One of the key features of Raiz is its selection of investment portfolios, which are designed to suit different investors. In this article, we're going to take a close look at all of the different Raiz portfolio options and explain everything you need to know about each one.

As someone who has been using Raiz since 2016, I have a good understanding of the platform and its portfolio options. It's given me plenty of know-how that I've put together an in-depth analysis of the fees, ETFs, and custom portfolio options available. I'll also let you know what I think s the best way to go about it.

If you're interested in investing with Raiz, or just want to learn more about the investment app, keep reading. There's also my full Raiz review, where I dive even deeper into the app's features and functionality as well as my explainer of what a micro-investing app is.

What are Raiz portfolios?

Raiz portfolios are investment options offered by Raiz, an investing platform that allows people to invest in exchange-traded funds (ETFs) with small amounts of money. The app provides eight different portfolios, each with a mix of ETFs designed to meet various investment goals and risk tolerances. These portfolios are diversified, which means they spread investments across various assets to reduce risk exposure.

You can choose from different portfolio options or create your own custom portfolio to meet your investment goals. By investing in a portfolio that matches your goals and risk tolerance, you can make money with Raiz through the growth and dividends created over time.

List of all the Raiz Portfolio options

Raiz offers seven prebuilt different portfolios that are designed to meet different investment goals and risk tolerances. The portfolios are named after either the level of risk the investor identifies with or the names of stones:

- Conservative: Invests mostly in cash and fixed-interest investments, with a small allocation to Australian and overseas stocks.

- Moderately Conservative: Invests mostly in cash and fixed interest investments, with a larger allocation to Australian and overseas stocks than the Conservative portfolio.

- Moderate: Invests mostly a balanced mix of cash and fixed interest investments, with a larger allocation to Australian and overseas stocks than the above portfolios.

- Moderately Aggressive: Invests in a mix of cash, fixed interest, and Australian and overseas stocks, with a higher allocation to stocks than the Moderate portfolio.

- Aggressive: Invests in a mix of cash, fixed interest, and Australian and overseas stocks, with a higher allocation to international equities than any other portfolio.

- Sapphire: Invests in a mix of Australian and overseas stocks, with a higher allocation to international equities than any other portfolio.

- Emerald: Invests in a mix of Australian and overseas stocks, with a focus on socially responsible investing.

- Property: Invest in units of a fund that owns a number of residential properties in Australia.

Whenever you are investing in Raiz you need to have your account set to one of these portfolios. Every time you deposit or send money into Raiz it gets allocated to its portfolio.

It is very similar to the setup Superannuation funds build their portfolios – where you'll find balanced and growth options (Raiz call these Moderate and Aggressive instead).

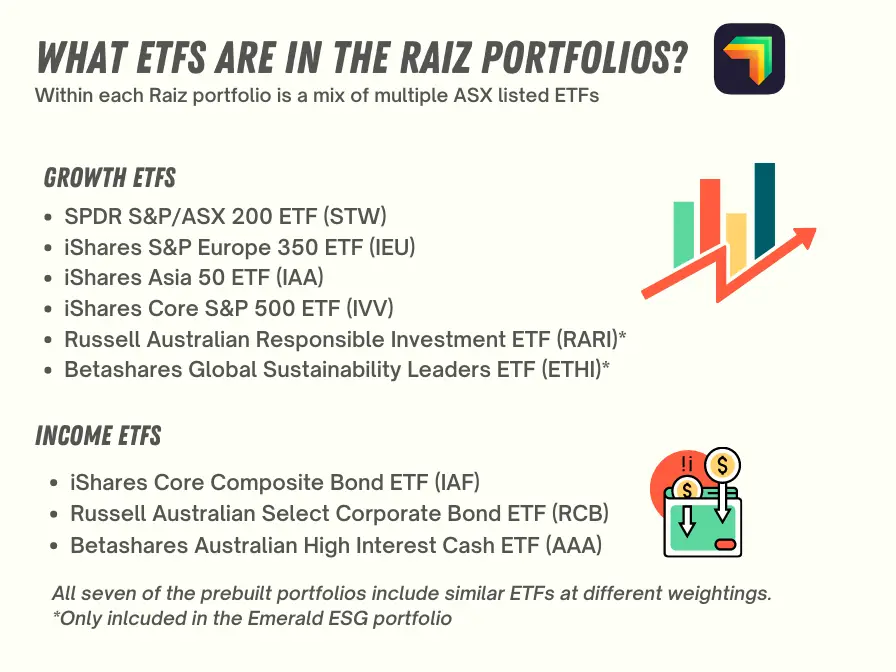

ETFs featured in Raiz Portfolios

In each of the five main Raiz portfolios, the following ETFs are used across all options:

