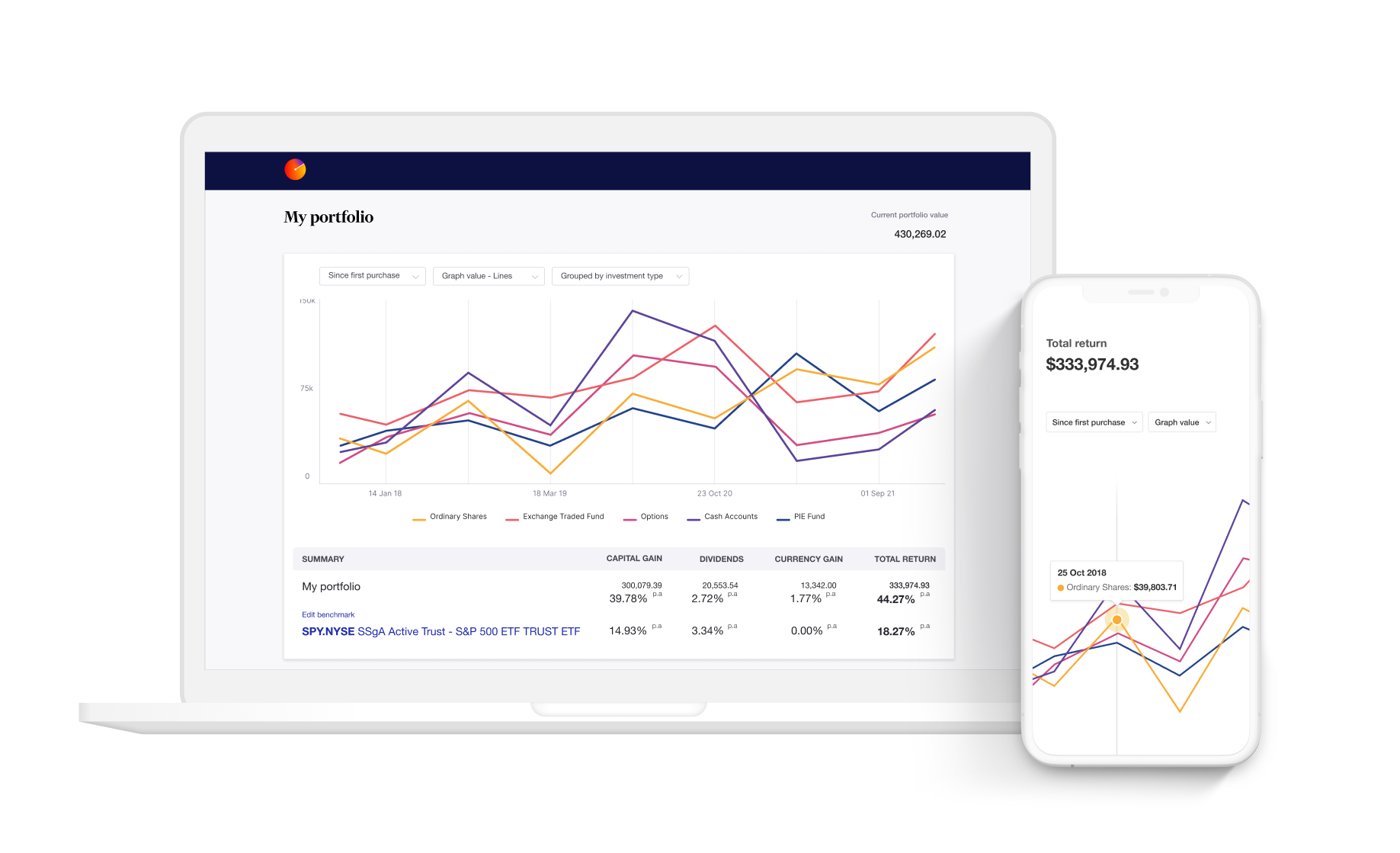

As an Australian investor, I've enjoyed using Sharesight for years now. At first, it was a great way to see all my investments in the one combined dashboard. Beyond that, though there are so many features that make investing so much easier, obvious, and even more fun.

Here is how I use the tool and the features I love in my own Sharesight review.

What is Sharesight?

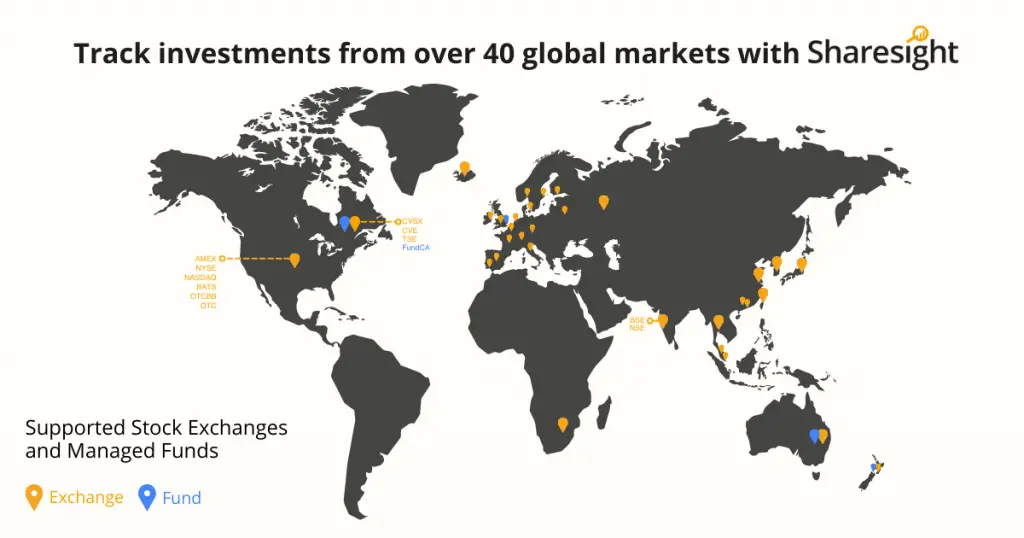

Sharesight is a portfolio tracker tool and platform. Built to replace your need to use and update the spreadsheet with numbers like when you buy, sell, and the returns you get from stocks.

