You know that feeling when you can't quite grasp a concept?

I've been there.

And I know many of you struggle to know why we have superannuation and when we can actually access it.

It's like trying to read a book in a foreign language.

I've personally completed RG146 studies in Superannuation which in layman's terms means I've had the entire concept of retirement in Australia mapped out so I understand what each aspect of super and the aged pension is supposed to do.

Instead of needing to go through a two day course to work it all out, I'm going to share what I learnt and provide a snapshot of what retirement really looks like for you and what a comfortable post-work like might need.

Unraveling the Mystery of the Retirement Income Plan (RIP)

The RIP is a concept crafted by the Australian Government's Productivity Commission.

It's not a physical thing or a specific financial product, but a structure, a way to think about and organise the different components of your retirement income.

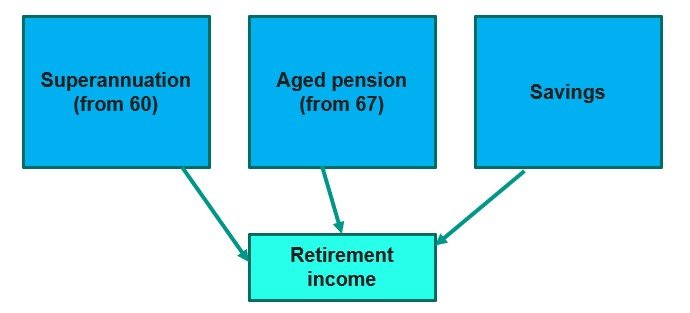

Think of your retirement income plan as a three-legged stool.

You've got your Super, your Aged Pension, and your General Savings.

Each leg of this stool plays an important role in keeping your retirement steady and comfortable.

Super is like your VIP pass to a good life after retirement. It's your money that your employer puts away for your golden years.

The Aged Pension is like a safety net provided by the Australian government.

If you've reached a certain age and meet certain criteria, you're entitled to receive this regular payment. It's not designed to foot all your bills during retirement but more on that later.

Lastly, General Savings are like your secret sauce for a comfortable retirement. These are your personal savings outside of Super and Aged Pension.

The best part? You're in total control here.

Now, this might seem like a lot to take in (trust me, I've been in your shoes), but I want to help you navigate these concepts like a pro.

Making the Most of Your Super

You can access your super when you reach what's called your ‘preservation age' and retire, or under some specific conditions (see diagram below).

Your preservation age depends on what year you were born, but it's somewhere between 55 and 60.

For most of us, it will be 60.

Think of your Super as that money in the bank that you're not allowed to use until you've reached your preservation age.

But here's the good news.

Super plays a critical role in ensuring a snug retirement.

It's like a slow-cooking pot.

You put in a bit of money, let it simmer over the years and you've got yourself a delicious retirement fund.

A whole lot of factors can spice up this fund, like the amount you contribute, the fund’s investment returns, and even fees and charges.

Just remember, the Super is your VIP pass to a good retirement.

And before we move on, it is helpful to take a look at your super once in a while.

Like the time you check the recipe while cooking, you need to take a peek at where your Super fund money is invested.

It's not about becoming a financial whiz overnight, but more about knowing what’s cooking.

Demystifying the Aged Pension

Now let's talk about the Aged Pension.

No, it's not a magical government cheque that'll take care of all your retirement expenses.

It's more like a dependable old friend who gives you a hand when you need it.

Here's the reality of the pension and the way it's intended to be used.

The Australian government provides the Aged Pension as a kind of income support for older Australians who need it.

To be eligible, you've got to meet certain age and residency requirements.

Currently, you can apply for an aged pension at age 67.

The payment amount? It depends on your income, assets, and other circumstances.

Now, don't get me wrong.

It's not that you shouldn't count on the Aged Pension at all. It's just that it shouldn't be your only plan for retirement income.

Picture it like the side dish to your main course of retirement funding.

It complements the plate but isn't meant to be the star of the show.

General Savings: Your Retirement Wild Card

And then there is the third leg of our retirement stool: General Savings.

These are like your wild card. Your secret stash. Your ‘break in case of emergencies fund.

