Investing in the stock market can be intimidating, but the S&P 500 index has long been a popular choice for novice and experienced investors alike. This index tracks 500 of the largest publicly traded companies in the US, making it a well-diversified investment option.

But what if you live in Australia and want to invest in the S&P 500? Don't worry, there are several exchange-traded funds (ETFs) available that track the performance of the S&P 500 and allow Australian investors to take advantage of this lucrative opportunity.

In this article, we will explore the benefits of investing in the S&P 500, the best ETFs to choose from, and the steps you need to take to start investing.

Understanding the S&P 500

The S&P 500, also known as the Standard & Poor's 500 Index, is a stock market index that tracks the performance of 500 large companies listed on the stock exchanges in the United States. The S&P 500 is considered one of the most widely followed equity indices in the world and is seen as a barometer for the U.S. stock market. The companies included in the index are chosen based on market capitalization, financial stability, and liquidity, among other factors.

Think of it as a one-stop shop for your stock market investments. By investing in the S&P 500, you are essentially investing in a diverse portfolio of some of the biggest and most successful companies in the world, such as Amazon, Microsoft, and Apple. It's a popular choice for both seasoned investors and those just starting out, and it has a history of delivering strong returns over the long term.

It's also one of the first indexes to be tracked via Vanguard mutual funds, making it a way for investors to invest in the stock market (rather than individual stocks). Over time and due to their popularity ETFs have become a way to invest in this index.

Why Invest in the S&P 500?

Investing in the S&P 500 through an ETF can be a simple and cost-effective way to access this market. ETFs typically have low costs ratios and offer convenient and flexible trading options. ETFs can be bought and sold like individual stocks, making them a convenient option for beginner investors. The S&P 500 has a long history of strong performance and is considered one of the best indicators of the health of the US stock market.

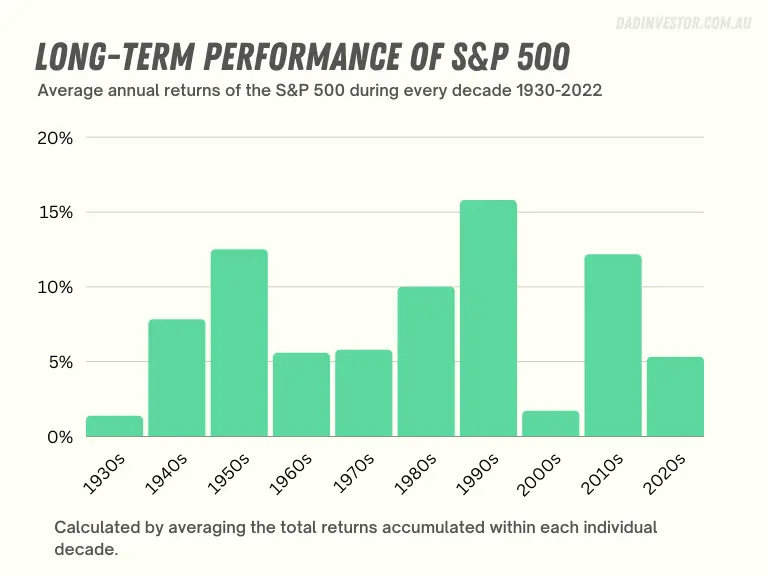

Over the long term, the S&P 500 has delivered an average annual return of around 10%. However, remember that past performance is not a guarantee of future results, and investing in the stock market always carries some level of risk.

Investing in the S&P 500 through exchange-traded funds (ETFs) can offer a number of advantages and benefits including:

- Diversification: The S&P 500 includes a broad range of companies across different industries and sectors, helping to spread out risk and potentially provide more stability compared to investing in individual stocks.

- Long-term growth potential: The S&P 500 has a long history of strong returns, and over time, the index has tended to rise, reflecting the overall growth of the U.S. economy. Investing in an S&P 500 ETF can offer a convenient way for investors to tap into this growth potential, without having to buy and manage individual stocks.

Reasons why an Australian might invest in the S&P 500 include:

- Exposure to the world's largest economy: The S&P 500 tracks the performance of 500 large companies listed on U.S. stock exchanges, providing investors with exposure to the world's largest economy.

- Global market diversification: By investing in the S&P 500, Australian investors can diversify their portfolios beyond the local stock market and potentially reduce overall portfolio risk.

- Access to leading companies: The S&P 500 includes many of the world's leading companies across a range of industries, offering investors the opportunity to potentially benefit from their growth and success.

- Dollar-denominated investment: As the S&P 500 is denominated in U.S. dollars, investing in an S&P 500 ETF can also offer a hedge against currency fluctuations.

What ETF tracks S&P 500 in Australia?