If you spend over 15 minutes a week reviewing or managing your portfolio of shares and managed funds, then you need to know about this tool.

Sharesight Australia provides a website as a service that can easily show you a combined view of all your investments, and stock holdings to provide you a summary of your portfolio's activity. All you need to do is put in your buy and sell transactions as they happen (which can even be automated), and you can get a complete picture of all your investments on one page.

While that seems simple enough, there is an incredible depth of significant features that I haven’t been able to find anywhere else (and definitely not using a spreadsheet).

The Best Deal on Sharesight Right Now

Sharesight has been my favourite stock portfolio tracker for year. It's a great alternative to using a spreadsheet and you can get 4 months free on any premium plan, or just simply sign up for a free account to start with.

Sharesight Review – Free version

If you’re thinking about using Sharesight, you might want to know how the free and premium plans work.

The free plan has a limit of 10 holdings, meaning you can track 10 individual stocks, managed funds, currencies, or a combination of them. If you’d like more holdings, more advanced reporting, benchmarking features, or improved support then a premium plan will suit.

As we go through the features in this Sharesight review I’ll label what is included in which plan.

Sharesight Features

Aggregate all of your investment accounts in the one place

Sharesight is not an investing tool. It is a tool to manage your investments. It gives you the ability to give an overview of everything you invest in and own, irrespective of what platform you trade through.

I invest through the following products that all need their own separate login :

- Vanguard Index funds

- ETFs on the stock exchange

- US stocks via Stake

- Robo investing apps like Raiz

- Employee equity plans

- Bitcoin through Independent Reserve

The difficulty with using investment platforms like these is that they all have different interfaces and display different data so it can be hard to know the exact performance of your entire portfolio.

- Vanguard for example only displays the number of units held and the total value of the investment at the current date.

- SelfWealth (my online broker) will highlight the performance of my portfolio within the day and the performance in dollars since purchase (as does Stake).

This means it's hard to get a total view of my portfolio’s performance. Nothing is consistent enough to give me a big picture.

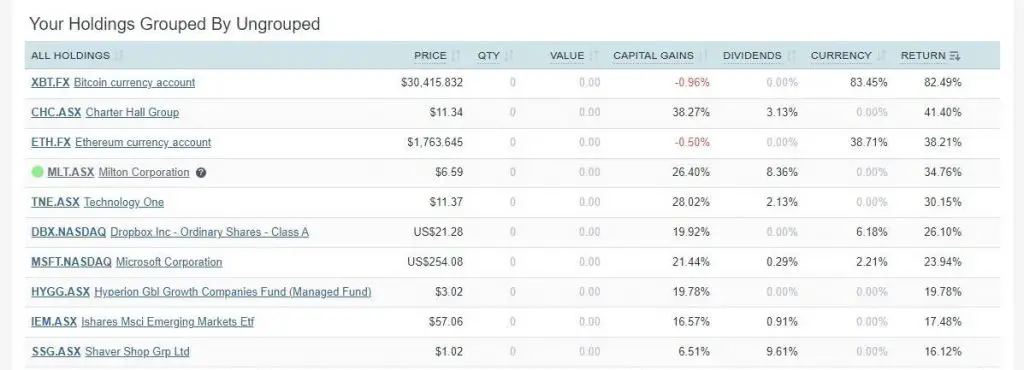

The focus in this table is quantity, value, capital gains, and total returns. With funds focusing on units held and stock brokers focusing on intraday performance, a table like this is a welcome feature when understanding total performance.