- Betashares Australian High Interest Cash ETF (AAA)

- SPDR S&P/ASX 200 ETF (STW)

- iShares Asia 50 ETF (IAA)

- iShares S&P Europe 350 ETF (IEU)

- iShares Core Composite Bond ETF (IAF)

- Russell Australian Select Corporate Bond ETF (RCB)

- iShares Core S&P 500 ETF (IVV)

What you'll find when I explain below, is it's the allocation towards each ETF that changes between the portfolios (rather than the ETFs themselves).

Raiz Plus

In addition to the preset portfolios offered by Raiz, the app also allows you to create your own custom portfolio via Raiz Plus. This is a good option for investors who want to have more control over their investment mix or want to invest in specific ETFs that are not included in the preset portfolios.

In a Raiz Plus portfolio you can include

- ETFs

- ASX50 stocks

- Bitcoin

- Raiz Property Fund

ETFs you can select from

The ETF options include index funds, bonds, international stocks, and more.

Each ETF has its own risk profile, fees, and historical performance, so it's important to do your research and choose the ones that best match your investment goals.

Here is the list of ETFs you can pick from in a Raiz Plus:

| Asset Class | ETFs |

|---|---|

| Cash, Bonds and Fixed Interest | AAA – Australian Money Market, IAF – Australian Government Bonds, RCB – Australian Corporate Bonds, VACF – Vanguard Australian Corporate Fixed Interest Index, VEFI – Vanguard Ethically Conscious Global Bond |

| Australian Stocks | STW – Australia Large Cap Stocks, RARI – Australia Socially Responsible Large Cap, VSO – Vanguard Australian Small Companies |

| Overseas Stocks | IAA – Asia Large Cap Stocks, IEU – Europe Large Cap Stocks, IVV – US Large Cap Stocks, NDQ – BetaShares NASDAQ, VGE – Vanguard FTSE Emerging Markets Shares, IOO – iShares Global 100, IXJ – iShares Global Healthcare, VETH – Vanguard Ethically Conscious Australian Shares |

| Sector or Themed ETFs | ACDC – Global X Battery Tech & Lithium, EARTH – BetaShares Climate Change Innovation, FAIR – BetaShares Australian Sustainability Leaders, HACK – BetaShares Global Cybersecurity, IFRA – VanEck FTSE Global Infrastructure (Hedged), RPF – Raiz Property Fund |

| Alternatives | BTC – Bitcoin, QAU – BetaShares Gold Bullion – Currency Hedged |

As you can see there are some fantastic and popular ETFs available including IVV, IOO and NDQ. The number of ETFs available have grown and its great to see these portfolio options considering its an alternative to buying and owning these individually.

ASX50 Stocks

Raiz Plus alos allows you to add individual stocks to your portfolio on top of ETFs (if you wish) which seem to be all from the ASX50 or largest 50 companies on the ASX.

They include:

- CSL

- Woolworths

- CommBank

- Fortescue Metals

- NAB

- Telstra

- Wesfarmers

- Xero

Property and Bitcoin are available as well in Raiz Plus

On top of filling up your Raiz Plus portfolio with ETFs and ASX stocks, you can complement them with up to 5% Bitcoin or part of the Raiz Property Fund.

Which Raiz portfolio is right for you?

To decide which Raiz portfolio is right for you, you need to consider your investment goals, your risk tolerance, and your time horizon. If you are investing for the long term and are willing to take on more risk, you may want to choose a portfolio that is more heavily weighted towards stocks, such Moderately Aggressive, Aggressive or Sapphire. If you are investing for the short term or are more risk-averse, you may want to choose a portfolio that is more heavily weighted towards bonds, such as Emerald. It is better to invest aggressively if you have a long-term investment horizon and are willing to take on more risk. However, if you need your money soon, investing conservatively may be a better option.

