As a user of uBank for a number of years, I was always impressed by their best feature – high-interest rates for online savers. That was good if I wanted to store cash somewhere, but found that to use it on a daily basis the app and digital experience was a bit lacking.

In 2022 though uBank merged with neo bank 86400 and combined the best of each – a quality digital experience that offers great banking tools and products.

Since then I've ramped up my use of uBank and found that they are fast becoming a great alternative to the big banks and constantly looking to upgrade and improve the way you bank on a phone.

This article will run you through what I've found out using the bank for my everyday banking and the things its now strong at and who it's going to be the best for.

Referral codes for ubank (2024)

- For uBank, get a $10 bonus when you download the app to create a free account here using code PM5BLA6 and make 5 purchases within 30 days

What Is ubank?

ubank was created in the early 2000s by Nab as a cheaper, faster, more digital-focused option of banking.

ubank's main perk for customers was their very competitive interest rates. Their home loan rates were very low, and their savings account rates were high. The problem I found as a customer was the interface was a bit lacking and while the product (rates) was fantastic, the experience was not as much.

It all changed in 2022 when uBank merged with the startup bank 86400.

Combining the great rates and offers of uBank with the beautiful digital experience of 86400, we now have one the two strongest offers of everyday banking in Australia.

uBank is a banking experience built for your phone, but also comes with all the features you'd expect from a traditional bank. It's modern, interesting, and helpful for those needing everyday banking.

Pros

- Great interface

- Best interest rates for savings accounts

- Wonderful spending insights

- Clear, helpful design

- Digital card available immediately with new accounts

- Regularly adding new features

- Live roadmap of features you can contribute to

Cons

- Desktop experience limited

- Limits on joint or shared accounts

- Need to deposit $200 a month to earn bonus interest

Ubank: Review of features

For this review, I ran through some simple banking tasks on both the uBank app and desktop to see how it fares in comparison to popular alternatives.

I've been a user of uBank for nearly 10 years but got interested in being a regular user of their products once they merged with 86400.

From here on out, I’ll share my experiences using the bank, as well as what I liked and didn’t like along the way.

Spending: The bread and butter of ubank

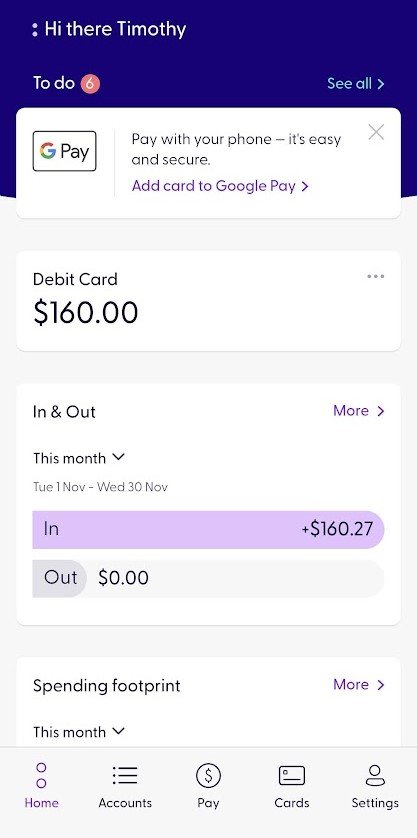

uBank has been really well designed in that it knows you are going to be spending money so it tries to create as much ability for you to do that.

Once you open an account with them they instantly give you a digital card to use. This is good to go straight away via the app meaning you can copy the numbers if using it online or attach it to your Apply Pay for Google Pay accounts. No more waiting for a card to come in the mail.

Speaking of cards – it's a bright neon teal type colour, so the one you won't be mistaken in your wallet.

