When deciding to make the switch from bank to bank, why not hop aboard the digital bank Express.

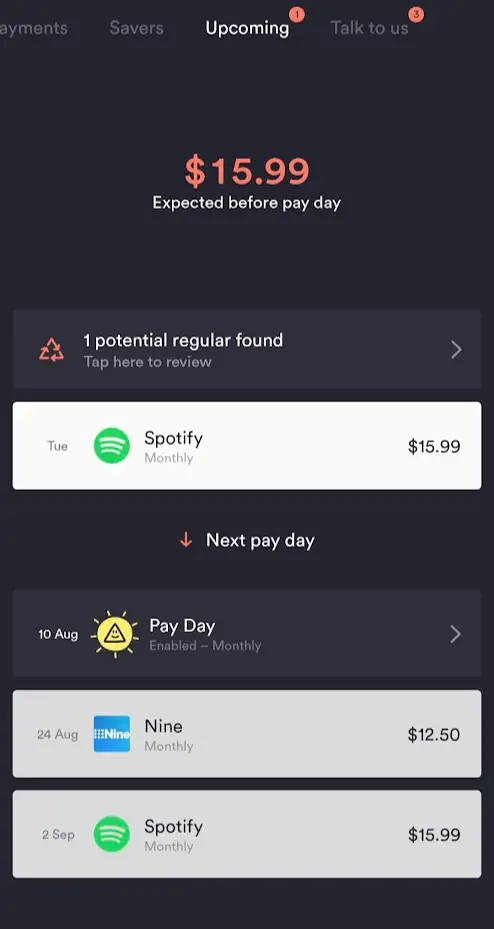

I've been using UP Bank for just over a year now after I wanted to see what all the fuss was about.

Since signing up for an account I've worked out what it's like using a neo bank.

But did I decide to move all my regular banking to UP? Short answer. No. It's still a new platform with a lot to build in its product suite, but the team is reimagining banking from the ground up so I like being part of the journey.

While it provides a solid fee-free banking experience, the banking app is its real differentiator. It allows for accessing and monitoring the accounts on the phone in a slick way. I'll get into the fun stuff soon, but let's start with the intro to this Up bank review.

What's a Neobank?

Neo-banks are banks entirely digitally created and operated.

The name bank has traditionally been associated with lengthy queues, poor service, and countless fees but they do have promises of being different.

There are no physical branches!

The bank gives everything the bank needs with its app for smartphones.

The bank promises to provide an app-driven banking experience with an intuitive user interface and beautiful design with the ability to rapidly track the expenditure of the customers.

What is Up Banking?

Up is one of the earliest “digital banks” on Australian shores.

Founded in 2017 in Melbourne, Up is a collaboration between a software company (Ferocia) and the Bendigo & Adelaide Bank (who owns Up Bank).

Up started as a neobank that was aiming to rebuild the digital banking experience from the ground up.

This led it to be one of the more innovative and front running banks to use digital technology.

It was the first neobank to provide instant Apple Pay provisioning, meaning you didn't need a physichal card before you could start using the account.

In Australia, it provides one of the more cutting-edge banking experiences available be entirely app based.

This does mean that it does not have branches, over the phone or desktop-based experiences (at least yet).

While the bank is owned by Bendigo Adelaide Bank the accounts are maintained separately.

Is Up Safe to use for banking?

Up bank has a full banking license and is regulated by Australian Prudence Regulation Authority (APRA).

It is owned and backed by the ASX listed Adelaide and Bendigo bank. This means the deposits are protected by Australian government guarantee and is similar to what is offered by any mainstream bank.

Any deposit (money held within Up) of up to $250k per person is protected under a financial dispute settlement scheme, FCCS.

Pros of Up Bank:

- User-Friendly App: Up Bank's app is designed for ease of use, offering a seamless and intuitive mobile banking experience.

- No International Transaction Fees: Customers can make purchases overseas without incurring additional fees, which is a significant advantage for travelers.

- Interest Rates: Up offers competitive interest rates on their savings accounts, making it an attractive option for those looking to grow their savings.

- Real-Time Payments: Up supports instant payments to other banks, which means faster transfers and access to funds.

- Budgeting Tools: The app provides detailed insights into spending, helping customers to manage their finances more effectively with budget analytics tools.

- Savings Automation: Features like Round-ups help customers save money by automatically rounding up transactions to the nearest dollar and saving the difference.

