If you are looking to begin investing in ETFs or just simplify your investing process, then CommSec Pockets is a great option to consider if you are sick of costly online brokers or apps.

There are some pretty flash-looking investing apps that have been created to disrupt and change the industry for online brokers. CommBank on the other hand owns the most popular online broker in Australia – CommSec.

I was an early adopter of CommSec Pockets and put it to the test to see if it was worth using as an investing app. I found it has some unique and powerful benefits to investors, in particular those with little experience.

This article will take you through the way CommSec Pockets works and what kind of investor its most suited to.

CommSec Pockets Review: An Introduction and Summary

CommSec Pockets is an investing app built through CommSec but designed to match the simplicity and low-cost investing benefits other micro-investing apps like Raiz or Spaceship are offering. Pockets allow you to invest in seven different ETFs that you can buy and sell for a low cost making it easier to start small or keep your investing simple. CommSec Pockets also provides plenty of support and guidance through the app as it explains the concepts of investing at a very simple level so there is less of a chance of you feeling overwhelmed if new to investing.

CommSec Pockets is also an app-only investing platform. There is no desktop or browser version so you will need to do all your work on the phone.

- Minimum deposit: $50

- Fees: $2 to buy or sell each ETF up to $1000 in value, no ongoing costs

- Options: Brokerage, ETF investing

While it's close to being a micro-investing app, Pockets still needs you to cover the entire amount of each ETF share. You can't invest based off the dollar amount you want to but the cost of the shares. For example, if you wanted to invest in the ETF IOO, you would need to cover the cost of at least one share. At the time of writing the share price is around $95 per share.

Pockets is more of a low-cost online broker alternative that is cheaper and more convenient. The investment options are limited to a certain number of ETFs and this list has not changed since its launch in 2019.

Trading over $1,000 at a time will cost you 0.20% of the trade value. For example, a $2,000 trade will cost you $4 ($2,000 x 0.20%). This is still a better deal than a regular online broker such as SelfWealth which charges $9.50 per trade (but gives you a broader range of ETFs or stocks to pick from).

What kind of investor is CommSec Pockets suited to?

CommSec Pockets is suitable for a wide range of investors, from those just starting out to experienced investors looking for a low-cost and convenient way to invest. This platform is ideal for investors who want to take control of their finances and build a diversified investment portfolio. CommSec Pockets is also suitable for investors who are looking for a low-cost option for investing in ETFs.

From my experience, the main considerations for choosing Pockets as your investing app of choice would be if you wanted to:

- Build a DIY ETF portfolio through the one app.

- Select and trade specific ETFs at a fraction of the cost or regular brokers

- Setup recurring investments to automate investing

- Want a simple, easy to understand interface to invest with

My reasons to join and use CommSec Pockets for investing was to buy my favourite ETFs every now and then. At the time I was an infrequent investor and paying “per use” meant Pockets was a good option.

How to invest with CommSec Pockets

You will need to have an existing CommBank account or CommSec account to investing using Pockets.

Since I had neither when I started, I used my wifes old CommBank account and signed up to CommSec through that.

It can be a bit confusing with all the accounts and steps involved. What's important to know is that CommSec and CommSec Pockets are two different platforms, but you can view the investments you make in your Pockets account in CommSec. You can't trade with Pockets through CommSec standard, you will need to use the app (and view the transactions in either Pockets or CommSec).

Another point of difference from Raiz or Spaceship is that once you transfer money in it is not invested automatically (unless you set up automatic investments), so you will need to manually buy or sell your ETF once the money is in.

To start investing with CommSec Pockets:

- Sign up for a CommSec Pockets account.

If new to CommBank you will need to apply online for a CommBank transaction account (takes 5 minutes). You will get a NetBank ID which you can use to open an account with CommSec Pocket via the app.

If you already are a CommBank customer, use your NetBank ID to join Pockets via the app.

- Link a bank account to your CommSec Pockets account.

You will need to send your money to a CommBank Direct Investment Account (CDIA) which can be done via a transfer. Then when the money appears in pocket you will be ready to invest

- Choose the ETFs you want to invest in.

When money is in your CDIA you will then need to invest it. You do that by selecting which of the seven ETFs you want to buy. Choosing which one is up to you, but once you have you go to the ETF's page and determine how many shares you want to buy.