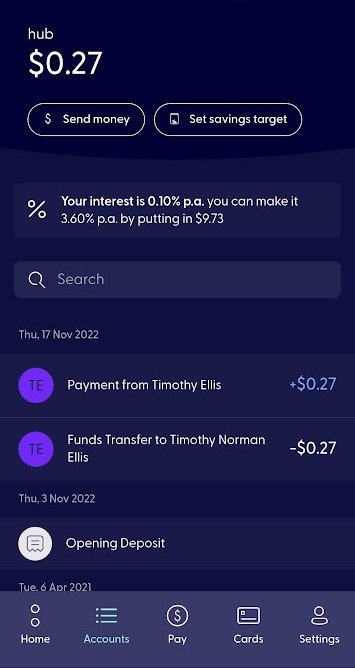

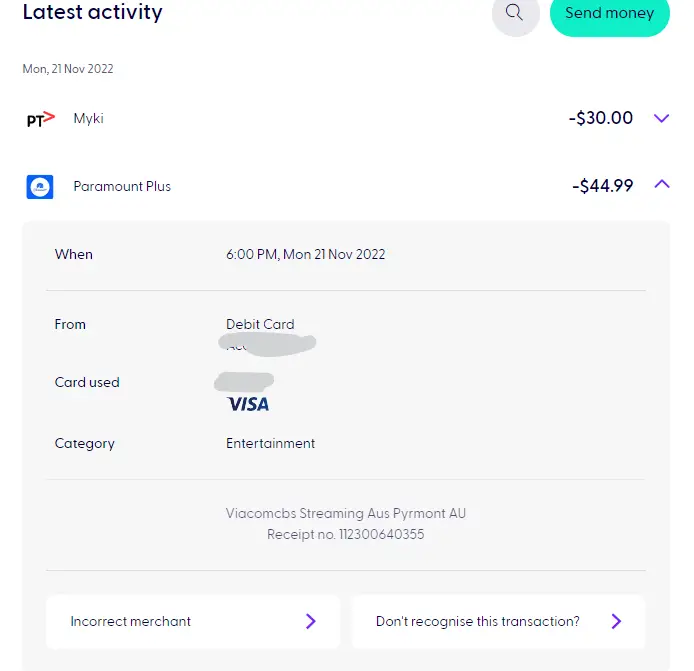

uBank also provides a simpler, clearer list of your recent transactions when you do spend.

Logos appear next to the listed transaction, with a clear title. This means you're less likely to be seeing BUSINESS 123 PTY LTD in your list and actually know what you spent and where.

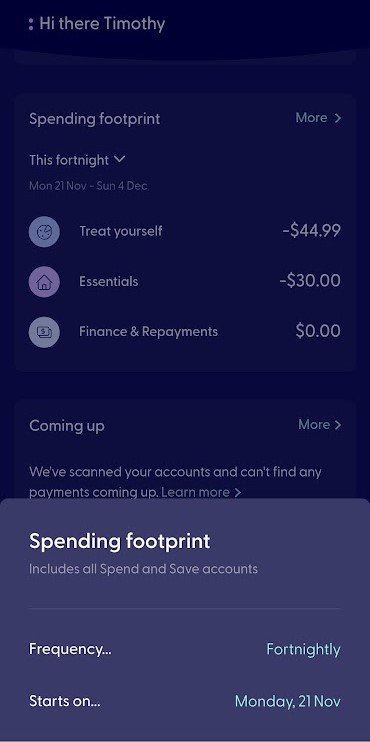

Another thing ubank will do to your spending is categorise it automatically for you.

Over time each expense you make contributes to what's called the spending footprint. A summary view of your expenses broken down by category. This can be viewed weekly, fortnightly, or monthly starting at any date. You can align it with when you get paid so it can give you a snapshot of exactly how you spend during that period.

Bigger banks have tried to setup this kind of spending insights but find uBank does it in a way that makes it something you can quickly understand without overwhelming you.

Savings: Best interest rates going around

Many of us love to chase interest rates when deciding on which bank to use. If that's you then you would have heard of ubank.

The reason I signed up to uBank and the reason I've used them for years is their rates. Higher than most and on the cusp of top-tier interest. As of February 2024, ING had the best interest rates for savings accounts at 5.5% with uBank offering 5.10%.

There are some requirements to claim the full interest rate with uBank, but it isn't much. All you need to do is add $200.

ING on the other hand to get their full savings to account rates needs you to deposit $1000 and complete 5 transactions a month while having your account grow.

This makes it a great option for an emergency fund or side savings account you don't want to touch or have connected to spending.

Another aspect of ubank is that they also adjust their rates nearly within 24 hours of RBA announcements. While this wasn't great when rates were going down, in 2022 when they shot up for a few months in a row they were very proactive.

Get money when you create an account with uBank.

A cash incentive to create an account

- For uBank, get a $10 bonus when you download the app to create a free account here using code PM5BLA6 and make 5 purchases within 30 days

Insights: understand what you do with your money

While most banks tend to just provide you with a summary of what transactions you've made, ubank tries to help you a bit further.

