Are you curious about Vanguard Investments and how they work here in Australia?

Maybe you've heard about their ETFs and index funds but are a little uncertain about how they differ and what might be the right choice for you.

I started investing with Vanguard all the way back in 2014 so have a bit of an understanding of what they actually offer investors.

I'll uncover the ways you can invest with Vanguard, diving into the ins and outs of their offerings, and helping you navigate your investment journey.

If you're a beginner investor or just curious about the Vanguard company, this guide is crafted just for you.

Investing with Vanguard in Australia is a strategic option for those looking to access a variety of index funds and ETFs. It's suitable for beginners and offers choices for all risk profiles. You can use their Personal Investor Platform to invest directly with their products from the company itself or find ETFs available through brokers and investing apps.

An Introduction to Vanguard Australia

Vanguard has become a household name in the investment world, not only globally but also right here in Australia. With a commitment to providing transparent and cost-effective investment options, Vanguard offers Australians both a platform and a range of products that cater to various investment needs. Its popularity has surged in recent years, and many investors are keen to explore what Vanguard has to offer.

Founded by the legendary John C. Bogle, Vanguard's mission is to provide low-cost, high-value investment opportunities to the masses. mission is to provide low-cost, high-value investment opportunities to the masses. It offers a wide array of investment products ranging from the popular ETFs (like VAS or VGS) to the more traditional index funds (or managed funds as they are labeled).

Images courtesy Vanguard website

Whether you're a beginner looking to dip your toes into the investment pool or a seasoned investor seeking diverse or simpler options, Vanguard Australia has something to offer. With a minimum investment of just $500, it opens doors for many Australians to the world of finance.

There are two ways you can be involved in investing with Vanguard Australia.

One is by using its own trading platform (Vanguard Personal Investor) where you can trade a wide range of their own products, including ETFs and managed funds.

Another option is to find and invest in their ETFs via other platforms, such as your own online broker or via your super fund.

Is Vanguard a good investment in Australia?

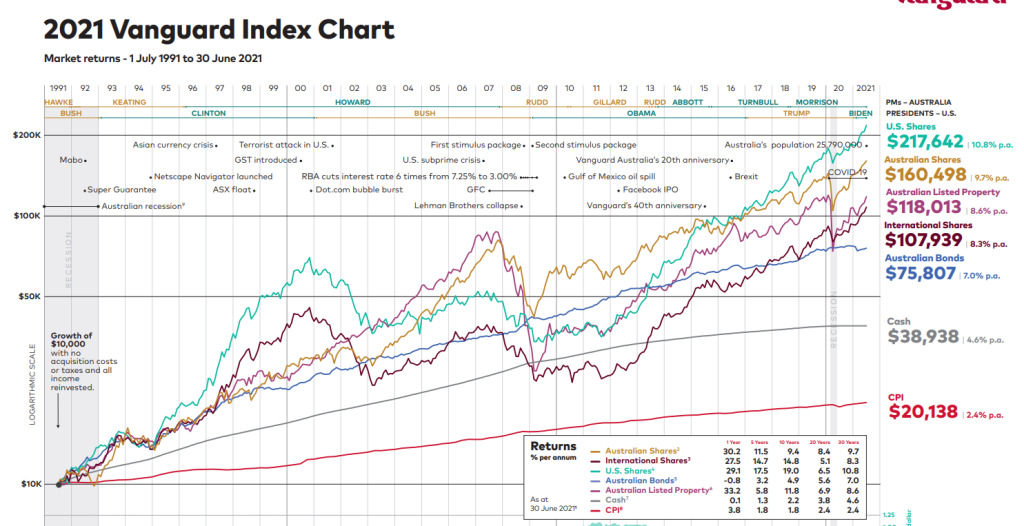

Vanguard has a strong reputation for being a solid investment choice, and that holds true in Australia as well. Their low-cost index funds and ETFs are popular for a reason—they offer broad market exposure, which historically has provided good returns over the long term. They've got options that track various indices, covering Australian shares, international shares, bonds, and more.

Whether you're new to the game or a seasoned investor, Vanguard's array of choices can fit into a diversified portfolio. Just remember, as with any investment, there are no guarantees; it's important to assess your own financial goals and risk tolerance.

