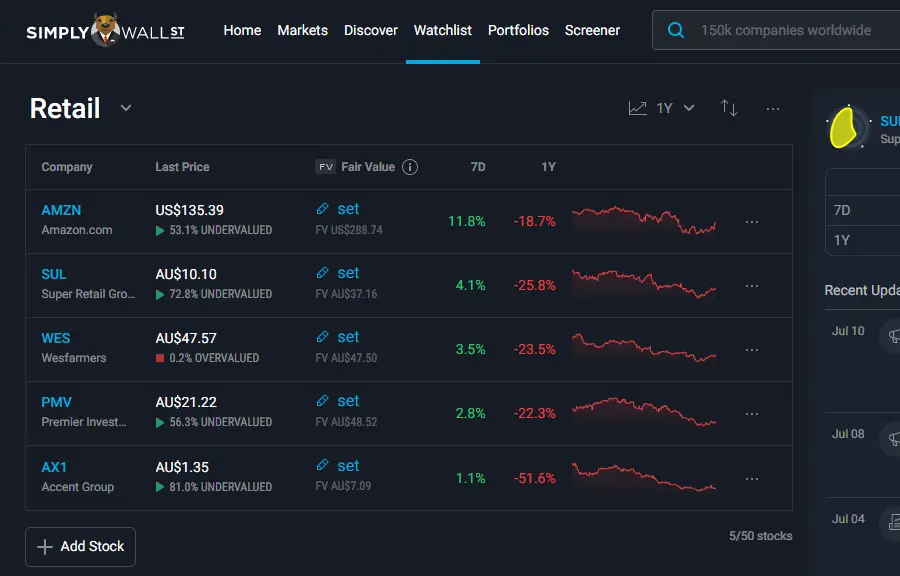

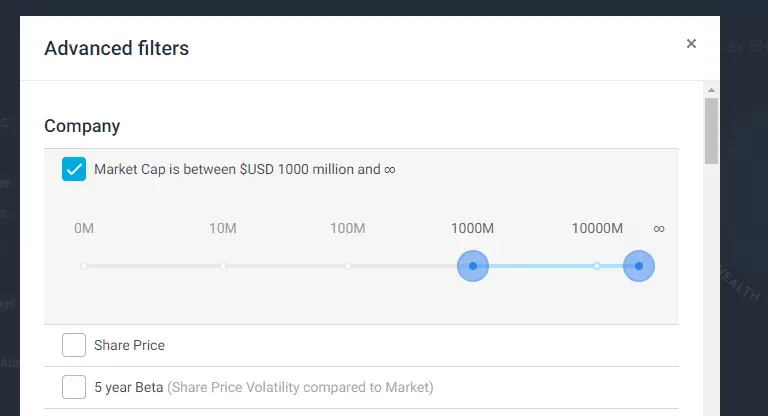

With the stock screener you can speed up your process with some advanced filtering.

Your search starts with 100k+ investable companies and funds but as you set toggles it whittles that down.

For example, you might want to look into US stocks that are in the Technology sector but have a market cap of over 1 billion. That's a pretty mainstream type of search but it'll do the work for you and present you those results.

I've loved using this as I've gone with some of the teachings of Warren Buffett and Phil Town by picking the sectors or industries that I truly understand. In my case it's Retail, Tech, and Finance. I keep a watch list for each of these but with premium, you can save your stock screener results and come back at any time.

Again another way it removes emotional investing.

Easily stay updated on fundamental changes and company announcements

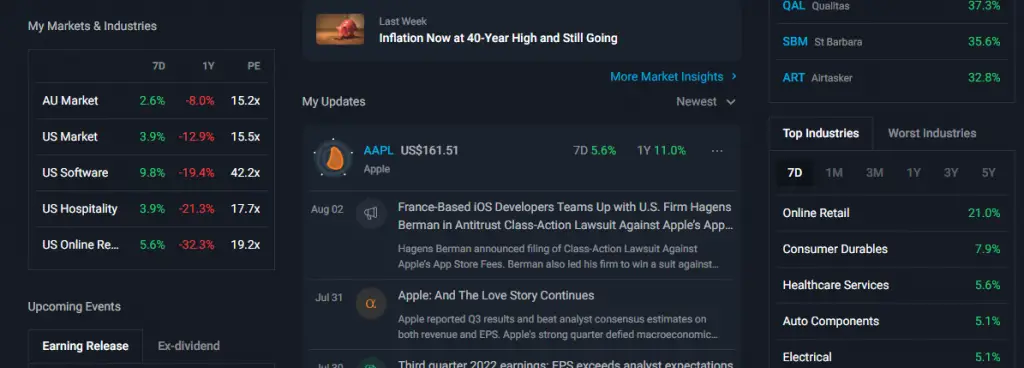

I mentioned that I use this like social media, and that's cause there is always up-to-date information that helps investors stay informed.