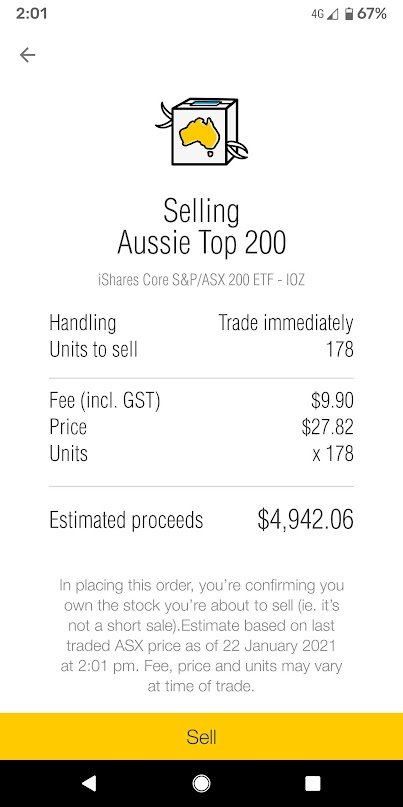

- Decide on the amount you want to invest.

You will need to buy a whole amount of shares per trade and this will be determined by it's stock price. Depending on how much you have in your CDIA you can tell how many ETF shares you can buy. Once you select that number you can confirm the total cost, including trading fees

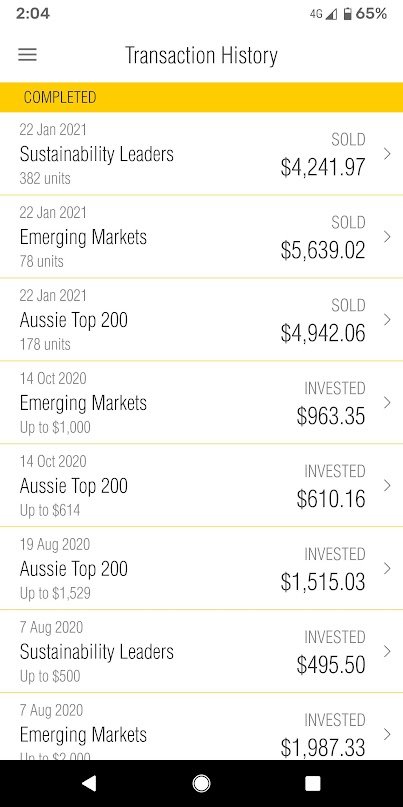

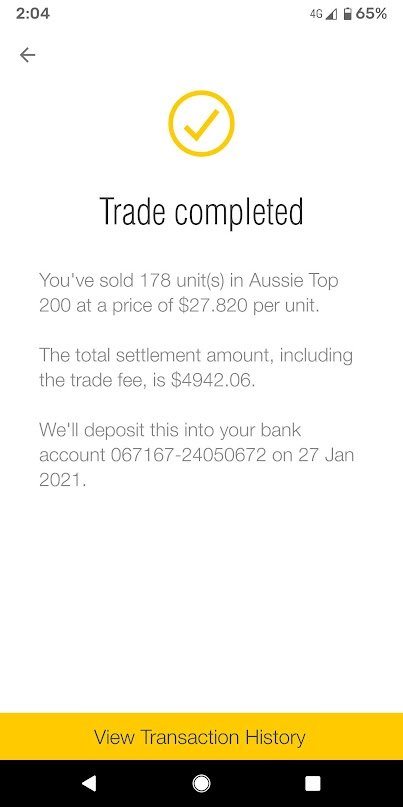

- Confirm your investment.

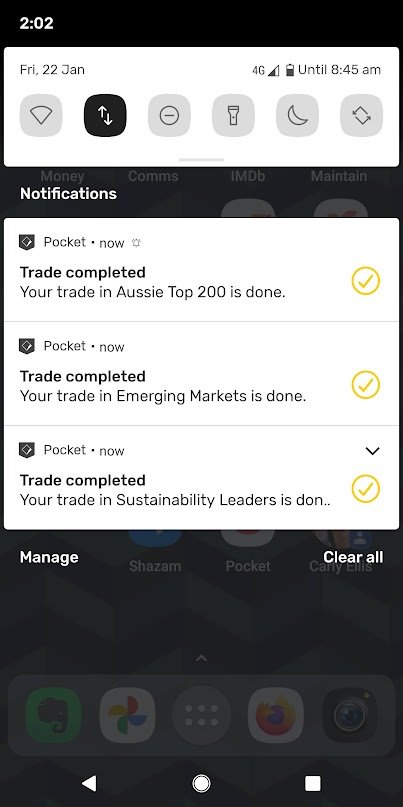

Once you complete the trade. It will then appear in your transaction history and you will now be an investor in the stock market through Pockets!

As you can see the app experience makes it a comfortable place to invest where it is clear what you are doing.