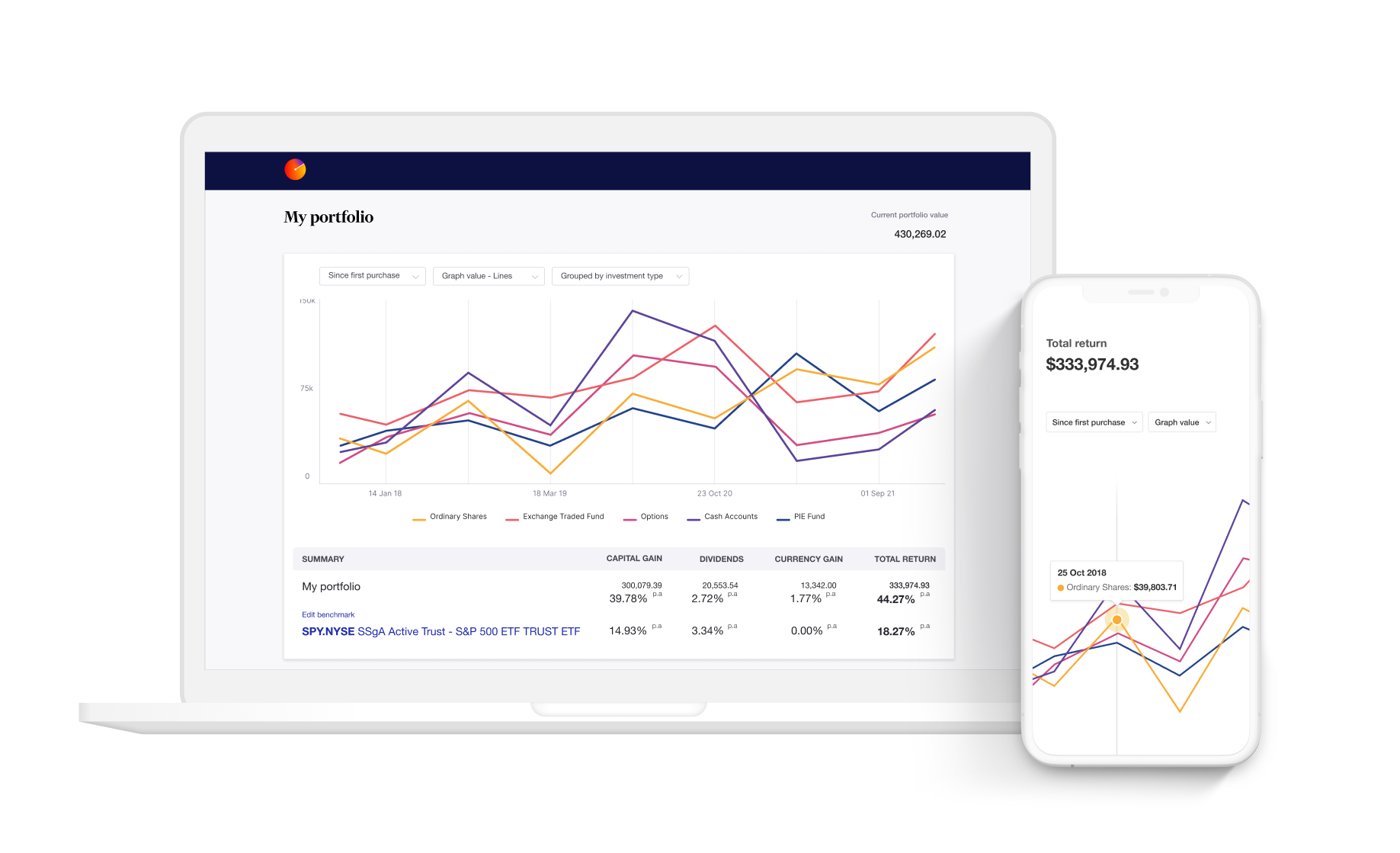

Easily find your portoflios performance

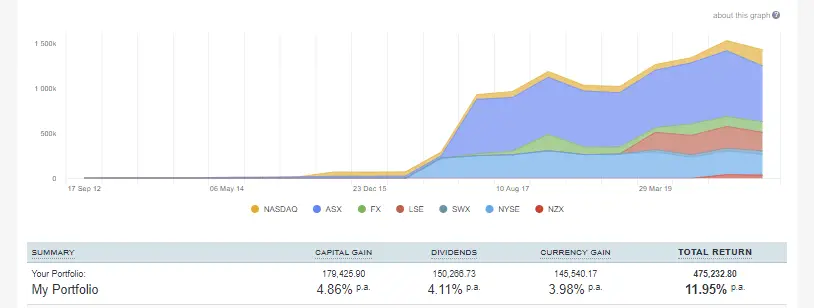

This feature is the real match winner for Sharesight.

Since Sharesight tracks and updates your portfolio as the markets open and closes you get the most up-to-date data from the minute you bought your holding to the present.

Haven't found a broker that gives me this kind of portfolio analysis

Other brokers seem to fix or limit the time frames when they show performance. A broker like Selfwealth for example only shows performance either from your date of purchase or within the trading day.

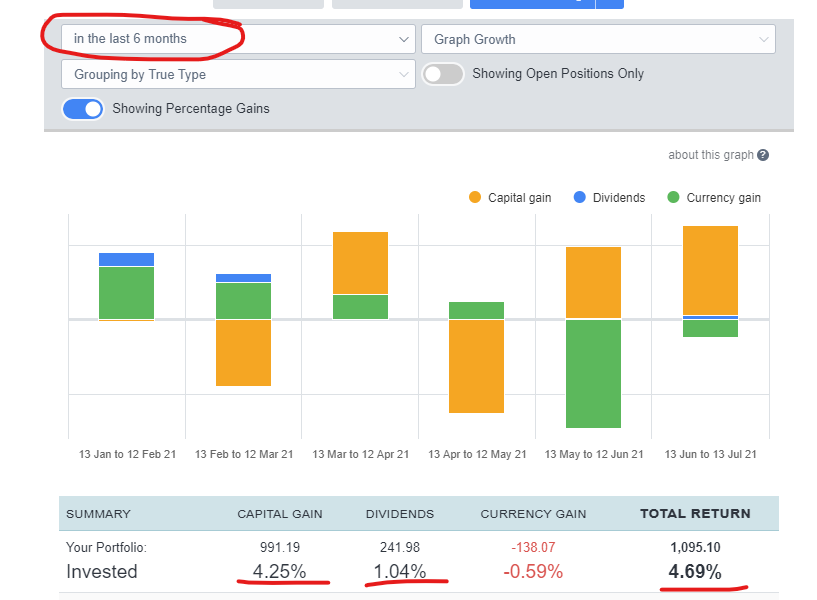

So what if you wanted to see your holdings’ performance over the last 3,6,12 months, 2 or 5 years.

Well just use Sharesight and select it from the drop down!

I love this. Let me show you how.

1 – Set timeframes to view past performance

With Sharesight you can set the time frame for your entire portfolio with one click to see the performance of each investment over the same time, together. A great way to easily get a long term view of YOUR results, rather than referring to reports or results from the investments you own.