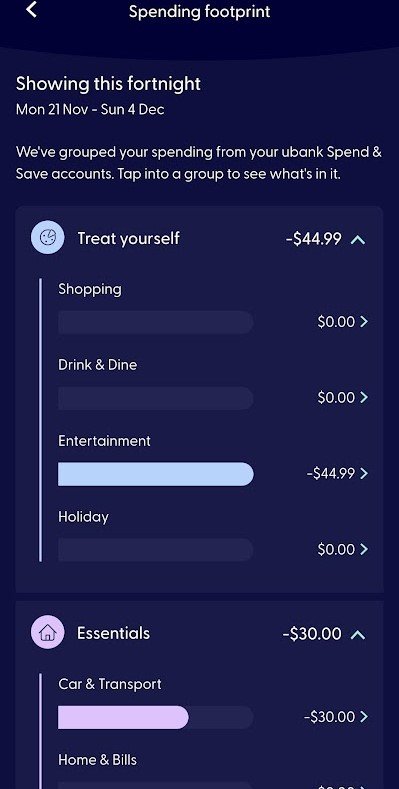

As mentioned, each expense is added to your “Spending Footprint” which is a way of categorising what you've spent.

This kind of spending categorising is something a few banks are doing, but it looks like ubank is doing it particularly well. Considering it's a mobile-first banking experience, the spending footprint is quite easy to navigate.

The result is a different way to look at your spending. Rather than the stock standard chronological list of expenses in order of date, you can look at what you've spent based on three categories:

- Treat Yourself – the more impulse, non essential spends

- Essentials – like your fixed expenses for living

- Finance and repayments – for loans or repayments

It doesn't look like you can edit these categories, meaning you have to stick with your money being aligned to what is in those groups. What you can do is move an expense to a different category.

Over time the app will work out what you think is entertainment or transport spending for example and group those costs in the right place.

From there you can simply tap on a category and find all the charges made in that area on one screen. A more effective way to find an expense or confirm what you spent as opposed to scrolling through a calender of spending.

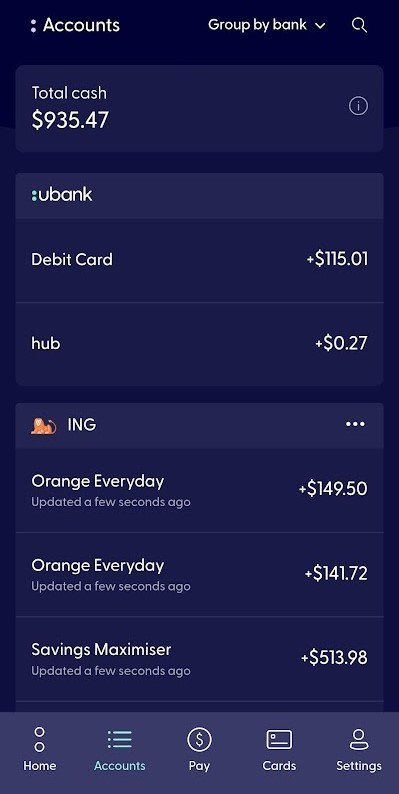

Yep, you can connect your credit cards, home loans, or other transaction accounts into ubank so you can see a summary of them all in one place.

This combines some of those other tools like PocketSmith or a budgeting app to see that broad view of everything you own financially in one place.

Note that you can't actually do any banking with your external accounts, it's for viewing only but you can see all the transactions for those accounts in the ubank interface.

But is it any good? Well yeah it is.

The way I used it was to bring in my regular spending accounts from ING and my home loan from Macquarie.

Seeing all those accounts in one app makes it easier to quickly understand what's happening with my accounts.

This is all app experience exclusive but brings another dimension to ubank.

In terms of security – how does this work? It uses Frollo which runs Open Banking API. No data should be held by uBank or the service as it is only displaying what is showing in your source banking apps. You will need to login to your other bank accounts to connect them via the ubank app.