You can set up automatic investments, but you will need money in your account for this to happen. If you wanted to do this you would need to transfer money to your CDIA account in CommSec and pockets would take money out of this at the interval you set.

Which ETFs does CommSec Pocket use?

CommSec Pockets offers seven ETFs from some of the world's leading fund managers such as Vanguard and BlackRock. These ETFs cover markets and sectors that are popular and in demand to most investors. You can invest in one, many or all ETFs while using your account. If you do trade multiple ETFs you will get charged a fee for each individual ETF you buy and sell.

The list of ETFs included to invest through Pockets includes:

- IOO – 100 Global companies

- IOZ – 200 Australian companies

- ETHI – Global sustainability leaders

- IXJ – Global Healthcare

- IEM – Emerging markets

- NDQ – Global tech companies

- SYI – High Dividend Yield Fund

Personally I like all these ETFs and in particular the first three, which can each be held as instantly diversified portfolio of shares.

You may be looking at this list and see that an ETF like IOZ is included even though its equivalent VAS is the most popular ETF in Australia.

The reason why IOZ was picked as opposed to VAS or A200 is the price per share. In Pockets, you need to buy the entire stock (not a fraction of it like Raiz or Spaceship). IOZ trades around $30 which is lower than VAS at $90 or A200 at $125 or so. The concept of the app is to make investing more accessible and affordable so buying into Australian stocks at $25 each time is that.

What is the best CommSec Pocket ETF?

Here is my biased answer – it's IOO. My investment strategy is to invest monthly into IOO. That is not a suggestion to what you should do but the broadest option (which offers the best diversification) in this list is IOO, and ETF that includes 100 quality companies from around the world.

Note that there is no option for defensive ETFs like bonds or fixed interest which would really make this app become all in one for DIY investors. You can of course buy these at other brokers or hold money in bank accounts for money that you might want to use within a few years.

What are CommSec Pocket's Fees?

CommSec Pockets offers simple and straightforward fee structures, making it easy for investors to understand the costs involved in trading. Instead of charging a recurring fee for having an account, fees are based on the frequency of trades.

For example, an investment of $1,500 would incur a fee of $3. Compared to the $19.95 fee charged by CommSec for the same trade, Pockets offers significantly lower costs for buying the same ETFs.

It's worth noting that frequent trading may not be the best option with Pockets, as the $2 fee per trade can add up over time. For instance, if you were to trade on a fortnightly basis, the costs could total $52 per year.

On the other hand, apps like Raiz offer a $4.50 fee for a custom portfolio of multiple ETFs and allow you to invest as little as $5 on a regular basis without incurring any additional costs. This makes Raiz a better option for those who trade regularly or for those looking to build a diverse portfolio with smaller amounts of money.

With that in mind the fee structure of Pockets is more suited to infrequently trading or an investor looking to put large sum (such as a tax return) into an investment every now and then.

Is CommSec Pocket better than Raiz?

CommSec Pocket and Raiz are both mobile apps that allow users to invest in the stock market, but they have some key differences. Below is a comparison table highlighting some of the differences between the two platforms.

| Feature | CommSec Pocket | Raiz |

|---|---|---|

| Minimum investment | $50 | $5 |

| ETFs offered | 7 | 23 via the custom portfolio feature |

| Investment fee | $2 per trade or 0.2% for amounts over $1000 | $3.50 for accounts under $15k or 0.275% p.a. if over $4.50 for custom portfolios under $15k |

| Bank account required | Yes, linked to a CommBank account | No |

| Dividends | Yes, can be reinvested or transferred to bank account | Yes, but are reinvested into your portfolio |

As can be seen from the table, CommSec Pocket is better suited to those who have a CommBank account and are looking to invest a minimum of $50. On the other hand, Raiz may be a better option for those who do not have a CommBank account and are looking to invest a smaller amount of money.

Raiz is a micro-investment app that allows users to invest even smaller amounts of money in a diversified portfolio ETFs. It offers a round-up feature that automatically invests spare change from purchases made with a linked bank account. Raiz also offers a feature of automatic recurring investments.

Whether one of the others is better determines if you are a regular investor of not. If you want to save up $1000 and put it into one specific ETF at a time, then Pockets may before you. If you wanted to add $5 a day into an app then it could be Raiz. Pockets is more active and suited for people who want to learn what investing is, while Raiz takes care of most of it for you, so you don't even need to use the app.

Can I use CommSec Pocket without a CommBank account?