Is Vanguard good for beginners?

Vanguard is often recommended for beginners due to its straightforward, low-cost approach. They offer a variety of index funds and ETFs that are easy to understand and invest in. Especially if you're looking to set it and forget it, their products make it relatively simple to diversify your portfolio without getting bogged down in the complexities of stock picking.

They also provide educational resources to help you along your investment journey. So if you're starting out and want a low-maintenance, effective way to invest, Vanguard has got you covered.

Who owns Vanguard Australia?

Vanguard Australia is a subsidiary of The Vanguard Group, Inc., which is based in the United States. The unique aspect about Vanguard is that it's client-owned. Essentially, if you invest in a Vanguard fund, you technically become a part-owner of Vanguard itself. This structure is designed to align the company's interests with those of its investors.

Can I invest $1,000 in Vanguard?

Yes, you can start investing in Vanguard with as little as $1,000. Both their managed funds and ETFs have a minimum investment requirement of $500, so your $1,000 could even be split between two different products if you like.

This low-entry threshold makes Vanguard a solid choice for those who don't have heaps of money to start but want to dip their toes into the investment waters. But always be mindful of any additional costs like brokerage fees for ETFs, especially if you're starting with a smaller amount.

Do millionaires use Vanguard?

Absolutely, Vanguard isn't just for beginners or those with modest portfolios; many high-net-worth individuals use Vanguard as well. One of the reasons is the company's low-cost index funds and ETFs. Lower fees can make a significant difference over time, and that appeals to investors of all sizes, including millionaires.

The wide variety of investment options, from conservative bonds to more aggressive growth stocks, offers the flexibility for sophisticated diversification strategies. So yes, millionaires do use Vanguard to maximize returns and minimize costs, just like everyday investors.

Understanding Vanguard Investments (in Australia)

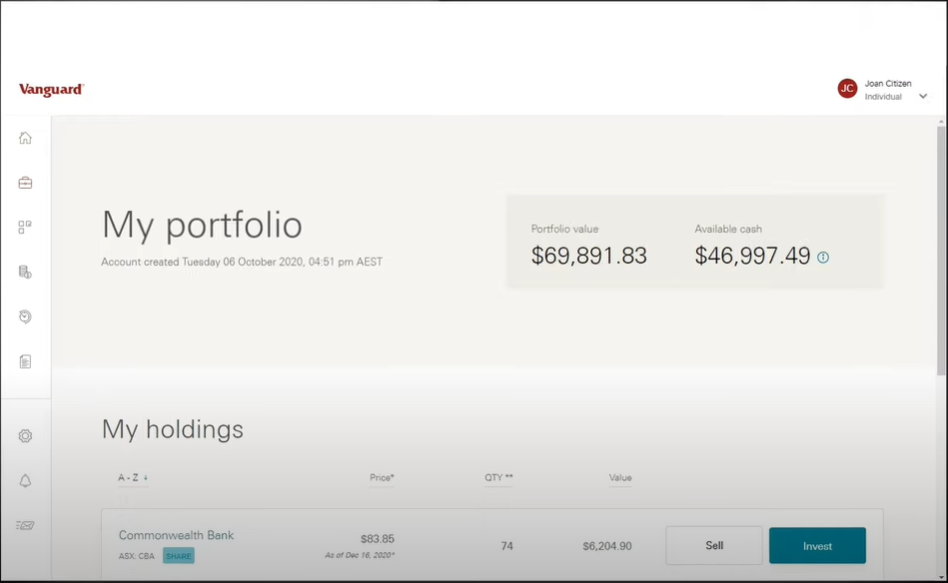

Vanguard Australia provides two key offerings: a Personal Investor platform and a range of investment products like ETFs and managed funds.

On the other hand, Vanguard's ETFs and managed funds are the actual investment products you can add to your portfolio.

These products are also available through other brokerage platforms, but using Vanguard's own platform may come with certain advantages like lower fees for their in-house products.

