Growing in popularity every year, ETFs are one of the best ways to get great long-term returns that the share market offers but without the complication of picking stocks.

I've been investing in ETFs for years now and love the simplicity, low cost, and low effort needed to be an investor when using them. In this article, I'll help you understand what ETFs are, how they work, and why they might be a good choice for people who are new to investing.

ETFs as an option for investors

When investing in the stock market you have traditionally had one option – pick stocks.

Over the last couple of decades though there has been a change to that. Rather than buying and sell individual stocks via a broker, ETFs were provided as an option to own a broader range of investments in one product.

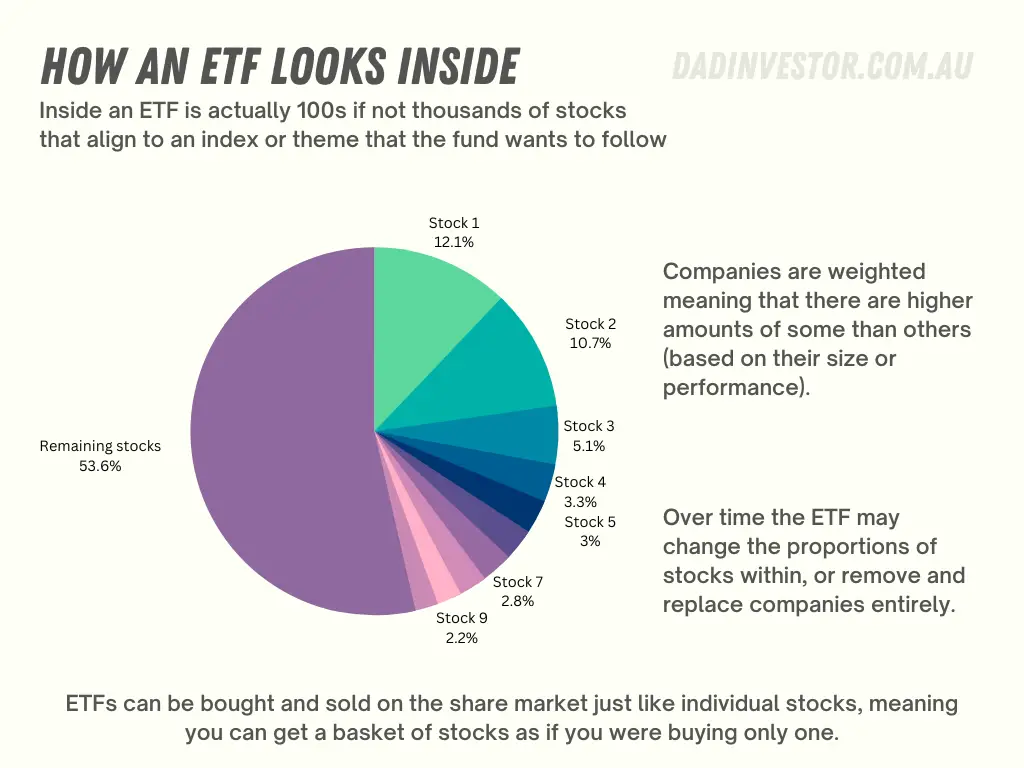

So while you can buy and sell individual stocks on the share market, you can now also buy ETFs the same way. The benefit though is that inside the fund are tens, hundreds or even thousands of companies. It's a stock portfolio already pre-built for you.

ETFs can cover an entire market, industry, country, or region. So instead of investing in one company like Netflix, you can invest in companies from USA, Australia, or even the entire world in one go.

Why invest in ETFs?

Along with instant diversification, ETFs offer low fees, and an easy way to trade in the stock market. They allow investors to hold a diverse range of assets in a single fund, helping to reduce your investment risk. ETFs also typically have low ongoing fees compared to other managed funds, making them a cost-effective choice. Plus, they can be easily bought and sold through an online broker or investing app, making them convenient for beginner investors.

It also can be said that ETFs is the where the future of investing will be. Like online banking did for banking, ETFs are similar in that they can provide fast, cheap access to become a regular investor.

Is investing in ETFs safe?