Included is a full overview of major updates and analyst insights that are most recent.

The good part is its all related to what you've saved in your watchlist so the more you have there the more appears in your feed.

Fast valuations and access to core data

One way Simply Wall St speeds up the research process is by having a consistent open look at a company's data.

Each company available has its own page profile with that page broken down into the following sections.

Overview – high-level notes on risks, size, performance, competitors, recent news, and fundamental numbers (like PE ratio and EPS)

Valuation – Six metrics that determine if the company is undervalued or not (a good sign of it being investable)

Future growth – Next 1 to 3 years based on analyst estimates (it aggregates a number of them for you)

Past performance – Last few years or revenue, earnings, and some others

Health – assets, liabilities, debt, and equity analysis

Dividend – How much, if any, and what do others pay in comparison

Management – who runs and owns the company, who is on the board, and what type of investors own it (individuals, funds, etc)

Information – where are they located, year founded etc.

You can use this kind of information in a few ways

High-level awareness of business

Deep dive into a specific area (like health or management)

Keep updated with how its been affected by market changes.

Quickly get a vibe of whether it is a good investment or not.

I actually use Simply Wall St for all these things and the visual format is fantastic in helping me do it quicker.

Setup watchlists and track portfolio

Beyond looking at individual information you can build some lists and even connect your portfolio up.

Watchlists are like they sound.

A list of businesses you can group together and easily see some info on them, including whether its undervalued or not.

I keep mine grouped by sector.

The other way to view grouped holdings is via the My Portfolio area.

This is more than a basic watchlist as it allows you to log the trades of stocks you have invested in. The date, price, and amount of shares you bought can be added to you can essentially track your investments in this area.

Now, this is a very different view of your investments than what you would get in say Sharesight.

It'll give you a combined score on your diversification, the valuation of your overall portfolio, future growth, past performance and more. So instead of needing to individually assess these you can group them together and view a real-time assessment of your portfolio as a whole.

Sharesight has API integration with Simply Wall St so they can automatically sync, so when you add a trade to Sharesight the Simply Wall St portfolios update as well.

This is all a great way to track your investments beyond numbers and make sure the reasons for keeping the businesses are still there

Other quirks and features of Simply Wall St

Articles

You might have found these when searching for stocks on their own, but the platform has some sort of AI working to spit out content articles based on the information they are collecting.

It tells a story on a certain piece of data and expands on it but then points to its platform as a way to do further analysis. Mentioning this as you don't need to be a user to access them and they are available here without login.

Find Investing ideas in the Discover area

So you might start using the platform with a few particular stocks in mind and want to assess them.

But what if you don't?

What if you want to find out what there is to buy and browse the markets?

Well, you can do that but there are 100k+ companies to run through.

What the Discover area of Simply Wall St does is provide you with investing ideas based on common themes or trends. Think of these like your curated playlists in Spotify. Each list of ideas is grouped together based on a common theme.

Renewable Energy

Airline Shares

Top Dividend Shares

Buy the Dip

It's another way you can quickly find some new ideas for investing.

Now there is nothing to say you should be investing in one trend or the other, but its a simple way to find stock ideas that might align with your values quickly.

Who owns Simply Wall St?

Al Bentley founded Simply Wall St in 2014. The startup is based in Sydney where it provides a platform to help investors understand complex data and make more informed, rational decisions.