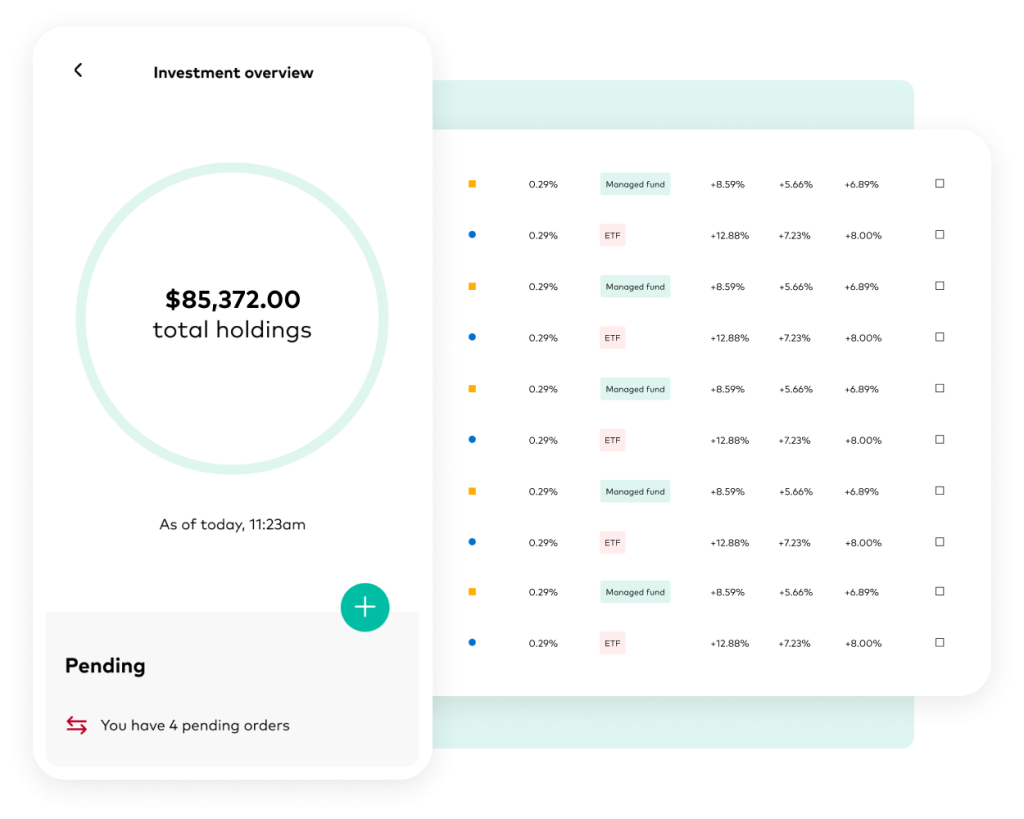

Exploring Vanguard's Personal Investor Platform

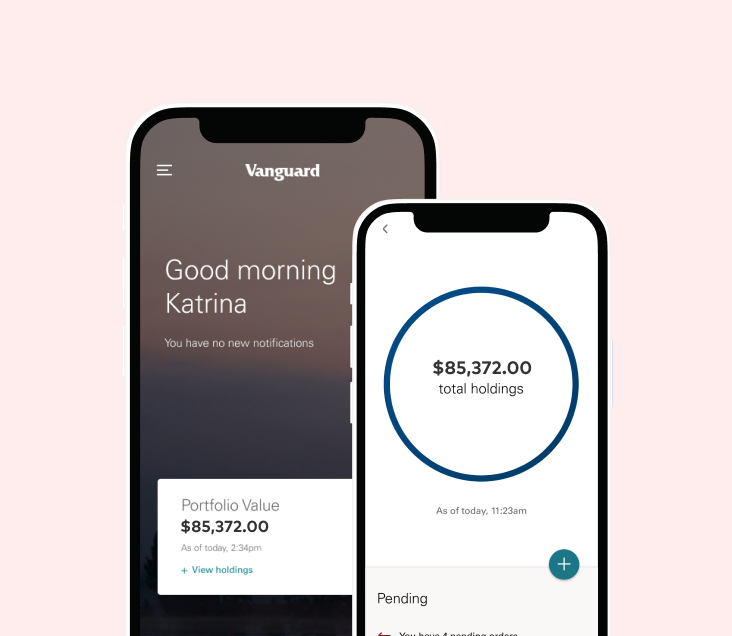

Vanguard Personal Investor is a digital platform designed to give individual investors in Australia direct access to Vanguard's range of managed funds and ETFs.