This really removes the guesswork from thinking you know what has happened in that period to actually knowing.

2 – See your performance split by capital growth and dividends

With Australian stocks commonly providing dividends, it’s easy to get influenced by the yield shown as a good sign of returns. What Sharesight does is break a return by showing capital growth next to dividends received, then combining the two.

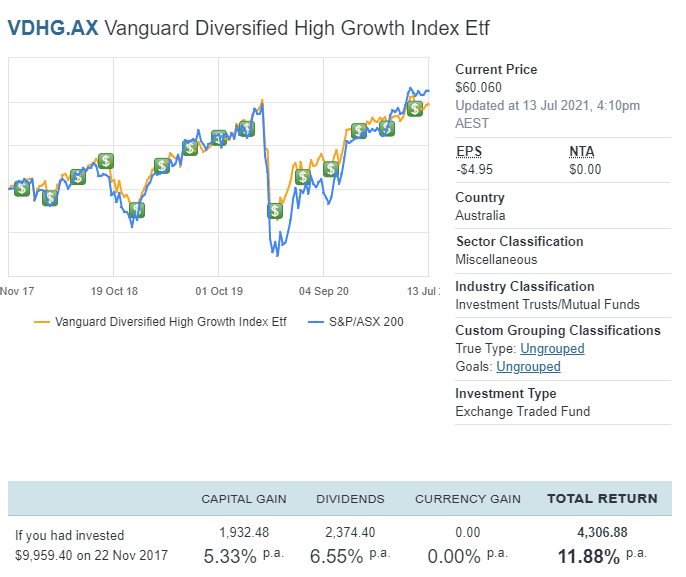

Take this of popular diversified ETF VDHG – Vanguard's High Growth Diversified ETF up to mid 2021.

You can easily see that while the overall return is a solid 11.88% per year over the last 5 years, it was about a 50/50 split between growth and dividends. You can even see the exact dollar amounts you would have received via each type of return.

This is very helpful, especially when you review your own stocks. You'll be able to see what is actually growing and what might be hiding behind strong dividends.

Track your individual holdings

Every holding you add to Sharesight has its own individual holding page.

On this page you can view all the information on it, such as when you bought the trade, how much for as well as any dividends that are coming up or were paid.

It also includes an easily readable graph of how the performance has faired over your given time frame.

You’ll can also add your own comments, notes, and attachments to the area or see more detailed corporate information.

It becomes even more valuable if you invest consistently in the same holding over time as all the trades line up and show you exactly the chronology of your investing.

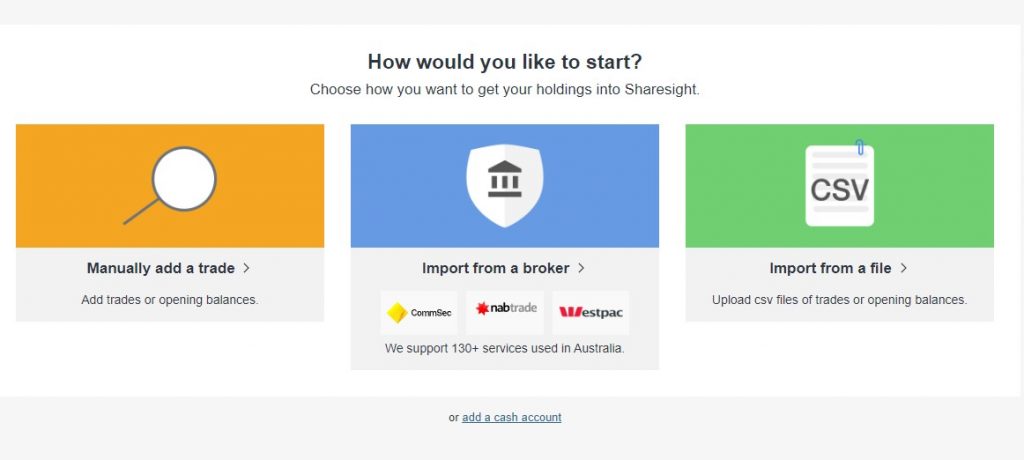

Easily add trades to the platform

There are a few ways you can add your buy and sell trades to Sharesight.

The easiest way would be automatic via its API. A number of brokers have partnered with Sharesight so you can sync the platform with your broker and the trades are automatically sent. Currently, only around 15 or so brokers are available for this, including CMC, St George, Bank of Queensland, and Interactive Brokers.

The next best way to have trades added is to have trades imported using email.

All you need to do is make sure your broker is supported by Sharesight (over 200 are) then just get your broker to email your trade confirmation to your Sharesight email address, which is a unique address given to you when an account is created.

From there Sharesight receives trades confirmation emails and stores the data, with you needing to confirm the information before it's added to your holding information.

Apart from those methods, there is step by step instructions on how to add holdings via data export and import via your broker, as well as the ability to add all trades in manually – which is actually what I do (I don’t trade often).

Multiplying this feature with the ability to connect with multiple providers also means you can set up Sharesight to handle multiple investment holdings irrespective of their platform.

You can view in symmetry how your bitcoin, ASX, Forex and Managed funds are going altogether in an aggregated view without much trouble.

