For many of us, retirement can seem like a distant destination, and the road there feels a bit foggy.

But what if clarity on your ability to retire can be closer than you think.

Sometimes, all it takes to see the path ahead is understanding a few crucial numbers.

I know many of us start to sweat a little when they get specific about the dollars and timeline of it all.

It's normal — after all, it's your whole future we're talking about.

But it isn't as complicated as it seems.

There are five key figures that really matter, and once you know what they are and what they mean for you, the whole retirement puzzle starts to fit together.

I'm going to walk through these numbers one by one.

You'll see why each one is important, find out how to crunch them, and get some pointers on boosting them.

Let’s get started.

#1 Your Super Balance

The simplest way to think of your superannuation is as a savings or investment account that you can't touch until you reach a certain age.

It's one of the core components on you building a comfortable income stream that's going to make sure you can keep living life without the need to work.

The more you've got in there, the more you can do when you move into retirement.

Finding Your Number

Checking your super balance is a breeze.

You can just log into your super account online (like you would a bank) and look for the number that says balance.

If you've never logged in or you're unsure who your fund is – then this is where you might need to check your emails or look at your payslip to work out where your payments are going as you would be receiving correspondence (like a statement) every now and then.

Top Tips to Grow Your Super

If you are looking at your balance or do know it already, the first question you're going to ask yourself is – will this be enough?

We'll address this in the next few numbers, but there is no need to stress if its not where you want it to be.

The government really incentivises you to be contributing to your super and it is a very tax effective way to invest and build a nest egg for retirement.

The easiest way to grow your super is to consider things like extra contributions — even small ones can make a big difference over time.

And don't forget to check if you're on the right investment option; sometimes a little tweak can mean more money in the long run.

If you need specific help with understanding this then I really encourage you to get in direct contact with your fund – who should be able to provide you some limited financial advice as part of your existing membership.

Give it the attention it deserves and it'll pay off big time when you're ready to hang up your hat.

Ideally this would be the key provider of your retirement income.

#2 – The Lifestyle Number

Alright, now that you know how much dough you've got in your super, it's time to figure out how much you'll actually need.

So, what's the magic number that'll let you do that?

This number is all about what you want your future to look like.

Do you want to dine out without fretting about the bill?

Maybe you're keen on travelling or want to spoil yourself, the pets, the kids or grandkids.

Getting this number in your head helps make those wishes a reality.

Now, you could scratch your head, guess and spend a bit of time noting down all the exact expenses you'll want to cover but why not make it easier?

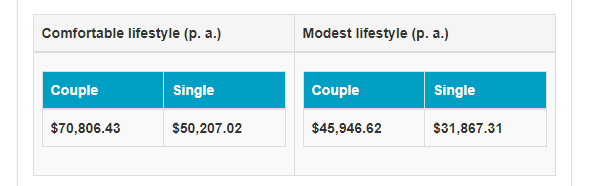

You need to know about the ASFA Retirement Standard.