It's a great option if you're looking to manage your investments on your own, and it's particularly suited for those who want an easy way to access Vanguard's various products while keeping brokerage fees low.

It's a quick and easy process to open an account. Vanguard has really invested in their digital platforms in recent years and the clarity of what you are doing as an investor is really obvious.

As you would expect, the focus of the platform is to get you to invest in their own Vanguard ETFs and Managed funds.

Investment Options

Inside the Personal Investor platform, you can buy and sell from a range of the following:

- Managed Funds: Investors can buy into Vanguard's managed funds directly, often with lower fees than investing through other platforms. These might also be referred to as index funds.

- ETFs: Exchange-traded funds can be traded like individual stocks on the Australian Securities Exchange (ASX).

- Direct Shares: The platform also provides access to individual stocks within the ASX300.

Not only can you get access to all of Vanguard's ETFs and funds but also shares on the ASX300. This is a handy blend for those looking for a core satellite approach where you can invest in market-covering products but then actively select individual stocks.

Both Vanguard's managed funds and ETFs often share similar investment strategies and underlying assets, aiming to mirror specific market indices or sectors.

However, the way they're accessed, cost, and managed are different which can cater to the type of investor you are and how you want to use Vanguard.

More on this in the next section.

Accessibility

One of Vanguard's defining features is its emphasis on accessibility. The Personal Investor platform is designed to be user-friendly, allowing investors of all levels to navigate with ease.

Whether you're new to investing or have years of experience, the platform offers tools and resources that make the investment process smooth and comprehensible.

An intuitive interface helps users navigate their investment options and manage their portfolios.

Apps for both Apple and Android are available.

Costs of Vanguard Personal Investor

Investing with Vanguard's Personal Investor platform is not only about variety but also about affordability. One of the platform's appeals is the low fee structure, especially for investing in Vanguard's own products.

Vanguard Products

- Account Fee: No fee on holdings in Vanguard-managed funds and Vanguard ETFs.

- Brokerage Fee: No fee to buy Vanguard-managed funds or ETFs. A $9 flat fee to sell (ETFs only).

ASX Direct Shares

- Account Fee: 0.10% p.a.

- Brokerage Fee: $9 flat fee per trade.

Investment and reinvestment options

The minimum initial investment for any ETF, fund, or ASX Share is $500.

Additional Investments are a different story though.

Ongoing, to buy into more ETFs or ASX shares via the platform, you need a minimum of $500.

This is in contrast to the managed funds where there is no minimum investment.

More on fees via the Vanguard site

Account Types

Individual, joint, company, trust, and superannuation accounts can be opened, offering flexibility to different types of investors.

There is also an option to invest for your kids.

The offer from Vanguard is to set aside some money regularly (as little as $25 per fortnight or month) and choose a portfolio that suits your risk preference, from Conservative to High Growth on behalf of your kids.

There are no account fees, and the aim is to grow the investment over time. It's a neat way to start building a financial nest egg for a child's future.

Benefits of Vanguard Personal Investor

- It provides a one-stop shop for Vanguard's investment products.

- Free to buy Vanguard ETFs or Funds ($9 to sell ETFs, $0 for funds)

- Allows for automatic investment plans, making it easier to regularly invest in managed funds.

- Often offers educational resources and tools to help investors make informed decisions.

Vanguard Personal Investor: Who's It For?

- Beginners: User-friendly with educational resources.

- Cost-Conscious Investors: Low fees, especially for Vanguard products.

- Long-Term Investors: Ideal for building a diversified, steady-growth portfolio.

- Hands-On Investors: Allows direct control and automatic investment plans.

- Seekers of Simplicity: A one-stop shop for Vanguard investments.

Not Ideal For

- Frequent traders or those seeking highly specialized investment options.