[humix url=”https://dadinvestor.com.au/humix/video/HfRd84Os5Au” loop=”0″ autoplay=”1″ float=”1″]

Raiz Portfolio Comparison

Different Raiz portfolios invest in different types of assets. Some portfolios may invest more in stocks, which can have higher potential returns but also more risk. Other portfolios may invest more in bonds, which can be less risky but also have lower returns. The portfolios also have different levels of risk and fees, so it's important to choose one that fits your investment goals and comfort with risk.

This table shows the variation of allocation towards the higher risk (but higher reward) allocation that is equities versus the more defensive (or slower growing) fixed income allocation.

| Raiz Portfolio | Equities Allocation | Fixed Income Allocation |

|---|---|---|

| Conservative | 22.5% | 77.5% |

| Moderately Conservative | 35.4% | 64.6% |

| Moderate | 47.2% | 52.8% |

| Moderately Aggressive | 72.7% | 27.3% |

| Aggressive | 90% | 10% |

| Emerald | 72.7% | 27.3% |

| Sapphire | 74.1% (including 5% Bitcoin) | 25.9% |

Conservative Portfolio

The Conservative portfolio offered by Raiz is designed for investors who want to take a cautious approach to investing. This portfolio is a blend of conservative fixed income and equity assets. Here's a breakdown of the ETFs included in the Conservative portfolio and their target asset allocation:

- Betashares Australian High Interest Cash ETF (AAA) – 24.5%

- SPDR S&P/ASX 200 ETF (STW) – 13.5%

- iShares Asia 50 ETF (IAA) – 3.0%

- iShares S&P Europe 350 ETF (IEU) – 3.0%

- iShares Core Composite Bond ETF (IAF) – 30.0%

- Russell Australian Select Corporate Bond ETF (RCB) – 23.0%

- iShares Core S&P 500 ETF (IVV) – 3.0%

As you can see, the Conservative portfolio consists mainly of fixed income assets, with 77.5% of the portfolio invested in cash and bonds. This makes the Conservative portfolio less volatile than portfolios with a higher allocation to equities. However, this also means that the potential returns of the portfolio are lower. The remaining 22.5% of the portfolio is invested in equities, including large-cap Australian companies, companies in Asia, Europe, and the US.

The Conservative portfolio is a good option for investors who want a lower-risk investment strategy with a focus on income generation and capital preservation.

Moderately Conservative Portfolio

The Moderately Conservative portfolio offered by Raiz is designed for investors who want a slightly less cautious approach to investing than the Conservative portfolio. This portfolio is a blend of fixed income and equity assets, with a higher allocation to equities than the Conservative portfolio. Here's a breakdown of the ETFs included in the Moderately Conservative portfolio and their target asset allocation:

- Betashares Australian High Interest Cash ETF (AAA) – 9.6%

- SPDR S&P/ASX 200 ETF (STW) – 21.2%

- iShares Asia 50 ETF (IAA) – 3.0%

- iShares S&P Europe 350 ETF (IEU) – 3.0%

- iShares Core Composite Bond ETF (IAF) – 30.0%

- Russell Australian Select Corporate Bond ETF (RCB) – 25.0%

- iShares Core S&P 500 ETF (IVV) – 8.2%

As you can see, the Moderately Conservative portfolio has a higher allocation to equities, with 64.6% of the portfolio invested in large-cap Australian companies, Asia, Europe, and the US. The rest of the portfolio is invested in fixed income assets, with 35.4% of the portfolio allocated to cash and bonds. This makes the Moderately Conservative portfolio less volatile than portfolios with a higher allocation to equities. However, this also means that the potential returns of the portfolio are lower.

The Moderately Conservative portfolio is a good option for investors who want a slightly higher risk investment strategy with a focus on income generation and capital preservation.