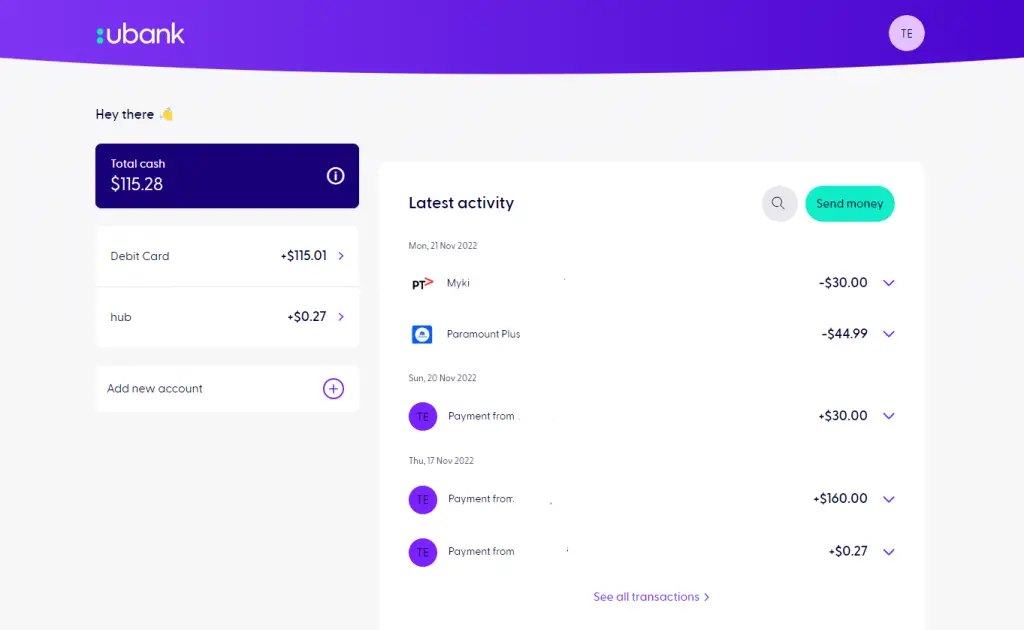

The ubank app

ubank is an app-focused experience and is worth talking more about this.

This is different from the traditional banks that have a desktop experience plus an app.

An app-first experience means you will find more features on the phone than on the desktop version.

The spending insights, making payments, and scrolling through your transactions are all nicely viewed on the app.

Also prevalent are the notifications and updates you will receive. When opening an account you'll get notifications to set up your Apple Pay or Google Pay accounts if you like, creating your PayID for fast transfers or what you can customise in the app.

In terms of customising the ubank app experience, there are a few handy features

- Personalise the home screen and what order things appear or whether they do at all

- Appearance – either default light or dark mode

- Push notification – toggle on and off things like messages for payments, updates, low balances etc

- Lock your card, change pin or report al lost/stolen card

These are all features only available with the app right now. The app options are not available in the desktop version (yet).

Moving around the app you will use the icon menu at the bottom. Most features are a tap or two away and the way space is used along with size of fonts makes it a really comfortable place to be banking.

As I've been using the app, there's never been a case of “oh I need to do this on the computer” when I'm banking. It feels natural to do everyday banking 100% on the app. .

ubank on desktop

Using the desktop version of uBank after the app is a bit unusual.

Usually with banking you do all your setup over the counter at a branch or online via a web browser. With ubank you need to create and setup your account via the app.

The desktop experience comes second.

That means you can do only a fraction of what the app can do. Though you're probably not wanting to set notification on the desktop version so a few features are not appliucable.

What you do need to do on the desktop version of ubank is authenticate with your phone. This means each time you want to login you need to enter a code they text you. Yes it's secure but also annoying if doing often.

The site itself is basically two pages – your main dashboard and a transactions page.

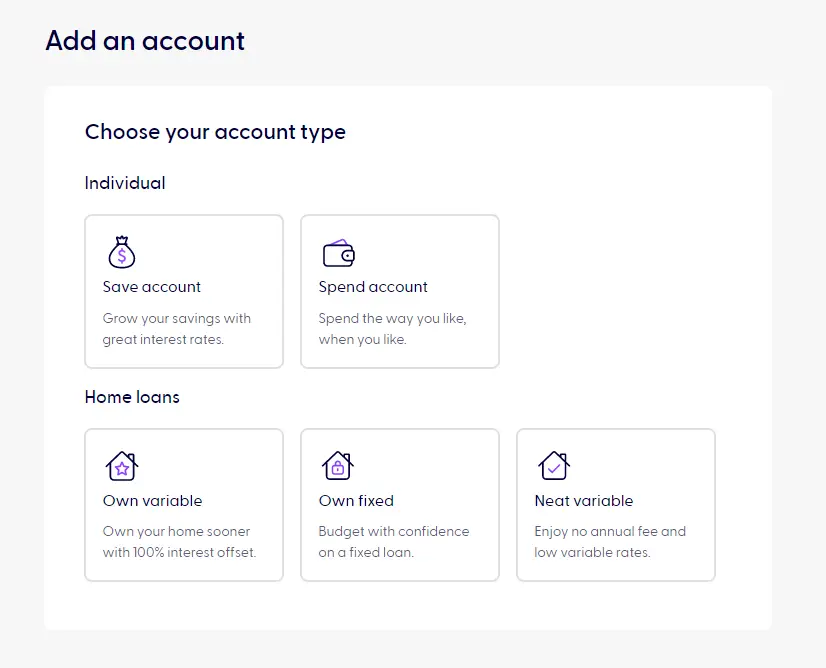

So its good to asess your payments, but the only real functions you can do is add an account and send money.

