It was only a few years ago that online brokers were slow, dorky, and unexciting.

They made us send in forms, have clunky-looking websites, and it was confusing to know what you were actually doing.

Since 2017 though, there has been a new player in the online broker space that I reckon defies all the old personalities of stockbrokers and is setting new standards for trading. Well at least accordingly to me since I signed up back then.

The name of the tool is Stake.

Initially launched as a way to buy and sell US stocks from Australia, it's now expanded and becoming a competitive option for investors across the ASX as well.

Stake Review: My verdict (is Stake a good broker?)

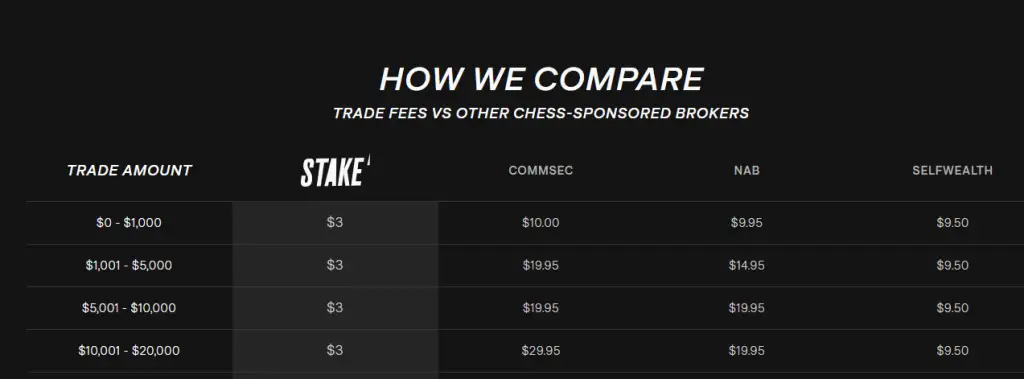

Stake is currently one of the lowest-cost online brokers in Australia.

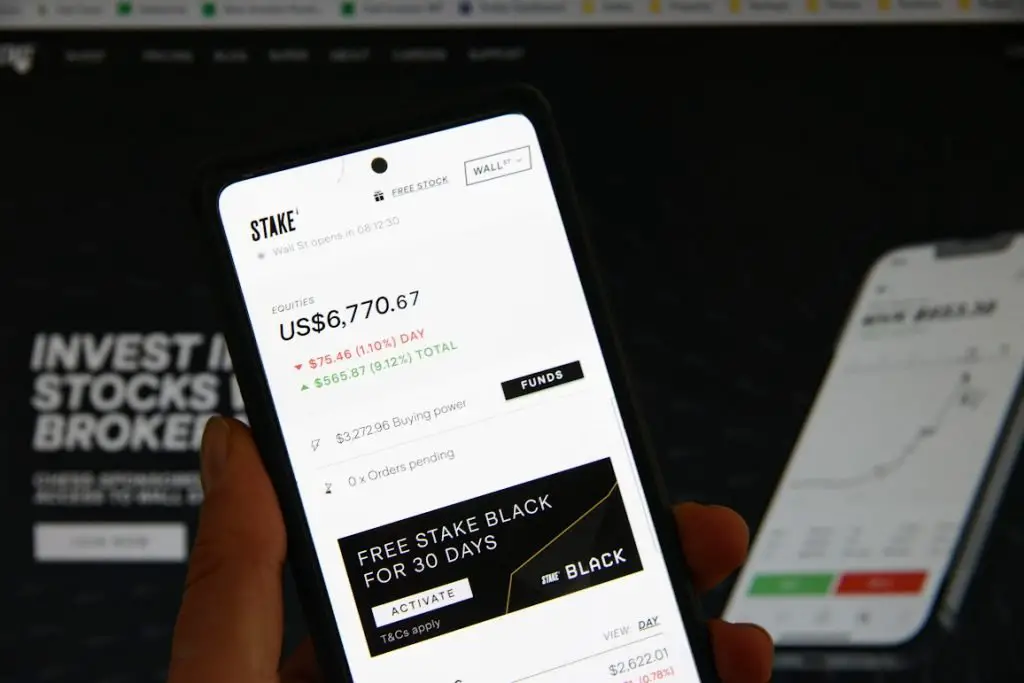

With its simple app first experience – I do all my trading there using a clean, simple interface.