Moderate Portfolio

The Moderate portfolio offered by Raiz is designed for investors who want a balanced approach to investing. This portfolio is a blend of equity and fixed income assets, with a higher allocation to equities than the Moderately Conservative portfolio. Here's a breakdown of the ETFs included in the Moderate portfolio and their target asset allocation:

- Betashares Australian High Interest Cash ETF (AAA) – 3.0%

- SPDR S&P/ASX 200 ETF (STW) – 31.7%

- iShares Asia 50 ETF (IAA) – 8%

- iShares S&P Europe 350 ETF (IEU) – 4.1%

- iShares Core Composite Bond ETF (IAF) – 19.2%

- Russell Australian Select Corporate Bond ETF (RCB) – 25.0%

- iShares Core S&P 500 ETF (IVV) – 9.0%

As you can see, the Moderate portfolio has a higher allocation to equities, with 52.8% of the portfolio invested in large-cap Australian companies, Europe, and the US. The rest of the portfolio is invested in fixed income assets, with 47.2% of the portfolio allocated to cash and bonds. This makes the Moderate portfolio less volatile than portfolios with a higher allocation to equities. However, this also means that the potential returns of the portfolio are lower.

The Moderate portfolio is a good option for investors who want a balanced investment strategy with a focus on income generation and capital preservation.

Moderately Aggressive Portfolio

The Moderately Aggressive portfolio offered by Raiz is designed for investors who are comfortable with a higher level of risk and want exposure to international equity markets. This portfolio is a blend of equity and fixed income assets, with a higher allocation to equities than the Moderate portfolio. Here's a breakdown of the ETFs included in the Moderately Aggressive portfolio and their target asset allocation:

- Betashares Australian High Interest Cash ETF (AAA) – 3.0%

- SPDR S&P/ASX 200 ETF (STW) – 43.6%

- iShares Asia 50 ETF (IAA) – 13.8%

- iShares S&P Europe 350 ETF (IEU) – 6.4%

- iShares Core Composite Bond ETF (IAF) – 3.0%

- Russell Australian Select Corporate Bond ETF (RCB) – 21.3%

- iShares Core S&P 500 ETF (IVV) – 8.9%

As you can see, the Moderately Aggressive portfolio has a higher allocation to equities, with 72.7% of the portfolio invested in large-cap Australian companies, Asia, Europe, and the US. The rest of the portfolio is invested in fixed income assets, with 27.3% of the portfolio allocated to cash and bonds. This makes the Moderately Aggressive portfolio more volatile than portfolios with a lower allocation to equities. However, this also means that the potential returns of the portfolio are higher.

The Moderately Aggressive portfolio is a good option for investors who want a higher-risk investment strategy with a focus on long-term growth.

Aggressive Portfolio

The Aggressive portfolio offered by Raiz is designed for investors who are willing to take on a high level of risk and want exposure to both domestic and international equity markets. This portfolio is a blend of equity and fixed income assets, with a higher allocation to equities than the Moderately Aggressive portfolio. Here's a breakdown of the ETFs included in the Aggressive portfolio and their target asset allocation:

- Betashares Australian High Interest Cash ETF (AAA) – 3.0%

- SPDR S&P/ASX 200 ETF (STW) – 54.0%

- iShares Asia 50 ETF (IAA) – 23.5%

- iShares S&P Europe 350 ETF (IEU) – 7.1%

- iShares Core Composite Bond ETF (IAF) – 3.0%

- Russell Australian Select Corporate Bond ETF (RCB) – 4.0%

- iShares Core S&P 500 ETF (IVV) – 5.4%

As you can see, the Aggressive portfolio has the highest allocation to equities, with 90% of the portfolio invested in large-cap Australian companies, Asia, Europe, and the US. The rest of the portfolio is invested in fixed income assets, with 10% of the portfolio allocated to cash and bonds. This makes the Aggressive portfolio the most volatile portfolio offered by Raiz. However, this also means that the potential returns of the portfolio are high.

The Aggressive portfolio is a good option for investors who are comfortable with a high level of risk and want to focus on long-term growth.

Emerald Portfolio

The Emerald portfolio offered by Raiz is a socially responsible investment (SRI) portfolio that is designed for investors who want to invest in companies that are making a positive impact on society and the environment. This portfolio is a blend of equity and fixed income assets, with a higher allocation to socially responsible equities than any other portfolio offered by Raiz. Here's a breakdown of the ETFs included in the Emerald portfolio and their target asset allocation:

- Betashares Australian High Interest Cash ETF (AAA) – 6.0%

- iShares Composite Bond ETF (IAF) – 21.3%

- Russell Australian Responsible Investment ETF (RARI) – 38.6%

- Betashares Global Sustainability Leaders ETF (ETHI) – 34.1%

As you can see, the Emerald portfolio has a unique allocation that focuses on socially responsible investments. The portfolio invests in companies that are considered to have a positive impact on society and the environment, such as renewable energy, sustainable agriculture, and responsible mining. The Emerald portfolio is a good option for investors who want to align their investments with their values and make a positive impact with their money.