That might be helpful if you prefer a computer to look at bills and transfer in money. You can also setup scheduled transfers and export the data to a csv if you are a spreadsheet kind of person.

It's obvious that the desktop version is a work in progress, but the app is as well. It's that the team are focussing on the app based product first and foremost. Over time I imagine the build will add more features.

Is it a deal breaker? Not really. You can do all your basic banking with the app and this compliments it, but don't expect anything amazingly new or different.

What does ubank not do?

So while ubank is a pretty capable bank – they do the basics really well. There are some areas that are a bit limited.

Limits on shared accounts

uBank uses the term shared account rather than joint accounts. What I found is that you can only have 1 transaction account and 10 savings account shared as well as 1 individual account.

This is a limit but likely something you might be able to work with. For me I share multiple transaction accounts with my wife so find that ING is a bit better for that.

uBank and Up Bank appear to be really focussed on individuals and getting them to build their banking there. Would imaging they will grow the capabilities here as the technology is developed.

Allow all options on desktop

Currently the uBank desktop app is very limited in comparison to the uBank app. That's fine as the experience in the app is first class, but for those that prefer banking on a computer it might become limiting.

Fees

This is good. No fees for opening or holding an account. Fee free withdrawals at Nab ATMs. No foreign exchange fees.

ubank FAQs

Who is ubank owned by?

uBank is owned by NAB bank. They've been around since 2008 and you money is secure.

Many big banks are spinning off smaller, more agile and modern banks as a way to attract different types of people.

ubank Vs Big 4: What’s The Difference?

The difference for me is agility and speed.

While the big four banks – Comm Bank, ANZ, NAB and Westpac have hundreds of years of banking expectation, new entrants like uBank have ability to do things differently.

They are building banking from the ground up digital rather than trying to replicate an over-the-counter banking experience online.

You will find there are no uBank physical branches, everything is done online. This makes is harder and slower to bank a cheque but all depends on how often you might do that.

What kind of person is suited to ubank?

Someone who operates their money individually, loves to do all their banking on their phone and doesn't need too many accounts.

Ideally it seems like ubank is setup for you to have one transaction account and a single or few savings accounts.

This is basic, but you can realistically operate like this.

Other reasons you might want to use ubank is for their great interest rates, using a savings account only.

Or you might want to connect all you accounts into the one place, which the uBank app can do.

Is ubank secure?

uBank operates under NAB’s banking license which means your deposits are guaranteed up to a single total of $250K under the Australian Government’s Financial Claims Scheme.

So whether you manage your money through uBank or NAB, it is secure.

Does ubank have ATM fees?

Not if you use a Nab branded ATM. If you take out money from one of those independent ones, you likely will have to cover the fee.

There is no reimbursement for ATM charges like some other banks have.

Is ubank an ethical bank?

This is up for interpretation. They are very transparent and you will need to visit their site to get an understanding of who they are and what the values of the bank are.

ubank used to have a green term deposit product that would put money into renewable energy projects but that looks to not be offered anymore.

I couldn't find an ESG statement or policy on the site but being backed by NAB they may follow what they do.

In Summary: ubank review

ubank is a vibrant, savvy platform you can use for everyday banking. It's packed with all the features you'd expect from a bank, but is able to make things easier and clearer to manage.

The agile approach ubank is taking to product development means the tools and options offered will only expand over time. It's a front runner in an industry where banks are trying to do digital the best.

If you are looking for an extensive desktop platform for banking or want to pop into a branch, then ubank might not be for you. If you love technology, using apps, customising notifications and understanding what you spend on then ubank can help.

It's a great option for everyday banking and with the interest rates available for savings accounts, one you should consider.

Get a $10 bonus when you download the app to create a free account (using code PM5BLA6) and make 5 purchases within 30 days.

It’s “up to” 4.6% interests rate as of now. But what’s the actual interest rate? I prefer ANZ plus that says up front 4.5% and at least I know what I am getting.

You’re right Gary – it get’s tricky when you need to meet criteria to “trigger” the interest rate being paid out.

I do like what ANZ Plus offer and if a reliable interest rate with no catches is what you are after then it’s as good as it gets right now. Think they are keen to go after these new smaller banks with their fancy apps so might be more to come.

Just downloaded the app and linked my ING accounts. Does the Spending Footprint feature track the ING accounts as well or just Ubank accounts?

HI Tony – answer is no. External accounts will not show in the footprint, but will show in the Total savings module in the Home screen. You can view all the transactions from all the accounts though on the Accounts page so might be something that can be done (but not sure myself). So while its handy to combine accounts it probably can’t be the app to assess your financial situation across everything. I do find the footprint helpful though but like you I have ING so the cross over isn’t the best.