Sending money to and out of Stake is also a smooth, fast experience with a number of options on how to fund your accounts.

You will need to pay attention to transfer costs, as Stake takes a cut of the money you transfer into USD and back (from AUD).

Stake Black is the premium version of Stake and is more suited to the active investor. The ability to instantly trade money that is yet to settle is the biggest benefit, along with some well-presented research for those interested.

It’s worth knowing that not every single US stock or ETF is available, but definitely more mainstream ones. It's more the “exotic” stocks or penny stocks rather than the more popular companies.

For what it is, it makes dorky online trading platforms a thing of the past and creates a slick-looking investing tool you'd be happy to log in to.

Stake Pros and Cons

Stake has a lot of things going for it. It’s focused on building a bigger better product and things change often. Even so, it manages to keep things simple and tidy which makes modern-day investing easier.

Pros

- $3 brokerage for US stocks and ASX stocks (really cheap!)

- Can buy US shares fractionally

- Money transfers in and out fast

- Slick, polished interfaced on both app and desktop versions

- Both US and ASX markets avaialble

Cons

- Premium version is not for everyone

- Company data is available but research is better done elsewhere

Stake features (and my favourite things to use)

As someone who was waiting for Robinhood to come to Australia for years, it was great to see a homegrown business like Stake give Australians more opportunities to invest in the US markets.

Before Stake, the process to buy US stocks was not easy. Brokers would charge high fees, you needed to fill out a few forms and it just wasn’t as simple as buying stocks in the ASX.

Since we all now live in the future, we get cool companies like Stake Australia giving you new ways to do things you've wanted to but in a much easier way.

So what makes Stake the best way to trade stocks in Australia?

Stake Fees are good ($3 brokerage for US Stocks and ASX trading)

Unlike CommSec (up to .31% of your investment per trade) or Self Wealth ($9.50) you pay very little to invest in US stocks.

The minimum amount you need to have included in a trade is $50 USD. That $3 though equates to 6% of your investment so already down that much when you invest so its worth considering how much you want to trade at a time.

I find that for anything over $500, the $3 becomes better value.

To give you an idea of the exact cost if you transferred in $1000, Stake would take a cut of $7. This is fairly reasonable considering you don't need to incur anything else to buy US stocks in Australia.

There is also an express fee so if you want your money to be added to your account as quickly as possible. This means you get your money in ready for share trading at the start of the trading day, rather than the end.

The Stake fees for an express transfer is 0.5% in addition to the .7%, so .12% in total per transfer. Per $1000 transferring in with the express option this makes the total cost $12.

You can buy fractional shares (in US Stocks)

This is easily the biggest benefit of the platform. Allowing fractional shares means you don’t need to be a minimum of one stock. You can buy a percentage or fraction of the share dependant on what you want to invest.

For example, say you wanted to invest $100 into Berkshire Hathaway. Traditionally you couldn’t as the price of one stock is well over $430,000+.

This way of investing means you can manage your budget and include absolutely any company as the stock price is not an issue at the time of purchase.

Stake has an easy-to-use interface

I love the simplicity and ease that Stake has set up its interface. Black and White, minimal menu and obvious buttons.

You think this is a fairly basic thing to comment on, but I’ve found online brokers overcomplicate the amount of information they present and show to you that it triggers you to do something you probably shouldn’t.

The app doesn’t push you to do anything and shows you a dashboard summary, a watchlist, and the ability to research or look up US stocks.

Transferring money in and out is fast

Stake is a growing company and they are focussed on building the technology to make tansferring money in and out as fast as possible.

Currently you can deposit money in via

- Your credit or debit card

- Bank transfer

- Using POLI

Once you pick your method, you can then determine the speed of transfer.