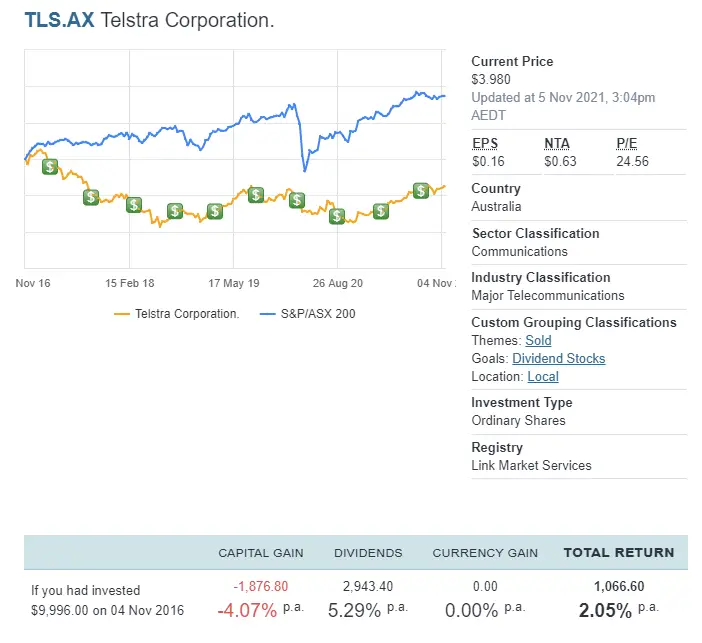

Share Checker

Until you become a regular user of Sharesight Australia you will not appreciate how handy this feature is. It is probably the most used tool of the site I access.

Without having to trawl websites, read annual reports or open PDFs you can get a breakdown of what $10k would have done over 1 day, month, year decade (if its been around that long).

Also see when dividends were paid, how the price has fared and if any share splits took place.

Also see how the market has performed against it at that time.

Here is what Telstra has done in the last 5 years.

Just looking at a chart like this immediately gives you an understanding of its overall return. So even though it might be talked about as a high income option, you'll see it hasn't grown.

A great insight that keeps performance data honest and give you the facts when you might be looking at a stock based on its growth or dividend performance.

Group your Investments (premium feature)

A handy aspect of the tool is the ability to build a snapshot of how diverse your portfolio is.

By default, there are ways to display this in a pie chart via things like market, country, industry, or neither.

What is helpful is the ability to build a custom group. You see I have a certain number of ETFs, so when I group my portfolio by industry or market it puts these in the “other” or miscellaneous category.

What I've done is set up a custom portfolio view so that I can put say IOO, ETHI and VGS into the Global group. This way I can tell if they make up my target allocation of 50% global ETFs. See below.

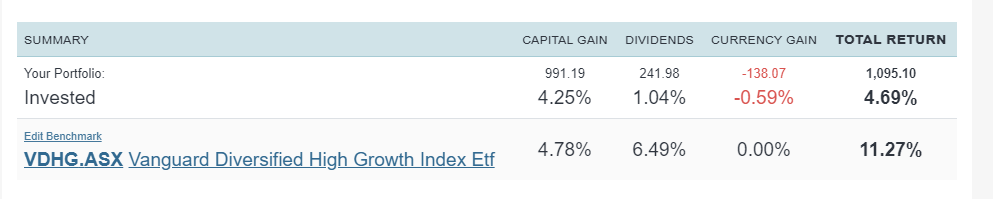

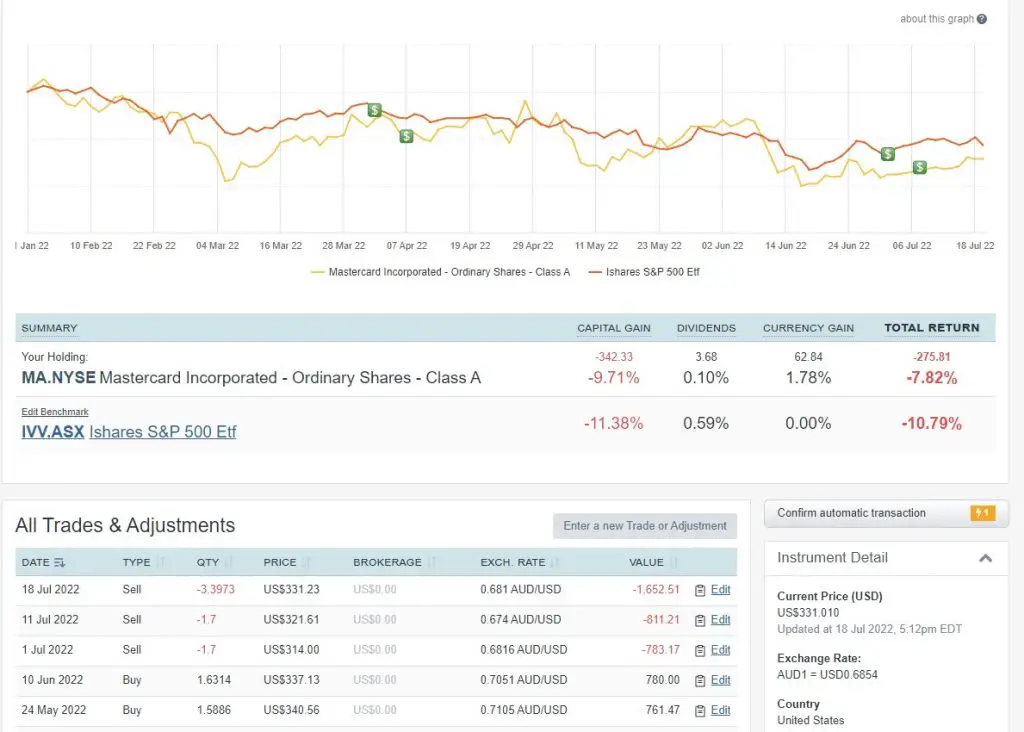

Benchmark your portfolio against anything else on the markets (premium feature)

Yet another handy feature in Sharesight is the ability to benchmark your portfolio against another fund, ETF, stock or company.

