Investing in ETFs can be a great way to generate a steady stream of income over the long-term. But can you actually live off the dividends from your ETF portfolio?

That's the dream, isn't it? Have a large stock portfolio that sits there and pays you an income like a salary.

I'm going to take a closer look at the dividend yields and growth potential of some popular ETFs in Australia and show you how to calculate the amount of money you'd need to invest to generate $50,000 in annual income from your ETF portfolio. I'll also answer some common questions that beginner investors have about ETFs and dividends so it's clear what it actually all means.

If you want to live off ETF dividends in Australia, you need to invest in ETFs that own a mix of stable and financially healthy companies that pay high dividends. You'll also need to have a large enough investment portfolio to make sure you earn enough money from dividends to cover your living expenses. This may take a long time to save up, so it's important to be consistent with your investments and choosing the right ETFs build you a reliable stream of income.

Do ETFs pay dividends?

Yes, ETFs can pay dividends to their investors. When a company pays a dividend to its shareholders, it typically pays the dividend to the ETF as well, since the ETF holds shares of the company. The ETF then distributes the dividend to its own investors.

For example, ETFs that invest in growing technology companies may not pay as much in dividends as ETFs that invest in older, more stable industries (like finance here in Australia). Also, ETFs that invest in other countries may have to pay extra taxes that can affect the dividend amount. So, it's important to look at many things before choosing an ETF to invest in that matches your goals and what you are comfortable with.

Do ETFs pay dividends in Australia?

Yes, ETFs do pay dividends in Australia. When an ETF receives a dividend from an Australian company, it must distribute the dividend to its own investors. The ETF usually distributes the dividend payments to its investors quarterly, although some ETFs may distribute dividends annually or semi-annually.

Dividends are common in Australia because Australian companies tend to have a strong focus on returning profits to their shareholders. This is often seen as a way to reward investors for their loyalty and to attract new investors to the company.

Also, the Australian tax system offers favourable treatment for companies that pay out dividends, which can incentivise companies to prioritise dividends as part of how they handle money and resources.

What is a good ETF for dividends in Australia?

If you're looking for a good ETF for dividends in Australia, there are a few factors to consider. One is the dividend yield, which is the annual dividend payments divided by the ETF's share price. Another factor is the ETF's track record of paying dividends, and the stability and growth of the companies it holds.

This gives a better idea of how well the investment is doing overall, since it shows how much money it's making and how much it's going up in value. By looking at the total return, investors can make better choices about what to invest in and how to manage their investments.

That being said, there are some ETFs in Australia that focus on holding companies that pay strong dividend compared to the rest of the stock market. It's common to see most ETFs in fact paying decent dividends due to the way companies are encouraged to pay them out.

Here are some popular ETFs for dividends in Australia that ETF investors may want to consider:

- Vanguard Australian Shares High Yield ETF (VHY): This ETF tracks the performance of the FTSE ASFA Australia High Dividend Yield Index, which includes around 75 Australian companies with high dividend yields. The ETF has a dividend yield of around 6-7% and a management fee of 0.25%.

- iShares S&P/ASX Dividend Opportunities ESG Screened ETF (IHD): As a point of difference to VHY this ETF tracks the performance of the S&P/ASX Dividend Opportunities Index, which includes 50 high-dividend-paying Australian companies. Companies are as also screened for sustainability considerations. The ETF has a dividend yield of around 5% and a management fee of 0.23%.

- SPDR S&P/ASX 50 Fund (SFY): While not a dedicated dividend ETF, this one tracks the performance of the S&P/ASX 50 Index, which includes the top 50 Australian companies by market capitalization. The ETF has a dividend yield of around 5% and a management fee of 0.286%.

Which ASX shares pay the highest dividends?

There are some ASX shares that pay good dividends, like BHP Group Ltd, Rio Tinto Limited, Commonwealth Bank of Australia, Westpac Banking Corp, National Australia Bank Ltd, Australia and New Zealand Banking Group Limited, and Telstra Corporation Ltd.

But don't just jump into buying shares because of the dividend. You got to look at other things like how healthy the company's doing financially, whether it's going to keep growing, and if it's worth the price. And remember, it's always good to mix it up with different investments, like ETFs, to be smart and safe with your money.