Either regular or instant. Regular can take 24 hours according to Stake but its usually 24-48 hours for the money to appear.

There might be a 24 hour hold from your bank when doing a bank transfers deposit for the first time, but other than that if you want money in instantly, you can with Stake.

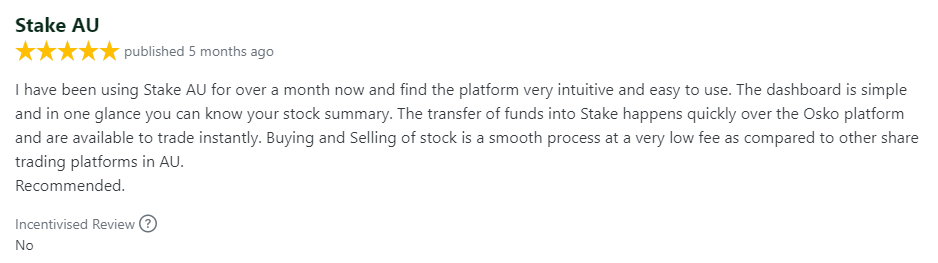

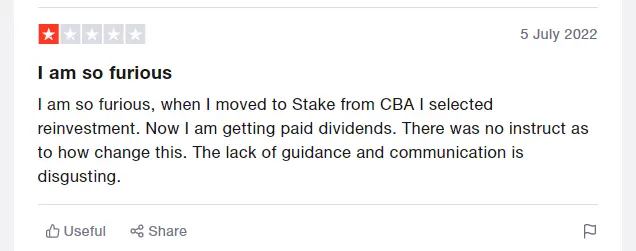

Other Stake reviews

I've looked around the internet and social media to find some other perspectives of how Stake is performing for others. It is a mixed bag as some users expect the equivalent of CommSec but the reality is this is a piece of technology that reimagines the online broker experience.

In all the reviews I could find, Stake had responded to the individual with some support. Some people were upset about features or processes they were used to in other brokers.

Stake Share Trading and How to Get Started

Setting up an account

Like most online brokers, you will need to provide a few details and pieces of identification to set up an account.

You’ll also need a passport or driver's license to confirm your identification.

The process is very easy and obvious so shouldn’t have you reaching for anything uncommon.

It does take a few steps to process all your information, so don’t expect to be signing up and share trading on the spot.

Here’s a summary of steps for how I set up my account

- Completed sign up form (with identification)

- Account was confirmed.

- Could login to account

- AUD Wallet setup (optional) so I could transfer money in

- Transferred AUD money to that account

- Transferred money form AUD to USD

- Started buying.

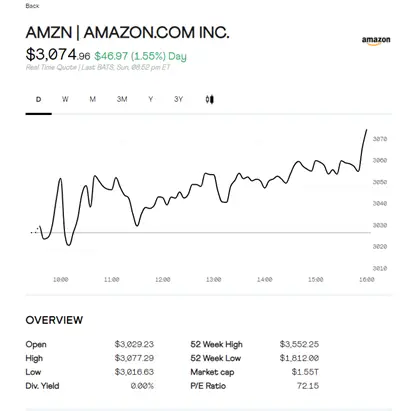

Researching US stocks with Stake

Ok so now you have an account it's time to find something to buy.

While Stake provides a great overview of the companies available for share trading, I wouldn’t say that it’s a research tool.

What that means is that you probably should be doing more research outside of the tool before coming here to buy.

There is a good amount of data that comes through and if you are looking for prices, basic financials, and links to related news then it’s all there.

I guess you can compare Stake to a supermarket, a really good one with heaps of variety. Apart from reading the labels and comparing a few other options around you, you probably want some other kind of information before buying something for the first time.

DadInvestor's Take

Sharesight is a helpful tool for tracking and analyzing your investments. It shows your portfolio's performance, taxes, and dividends all in one place.