With that said, the Emerald portfolio is a great option for investors who are looking for a sustainable and ethical investment option.

Sapphire Portfolio

The Sapphire portfolio is one of the most aggressive portfolios offered by Raiz, with a higher allocation to international equities than any other portfolio. This portfolio is designed for investors who are willing to take on more risk in pursuit of higher potential returns. Here's a breakdown of the ETFs included in the Sapphire portfolio and their target asset allocation:

- Betashares Aust High Int. Cash ETF (AAA) – 3%

- SPDR S&P 200 (STW) – 41.4%

- iShares Asia 50 ETF (IAA) – 13.1%

- iShares S+P Europe 350 (IEU) – 6.1%

- iShares Composite Bond ETF (IAF) – 2.9%

- Russell Aust Select Corp Bond ETF (RCB) – 20%

- iShares Core S&P 500 ETF (IVV) – 8.5%

- Bitcoin – 5%

As you can see, the Sapphire portfolio has a unique allocation that includes a higher allocation to international equities, with exposure to both developed and emerging markets. This portfolio aims to provide investors with a higher potential return by investing in a diversified range of global equities, while still maintaining some exposure to Australian bonds and cash.

Note that the Sapphire portfolio is designed for investors who are willing to take on more risk and have a longer investment horizon. This portfolio may experience higher volatility than other portfolios, particularly during market downturns. Investors should carefully consider their investment goals and risk tolerance before investing in the Sapphire portfolio.

Raiz Emerald vs Aggressive

When deciding on Raiz Emerald vs Agressive both portfolios offer unique opportunities. The Aggressive portfolio focuses on long-term growth with higher risk, while the Emerald portfolio emphasizes socially responsible investments with a lower risk profile.

The Aggressive portfolio puts most of its money (90%) in stocks from Australia, Asia, Europe, and the US. The remaining 10% is invested in safer things like cash and bonds. This mix is great for people who want their money to grow quickly, even if it means taking on more risk.

The Emerald portfolio, on the other hand, has a unique mix of investments. It mainly focuses on companies that are making the world a better place, like those that use clean energy or help protect the environment. This portfolio doesn't have a set percentage of stocks and bonds like the Aggressive portfolio, but it still aims to provide a good balance for your investments.

So which one should you choose? If you're a risk-taker and want the chance to earn more money over time, the Aggressive portfolio might be for you. But if you care about the environment and want to invest in companies that do good things, the Emerald portfolio is a wonderful choice. Remember, there's no guarantee that one portfolio will perform better than the other, so think about what matters most to you and what level of risk you're comfortable with before making a decision.:

| Raiz Emerald vs Aggressive | Raiz Aggressive Portfolio | Raiz Emerald Portfolio |

|---|---|---|

| Risk & Return | High risk, potentially high return | Lower risk, potential moderate return |

| Investment Focus | Domestic and international stocks | Socially responsible investments |

| Asset Allocation | 90% equities, 10% fixed income | Unique mix focused on Socially Responsible Investing |

| Investor Profile | Long-term growth, higher risk tolerance | Values-aligned, positive impact |

| Key Benefit | Exposure to global equity markets for growth | Supporting ethical and sustainable companies |

Fees charged per year for each Raiz portfolio at different balances.

I've mentioned before that you need to be aware of the fees that you will pay with Raiz, especially early on or if you have a low balance.

Balances under $20,000 (or $25k for Raiz Plus portfolios) will get charged a $4.50 monthly fee. This for a balance of $1,000 represents 5,.4% of your portfolio which is considered very high. That means you need to return over 5.40% each year to be able to make a profit after fees.

For balances over $20k for Standard Portfolios and then $25k for Raiz Plus Portfolios the fees convert to a percentage-based amount which is .275% of the balance (charged monthly).

Once you get over $10,000 the fees as a percentage make more sense. Then once you have over $20,000 then you really find some good value with the monthly cost at 0.275%.