- No Account Keeping Fees: Up's everyday account has no monthly maintenance fees, which can lead to savings over time.

- Environmentally Conscious: Up Bank is noted for not investing in fossil fuels, appealing to environmentally conscious consumers.

- 2UP Feature: This unique feature allows two people to manage their finances together, making it easier for couples or friends to budget and save.

- Government Deposit Guarantee: Deposits are protected by the Australian government's Financial Claims Scheme, offering peace of mind up to $250,000 per account holder.

Cons of Up Bank:

- Limited Physical Presence: As a digital bank, there are no branches, which may be a disadvantage for those who prefer in-person banking services.

- No Overdraft or Home Loan Products: Currently, Up does not offer overdrafts or home loans, although home loans are mentioned as coming soon.

- Cash Deposit Limitations: Depositing cash can be less convenient compared to traditional banks, as it may require visiting a partner institution or using specific ATMs.

- Limited Product Range: Up's range of financial products is more limited than that of larger, traditional banks, which might offer a wider variety of loans, credit cards, and investment services.

- Newer on the Market: Being relatively new compared to established banks, some customers might be hesitant to switch due to familiarity and trust built with their current banks.

- No Credit Card Offering: At the time of writing, Up Bank does not provide a credit card option, which could be a deal-breaker for customers seeking credit services.

What does Up offer?

Up currently includes two accounts type

- a transaction account and

- savings account.

You create a transaction account first, that has a debit card linked to it.

From there you can create multiple savings accounts that are linked to that original account.

At this stage there is only one transaction account you can create per person.

That's the basic product overview, but the evolution of these products has been continual since launch and there is plenty the Up Bank team wants to achieve in the product space according to their road map.

Traditional banking services Up bank provides

Comparing it to a standard online banking offer (more on the unique features soon), Up bank provides what you would expect from a traditional bank in a speedy, well presented way.

Low-cost bank accounts

Just about a staple for banks these days, but Up is free to apply for and keep a bank account, or savings account and use their traditional banking services.

For ATM withdrawals and cash out, you will avoid paying atm fees when using the major bank-owned ATMs.

Unlike a bank like ING, they won't cover the ATM costs if you do get charged to use one.

A transaction account linked to multiple savings

As is the case for many digital focussed or modern build banks, Up Bank offers a single transaction account with the ability then add multiple savings accounts attached to it.

Note that only a single transaction account can be created per person or per account so may be a detriment to some people.

I know it was one of the reasons I didn't move all my banking to Up and continue to use ING.

Linked Savings accounts

Your standard savings accounts are called Up Saver and 2Up Saver (if going for a shared savings account) which can be created instantly via the app.

The interest you can earn is competitive.

I'd say they'd be easily better than the big banks, but not top tiers like ING or uBank.

You will need to use your up debit Mastercard five times a month to unlock the bonus interest which makes up the majority of the interest rate for your savings account.

When I say your Up debit Mastercard, it doesn't need to be the physical card itself.

Can be an online payment or device payment.

Overseas transactions

Happy to report that there are no overseas purchase fees online or in-store.

I've been using the transaction account for that purpose and it's great to avoid international transaction fees or a foreign transaction fees whether you are travelling or just purchasing overseas

Deposits.

The bank offers offer free deposits to the Australian Post office at no charge via Bank@Post. The only thing required is the physical Up card and PIN. You may need your ID when you deposit a cheque. Deposits may take 5-10 days to appear.

Home loans

Up home loans are offered to exiting customers who want to keep all their money together in the Up bank experience.

There are a few parameters they have set and would say that it is not the most flexible offer for those looking for a home loan:

- Principal place of residences only

- Must have at least 10% equity

- A capital city or major regional centre

They are not flaunting interst rates on their site, so imagine it is not the most appealing offer in terms of numbers. There is mention of up to fifty free offset accounts that you can add which coincides with the ease of which you can add savers in the standard banking experience.

Looking at the rates and fees page I can see the numbers are comparable with the big banks or just a bit better.

I like the appeal of having an all in one banking and home loan experience (which I have with Macquire) but Up bank will need to offer something a bit more for me to want to refinance any time soon.

Credit cards

Up bank does NOT offer any form of credit cards.

This is a focus of the business which it's the largest age group of customers is 16-24, who the bank believes is not ready for a credit card.