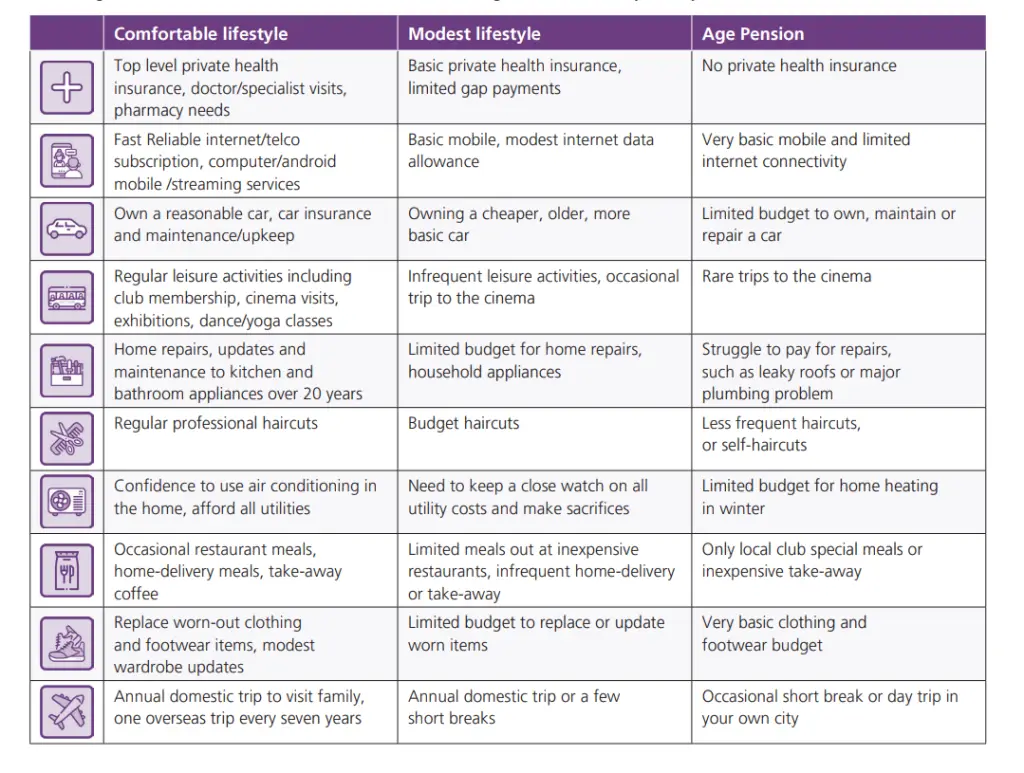

It's a guide that shows what us what we're going to typically be spending on to have a ‘comfortable' or ‘modest' life in retirement.

Consider these two bookends, you have the modest lifestyle which is living a frugal basic life while the comfortable lifestyle (and its costs) considers you saying yes to most things and more in retirement.

This number gets updating every quarter and provides a reasonable guide to start off, explaining the costs you may occur and at what level you want to spend on them.

Use it as a starting point to tally up your own budget.

If you look at the explainer guide on the ASFA site it also shows you that even a modest lifestyle is considered a level above one where you live solely off the age pension.

As I've mentioned before, the idea of retirement income is that its build from your super + ages pension + general savings, so in effect the more you have in your super balance is likely a key contributor to how comfortable your retirement may be.

Also note the balance needed to live that comfortable or modest lifestyle.

It might be more or less than you think is required.

Many people think they need millions to retire comfortably but this standard tells us otherwise.

If you were to add up all your super + savings right now you can get a rough idea of how achieveable a modest or comfortable retirement might be.

What is your number?

If you're a bit short or off the mark then think about how you can start to save towards it.

Your dream retirement doesn't have to be a pie in the sky. It's about making choices now that will let you enjoy the fruits of your labor later. It's your life, your plan, and now, your number.

Alright, that's two down.

Before we continue if you haven't already, click that subscribe button because every new subscriber is like a high five and my kids are keeping count so want to get them a bit excited.

Thanks for the support, and now we move on

#3 The age when retirement becomes real

So, you've got a handle on what you've saved and what you need.

Now, let's talk about when you can actually get your hands on that money.

These are not financial figures, but ages.

The ages to when you can turn on income sources coming from your super and aged pension.

Too many people get confused about when these actually are and also assume they are ages to when you can actually retire.

Timing Is Everything

For most of us, that age we can access super (for most of us) is age 60. That is what we call your preservation age.

This is the time when you can start turning what you've saved and stored in your account and either withdrawal it or turn it into an income stream (which can be used to replace your salary).

While you can dive into your super at 60, the age pension is another story.

67 is the age the government has set for you to be eligible for the pension.

This is the time when, depending on what you own (asset test), you can qualify to receive a payment for the government.

Ideally, you'd be mixing this with your money from super to create a nice juicy income stream so you can live as close to a comfortable retirement as possible.

Knowing these dates is crucial because they affect how you plan your life.

While you can retire at 60, you need to make sure you have enough in there to fund you through your retirement years, especially before the aged pension kicks in at 67.