Monthly costs

| Portfolio | Monthly Fee | $1,000 Balance | % Fee | $5,000 Balance | % Fee | $20,000 Balance | % Fee |

|---|---|---|---|---|---|---|---|

| Emerald | $4.50 | $54 | 5.40% | $54 | 1.08% | $55 | 0.275% |

| Sapphire | $4.50 + .275% | $54 + $2.75 | 5.67% | $54 + $13.75 | 1.35% | $55 + $55 | |

| Conservative | $4.50 | $54 | 5.40% | $54 | 1.08% | $55 | 0.275% |

| Moderately Conservative | $4.50 | $54 | 5.40% | $54 | 1.08% | $55 | 0.275% |

| Balanced | $4.50 | $54 | 5.40% | $54 | 1.08% | $55 | 0.275% |

| Moderately Aggressive | $4.50 | $54 | 5.40% | $54 | 1.08% | $55 | 0.275% |

| Aggressive | $4.50 | $54 | 5.40% | $54 | 1.08% | $55 | 0.275% |

| Plus | $5.50 | $66 | 6.60% | $66 | 1.32% | $66 | 0.33% |

How much money do you need in Raiz?

You can start investing in Raiz with as little as $5. There is no minimum amount required to maintain your investment. $0 balances do not get charges, so it is ok to open an account and have a look before you start investing.

How to get the most out of Raiz

To get the most out of Raiz, here are some tips to keep in mind:

- Set a realistic investment goal and time horizon (avoid cashing out too soon)

- Choose the Raiz portfolio that matches your investment goals and risk tolerance.

- Add money to your investment account regularly to take advantage of dollar-cost averaging.

- Keep an eye on your investment performance and adjust your portfolio as needed.

Can you make money with Raiz?

Yes, you can make money with Raiz by investing in a portfolio and regularly contributing to it. However, it's important to remember that investing always comes with risk and past performance does not guarantee future returns. It's important to carefully consider your investment goals and risk tolerance before investing in any portfolio.

Is Raiz good for large investments?

Raiz can be a good option for large investments as it allows you to invest in ETFs with small amounts of money. However, if you have a large amount to invest, you may want to consider other investment options that offer lower fees. Raiz charges a monthly fee that varies depending on the size of your investment account. It's important to weigh the potential returns against the fees before making any investment decisions.

What happens if Raiz goes bust?

If Raiz were to go bust, your investments are held in a custodial account that is separate from Raiz's assets. This means that your investments are protected in the event that Raiz becomes insolvent. Because the underlying investments are ETFs, you are likely to receive access to those ETFs or they will be sold and the proceeds returned to you.

Does Raiz have monthly fees?

Yes, Raiz charges monthly fees that vary depending on the size of your investment account. The fees range from $3.50 per month for smaller accounts to 0.275% per year for accounts over $15,000. The Custom portfolio option is $4.50 per month or .275% for balances over $20,000

Is Raiz better than a savings account?

Raiz offers the potential for higher returns than a savings account but also comes with more risk. Savings accounts are a low-risk, low-return investment option, while Raiz portfolios offer higher potential returns but also have more volatility. It's important to carefully consider your investment goals and risk tolerance before deciding which option is best for you. Raiz portfolios can be a good option for those willing to take on more risk in pursuit of potentially higher returns.

So which Raiz portfolio is best?

Raiz provides a great option for investors who want to get started with investing but may not have a large amount of capital to work with. By investing small amounts of money into a diversified portfolio of ETFs, you can build wealth over time and reach your financial goals. The range of portfolios offered by Raiz caters to different investment goals and risk appetites, making it easy for investors to find a portfolio that suits their needs. Additionally, the custom portfolio option allows investors to build a portfolio that aligns with their personal investment preferences.

When it comes to fees, Raiz is transparent about what you will be charged, and the fee structure is simple to understand. The low fees make it a great option for investors who don't want to pay high fees or deal with the hassle of managing their own investments.

Overall, Raiz is a great option for beginner investors who want to get started with investing. With a range of portfolios to choose from and the ability to start investing with small amounts of money, Raiz provides a great option for building wealth over time. Just remember to do your own research and carefully consider your investment goals and risk tolerance before investing.