Investing in ETFs carries some level of risk like any investment does. The value of an ETF can go up or down, depending on the performance of the companies that are held within it. However, ETFs can offer the diversification, which can help to spread risk across a range of assets. As a result, the overall risk of an ETF may be lower than the risk of investing in a single stock or company.

For example, if you owned stock in only Microsoft (MSFT) and it dropped 5% one day, then all of your investment portfolios would drop that much. However, if you invested in an ETF such as IOO that has 100 companies within it with Microsoft in it then you only see a portion of that drop. IOO has 12% of its fund in Microsoft so your portfolio would only see 12% of that 5% drop, which is .6%.

What is the downside of investing in ETFs?

One potential downside of investing in ETFs as a beginner is that they may not have the same level of potential returns as picking individual stocks. You get more averaged returns that align with how the market your ETF invests in performs over time. ETFs are also at risk of market fluctuations which means the value can jump and down depending on share price performance.

It's also important for beginner investors to carefully research and choose the right ETFs for their portfolio, as not all ETFs are created equal, and some may have more risks than others.

Are ETFs a good investment for beginners?

ETFs can absolutely be a good option for beginner investors. It is a simplified way to invest in stocks without the need to study stock charts and data. ETFs are also generally easier to buy and sell than other types of investments, making them a convenient choice for beginners. As the creator of the index funds, John C. Bogle said “Don't look for the needle in the haystack. Just buy the haystack!”

I've found through first-hand experience that picking stocks is something very few people can be consistently good at. Using ETFs takes away the need for you to be a top-tier analyst and gives you a great group of companies to own in one go. Investing in that fund for a long time on a regular basis can help you build some significant wealth.

How do ETFs make you money?

First, some ETFs pay dividends, which are payments made to shareholders from the profits of the companies held within the ETF. For example, if an ETF holds stocks that pay dividends, the ETF may distribute those dividends to shareholders.

Second, ETFs may increase in value over time. If you buy an ETF at a certain price and sell it later when the price has gone up, you may make a profit. This profit is the difference between what you paid for the ETF and what you sold it for. Keep in mind that the value of an ETF can also go down, which means you could lose money if you sell it for less than you paid for it.

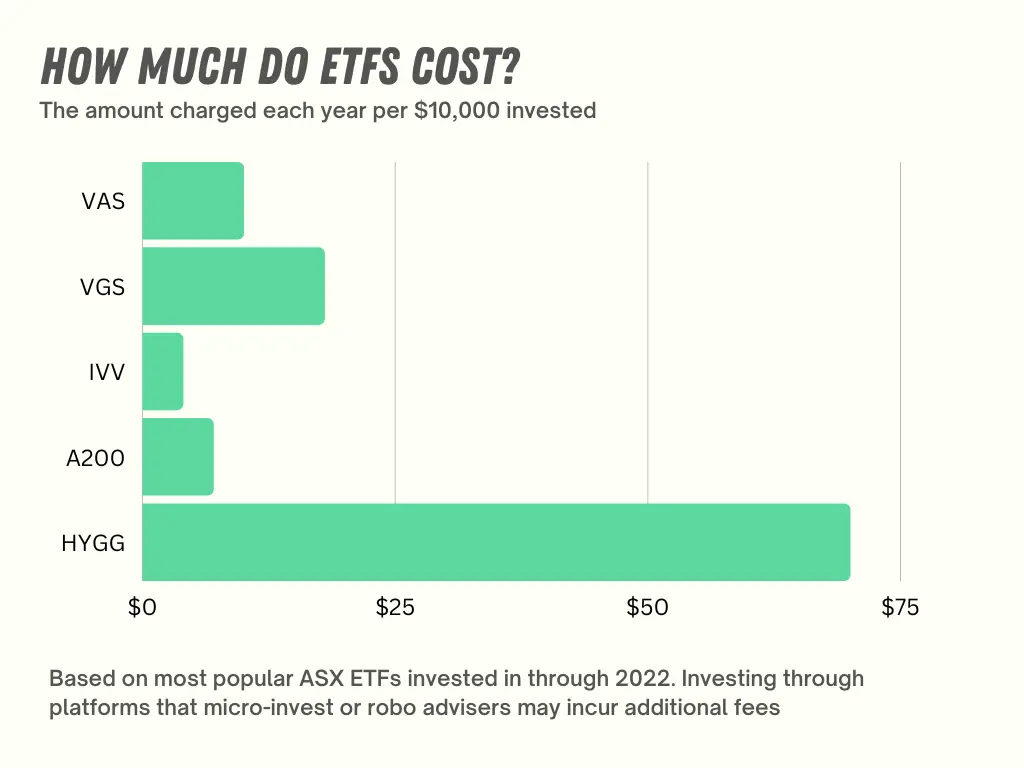

How do ETFs charge fees?