The Early Retirement Dream

What if you want to retire earlier?

That’s where your savings outside super come in handy.

If you're dreaming of calling it quits on the daily grind before 60, you’ll need additional money to tide you over until your super and pension can take the reins.

This is where the third leg of the three legged stool takes form – your general savings and investments.

How early you retire or how comfortable you can based on what additional money you have grown on top of super in a post tax environment.

The good news is that there is no age minimums needed to start there.

Get into investing sooner and you could be building something that creates you opportunity before you reach 60 even.

Now knowing these ages or the dates you reach them isn't about circling them on a calendar.

Planning means looking ahead.

Start by calculating how much you'll need each year and then match it against when different income streams become available.

If there’s a shortfall, now's the time to plan how to fill it, whether it's through saving more now, investing, or even working part-time in early retirement.

#4 The Aged Pension (and how much you actually get)

Now, let’s talk about the age pension a bit more.

In particular how much you can recieve.

As I've been saying, relying on it alone can lead to a tight squeeze financially.

That becomes evident when you actually see the maximum you can get.

Here’s the lowdown.

At present, for singles, the max rate is around $1,002.50 per fortnight, and for couples, it's about $1,511.40 combined.

It’s some help, but hardly enough for the dream retirement.

In fact, it's actually pretty close to the poverty line which in 2022 was $978 a week (for a single adult and $2,054 a fortnight for a couple (with 2 children).

Source: Poverty – Poverty and Inequality (acoss.org.au)

This really points again to the fact it should be a compliment to your other income streams in retirement (like super).

If you're eligible to receive the aged pension this kicks in at age 67 but does depend on the amount of assets, you have not included your house but including things like your super balance.

You can have assets of up to $1,003,000 as a couple that owns their own home before your payments start reducing in a pro rata type fashion.

The government also does income test to determine if you're not working either and may reduce payments if there is cross over there.

Basically the more you have the less you get, which is completely fine.

Personally, I'm aiming for a completely self funded returement.

This means I'll have enough in my super and general savings or investments to cover my income and live a comfortable retirement.

Speaking of general savings, lets talk that last number.

#5 Your Personal Savings

This is what I like to consider the final piece of the puzzle.

It's definitely something many people overlook or often neglect but its something that is going to make everything fit.

This is all about the money you have saved, invested, put away or just sitting in bank accounts.

Combined this will tell you on top of other numbers like your super a balance and pension payments, how comfortably you can retire or how early you can do it.

Your personal savings give you flexibility.

Whether it being a savings account, investing in shares or other options – the choice is yours.

The aim is to have your money grow over time, so you can step back from work whenever you choose.

Yes, it may be tricky to find extra money to put aside but in this modern era of investing there is the ability to start and continue with as little as $5 at a time.

If you think about the concept its really all about saving money that you spend now, putting it to work and then taking it back to use when you want to do something with it, like retire early.

Your Retirement Roadmap

There you have it — five key numbers that will help open the door to your retirement dreams.

Let's map them out one more time:

- Your Super Balance – A big contributor to creating a comfortable retirement. Know it, grow it, and keep an eye on it.

- Your Lifestyle Number – This is your target for living comfortably – refer to the ASFA retirement standard if you want a guage.

- Your Age – Mark down when you can tap into your super and pension. It's when your retirement journey can officially kick off and you can unlock new income streams.

- The Aged Pension – Understand what the pension offers, and why it’s a compliment to your super not a sole source of money in retirement.

- Your Outside Investments – Plant those seeds early. Every dollar is a step towards early retirement or a financial boost for those ‘just in case' moments.

Now, why not make this practical?

Take a moment to jot down these numbers for yourself.

Log into your super account, peek at the ASFA standards, look at your budget, and familiarize yourself with the pension rules.

Every number you note, every plan you make, brings you closer to a retirement that’s not just a hope, but a reality you can count on.

So go on, take the first step on this checklist, and turn those retirement dreams into your future lifestyle.