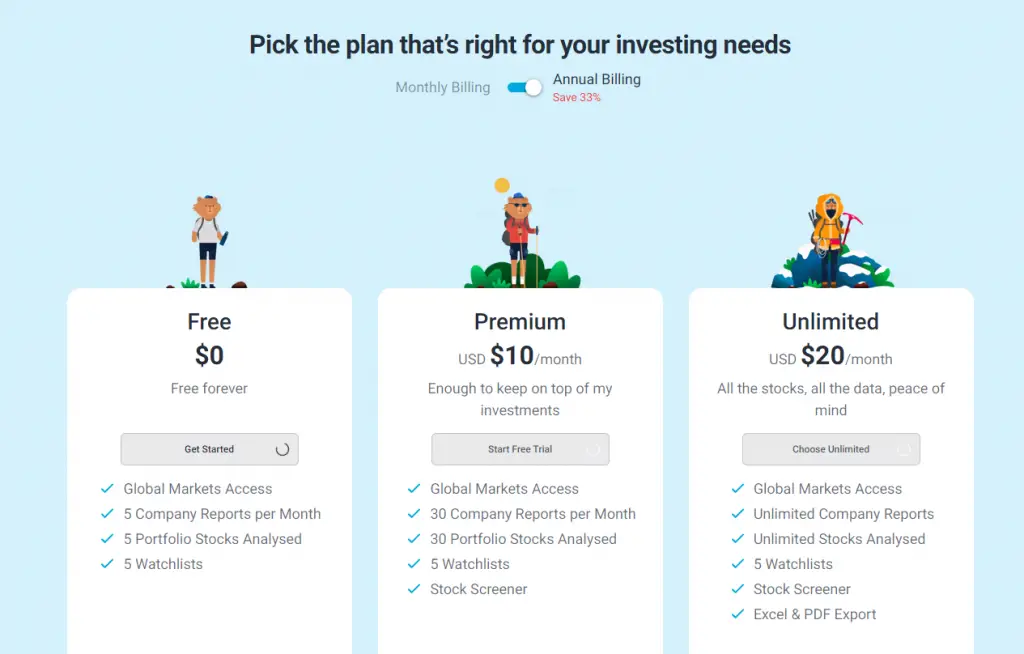

Is Simply Wall St free?

Simply Wall St has a free plan. It is how I started using the platform and is a great way to work out whether you will find value in its service.

The free plan is not a trial so you can continue to use it without needing to upgrade at a certain point.

Is Simply Wall St any good?

I trade both Australian shares, ETFs, and US shares and find the platform is helping me become a better investor.

At a high level, it provides easy access to all necessary information necessary for the evaluation of a business's performance. Additionally, the system allows you to build portfolios easily and check their performance.

More Simply Wall St reviews

It wasn't hard to find glowing reviews of Simply Wall St.

While it's not a product for every investor, those that do use regularly seem to love it.

Is the Simply Wall St free plan enough?

With the free plan, you get to get all the global market information, but you can only look at 5 company reports per month which is the core function you'd be wanting to use.

If that's all you need it for, then great but I found I loved the reports so much that I needed more than 5 a month so upgraded to the premium plan shortly after using it.

The free plan does exclude some features of Simply Wall St that you'll find valuable if you do upgrade, such as the Stock Screener and report exports.

What’s included in Simply Wall St premium?

More. More of what's included in the free plan plus a few extra features you can't get unless you are a premium member.

There are two tiers of premium – premium and unlimited.

The difference between the two is the number of reports you get included each month.

For premium it's 30 but with Pro it's unlimited.

Unlimited is also the only plan you can export company reports to Excel or PDF

Simply Wall St offers a 14-day free trial for premium plans.

Company reports

Every time you click on a company and load its report, that counts towards your limit. You can look at that report again without adding to your tally. With the free plan, you get 5 a month. With premium it's 30, and with Unlimited its, er, unlimited.

The jump from 5 reports a month to 30 is the obvious one, meaning you can research a company a day. Whether you need to retrieve an unlimited amount of reports will be something you can test out but I find 30 is heaps.

Search for specific stocks using the Stock screener

This is a paid feature only and allows you to filter stocks by a host of filters.

It's a feature for those looking to research at a high level first and then find companies to read reports on.

Excel and PDF Exports

An unlimited plan-only features, this option gives you the ability to download and collect a soft copy of the report at the point in time you load it.

It is handy to have a static version of reports on occasions, as the platform is dynamic so you will not necessarily see what has changed but a snapshot of the company's metrics at the date you upload it.

Downloading reports allows you to save timestamped copies of the report.

Might be a feature for more established or institutional investors, but the exports do look nice.

Simply Wall St Pricing

The free plan is $0 per month, year, and lifetime.

The mid-tier Premium plan is $10 a month USD if you pay the year which makes it $120 USD which is nice clean pricing to remember.

The unlimited plan is double the Premium – $20 a month on an annual plan or $240 a year.

In my experience, the cost has been covered by saving me time and money. I no longer need to spend as many hours researching stocks and trawling through stock sights. I've also avoided investment mistakes by quickly finding information on why I shouldn't be buying that stock.

The perfect example of this is when a mate tells you that stock X is about to skyrocket. You can quickly log onto Simply Wall St and find business fundamentals and get a data-driven assessment on whether your friend is being helpful or not.

Final thoughts on Simply Wall St

As an active investor, I rely on tools and services that support the way I like to go about it.

To me, anything that can help me make better decisions and in a quicker, clear-cut way is of value.

It makes stock research so much more elegant. Gone are the days of needing to click through finance sites ad tabs for basic company information.

Hello to the new way of doing things. Simply Wall St is the future for stock insight, and am looking forward to seeing where it goes next.