It hasn't ruled out offering one entirely but won't be rushing to launch one unless it meets the needs of customers.

The Up bank app experience

Now we covered the product basics, let's start talking about the fantastic banking app they provide.

It's fairly cutting edge and always adds new features or updates.

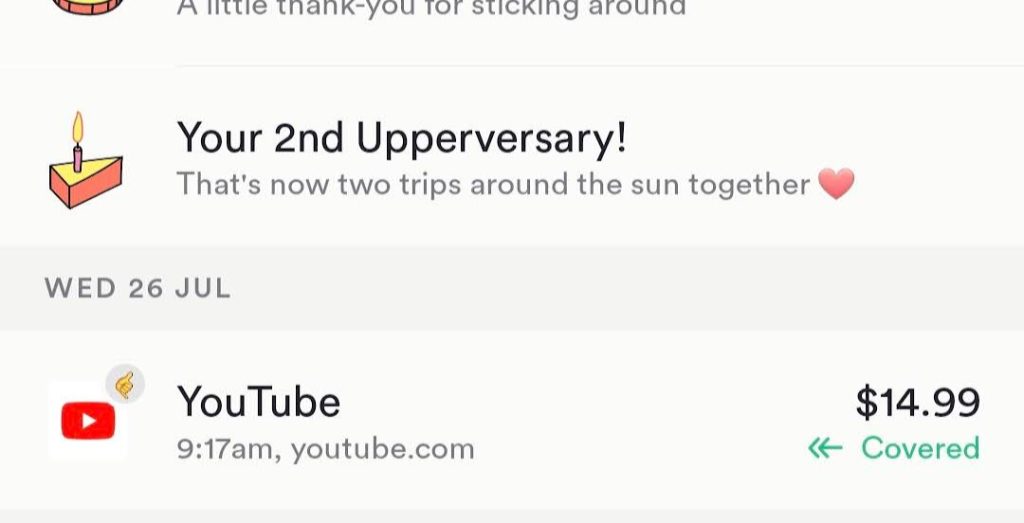

Instant and threaded payments

Up provides a conversational payment feature in its app that allows users to pay customers and companies in real-time using OSKO, PayID, or good old BSB.

So if you have a friend you transfer to regularly, then it's a simplified way to view your detailed spending history for that person. Up bank call them threaded payments.

Contactless payments

In terms of how you might want to pay beyond using the debit card, you can connect your Up account to the following devices:

Google Pay

Apple Pay

Samsung Pay

Garmin Pay

Fitbit Pay

Yeah, they are big on wearable transactions. If you have an Apple Watch then they regard the app on it as one of the best banking experiences for the device.

Create an Up bank account and get $15

Get the tools to help them master your money, smash savings goals and simplify your financial life. Join Up Bank today and get $15 dropped in when you complete your signup.

Round-ups

Just like Raiz, you can set your transaction accounts to round up your purchases to the nearest dollar and send that amount automatically to a savings account.

A nice little feature that a few banks offer, but also a small way to build up savings.

Money insights and more detailed spending history

One of the more unique ways the Up app provides a better experience to most apps is the way they display your spending.

Rather than a just list of incoming and outgoing transactions, up breaks it down into a number of sections you can swipe back and forth with.

Activity – see all your transactions

Payments – Summary of all your outgoings and the ability to send or even request money