There are several ETFs that track the S&P 500 in Australia, including the iShares S&P 500 ETF (IVV), the SPDR S&P 500 ETF (SPY), and the BetaShares U.S. Equity ETF (QUS). All three of these ETFs provide investors with exposure to the same underlying index, the S&P 500. There are some differences between the three ETFs that investors should know before making a decision on which to invest in.

IVV is one of the largest ETFs in the world and is widely recognized as a low-cost, passive investment option. SPY, on the other hand, is the first ETF ever created and is known for its liquidity (easy to trade) and low expense ratio.

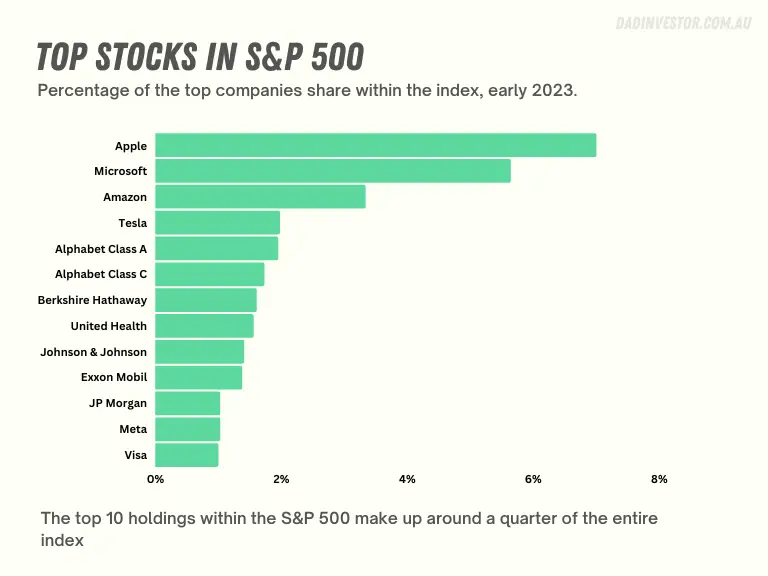

These two ETFs typically follow the weightings of the companies that make up the index. Apple is the largest company making up 6.5% at time of writing meaning for every $100 invested into IVV or SPY, $6.5 goes toward Apple.

QUS offers investors exposure to the S&P 500, but with a focus on U.S. equities that are high-quality and dividend-paying. This ETF follows an equal weighting exposure meaning you will be investing in all 500 companies equally. For example $100 invested in QUS means 20 cents goes to each of the 500 companies.

| ETF | Ticker Symbol | Expense Ratio |

|---|---|---|

| iShares Core S&P 500 ETF | IVV | 0.04% |

| SPDR S&P 500 ETF | SPY | 0.09% |

| BetaShares S&P 500 ETF | QUS | 0.07% |

In terms of investment strategy, each ETF has its own approach, so it's important to understand the differences before investing. For example, IVV is passively managed, which means that it aims to mirror the performance of the S&P 500 index, while QUS uses a “smart beta” approach that aims to outperform the S&P 500 through the use of alternative weighting methods.

Is IVV the same as S&P 500?

The S&P 500 is an index comprised of 500 of the largest publicly traded companies in the United States. IVV, on the other hand, is an Exchange Traded Fund (ETF) that tracks the performance of the S&P 500. IVV provides investors with exposure to the same companies and sectors as the S&P 500, but in the form of a single, tradeable security. While the S&P 500 and IVV are related, they are not exactly the same thing.

While IVV aims to closely track the performance of the S&P 500, there can be small differences due to factors such as expenses and timing.

Does Vanguard have an S&P 500 ETF?

Yes, Vanguard does have an S&P 500 ETF. It is called the Vanguard S&P 500 ETF (VOO) and it is designed to track the performance of the S&P 500 index. This ETF is not listed on the ASX and is only available via the US stock markets. For Australian investors, this means you will need to invest via a broker that trades in the NYSE.

Vanguard's closest international ETF to IVV or SPY on the ASX would be the Vanguard U.S. Total Market Shares Index ETF (VTS). This ETF covers the entire US stock market, including the companies that make up the S&P 500. It does have nearly 4,000 holdings so much broader investment than the S&P 500.

How do I buy S&P 500 ETF in Australia?

To buy S&P 500 ETFs in Australia, you can go through an online broker like Stake and Selfwealth or use a micro-investing app Raiz via their custom portfolios. or Selfwealth. Each of these platforms will have its own sign-up process, but generally, you will need to provide personal information, proof of identity, and fund your account before you can start investing. Once your account is set up, you can search for the ETF you want to invest in and place an order to buy shares.

Here the steps to take if you want to start investing and invest in the S&P 500 in Australia:

- Choose an online broker or investing app: This could be a platform like Stake, Raiz, or Selfwealth.