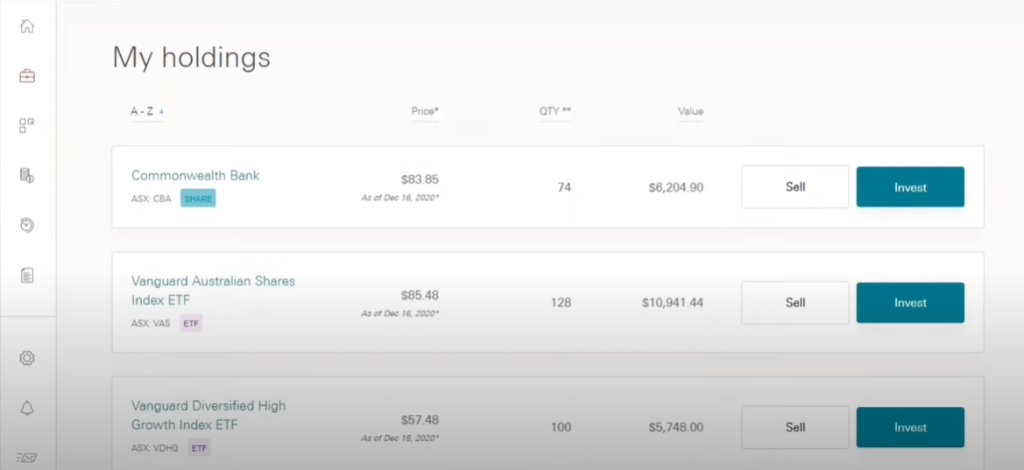

ETFs vs Managed Funds: Vanguard's Two Product Offers

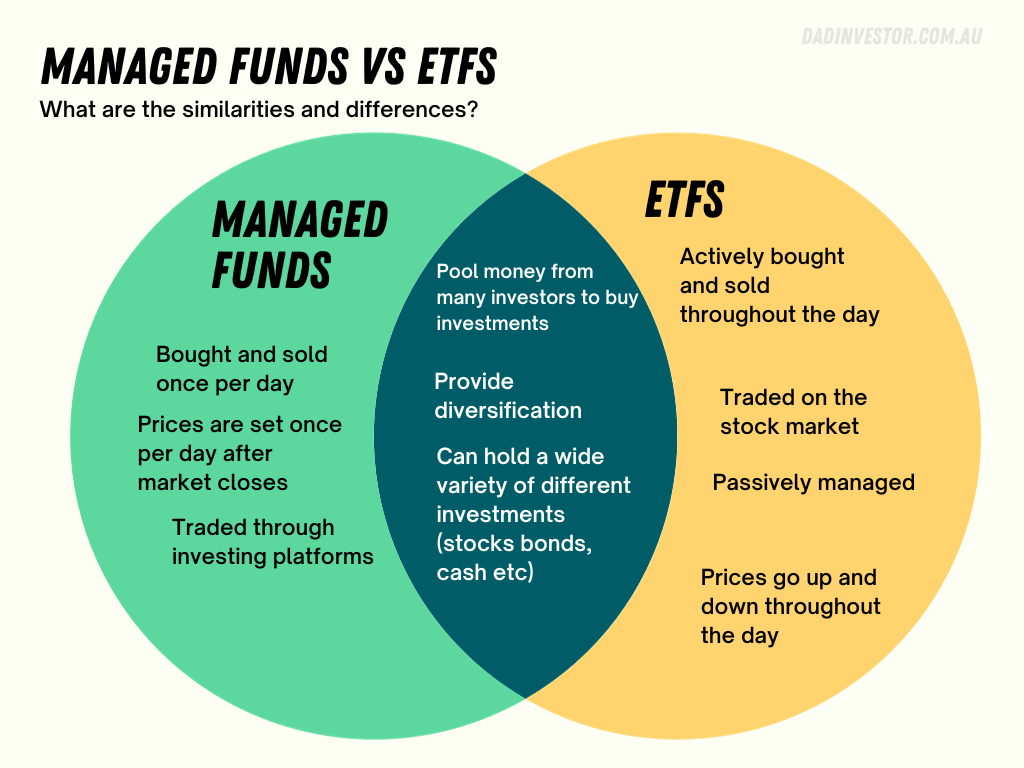

One of the big decisions when you use the Vanguard Personal Investor platform is choosing between ETFs and managed funds.

