Ever wondered what really moves the needle when it comes to building a profitable investment portfolio?

Many of us are tempted to think it's all about picking the next Apple or Tesla.

But, what if I told you that the true secret behind robust investment success is something far less glamorous but way more dependable?

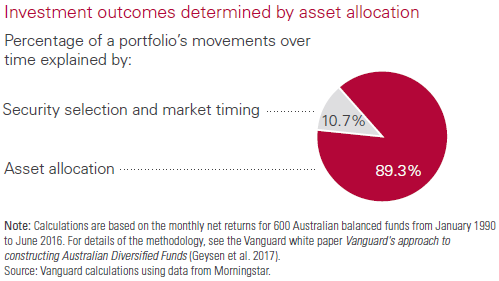

According to Vanguard, one of the investment world's most trusted names, a whopping 90% (or to be exact, 89.3%) of your investment returns are determined by just one thing: Asset Allocation.

In today's article, we're pulling back the curtain on this crucial yet often overlooked aspect of investing and break down what asset allocation actually is and how to execute it so you can feel much more confident with how you invest.

What is Asset Allocation?

Alright, first things first: What on earth is asset allocation?

It's about where you put your money.

Think of it like deciding how to use your monthly salary. Some of it might go into a savings account, some might be used to pay down a mortgage, and maybe a portion gets invested in a side business.

Now let's think about it from an investing perspective

In its simplest form, asset allocation is the practice of dividing your investments among different asset classes like stocks, bonds, cash and categories like real estate or cureencies.

Imagine your investment portfolio as a pie. Each slice of that pie represents a different type of asset. The size of each slice? That's what asset allocation is all about.

And just like you wouldn't put all your monthly income into dining out and entertainment, you shouldn't put all your investment eggs in one basket either.

Asset allocation spreads your money around so that it can focus on what you are looking to achieve. Whether that is growth, income or stability.

The Study That Proves It Matters (for 89% of your investing success)

The Study That Proves It Matters

Vanguard, the global investment powerhouse, conducted a study examining over 600 Australian balanced funds over a span of 25+ years.

Their objective was to understand what truly drives the performance of an investment portfolio over the long term.

The key takeaway from this study?

A remarkable 89.3% of a portfolio's long-term returns were determined by asset allocation.

To break it down further, the term “long-term” in this context implies a timespan extending beyond 10 or even 25 years, whereas short-term might refer to periods as short as a few months to a year.

In essence, where you decide to put your money (like stocks.vs savings accounts vs properties) majorly influences your financial success over a long time horizon.

“success” refers to achieving stable, long-term returns on an investment portfolio.

It's not about striking it rich quickly or beating the market every single quarter.

Rather, it's about consistent performance over time.

What the 89.3% Actually Represents

When we talk about the 89.3%, that's the decision to determine what proportion of your money is placed in different types of investments.

That could be it in the stock market, a savings account, or real estate like rental properties.

In the investing world, different assets like stocks, property, and savings accounts each have their own “return patterns,” which essentially means how they behave over time.

- Stocks: High potential for growth but accompanied by volatility.

- Savings Accounts: Provides security and liquidity but offers low returns.

- Properties: Can offer both rental income and value appreciation but comes with higher entry costs and maintenance responsibilities.

By allocating your resources wisely among these different asset types, you stand a better chance of reaching your financial goals without undue risk.

So what this all means (according to the Vanguard study) is that simply deciding to allocate money towards stocks is 9/10s of the effort needed to find investing success.

Not what you pick or when you do it. Just the fact you are doing it.

What you pick only accounts for 10%

So what accounts for the remaining 10.7% that isn't Asset Allocaton.

This slice of the pie covers factors like market timing and individual security selection.

Translated this means what day, week or month you invest and what exact ETF or stock you pick.

Those decisions only attribute to 10% of your cuscuses.

While they aren't insignificant, but their role is relatively minor in the grand scheme of long-term investing.

Again, the mere fact you've decided to allocate money to investing is the biggest contributor to long-term success.

If you think about what we see advertised – it seems like the products (stocks, ETFs, currencies) are the most important part.

Research suggests otherwise.

Yeah, you might get lucky picking a winning stock or timing the market just right, but these are the cherries on top rather than the main course.

It's easier to promote a thing like a product, platform or app than it is to promote a process (like deciding to invest).

The Real Deal: Being in the Investment Game

The main thing is you've got to be in the game to win.

That means if you want your money to grow you need to be invested in assets that actually grow—like shares and property.

If you let your money loiter in low yield accounts then you can only expect low returns.

The Vanguard study makes it clear: The specific stocks or properties you're into are kinda like your favorite topping on a pizza; nice but not critical.

What really matters is that you're eating pizza in the first place, or in finance terms, you're invested in the right kinds of assets.

hat's about 90% of your game right there.

Your Game Plan for Asset Allocation

Now that you know asset allocation is like the star player on your investment team, how do you actually figure out your ideal lineup?

Decide what you're saving for the short term (under 10 years) and what you're investing for the long haul.

Short term you probably want stability so pick something more stable.

If you've got a chunk of cash you won’t need for a decade, you can get that into growth assets like stocks or property.

But what exactly should you buy?

I have plenty of articles that can help you with that, but the idea is to look for opportunities that are better than low-risk low reward options (like a savings account).

Products like ETFs are not just easy to start small with, but great transparent investment options.

They each have their own product page that explains what type of returns you can expect over certain time frames.

Practical Tips

- Know Your Goals: Understand what you're saving and investing for, and let that guide your asset allocation.

- Keep It Manageable: Diversify but keep it straightforward enough that you don’t need an MBA to understand your own portfolio.

- Rebalance: Markets change, and that'll mess with your asset mix. Adjust periodically to keep things in line.

- Turn Off the Noise: Forget about market hype and news. Stick to your plan.

- Get Some Guidance: If it's overwhelming, consult a financial advisor. They can tailor advice to your unique situation.

The final word on Asset Allocation

Yes, it's a technical term but if you get your head around how it works it'll help drive nearly 90% of your success as an investor.

All it means is sticking with a game plan that focuses on stuff that grows, like stocks and real estate.

The actual stocks you pick or when you jump in and out of the market?

Not a huge deal.

It's kind of like stressing over the color of your car when you should be more concerned about the engine inside.

But listen, you’ve got to be in the game.

Stashing your cash in a regular old savings account won’t help you grow your wealth in any meaningful way.

Keep it straightforward, check in now and then to keep things balanced, and if you're scratching your head, there’s always someone you can chat with for guidance.