- Open an account: Once you've chosen a platform, you'll need to open an account follow the steps.

- Fund your account: Transfer funds into your account to get started with investing.

- Search for S&P 500 ETFs: Most platforms will have a search function where you can easily find the S&P 500 ETFs available for purchase. Raiz is a bit different where you'll need to select IVV as part of a custom portfolio.

- Compare fees and performance: Make sure to compare the fees and past performance of the different S&P 500 ETFs available. They are some of the absolute cheapest available ETFs around though due to their long history and popularity.

- Place an order: Once you've decided on the S&P 500 ETF you want to invest in, place an order through the platform.

- Monitor your investment: Regularly check your portfolio and make adjustments as needed to ensure you are on track to reach your investment goals. I use Sharesight to do this.

How do I invest in IVV in Australia?

To invest in IVV in Australia, you will need to go through an online broker or use an investing app. Once you have signed up and funded your account, you can search for the IVV ETF and place an order to buy shares. Make sure understand the fees and charges associated with the online broker. Stake is one of the cheapest ways to trade on the ASX at $3 a trade.

How do I start the Vanguard S&P 500 ETF?

To start investing in the Vanguard S&P 500 ETF (VOO), you need to open an account with a broker that offers US ETFs. Stake and Selfwealth are two brokers I've bought US ETFs through. There are some tax implications and currency exchange rates to consider or pay for if you do go down this path.

Considerations for Investing in S&P 500 ETFs

Does S&P 500 ETF pay dividends?

Yes, the S&P 500 ETFs generally pay dividends. Dividends are payments made by companies to their shareholders, usually in the form of cash. The S&P 500 ETFs, including IVV and VOO, track the performance of the underlying index, which includes the dividends paid by the companies in the index. As a result, the ETFs pay dividends to their shareholders based on the dividends paid by the underlying companies.

Is it still a good time to invest in S&P 500?

The S&P 500 has had a strong performance since the year 2000. Despite facing several market downturns and recessions, the S&P 500 has consistently grown over the past two decades. From the year 2000 to 2020, the S&P 500 has delivered an average annual return of roughly 7%. This has resulted in a total return of approximately 240% over the 20-year period.

While past performance is not a guarantee of future results, the S&P 500's historical performance is often seen as an indicator of its potential for future growth. While I've just mentioned performance since 2000, if you look at the numbers back before that you'll see more long-term performance.

Another benefit of the S&P 500 is the ability for it to move as the market does. The 500 companies included change over time so that you get 500 strong businesses to invest in. If a company grows, so does your investment in the business.

Should I buy VGS or IVV?

The choice between VGS and IVV ultimately comes down to personal preference and your investing goals. Both are international ETFs aim to track the performance of overseas markets and have similar companies within it. VGS is a much broader ETF than IVV and covers companies around the world.

It would be up to you to think whether investing in the top 500 US stocks or a range of holdings from around the world is for you. VGS is offered by Vanguard and has a slightly higher expense ratio compared to IVV, which is offered by iShares. However, IVV has a longer track record and is more widely traded.

What is the Australian version of S&P 500?

The Australian version of the S&P 500 is the S&P/ASX 200 index. It is a market-capitalization-weighted index that tracks the performance of the 200 largest companies listed on the Australian Stock Exchange. The index reflects the performance of the broader Australian stock market and is widely used as a benchmark by investors and financial professionals in Australia.

What ETFs does Warren Buffett invest in or recommend?

Warren Buffett, widely regarded as one of the greatest investors of all time, is known for his long-term investment strategy and low-cost approach. He recommends that most investors invest in low-cost index funds, such as the S&P 500 ETFs. In particular, he has recommended the Vanguard S&P 500 ETF (VOO) as a good investment option for most investors.

VOO would have been his recommendation due to him mostly talking to an American audience where VOO is more common. For Australian investors, IVV is the more popular option to invest in S&P 500.

Conclusion

Investing in S&P 500 ETFs in Australia could be a smart choice for those who are looking for a long-term investment. These ETFs provide exposure to a diverse range of high-performing US companies and have historically delivered solid returns over time. The three main ETFs that track the S&P 500 in Australia are IVV, SPY, and QUS.

Investing in ETFs is easy and accessible through online brokers or investing apps, with micro-investing being a popular option. To invest in IVV in Australia, you can simply follow the steps outlined in this article.

Overall, the S&P 500 has been a strong performer since 2000 and is still considered a good time to invest for those who are willing to weather short-term market fluctuations for long-term growth. While it is important to carefully consider your investment goals, risk tolerance, and overall financial situation before investing, the S&P 500 ETFs offer a solid foundation for a diversified investment portfolio.