There are several ASX shares that pay high dividends. Some of the popular dividend paying ASX shares include:

- Commonwealth Bank of Australia (CBA): This bank has a dividend yield of around 6.4% over the last 10 years on average

- Westpac Banking Corporation (WBC): This bank has a dividend yield of around 5.72% over the last 10 years on average

- BHP Group Limited (BHP): This mining company has a dividend yield of around 6.15 % over the last 10 years on average

- Telstra Corporation Limited (TLS): This telecommunications company has a dividend yield of around 5.38% and a long history of paying dividends.

Source: Sharesight Share Check March 2023

It's worth noting that while high-dividend-paying stocks can provide a steady stream of income, they also come with risks, such as changes in interest rates, economic conditions, and company-specific risks. It's important to do your research and diversify your investments to manage these risks.

Is it worth buying a dividend ETF?

Dividend ETFs can provide a steady stream of income, which can be useful for retirees or investors who are looking for passive income. Dividend ETFs can also provide some downside protection during market downturns, since companies that pay dividends tend to be more stable and financially healthy. Whether it's worth buying a dividend ETF depends on your investment goals and risk tolerance.

However, dividend ETFs also come with some risks. For example, if interest rates rise, dividend-paying stocks may become less attractive to investors, which could cause their share prices to fall. Additionally, if the companies that the ETF holds stop paying dividends or reduce their dividend payments, the ETF's dividend income may decline.

What is the downside of dividend ETF?

The downside of dividend ETFs is that they may not provide the same level of growth-oriented ETFs or individual stocks. Since dividend-paying companies tend to be more mature and financially stable, they may not have as much room for growth as younger, high-growth companies.

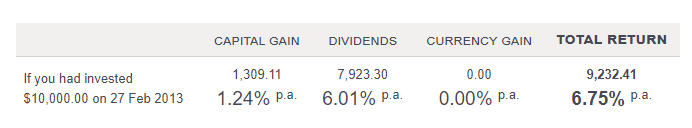

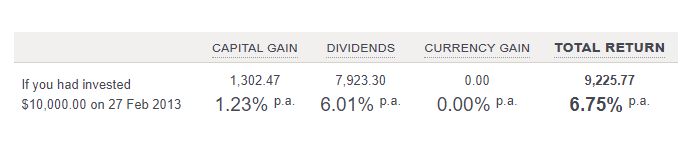

Take VHY for example. It paid a nice dividend of 6.01% to investors each year on average the last 10 years. If you look at its growth though it only rose in price by 1.23% over the same 10 years (to March 2023).

Another potential downside is that dividend ETFs may have a higher management fee than non-dividend-paying ETFs, since the ETF manager needs to spend time and resources evaluating and selecting high-quality dividend-paying companies.

Can you live off ETF dividends?

Yes, it's possible to live off ETF dividends if you have a large enough portfolio and a strategy for generating income. To generate income from ETF dividends, you'll need to invest in high-dividend-paying ETFs, such as the ones we discussed earlier. You'll also need to invest in a diverse range of companies and sectors to manage risk and ensure a steady stream of income.

It's important to note that living off ETF dividends requires a large portfolio, since even high-dividend-paying ETFs may not provide enough income to cover all of your expenses. For example, if you have a portfolio of $500,000 invested in an ETF with a 5% dividend yield, you will generate $25,000 in dividend income per year. However, this may not be enough to cover all of your living expenses, depending on your lifestyle and cost of living.