All ETFs charge fees to cover the costs of managing and administering the fund. These fees can be listed as expense ratios or MET and are expressed as a percentage. This percentage or expense ratio is subtracted from the fund's returns, so it reduces the amount of money you can make on your investment over time.

For example, if you were to invest in VAS on the ASX, this would cost you .10% per year. So if the ETF returned 8.5% (which it has on average the last 10 years), then the .10% would come off that leaving you a total return of 8.4%.

Some investment tools like micro-investing apps may also charge a monthly fee to have an account that gives you access to ETFs. Online brokers also charge you a fixed amount each time you buy and sell an ETF on their platform as well so factor that in when thinking of fees for a regular investor.

How do I start investing in ETFs in Australia?

The first step to buying ETFs in Australia is to work out what tool you want to use.

Your options are

- Online broker – buy ETFs directly and manually for a fixed fee each time

- Micro-investing apps like Raiz or CommSec Pockets – buy into ETFs using small amounts of money whenever you like that you can automate (for a small monthly fee)

- Investing platforms like Stockspot or SixPark – where you have a team assisting you in building a portfolio of ETFs that they will manage and adjust for you.

For most beginner investors who want to invest a small amount of money or experienced investor who wants simplicity, I suggest a micro-investing app. These give you a cheap way to start as you only need $5 and also a helpful way to understand the process of investing.

Personally, I use both online broker and investing apps for my investing and regularly invest in ETFs.

How many ETFs should I have in my portfolio?

The answer is – it depends. You can have a single ETF or as many as you like with it all depending on your investment goals, risk tolerance, and method of investing. ETFs on their own are diversified funds made up of hundreds or thousands of companies within them so its not always needed to add more ETFs to your portfolio to diversify. Since there are so many companies within an ETF, you may find there is crossovers of companies held if you own multiple.

For example, if you buy the VGS ETF then you will have over 1400 companies within that fund you own a part of from across the world. If you then buy IVV you will have 500 or so companies within that fund that you are investing in. This however will give you some crossover as 70% of VGS invests in the US stock market which IVV is completely invested in. Companies like Apple, Microsoft and Google are in both funds, so you are investing twice into the same thing.

Another thought on owning multiple ETFs is how you manage them over time. Along with the paperwork you receive in the mail, you will also need to know how much of each ETF you would like to own as a percentage of your entire portfolio. Do you go 50% VGS, 50% IVV for example? or 80/20? This is called re-balancing and as an investor is something you should be thinking about.

That's why I have simplified my ETF investing and now only stick to the one ETF – IOO. That gives me access to 100 great companies and that's all I need. I also have a custom portfolio in Raiz that has a few ETFs within it, ranging from NDQ to IVV to ETHI.

How much to invest in an ETF per month?

This is less a question for ETF investing, and more a question for you as an investor. ETFs are the product you invest in but working out how much you invest is dependent on your capability and situation. With the introduction of micro-investing apps, you can start with as little as $5 and work your way up as you like or stay small.

How often should I buy ETFs?

A common way to invest in ETFs is to use the dollar cost average strategy. This means you add the same regular amount over time, which could be weekly or monthly. This means you are consistently adding to your portfolio irrespective of share market performance and getting a good price average.

It can also help to align your investing with the intervals in which you receive income. For instance, if you get paid an income fortnightly then you can invest at that interval, or the same if you get paid monthly. Another thought on when to invest in ETFs is the infrequent money you may receive. Tax returns are a good example as you may only receive one lump sum a year, which can be a good amount to use for investing in ETFs.

Regular investing is more cost-effective when done through an investing service like the micro-investing apps, while more infrequent trading is more cost-effective when done manually via a broker.