- Key features: Aggregation of investments, share tracking, live updates

- Best for: Replacing spreadsheet to track shares, tax reporting on investments, researching growth, dividends, and total returns of stocks

- Price: Free $0 plan up to $49 per month (depending on features and number of holdings)

How to buy and sell

You’ll need to head to the individual company you want to buy or sell to trade. This is a bit different from other brokers that have a share trading page where you then look up to find the company.

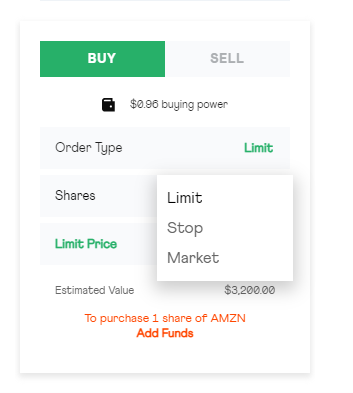

You have three options with your order types.

- Limit – set the highest price you want to pay for that stock (per share)

- Stop – Buy the stock once it gets to a certain price that you set

- Market- Pay whatever the price it is at now.

The way to sell is very similar.

The market is the simplest form of share trading as you are buying or selling at market price. The other two are more specific so if you need to set these then Stake makes them available for you.

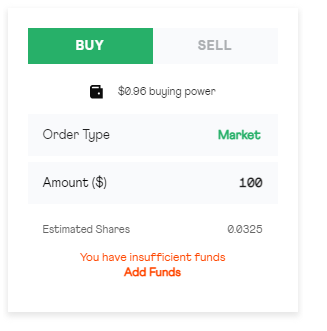

If you are interested in trading fractionally then you will notice when you are doing a Market order, the estimated shares will update to show you how much you will own.

You can also order fractionally with Limit or stop orders, but you will need to specify what fraction of a share would like

Managing your stocks

Once you have US stocks bought, they sit in your portfolio.

Here you can see the amount of stock you own, the units, the average price you paid, the day change, and total change.

It’s nice to have this info on one page, but I use the tool Sharesight to cover all my performance and reporting.

Reporting and transactions

In terms of reporting, apart from the dashboard, there is not much to see. Not that you need to find anything else, but there are a few features available.

Activity – quickly see what date you bought or sold particular shares. Basic details.

Day trade settings – If you like there are a few options here as your account may be restricted if you make more than 3-day trades in a 5 day period. A day trade is when you buy and sell in one trading day (US time).

Account statements and reports can be found if you are looking for summaries of your trading as well as a timeline on your deposits and withdrawals, including when you moved money from AUD to USD and vice versa.

Answers you probably want to know about Stake Australia

How does Stake handle US Tax forms, like the W-8BEN form?

As a foreigner or non-US resident, you will need to complete a W8-BEN form when you buy US stocks. Completing these forms reduces withholding tax from 30% to 15%.

Previously you needed to fill out this form separately.

The beauty of Stake is that they will digitally complete this form for you. Working with either US broker-dealer, they take care of this process for you.

What are the Stake fees and costs to use the Stake app?

To open a Stake share trading account is completely FREE. To trade through the broker it will cost $3 to buy or sell a stock, whether on the ASX or US Markets. There is a FX fee when you move money from AUD to USD or vice versa.

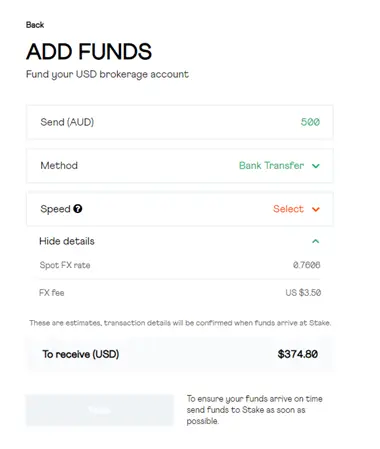

You need to trade on Stake Wall St with USD so being in Australia you need to move your money from one currency to the other. So you'll send money to an Aus bank account then via the Stake app transfer that money to their USD account.