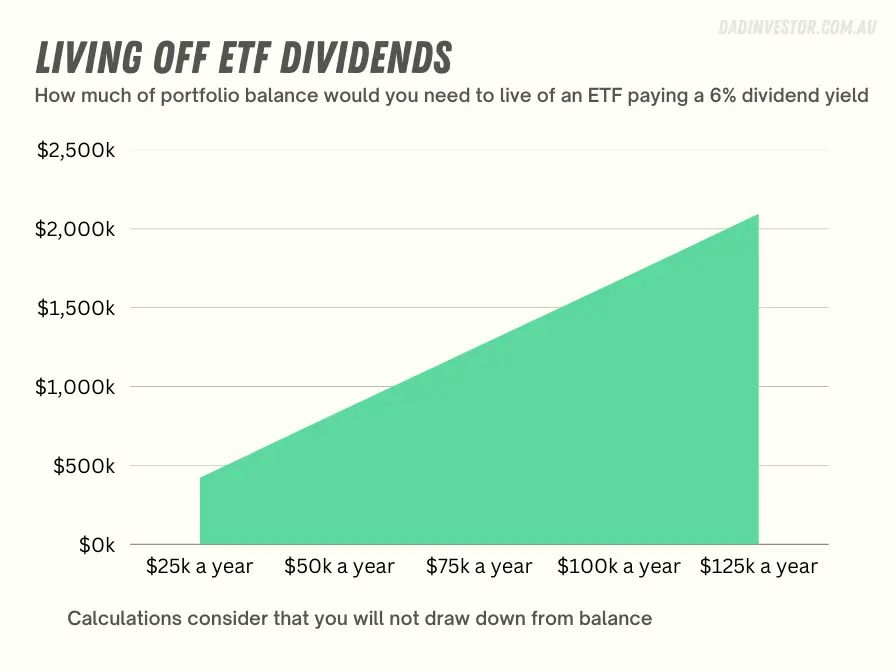

Let's use the most popular dividend ETF in Australia VHY, take their 6% dividend history and see how much you'll need to have of it to provide yourself different levels of income.

| Desired Annual Income | Amount Needed to Invest in ASX:VHY |

|---|---|

| $25,000 | $416,666 |

| $50,000 | $833,333 |

| $75,000 | $1,250,000 |

| $100,000 | $1,666,666 |

| $125,000 | $2,083,333 |

| $150,000 | $2,500,000 |

As you can see, to generate $25,000 in annual income from VHY at a 6% dividend yield, you would need to invest $416,666. To generate $50,000 in annual income, you would need to invest $833,333, and so on. It's important to note that this is a simplified calculation and does not take into account taxes, fees, or other investment considerations.

Looks like you'll need $400k or really start living off ETF dividends. How long is that going to take to save. Let's hvae a look at someone who is earning $80,000 a year (post tax) and saving 15% ($1k a month). I say 15% because likely you would be someone serious about investing and living off dividends.

| Desired Annual Income | Amount Needed to Invest in ASX:VHY | Time to Save (Years) |

|---|---|---|

| $25,000 | $416,666 | 28.97 |

| $50,000 | $833,333 | 57.94 |

| $75,000 | $1,250,000 | 86.91 |

| $100,000 | $1,666,666 | 115.89 |

| $125,000 | $2,083,333 | 144.86 |

| $150,000 | $2,500,000 | 173.83 |

That last column is a bit soul crushing. 29 years saving a $1000 a month to live on $25k a year? Fair bit of work.

Few notes for this

- It's a basic calulcation

- I've estimated you put the money into a savings account of 3%

- It thinks you won't draw down the amount you invested (purely live off the dividends)

So, there are a fair few different ways change what's required here so you can get to your goals sooner. I won't go into that here, but the exercise is there to illustrate the work needed to live off dividends.

Are high dividend ETFs worth it?