You do need a premium account to access this, but if you are serious about managing a DIY portfolio it is worth the expense.

For example, here I compare my Invested portfolio (a custom name I gave to a few individual stock picks) in the last year against VDHG to show me comparatively its growth dividends and overall return.

This is a great awareness feature as it can give you an indication of what an alternative investment might have looked like.

In this instance all my fiddling with individual shares in Stake (which are tech focused) turned out half as effective as investing into the NASDAQ ETF itself.

As a premium user, you can change the benchmark. I prefer to set it at a broad market ETF or index so I can see if I’m beating or matching the market.

This tool has shown me that sometimes I don't know any better and while I might seem like the work in picking stocks is a better move, being passive is just as effective to building wealth.

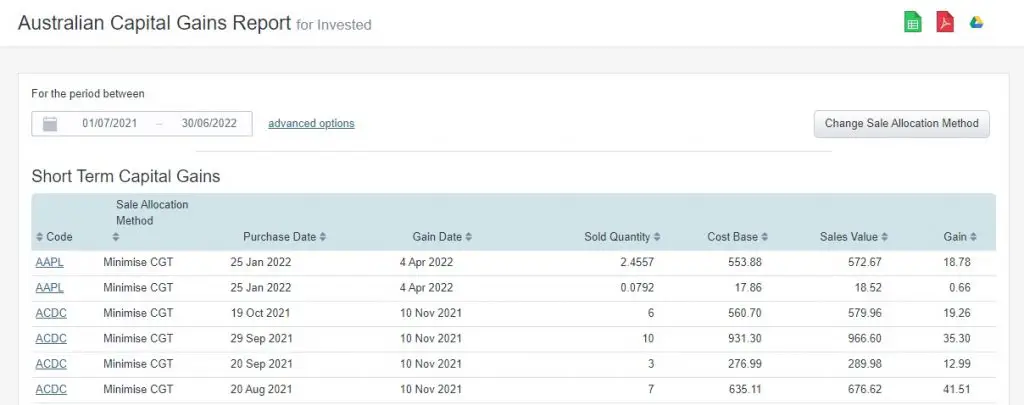

Make tax time easier with automated reporting for income and CGT (premium features)

I will not delve into it much in this Sharesight review, but the reporting features are massive time savers come tax time.

You can literally print of these and give to your accountant for tax time. All you need to worry about is adding in your investments when you buy and sell.

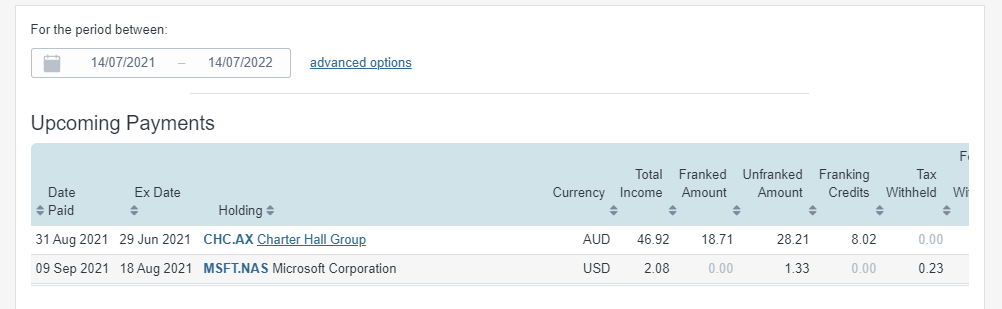

Here is a screen of what is in these reports

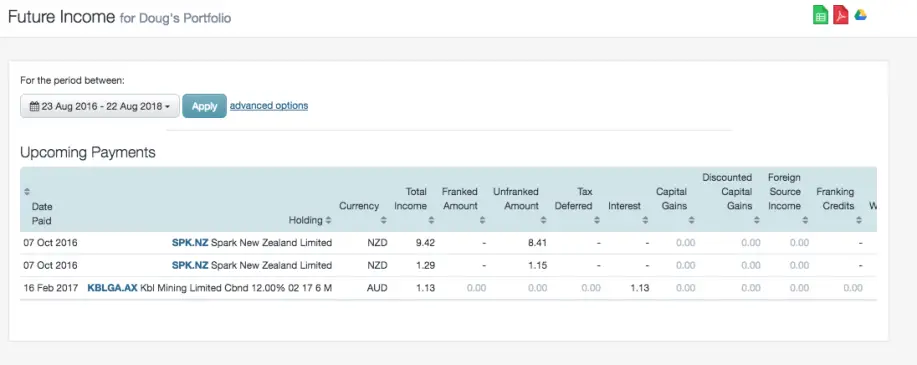

A couple of my favourites are the future income report and CGT reports.

Future income does exactly that – report on income that has been confirmed and you can expect at a future date. Handy if you are focusing on dividends.

CGT reports will give you a nice clean list of what gains and losses you had throughout the latest financial year, helping me out at tax time.

It can generate all these reports for your time frame of choice, making it a massive help when needed.

Other quirks and features of Sharesight

Ok so the core features are pretty solid, but there are also some unique aspects of the platform that I appreciate.

Is Sharesight tax deductible?

As a premium (paying) member of Sharesight, chances are that you can claim the expense as a tax deduction. This is because you likely derive income from the sharemarket and this tool is associated with you managing that.

I cannot 100% say yes everyone can claim it so make sure you check with a tax pro before you do.