Types of ETFs

There are many different types of stock ETFs that you can invest in, each with its own unique characteristics and investment strategies. Here are a few examples:

- Index ETFs: These ETFs track a specific market index, such as the S&P 500, the NASDAQ, or the ASX200, and hold a portfolio of stocks that reflects the companies within that index.

- Small-Cap ETFs: These ETFs hold a portfolio of stocks of small-cap companies, which are companies with a smaller market cap. In Australia, a small-cap company is considered one that is outside the top 100 in size, while in the US it is a company that is valued at less than $2 billion.

- Dividend ETFs: These ETFs hold a portfolio of stocks of companies that pay higher dividends than most, which can provide investors with a source of regular income.

- ESG ETFs: These ETFs hold companies that have passed screens to exclude companies with direct or significant exposure to factors such as fossil fuels, weapons, climate change, or engaged in activities deemed inconsistent with responsible investment considerations.

Examples of Popular ETFs

The most popular ETFs cover well-known and widely followed indexes. These indexes cover popular regions and countries, have high trading volumes, and lower costs.

Most popular ETFs in Australia in 2022 (by amount invested in them)

1. Vanguard Australian Shares Index ETF (VAS)

- Size: $11.8 billion

- 10-year average total return: 9%

- Cost: .10% pa

- Year Founded: 2009

An ETF that includes the top 300 companies in Australia including BHP, the big four banks, CSL and Telstra.

2. Vanguard International Shares ETF (VGS)

- Size (TTM): $5 billion

- 10-year average total return: 9%

- Cost: .18

- Year Founded: 2014

An ETF that includes over 1400 companies from around the world. Predominantly from the US, it includes companies such as Apple, Microsoft, Telsa, Johnson & Johnson, and Alphabet (Google) along with companies from Japan, Canada, and Europe.

3. iShares Core S&P 500 (IVV)

- Size (TTM): $4.8 billion

- 10-year average total return: 17%

- Cost: .04%

- Year Founded: 2000

One of the cheapest and most well-known ETFs covering the S&P 500 in the USA. It has performed well recently due to the US tech stocks that dominate the portfolio.

4. BetaShares Australia 200 (A200)

- Size (TTM): $2.7 billion

- 3-year average total return: 6%

- Cost: .07%

- Year Founded: 2018

A challenger to VAS but targets only the top 200 companies on the ASX, not the top 300 like VAS does. Also, cheaper to own than VAS.

5. Hyperion Global Growth Companies Fund (Managed Fund) (HYGG)

- Size (TTM): $1.9 billion

- 5-year average total return: 8%

- Cost: .7%

- Year Founded: 2014

An actively managed ETF of around 25 holdings that are mostly US based. This fund hand-picks what is in and out of the portfolio and how much is owned. This means companies like Tesla, Microsoft, and Service Now make up over 33% of the fund. I am a former owner of this ETF.

Pros and Cons of ETFs

ETFs can be a great investment option for beginners or experienced investors but have their own set of pros and cons. Here are a few to consider:

Pros:

- Diversification: ETFs allow investors to diversify their portfolio by holding a basket of assets, rather than just a single stock, which can help reduce risk.

- Low cost: ETFs often have low costs, which can help to increase returns.

- Convenience: ETFs can be traded like stocks, which makes them easy to buy and sell. This allows investors to pick from a wide range of popular investing tools that suits their investing style best

- Transparency: ETFs are required to disclose their holdings daily, so investors can see exactly what they are investing in.

- Asset class and geographic diversification: ETFs offer a wide range of choices for investors, including tracking different indexes, sectors, countries or even commodities, which can help investors to have a well-diversified portfolio

Cons:

- Short-term focus: Because ETFs can be traded easily, some investors may be tempted to buy and sell frequently, which can lead to higher transaction costs and reduce your ability to see the long-term performance.

- Lack of customization: ETFs track a pre-determined index and provide a passive investment strategy. They do not provide the ability to pick and choose individual stocks.

- Limited coverage of niche markets: ETFs tend to focus on broad-based indexes, which means they may not provide enough exposure to niche markets, although this is changing over time as issues like Betashares release more boutique ETF options.