SAvers – Your savings accounts

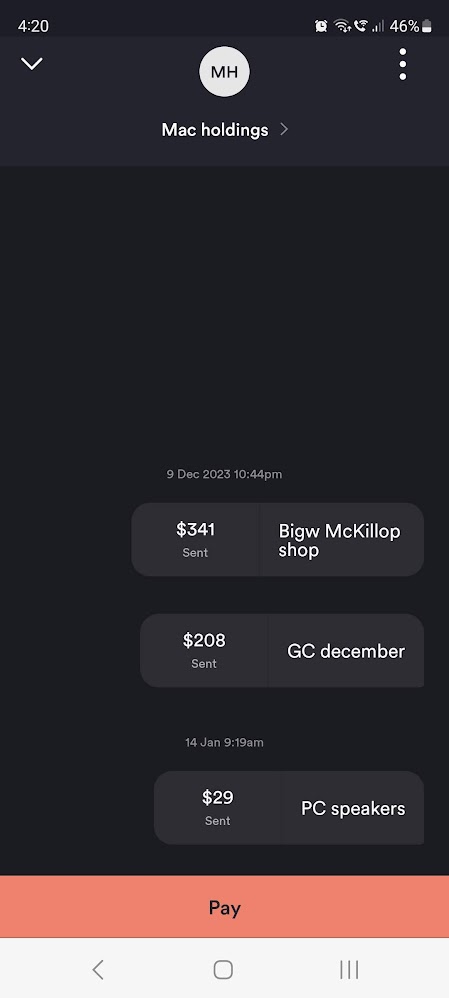

Upcoming – Up remembers your regular payments (like a subscription) and will note it here so you know what exactly they will all cost in the month ahead. It'll also note your Payday is a regular wage or salary comes, in on the same frequency.

An obvious but also a rare feature that Up manages to provide are icons and logos for all the transactions that take place. For example, if you spent money at coles the icon will appear so it's easier to quickly identify what you spent. No more confusing descriptions wondering what exactly you paid for and where.

There is also the weekly insights area. This is a list of transactions completed during the previous week and compares these transactions with the transactions of the previous week.

Automation

I love automating my finances and the Up Bank account knows how to do it well.

The feature Up bank has is called split payments.

This gives you the ability to have your income automatically distributed around your up saver account or accounts. Leaving you the money you can spend in the spending account.

The coolness of the app shines here where you don't need to nominate a dollar amount but an actual percentage of your pay towards a savings account – 10, 20, 40%. Automatically.

You can turn this on and off at any time, but for those who want to commit to multiple savings goals, it's a handy feature.

Zap card (digital immediately)

Basically a digital version of your debit card that you get access to immediately after signing up to up bank.

Through the app you can access the card number, expiry and CVV so you can make purchases even if you don't have a physical card. All you'd need to do is transfer money it (and if its Osko its instant) and then use the card to tap and pay (via your phone) or online.

Technically you can create a new account transfer money into it (via Osko) then use it to buy something while you literally wait in line if you wanted to.

Unique features to Up Bank

The above are some of the features that are sort of variations of what you might expect from a bank but there are some really interesting ways they are using tech to give you more interesting ways to manage your money.

2UP

2-PLayer banking is a term Up bank has coined themselves. It's a reimagined way to do joint bank accounts.

Lack of joint accounts was the main reason I was reluctant to use UP as the main bank account, and even with it now available I haven't tried it.

You'll need to have your own individual accounts to create a joint 2Up account. That'll be a shared bank account where you spend on it via the individual cards you get for it – or via Google Pay or Apple Pay.

After that you can add joint Up saver accounts as you like, so it can become a mix of personal and combined savings.

At the moment I'll be sticking with ING for my joint accounts. Purely because I do a bit of banking via the desktop and Up do not have that option yet.

I'd say the 2Up features is more geared to couple thinking about joining their finances as it seems a good way to do it without losing your personal accounts. Oh and I have an article on combining finances with a partner if that is you right now.

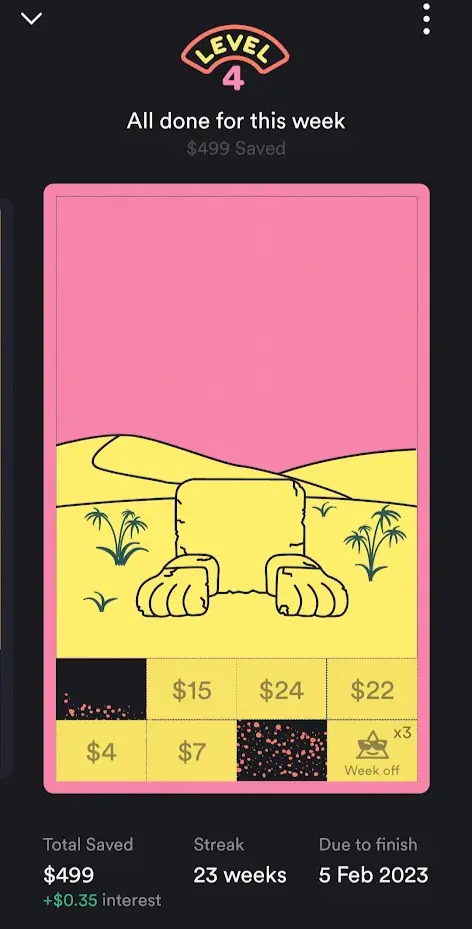

Savings challenges

If you are struggling to save a consistent amount each week then why not let Up help you?