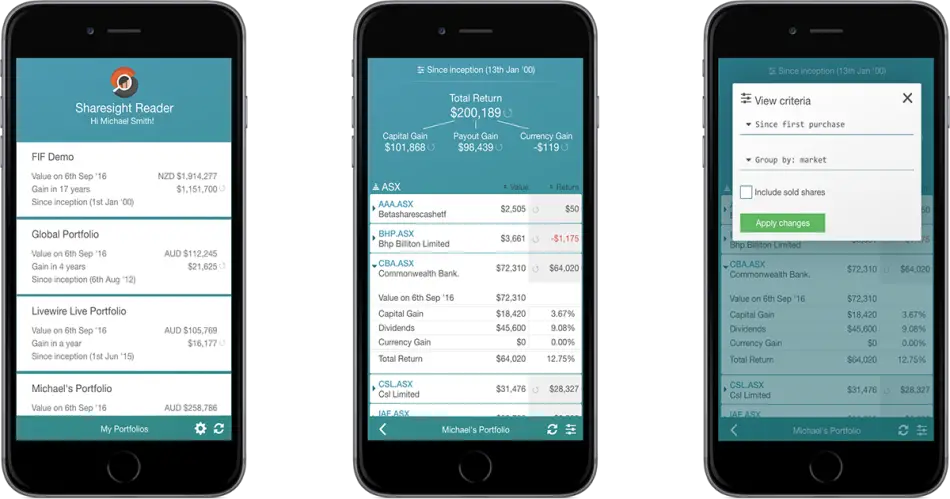

Is there a Sharesight app?

Yes, there is a Sharesight app. It will be decommissioned soon and taken from the app store. It's named the Sharesight reader and gives you a basic read-only version of the tool.

While it's not the flashiest too to use in comparison to some of the investing platforms out there, it will give you performance numbers of your portfolio.

Sharesight is constantly building a better product

Since I started using Share sight in 2018 the platform has grown significantly. The features, the access, the connectivity, the ook, and the interface have all evolved (for the better)

Not every company wants to consistently go above and beyond to deliver a first-class experience for its customers, but during my time as a customer I've noticed Sharesight is doing it.

Whether it be new tutorials and guidance on getting the best out of features, adding new brokers and funds to the service for easy management, or things like this…

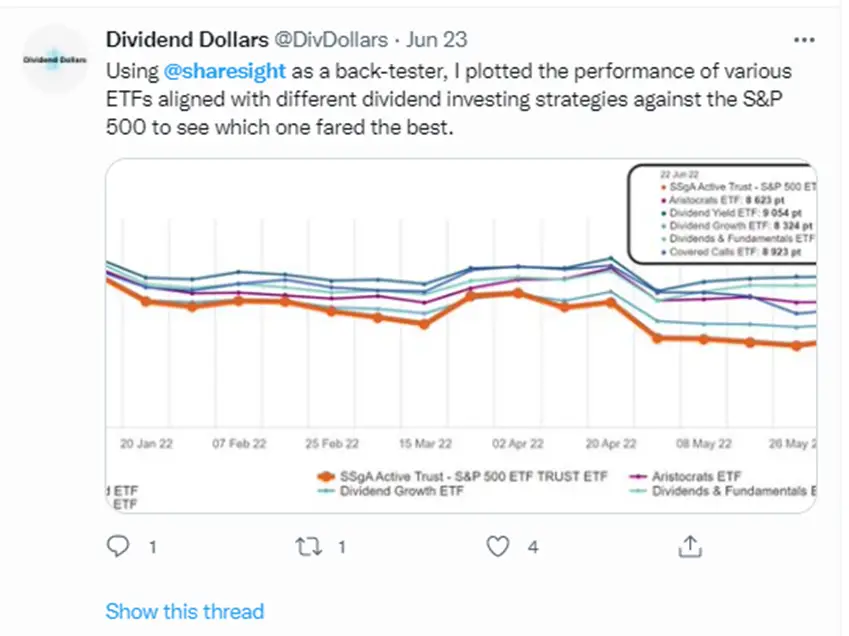

The Sharesight Community is growing

I also a fan of the new Sharesight community that has been added. A forum and message board that's all about investing and the Sharesight tool, for Sharesight pro or premium members.

It's great to be able to see what like minded investors and Sharesight members are doing with their money.

I keep tabs on the conversation topics, so If you are in the community lookout for me there!

Product performance

So I've told you now why I like the product, but what does the investing community think of it?

It's not that hard to find glowing reviews around on people raving about the tool. I just did a quick search on Twitter for some comments on it and this is what I found.

There you go. A variety of users all finding a different way to enjoy the platform.

Is Sharesight on the free plan enough?

The free plan gives you the ability to add 10 holdings (stocks, funds, currencies, etc) to a portfolio. If that is what you have invested then you can easily find value in the tool.

Getting access to the share tracker alone would be valuable for me, even if you don’t add any holdings.

You will find that there are a few greyed-out areas around the site that are only accessible as a premium member so you might get FOMO using it at times.

The good news is though you can get your first four months free when you sign up for an annual plan so the cost to go next level can be subsided somewhat.