They often provide access to the same underlying asset class or companies, making the choice between them a matter of preference and convenience.

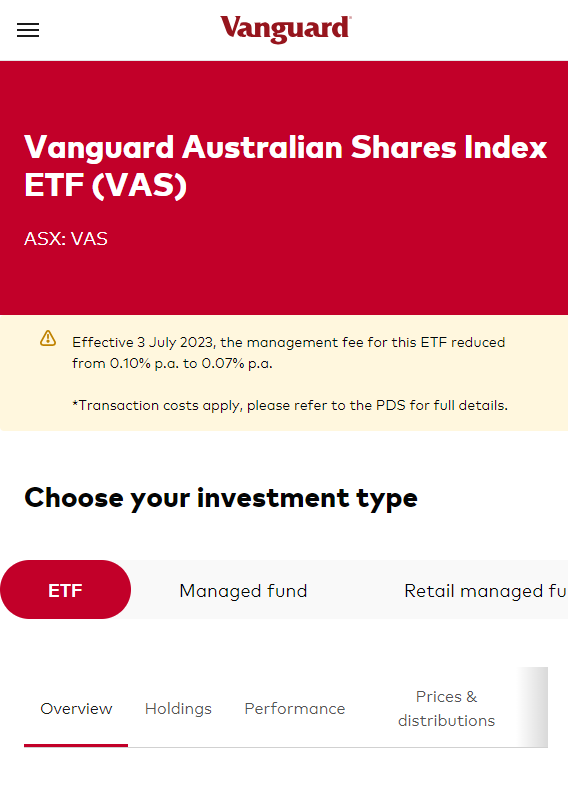

For instance, the Vanguard Australian Shares Index ETF and the Vanguard Australian Shares Index Fund own the exact same underlying assets.

What separates them?

It's the way you invest and interact with these funds:

- Managed Funds are not listed on a stock exchange, meaning you buy into them directly and often with lower minimum investments.

- ETFs are listed on the Australian Securities Exchange (ASX), offering greater trading flexibility, liquidity, and intraday pricing.

Managed Funds

A managed fund is like a pool of investments where your money is combined with other investors. Rather than owning the investments yourself, as with direct share purchases, the fund owns the underlying investments. An investment manager takes care of buying and selling assets on behalf of the investors.

When you invest in a managed fund, you're buying units in that fund, which allows you to diversify your portfolio for a relatively small initial outlay.

Examples of Vanguard Managed Funds:

- Vanguard Australian Shares Index Fund

- Vanguard International Fixed Interest Index Fund (Hedged)

- Vanguard Balanced Index Fund

Exchange-traded funds (ETFs)

An ETF is essentially a managed fund that's traded on the stock exchange. Unlike managed funds, you can buy and sell ETFs like individual stocks.

ETFs can come in various forms, such as shares, bonds, domestic or international assets, different market capitalizations, hedged or unhedged, and even sector-specific products like property or commodities. Vanguard's diversified ETFs offer low-cost access to thousands of securities across various asset classes in just one trade.

Examples of Vanguard ETFs:

- Vanguard Australian Shares Index ETF (VAS)

- Vanguard U.S. Total Market Shares Index ETF (VTS)

- Vanguard Global Aggregate Bond Index ETF (VBND)

Both ETFs and managed funds offer great diversification, letting you spread your money across different areas. But when it comes to pricing, ETFs change throughout the day, while managed funds are priced at the end of the day.

VAS vs. Index Fund (ETF and managed fund comparison)

Imagine you're looking at two different options from Vanguard's platform: the Vanguard Australian Shares Index ETF, known as VAS, and the Vanguard Australian Shares Index Fund.

They both invest in essential the same thing (the ASX300 or top 300 companies on the ASX).

What sets them apart?

- Cost: VAS charges a slim 0.07% fee per year, while the Index Fund is at 0.16%.

- Price: The latest share price for VAS is $88, but the Index Fund sits at just $2.46.