This is where your personal financial habits come into play.

Whether it's that cash you've been putting away in a savings account or investments in stocks, bonds, or property, it all counts.

And the great thing about general savings is you're in the driver's seat.

You control how much you save, where you invest it, and when you can use it.

Remember, even though we have our Super and possibly the Aged Pension to support us, these general savings can be a lifesaver.

They can help you navigate unexpected expenses or even let you splurge on that world cruise you've been dreaming about.

From personal experience, building up general savings can be incredibly satisfying.

Seeing a number grow over the years can give you a sense of security and a lot of options when you retire.

The earlier you start saving, the better off you'll be!

Super, Aged Pension, General Savings.

These are the three basic elements of retirement income.

Defining a Comfortable Retirement: Through the ASFA Lens

Now that we've gone over the three streams of your retirement income, let's switch gears a bit and talk about the end goal – a comfortable retirement.

But what does that mean exactly?

Thankfully, the folks at the Association of Superannuation Funds of Australia (ASFA) have got us covered.

ASFA has this nifty standard that helps define what a ‘comfortable' retirement looks like.

Picture this: you're retired, you can afford a good range of leisure activities, have a decent car, go on regular holidays, and even afford little luxuries in life.

Sounds perfect, right?

That's essentially what ASFA's definition of a comfortable retirement is all about.

But let's talk numbers. The latest figures from ASFA suggest a single person needs about $44,224 a year for a comfortable lifestyle, while a couple needs around $62,562.

Keep in mind, these numbers aren't set in stone.

They can fluctuate based on factors like lifestyle, location, health, and so on.

And now you might be wondering, “But how much do I need to have saved up to achieve this?”

Well, according to ASFA, to support a comfortable lifestyle, a couple retiring today would need a lump sum of around $640,000 in their superannuation if they intend to rely solely on this without drawing on the Aged Pension.

For singles, the estimated requirement is about $545,000.

These numbers might seem a bit daunting, but remember, they're based on the idea of not relying on the Aged Pension at all.

For many Australians, their retirement income will likely be a combination of Super, the Aged Pension, and their personal savings.

The Hard Question: Can You Afford Retirement?

I know, we're starting to get into the nitty-gritty here, but bear with me. One of the most daunting questions you might ask yourself is, “Can I afford to retire?”

Here's a practical approach. Take a look at your current savings, super balance, and potential aged pension.

Now, compare it with the ASFA's comfortable retirement budget.

It might not be a perfect calculation, but it'll give you a ballpark figure of where you stand.

Also know that many super funds offer retirement calculators.

These are handy tools that take into account your current super balance, contributions, and intended retirement age to estimate how much you might have when you retire. Some even factor in the Aged Pension.

Remember, while these calculators offer a helpful guide, they can't predict the future.

They are, however, a valuable starting point in your retirement planning journey.

Aim for the Win: Self-Funded Retirement

Now, this is the part that gets me fired up: aiming for a self-funded retirement.

You see, the Super and the Aged Pension are great, but if you can fund your retirement without relying heavily on the government, you're winning.

This is my ultimate goal.

We're should be aiming to build a financial safety net for ourselves.

Striving for that independence and freedom that comes with being self-funded in retirement.

It's not about finding ways to squeeze more out of the government.

It's about empowering ourselves to live comfortably on our terms.

I mean, who doesn't love the idea of being the master of their own destiny?

And the beauty of it is that it's achievable.

It requires planning, dedication, and some financial discipline, but it's definitely within reach.

Wrapping It Up

If you've read this far, you've stuck with me through it all, and for that, I'm grateful!

Remember, planning for retirement isn't about achieving perfection or getting all the answers right away.

It's about making informed decisions that suit your personal circumstances and goals.

It's about learning to navigate the world of finance in a way that empowers you to enjoy your golden years on your own terms.

You're not alone in this journey.

Many tools and resources are available to help you along the way, from your super fund's retirement calculator to professional financial advice.

Use them to your advantage.

Lastly, it's never too early or too late to start planning for retirement.

The steps you take today, no matter how small, can make a world of difference in the long run.

So here's to you – to your retirement journey and the future that lies ahead.