The cost of this is 70 basis points or 0.7%. For example, if you moved $500 from AUD to USD, Stake would take 0.7% of the AUD amount but charge you in USD. Note that you are charged USD.

So if $500 AUD is $378 USD, then the fee would be 0.7% of $500, so $3.50 but in USD.

It might be tricky to get your head around at first but this is the one and only fee structure you need to understand.

Another fee you may pay is an express fee which is 0.5% on top of your FX fee so that your money gets added a day earlier.

Stake Black is a premium membership to Stake share trading, which is $9, and will talk about that below.

Does Stake help with tax Reporting?

Stake can help you but will not guide you with your tax, so you need to be aware of your obligations or send what you need to a tax accountant.

Here is what reports Stake can provide

- List of trades

- List of transactions

- FX trades.

Stake recommends tools like Sharesight to help with your reporting.

Will I get dividends?

Dividends get paid to your trading account, which is the cash account you send money to buy US stocks.

You will receive dividends even if you have fractional shares, you just receive the same fraction that you own.

When a dividend is paid you will have either 15% tax withheld (if you completed a W8 form) or 30% (if you didn’t complete the form).

At this stage, Stake doesn't offer dividends to be reinvested which is a problem for some so take note if coming from the more traditional brokers like Commsec or Selfwealth.

What are the time zones for trading?

The NYSE and NASDAQ exchanges are open 9.30 – 4pm Eastern Time, which is around 15 hours behind the east coast of Australia.

For me, this normally means the market opens late night in Australian hours and closes around dawn the next day.

Even with these hours making it awkward to be awake the full trading day, you can still place orders 24 hours a day and they just get fulfilled when the market is open.

What options for trading options are there?

You can place limit orders, market orders, and stop orders with Stake share trading.

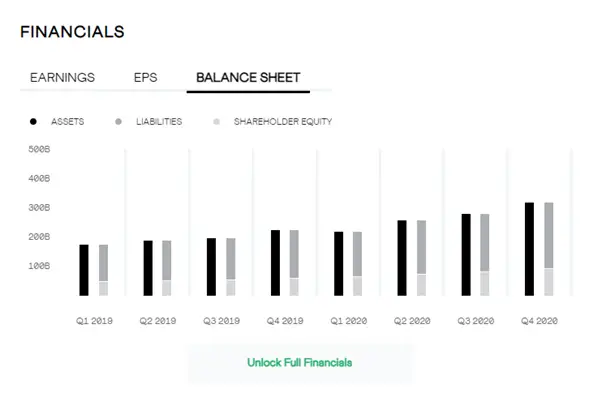

What is Stake Black?

If you are feeling like you really want to make a go of this US trading thing, then Stake Black might be for you.

It’s tool that expands the features available within the platform and is available in two forms – Stake Black Aus and Stake Black Wall St.

For Stake Black Australia (ASX) you get.

- Market depth (see the whol picture on orders and liquidity)

- Course of sales (see the trades moving the market)

For Stake Black Wall St (NYSE and NASDAQ) you get:

- Instant buying power on sell trades (my favourite)

- Buy and sell ratings from analysts

- Price targets on stocks from the pros

- Full company financials and data

Subscribing to these will cost $12AUD each or $17AUD a month combined. Thats either $144 a year for one or $204 for both. Monthly you will pay a bit more.

Personally, I use Stake Black Wall St, and there is a 30-day free trial for some members which can be activated within the app.

You can see more about what Stake Black is and what I think in the video below about it.

Stake Black features

Instant Buying Power

This is the one that had me upgrading for a year. The ability to instantly trade using the money you just made from a sale. Normally brokers make you wait a couple of days until the money from a recent sale becomes available for investing. Stake does away with that and gives you instant access to the money. Considering I trade late at night with US stocks, it's handy to be able to do it all within a couple of minutes when I do trade, rather than wait for processing.

Research and ratings

If you are a more active investor, then you will find each individual holding has consensus reports. That is, the buy and sell ratings from pros who are covering the markets. These include price targets that you may want to buy and sell at.