- Reinvestment: Managed funds have no minimum investments so you can put in very little money on an ongoing basis, while ETFs through the Vanguard platform need a $500 minimum or through other brokers the cost of at least one whole share.

- Trading Flexibility: VAS can be traded like individual stocks on the ASX, which means you don't need to use Vanguard Personal Investor to access them (which is not the case for managed funds).

Here's a table to expand on the comparison:

| Differences | Vanguard ETFs | Vanguard Index Funds |

|---|---|---|

| Brokerage Fee (Buying) | $0 when purchasing with Vanguard Personal Investor Account | $0 when purchasing with Vanguard Personal Investor Account |

| Brokerage Fee (Selling) | $9 when selling with Vanguard Personal Investor Account | $0 when selling with Vanguard Personal Investor Account |

| Adding New Funds | Can buy additional units anytime (must be bought in whole shares); | No minimum additional investment. Can set auto invest at a minimum of $200 |

| Pricing | Market price changes continuously throughout the trading day | End-of-day price (net asset value) – updated daily |

| Trading Flexibility | Traded on ASX; can use limit and stop-loss orders | No similar trading opportunities |

| Ongoing fees | 0.07% (VAS) – $7 per $1000 invested | 0.16% (VAS equivalent Index fund) – $16 per $1000 invested |

And here's a bullet list of similarities that they both share:

- Initial investment: $500

- Transparency: view all holding within fund

- Asset Ownership: Both have a trust structure; dividends and capital gains are distributed to unit holders.

- Diversification: Both provide broad exposure to different asset classes, industries, market segments, and even countries.

- Regulation: Both are subject to the same requirements under the Corporations Act.

- Structure: Both have an open-ended structure, creating and redeeming units depending on supply and demand.

In the end, your choice between ETFs and Vanguard Managed Funds will depend on factors such as cost sensitivity, price point preferences, reinvestment strategies, and desired trading flexibility.

Other ways to invest with Vanguard

In 2022, Vanguard introduced a new platform specifically for Superannuation, catering to Australians planning for retirement.

Unlike their general investment platforms that offer ETFs and managed funds, Vanguard's Superannuation platform is designed to work within Australia's retirement savings system.

It provides access to Vanguard's existing range of products, like their managed funds and ETFs, but within the unique framework of superannuation.

This change gives investors the opportunity to invest in Vanguard's well-known products with the added benefits associated with super funds, including potential tax advantages.

Starting Your Investment Journey using Vanguard Australia (in 3 steps)

Ready to dip your toes into the world of investing with Vanguard Australia, but not sure where to start?

Don't worry, here's a 3-step guide to getting started.

There's really only three decisions you need to make and they are mostly around how you are planning to be an investor now and ongoing.

Pick Platform – Broker vs. Vanguard Personal Investor

Your first decision is to choose between investing through a broker or directly through Vanguard's Personal Investor platform.

The broker route might provide access to different products beyond Vanguards, while Vanguard Personal Investor will specifically cater to Vanguard's offerings and provide you access to their managed funds.

Pick Product – ETFs or Managed Funds

If you went with the option to use Vanguard Personal Investor you'll need to decide what type of investment option suits your needs best.

Are you interested in ETFs that trade like individual stocks or managed funds.

Both have their unique features such as cost and reinvestment options.

Pick Frequency – Your Investment Schedule

Lastly, plan your investment schedule.

How often will you invest?

Monthly, quarterly, or as a one-off?

This will depend on your financial situation and investment goals.

Also work out if you want to set up automatic investing or go through it manually.

By focusing on details like platform selection and product options, you can find a bit of a roadmap to get you going that takes the complexity out of investing.

Your Pathway to Investing might be with Vanguard Australia

Investing with Vanguard Australia lets you choose from different investment options that fit your financial goals and where you are in life.

Yes, it can feel like a complicated maze, especially when you're new to it but remember that the process is as crucial as the product you choose.

It's not merely about picking the ‘right' fund or ETF; it's about understanding the journey and making choices that fit your individual needs.

It doesn't need to be complicated.

Start with the platform, select the product within it, decide on the frequency, and most importantly, begin with confidence.