I tried out a $1000 savings challenge over a year.

This had the Up app ask me how much I wanted to save each week.

They were really odd amounts and its helpful if you have either a lot or a little able to contribute towards the goals.

there is also an option to have the week off in case its not possible.

While you do it as well, the app reveals a few different images piece by piece as you contribute.

A fun way to make it more realistic to build up some money.

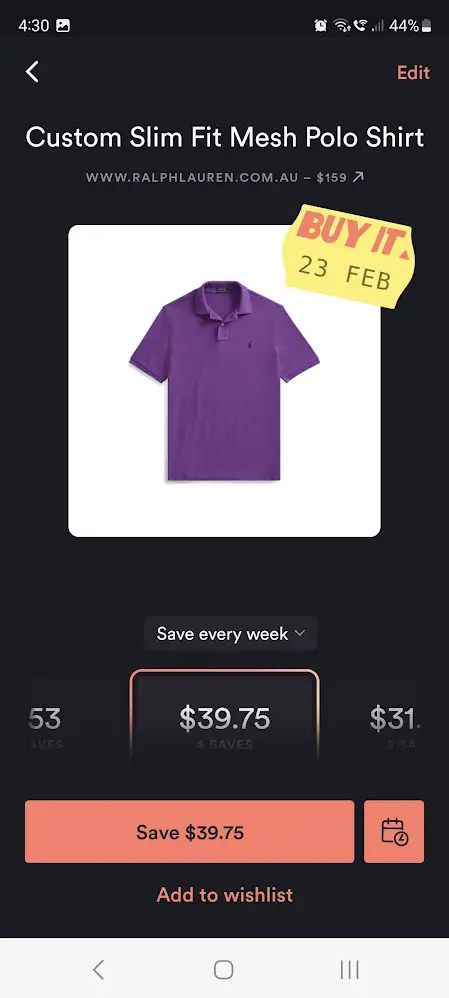

May Buy

This is a really unique feature that helps you save up for something you find in a few installments. If you see something online that you want to purchase, you can share that with the Up Bank app and it will turn it into a savings goal and show you exactly how much you can stash away with a few contributions to meet the amount of the product.

For example you might want a PS% for $800. If you share that with the app, it will ask if you want to save an amount over a few weeks, fortnights or months depending on what you want to commit too.

It might be $100 a month for 8 months. The may buy will then take that amount from your transaction account on a recurring basis until the goal is met.

At any time or even when you fund the full amount you can pull the money back to your regular savers or account to spend.

Its a cool way to make saving a bit more real and helps you avoid credit.

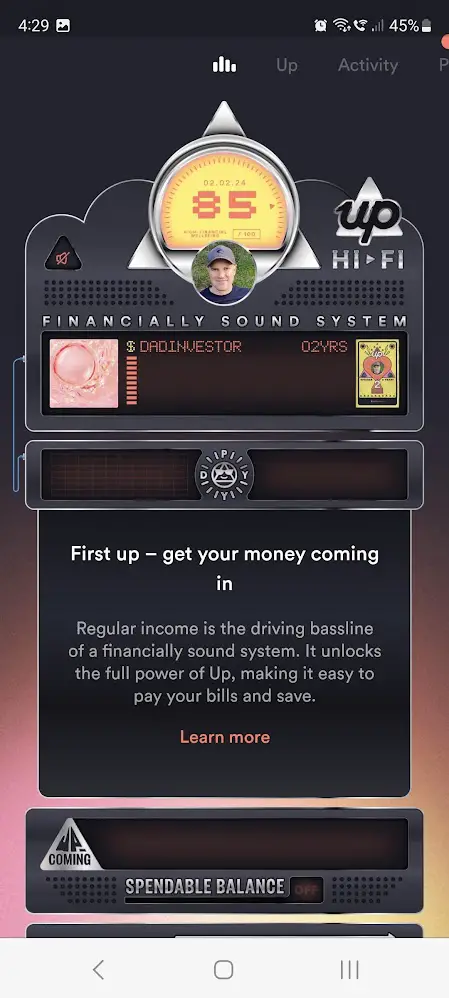

Up Hi-fi

This is a interactive regular check-in to see how you’re feeling about your money with a simple, automated system focused on helping you move easily between pay days, confident your bills are sorted, savings goals on track, and you have a clear picture of what you have left to spend on the good life.