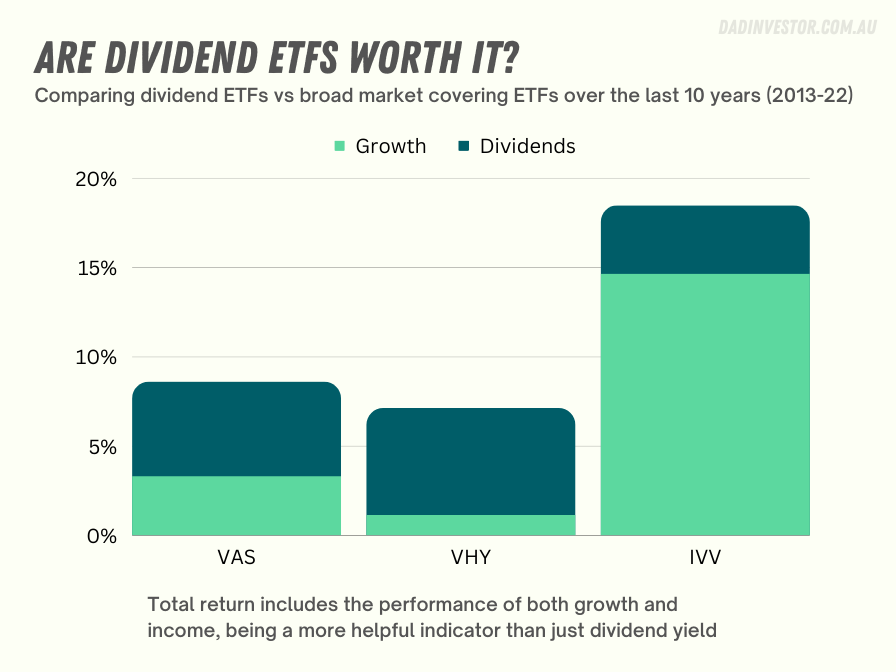

When investing in ETFs, it's important to consider both the yield and growth potential of the underlying assets held by the ETF. Combined these two measures form the total return and can give the investor a more complete picture of how an investment or ETF performs.

One of my early investments was in Vanguards High Yield Index Fund (before the ETF existed). I thought I was really savvy by investing in something that produced strong income. The problem was it never grew. In fact it lost value. This was hard to stomach as other funds and ETFs like VAS or IOO were growing better than my dividend yield.

This is because income-generating assets tend to be less volatile and less likely to appreciate in value over time. As a result, investing solely for yield may limit your potential for long-term growth.

On the other hand, investing solely for growth may lead to a portfolio that is heavily weighted towards more volatile and risky assets that may not generate significant income. This may make it more difficult to generate the income you need to cover your living expenses or meet your investment goals.

By balancing both yield and growth in your ETF portfolio, you can generate both income and growth potential over the long-term. This can help you achieve a steady stream of income while also giving you the potential for long-term growth and capital appreciation.

How to get started investing in ETFs for dividends.

To get into ETF investments, you can use a micro-investing platforms like Raiz or CommSec Pockets, which allow you to invest small amounts of money into ETFs automatically. You can also use online brokers such as Stake or Selfwealth to go through more traditional investing platforms.

Here's a quick summary of some steps you can take to invest in ETFs for dividends (this is not advice just an explainer):

- Set a goal for how much dividend income you want to earn each year, and how much you'll need to invest to achieve that goal. For example, if you want to earn $10,000 in dividends per year from an ETF portfolio with a 5% yield, you'll need to invest $200,000.

- Choose a high-dividend-paying ETF that suits your investment goals and risk tolerance. The iShares S&P/ASX Dividend Opportunities ETF (IHD), Vanguard Australian Shares High Yield ETF (VHY), and SPDR S&P/ASX 50 Fund (SFY) are popular options in Australia.

- Consider using micro-investing platforms like Raiz to invest small amounts of money into ETFs automatically. Raiz offers a range of ETF portfolios that include high-dividend-paying ETFs, and their platform can round up your spare change or invest a set amount regularly.

- Use an online broker like Stake or SelfWealth to invest larger amounts of money into ETFs. Both platforms offer low-cost brokerage fees and easy-to-use interfaces. Stake specializes in ASX and international ETFs, while SelfWealth offers a community-driven platform that allows you to see how other investors are performing.

- Diversify your investments by investing in a range of ETFs that hold different companies and sectors. This will help you manage your risk and ensure a steady stream of income.

- Monitor your portfolio using portfolio trackers like Sharesight or Morningstar and make adjustments as needed to ensure your portfolio continues to meet your investment goals.

Final thoughts on living off ETF dividends in Australia

Living off ETF dividends is an achievable goal, but it requires a significant amount of money to get started. To earn a comfortable annual income of $50,000 from a diversified ETF portfolio with a 5% dividend yield, for example, you would need to invest at least $1 million. That means It's important to have a long-term perspective and to start investing early, even if it's just small amounts, to take advantage of the power of compounding and maximize potential returns over time.

If you're just getting started with ETF investing, there are a few things to keep in mind. First, do your research and choose ETFs that align with your investment goals and risk tolerance. Look for funds with low expense ratios and high liquidity to minimize costs and maximize flexibility. It's also important to diversify your portfolio across different asset classes and geographies to manage risk and improve overall performance.

Finally, remember that investing is a long-term game. It takes time and discipline to build wealth and earn a steady income from ETF dividends. Be patient, stay focused on your goals, and seek out advice and guidance from trusted sources if you need help along the way. With the right mindset and approach, anyone can achieve financial freedom and live off ETF dividends in the years to come.