You will need a CommBank account to open a CommSec Direct Investment Account (CDIA), which is necessary to use the CommSec Pocket app. You will also need to have funded your CDIA) as that is where Pockets will take money to complete your trade. You do not need to be banking with CommBank to setup pockets but you will need an account that stays open while you invest through Pockets.

It's important to note that, you will need to have sufficient funds in your Commonwealth Bank account to cover any shares or financial products you purchase through the CommSec Pocket app.

How do I transfer money from my CommSec Pocket?

You can transfer money from your CommSec Pocket account to your linked Commonwealth Bank account by following these steps:

- Log in to the CommSec Pocket app and select the ‘Withdraw' option from the menu.

- Select ‘Transfer to Bank' and enter the amount you wish to transfer.

- Review the details of the transfer and confirm the transaction.

- The money will be transferred from your CommSec Pocket account to your linked Commonwealth Bank account. The transfer may take a few business days to process depending on the bank's policies.

It's important to note that you can only transfer money from your CommSec Pocket account to your linked Commonwealth Bank account, and not to any other bank account. Also, you should ensure that you have enough funds in your CommSec Pocket account to cover any shares or financial products you have bought through the app before making any transfer.

Does Commsec pockets pay dividends?

Yes, CommSec Pockets pays dividends to investors. Dividends are paid directly into your CommSec Pockets account and can be automatically reinvested or withdrawn.

Best features of CommSec Pockets

CommSec Pockets offers a number of standout features that make it a compelling option for DIY investors. One of its biggest selling points is its low fees. With a flat fee of $2 per trade, CommSec Pockets is one of the cheapest online brokers in Australia.

| Feature | CommSec Pockets | SelfWealth | Stake |

|---|---|---|---|

| Trading Fees for ASX ETFs | $2 per trade (under $1000 trade) | $9.50 per trade | $3 |

| Mobile App | User-friendly | User-friendly | User-friendly |

| Daily Balances | No | Yes | No |

| Portfolio Tracking | No | Yes | No |

The above table provides a comparison of some of the key features offered by CommSec Pockets, SelfWealth, and Stake. As seen in the table, CommSec Pockets stands out for its low trading fees and user-friendly mobile app, but does not offer portfolio tracking or daily balance updates.

One unique aspect of CommSec Pockets is that it does not show daily changes in your balance, avoiding the potential for emotions to be influenced by short-term fluctuations in the market. This can help encourage a long-term perspective on investments, which is crucial for building a successful portfolio.

Benefits of investing with CommSec Pockets

As a DIY investor, you have the advantage of having more control over your investments. With CommSec Pockets, you can choose specific ETFs based on your personal preferences, whether it be in a particular region, sector, or focused on high dividend returns.

If you already have a CommSec account, investing with CommSec Pockets is a simple and convenient process. Simply add the app to your phone and start investing right away.

The app is user-friendly and easy to navigate, and you don't need a large amount of money to start investing. Additionally, there are no ongoing fees, so you can keep your costs low.

Investing with CommSec Pockets can also help you develop the discipline and habits of a successful investor. With low costs and the ability to invest small amounts, it's a practical and accessible way to begin building your investment portfolio.

Things to consider.

- While you can invest from $50, the $2 fee would make it costly for trades less than $200. I recommend $500 plus a trade if you want to keep things low cost

- To a new investor, it may not be obvious what to pick from, so researching ETFs and how to build a portfolio is recommended

- All investments are ETFs that hold 100% stocks – no diversification across asset types like fixed interest or property

- You cannot buy fractionally so you need the exact amount to cover the cost of the shares.

Ready to become an investor with CommSec Pockets?

CommSec Pockets offers investors a cost-effective, accessible, and convenient way to take control of their investments. Whether you are just starting out or are looking to diversify your portfolio, this app provides the tools and flexibility you need to reach your financial goals.

With its user-friendly interface, low fees, and diverse selection of ETFs, CommSec Pockets is an ideal choice for DIY investors. Whether you are seeking to invest in a specific region, sector, or are focused on high dividend returns, this app provides the customization you need to build a portfolio that meets your unique needs and priorities.

So if you're looking for a simple, practical, and effective way to start building your investment portfolio, consider CommSec Pockets today. Whether you are a beginner or an experienced investor, this app has the features and benefits you need to succeed.

If I already own specific ETF shares through Commsec and that ETF is also on Pocket, will any ETF purchase on pocket merge with the same ETF on Commsec?

Hi Brad – unfortunately not. It’s a bit awkward but if you login into CommSec standard you will be able to see your commsec account and then your pockets account seperately. So you can see a combined holding statement to an extent but you can only trade and products you own on the platform you bought them on.