Hi-Fi is a tool that helps you keep an eye on your money by checking in on how you feel about your finances and using a simple setup to manage your cash.

Hi-Fi is especially aimed at those who find traditional money management unengaging or challenging to maintain. The idea behind Hi-Fi is to make it easy to tell the difference between what you need and what you want, with the option to get more detailed if you like.

It integrates features such as Pay Day, Upcoming, Spendable Balance, and Pay Splits into one system that balances bill payments, savings goals, and discretionary spending. It's a kind of in app budgeting approach that separates essential needs from wants while providing the option to adopt a more detailed envelope-style budget if desired.

Up Bank gives you their financial wellbeing score derived from customer surveys that assess their relationship with money and financial resilience.

This score helps track progress over time and gauge the effectiveness of the platform. Hi-Fi also employs an engaging, music-aided survey experience to encourage thoughtful responses.

Is Up right for you?

If you love new banking technology and a different way to do money management then give the Up app a go.

I've been using it for a year as an experiment and have become more used to the way it presents your spending, savings, and accounts.

There are no fees for basic stuff, so it's a good solid option for that. But it's really the Up app that is the winner here. Full of fun features, notifications, labels, and graphics that just make banking a little more personal.

So while it has not yet offered a complete product suite that many Australians want in a bank. like credit cards or home loans, it's still worth trying to use the technology available.

Some of the key types I would say Up Bank is suited for:

- Tech-Savvy Millennials: Up Bank's mobile-first approach is ideal for millennials and younger generations who handle most of their life through their smartphones. The intuitive app with features like instant notifications, spending insights, and easy in-app support caters to those who prefer managing their finances digitally.

- Travelers: Individuals who travel abroad often would benefit from Up Bank's no international transaction fees and free ATM withdrawals overseas. The convenience of a travel-friendly debit card without the usual extra costs can make Up an excellent banking choice for globetrotters. Since the accounts are free you can use this account purely for overseas travel.

- Budget-Conscious Individuals: Those who are keen on budgeting and tracking their spending would find Up's built-in budgeting tools and real-time spending notifications particularly useful. The app's features can help users stay on top of their finances and save money more efficiently.

- Eco-Conscious Consumers: Up Bank's commitment to not investing in fossil fuels might appeal to environmentally conscious consumers who want to ensure their money isn't supporting industries that have a negative impact on the environment.

- Couples and Roommates: The 2UP feature allows two people to manage their finances together, which can be ideal for couples or roommates who want to track shared expenses, budget jointly, or save for common goals. It simplifies the process of managing shared finances without the need for multiple accounts or complex spreadsheets.

Summary of UpBank

- All digital – sign up for an up account via the app and start using the digital debit card straight away

- Competitive – No account fee, fee free to use ATMs and the big banks, decent interest rates for savings (after 5 purchases on your card a month)

- Device friendly – Apple Pay, Google Pay, Samsung Pay, Fitbit pay, Garmin pay are all there

- Modern banking technology – round-ups, weekly spending notifications, money insights, payment splitting, conversational payments (read more on all these below)

- Colour scheme – it's all orange, yellow and black. The debit card is a neon bright orange

I've had fun exploring my up account over the two years.

Didn't think it was possible to be surprised and impressed by a bank but I have.

It can be a bit different and unusual to understand at first but start slowly using it and you'll find it's not just a solid set of banking products, but brilliant banking technology.

Why not sign up for free, get $15 for doing so and see what the fuss is all about?

Create a bank account with Up and get $15

Get the tools to help them master your money, smash savings goals and simplify your financial life. Join Up Bank today and get $15 dropped in when you complete your signup.

Can you deposit cash or a cheque into Up Bank?

The bank offers offer free deposits to the Australian Post office at no charge via Bank@Post.

The only thing required is the physical Up card and PIN.

You may need your ID when you deposit a cheque. Deposits may take 5-10 days to appear.

Is Up a legitimate bank?

Yes, they are owned by the Bendigo Bank and Adelaide Bank organisation.

I am interested in setting up my SMSF funds with UB

Can you tell me what the interest rate

Is for SMSF

HI Ross- current rate is 4.35% which is ok but definitely not a top rate, as I know ubank do 5% currently (Nov 23)