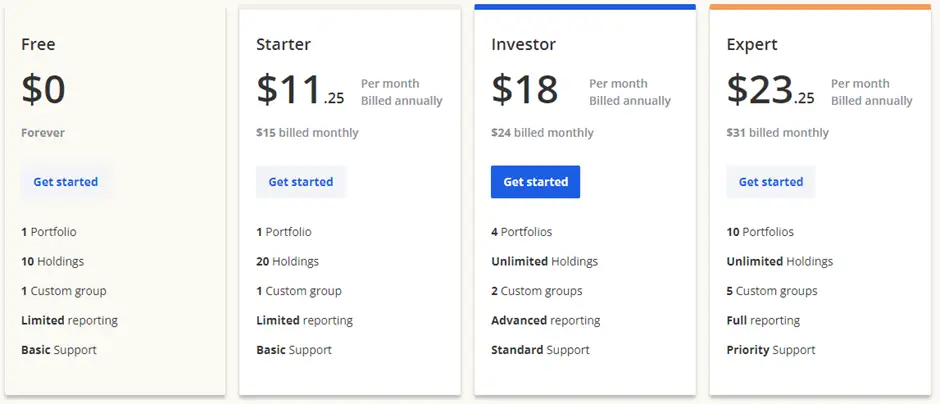

What’s included in Sharesight premium?

There are three types of Sharesight premium plans – Starter Investor and Export.

The starter plan is simple in that it allows you to add up to 20 holdings which is double the free plan, but not much else.

For me, the best plan is the Investor plan. It’s not the most expensive and fully featured but has plenty for the serious DIY investor.

Getting started with Sharesight premium

You can sign up for a premium plan when you sign up to Sharesight for the first time, or upgrade from a free plan as an existing user.

You can also go up and down plans throughout your membership, with features being added or removed if you do this.

Add cash accounts

If you want to keep track of your cash accounts or uninvested money within Sharesight you can keep a pseudo-cash account in it. There is no connectivity but for reporting and charting purposes you can see the value of your collective money.

Future Income Reports

On one page, find out whether your holdings are going to pay dividends (when announced), what date they’ll be paid, and how much.

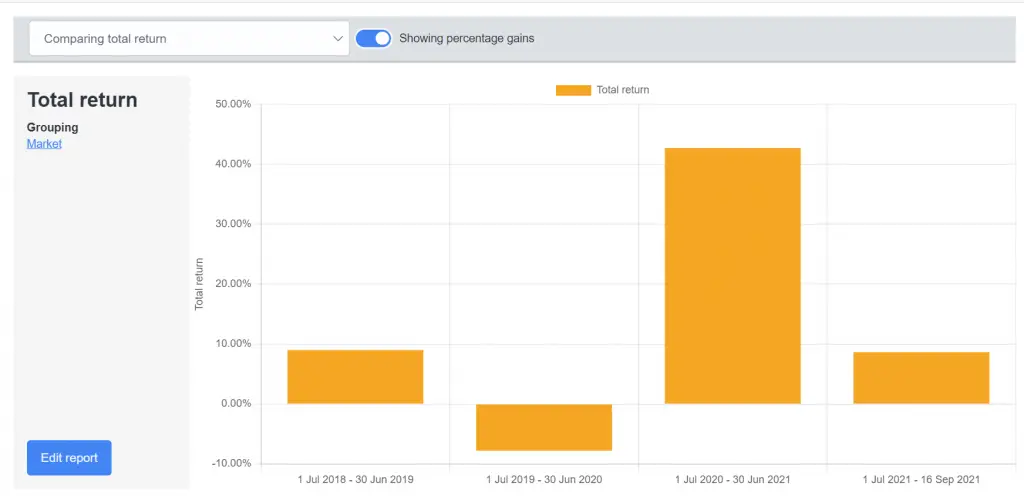

Multi-period performance

This is for real investing enthusiasts. Break down what month or period contributed most to your gains or losses.

For example, track which month gave you the best return over the last year (or 2 or 3).

Yeah look, it's probably not something that’s a must-have but it is cool to play with.

Grouping, labeling, and filtering

Top-tier premium accounts give you the full range of tailoring options. You can group holdings any way you like (as opposed to the default region, sector, or industry classification). You can also label holdings even further and then filter your reports this way.

Support

Support is something I’ve rarely needed when using Sharesight. Free and Starter plans can only access the live chat feature which basically points you to the most relevant support documents.’

Investor and premium plan users have access to email support which is more tailored to your problem and has more direct contact with the client support team.

Pricing

Shareisght recently updated its pricing in April 2022 with the pricing tiers depending on which region you are from.

Here is the table of “global pricing” which is in USD.

While the free plan is, er, free I find that it’s too barebones to get the full Sharesight experience but a great entry into what the tool can do.

Can Sharesight replace my spreadsheet?

Short answer – yes and more.

Sharesight is an amazing tool that gives you amazing insight into your investment portfolio.

But is it worth the price?

If you love the stock market, trading at least semi-regularly, and knowing what your returns are then yes.

It’s no the tool for the most immediate of beginners (focus on your strategy and broker capabilities first), but anyone who’s been investing more than a year will find this superior to a spreadsheet.

There is no way I’m personally going back to the spreadsheet having used Sharesight. It’s too convenient, saves too much time, and has too much information for me to give up.

Sharesight review: In Summary

There is plenty more to find with the product, but this is what I use Sharesight for and find most useful.

While it sounds rosy to say, Sharesight is a superb tool for serious investors. If you own over one stock there is no better way to track your portfolio. I’ve tried spreadsheets, I’ve tried other services but nothing works like this.

If you haven’t yet tried it or staring at a spreadsheet doing manual entries – this tool is for you.

It's free if you have 10 holdings or fewer (with some features limited) but even if you get a premium plan, you might be able to deduct the cost.

The Best Deal on Sharesight Right Now

Sharesight has been my favourite stock portfolio tracker for year. It's a great alternative to using a spreadsheet and you can get 4 months free on any premium plan, or just simply sign up for a free account to start with.