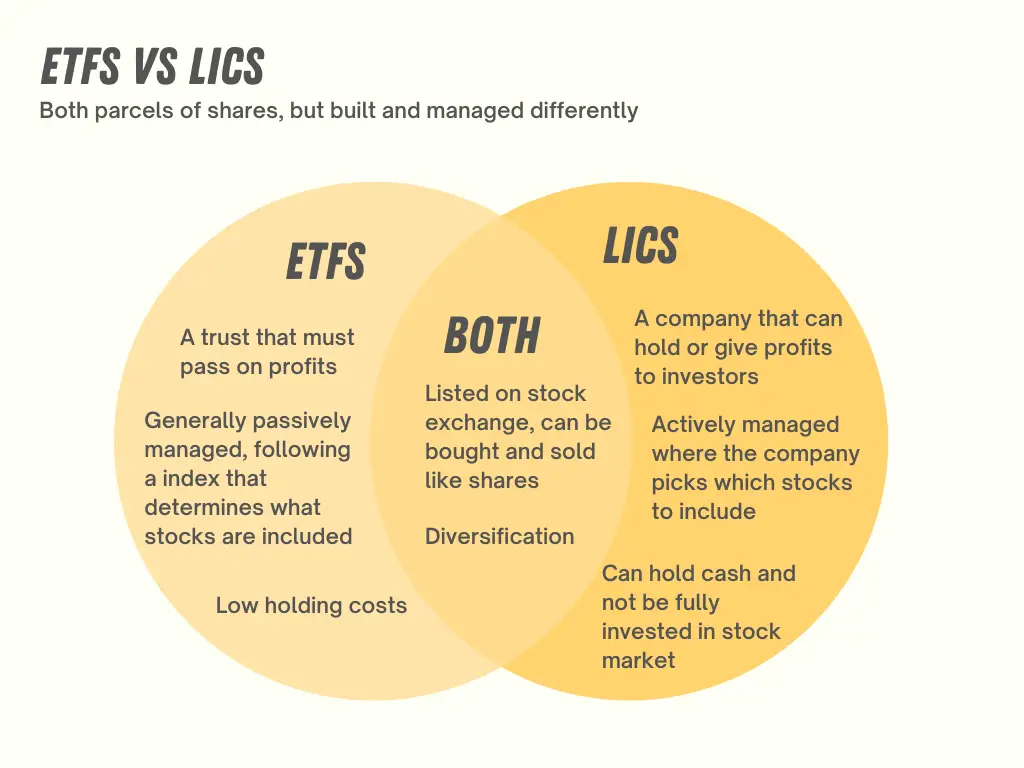

ETFs vs LICs

LICs, or listed investment companies, are a type of investment vehicle that allows investors to buy shares in a company that holds a diversified portfolio of assets, such as stocks or bonds. Like ETFs, LICs offer investors the opportunity to buy a diverse range of assets in a single share.

One difference between LICs and ETFs is that LICs are typically actively managed, which means that a portfolio manager is responsible for selecting the assets the company holds. ETFs, on the other hand, are typically passively managed, meaning they are designed to track the performance of a specific index or benchmark and do not require a portfolio manager to select the assets they hold.

Another difference is that LICs may have higher fees than ETFs, as they are actively managed. Finally, the way in which profits from LICs are distributed to shareholders may differ from ETFs.

In Australia, LICs are popular as they offer good dividend returns for investors who want a regular income. The prices are also very low so you can don't need much money to buy into them via your online broker. Some examples of LICs include ARGO, AFI, and Washington H. Soul Pattinson (SOL).

In summary: ETFs are an option for beginner investors

If you are a beginner investor or want a simple way to invest for the long term, then ETF may be the option for you. It's becoming a mainstream way to invest in the stock market, at a low cost and without the headaches of picking stocks.

I personally am an ETF investor and even though feel like I can do better picking stocks or speculating, always come back to the good consistent returns that ETFs provide.

There is also a growing range of ETFs to pick from that suit the type of goals or investing ambitions you have. If you want to invest ethically, get dividends, or focus on the tech you can all through different types of ETFs. The choice is yours, but it can be a huge range to pick from so make sure you read my article on how to pick them in this guide.