The last week I’ve been looking at simplifying things in my life. Not just through money but the mindset, the routines, the processes that our family goes through each day.

I know I try to keep things as simple as possible, cause that means it's easier right?

Things can get really complicated quickly.

For example – have you ever done research on something you wanted to buy?

Maybe something like a new TV. You likely didn’t just walk into a store and pick what you thought was the best. If you’re like me, you would have searched online, talked to a few people, and read some reviews.

Then when you find what you want and search for the best price.

It seems like a simple process, but thinking about it all the time, using energy put into deciding, it becomes a bit of a process.

And I could have picked the same one I might have picked with no research at all.

There is a difference though in picking something randomly from instincts or doing all the research you can to make the best decision, and it has a name.

Introducing informed simplicity.

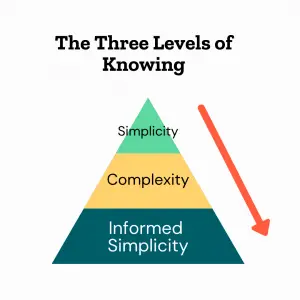

It’s a three levelled approach to knowing.

- You start with simplicity – happily unaware

- Then comes complexity – inability to decide

- Finally, you reach a state of Informed simplicity – the enlightened view

Let’s see how this might work when we want to buy this new TV

- Simplicity – any tv will be an upgrade to what you have

- Complexity – There are so many options, how do I pick

- Informed simplicity – I see the one most suited to what I need

I’ve gone through a similar cycle with my finances.

Day 1 of earning an income (age 16, working at Woolworths) I setup myself a bank account at Westpac. It was one account, with a debit card.

Simple.

Over time, I added savings accounts, then as I got older and moved to full-time work I kept adding things.

- Credit cards

- Shares

- Mortgage

- Another credit card

- Offset account etc.

Suddenly my money had gone from simple to complex.

Even my investing was getting complex. I made it complex by over doing what I needed to do.

I started buying different ETFs and picking stocks, thinking that more effort equals better results.

The thing is, I didn’t know this was the case until I did it.

I got to a stage where I forgot I had an account with uBank (with money in it).

Like a house or garden, your money can get messy

Through this complexity, I could work out what was important and recognise what system was going to help me.

I cut back my accounts, ETFs, stocks etc and suddenly I had reached informed simplicity. I could do less for the same results.

I don't need 20 TVs in my house to watch one show. I didn’t need 20 bank accounts and investments to achieve my financial goals.

I’ve scaled everything back, closed accounts and sold investments. I’m now using two banks for managing money, one tool for investing regularly, and a credit card. That’s it.

Everything feels as small as it did in the early days of making money as a teenager.

I had come full circle, but this time it informed me.

Simple does not mean ineffective

I can't talk all day about how relieving it is to appreciate simplicity, especially with money

- Fill up one savings account.

- Spend from one card.

- Invest in one thing.

- You get the same results

Can you think of a time you've gone through this simplicity cycle? What are some ways you've made things simpler with your life or money?