Company financials

Along with the ratings, there are deep dives into the company's financials and recent performance. You get a snapshot, without getting everything. I use them as prompts or reminders of any given company's financial situation. Reality is you probably should be doing your research outside of a stockbroker, either manually or with something like Simply Wall St.

Stake Alternatives

You might be looking at investing for the first time or using Stake as a different regular broker than what you are already. For me, I moved from Selfwealth recently and now do all my new trading on the Stake App.

WeBull Australia

Webull Australia is a powerful trading platform with a user-friendly interface, and advanced research tools for investors of US stocks, options, ETFs, and fractional shares. It has a well-built app that is always evolving and is a great option for investors who are looking for a reliable and affordable way to start trading.

Read my full review on the platform here

Stake vs CommSec

CommSec is the grandaddy or online brokers in Australia, while Stake is the Gen Z upstart.

If you want simplicity, cheap trading costs and fast processing then Stake is able to beat Commsec in these areas, especially if you are using Stake Black.

CommSec has more variety of companies available and better research tools but you do pay for them. Trades can cost $30+ so if you are a regular trader it can be a factor.

Another difference between them is that CommSec only lets you trade on the ASX by default.

You will need to apply for an International trading account to buy US stocks (or other global markets). The benefit of using the Stake app is that your account is ready to go much sooner if you want to start trading US stocks from Australia as well as the ASX.

Stake v Selfwealth

Selfwealth is a bit of an in-betweener online broker. It's still young but has plenty of the more traditional broker features.

Selfwealth does offer low cost fixed trades at $9.50 for both US stocks and ASX shares but this is obviously higher than the cost to use Stake.

The interface is a lot more traditional compared to Stake, and seems more like CommSec. They have re-branded recently which I think is a sign they are looking to compete both with the bigger brokers but also the more modern players like Stake.

The best way to use Stake

If you are brand new the best way to use Stake for share trading is to start with these steps:

1. Sign up

Stake just asks for a few details and you will have your own FREE account.

Once logged in you can tour the platform or app and see how the experience is without putting any money in yet.

You can also compile a watchlist to see some stocks or ETFs you have interest in over time.

2. Transfer some money in

The transfer process involves sending your AUD into an account where it's transferred to USD. The minimum is $50 to transfer in.

Note the time it may take to recieve that money, especially the first time. If you are trading in the US markets there will be a fx fee to cover currency exchanges.

3. Get to work

Stake can easily toggle between the ASX and Wall St markets so the app interface is fast and simple.

Trading is just as easy on mobile as it is desktop with clear labels of how much trading costs.

If you are investing in the US stock market, take note of the market opening and closing hours.

So what are you waiting for? HelloStake

Stake is your simple, convenient and clear way to buy US stocks in Australia. Whether you want to have a go at it, buy and hold for the long term, or trade regularly I think it’s one of the best tools out there.

It’s also a product that continues to evolve. In my time since joining in 2018, the interface and options have grown significantly so enjoy seeing new features added every now and then.

As they say at Stake – Hello Wall St!

I curently own Carbon revolution shares. The company has been taken over by a USA co.

They say i need to transfer my shares to a usa trading co. who is a DTC participating broker.

Can any one help with the name of a suitable Australian broker????

Hi Donald – have found a bit of Q and A for the Carbon DTC situation online here – https://investors.carbonrev.com/resources/dtc-faqs-0

In it mentions Westpac as a DTC participant but do believe there would be many in the industry that are as well.

You fail to mention Stake’s minimum $500 spend per position!

e.g The minimum investment to buy shares from SUN, WOW, and RIO with Stake is $500 each times three = AUD$1,500.

When investing in companies listed on the Australian Securities Exchange (ASX), the standard minimum investment required is $500.

This isn’t a Stake rule, but market wide and you’ll find all ASX brokers adhere to this. After first purchase though there are no limits.

US Markets Stake has a $50 minimum.

Thanks for reading.