You've just bought your first shares or ETFs.

It's an exciting milestone, but I want to let you in on something important: the investment journey doesn't stop at ‘Buy.'

No, that's where the next phase kicks in.

Now comes the somewhat overlooked, but utterly crucial task of tracking and managing those shiny new assets.

It's like being handed the keys to a new car; you don't just park it in the garage and admire it—you take it out for spins, keep it fueled, and get it serviced regularly.

So, what does the investment equivalent of “regular maintenance” look like? That's what we'll unpack today.

Essential Post-Purchase Tasks

Alright, let's get into what you should be doing after that exciting moment when you click ‘Buy.'

The tasks that come next are beneficial to your success

While they might seem like extra homework, they're the difference between hoping your money will grow and actually taking control of that growth.

And you will get better and faster at doing them once you start.

Here's some of the things I do on a regular or irregular basis to keep a pulse on my money, and think it'd be helpful to incorporate and consider yourself.

I'll explain what they are first, then demonstrate how I do them.

True Performance Tracking

Performance isn't just about asking, “Is the price higher than when I bought it?”

That's just the tip of the iceberg.

Factor in things like transaction fees and dividends to get a clearer picture.

This is what’s known as calculating your “true performance,” and it’s one of the first things you'll want to get the hang of.

Like any investment you start with what you put into it, take out the costs and expenses, add on the growth or income you got and find out the actual performance.

Upcoming Dividends

Knowing when dividends are about to be paid is like knowing when your next paycheck is coming.

With dividends, you can plan on reinvesting or using the cash for other expenses.

Some investments pay monthly, some quarterly, many twice a year and some even. annually.

Knowing this means you can plan what to do with the money.

Ongoing Research

Once you've invested, staying on top of market news, company earnings, and industry trends is a thing.

I'm officially calling this research but its more about paying attention to things that could impact or change your investments.

You don't need to turn into a trader or be a daily reader of the news but if you invest in CommBank and see a headline that the CEO just got fired then its worth paying attention to it.

Another example if ETF changes its fees.

Research like this allows you to make informed decisions, whether that's holding onto a particular stock or considering selling it off.

Historical Performance

Looking at how your investments have performed over time helps you gauge their stability and potential future growth.

You probably went in looking at historical info – like the performance over time – and made an assumption on that being what could likely happen going forward.

Use the same analysis you did when you first invested to look back again but include the time you've held that investment to see if the trend of performance is confortable enought for you.

This is something you might only do once a year, but still helps you keep informed.

Asset Allocation

How are your investments split?

Stocks, ETFs, perhaps a bit of real estate?

Each of these asset classes carries different levels of risk and reward.

Understanding your asset allocation is essential for balancing your portfolio’s performance and risk.

It might be that you started out investing with a $1000 a month into a stock portfolio.

But recently your cash savings took a hit and the balance has dropped.

An activity like asset allocation would have you splitting that $1000 so that some goes into cash and some into the portfolio.

Could be for a moment, months or ongoing.

Diversification

Diversification is like Asset Allocation 2.0.

Within each class, like stocks, you want a mix—some high risk, some low risk, and some in the middle.

This ensures you're not putting all your eggs in one volatile basket.

For example, gain you might own IOO and VAS at a 50/50 split of your portfolio.

IOO has 100 companies within it and VAS 300.

But is that enough diversification for you?

Has there been recent volatility that has made you uncofortamble?

Maybe adding a new ETF, like VGS, which has thousands of companies within it can add some diversification for you.

Rebalancing

Asset values change over time, affecting the balance of your portfolio.

Rebalancing is the periodic adjustment you make to bring everything back in line with your investment goals.

You might have gone in with an idea to go 50% IOO and 50% VAS, but over the years its changes (due to growth).

The split is now 60/40.

What do you do?

Buy more of VAS so it comes up to 50% again?

or sell down IOO so and put the proceeds into VAS?

I don't have an answer for you but some questions to consider (if you are in this spot)

Tax Reduction

Let’s not forget about tax planning.

Investments aren't just about making money; they're also about keeping as much of it as possible when tax season comes around.

Understanding which investments are tax-efficient is a smart move.

- CGT

- Reportable income

- Deductible costs

This isn't a tax article, but there are considerations a good accountant will help with if things seem complicated.

Tools for Portfolio Tracking

So you've got this laundry list of tasks to keep your investments on the up-and-up.

Now comes the question: How are you going to manage all of this?

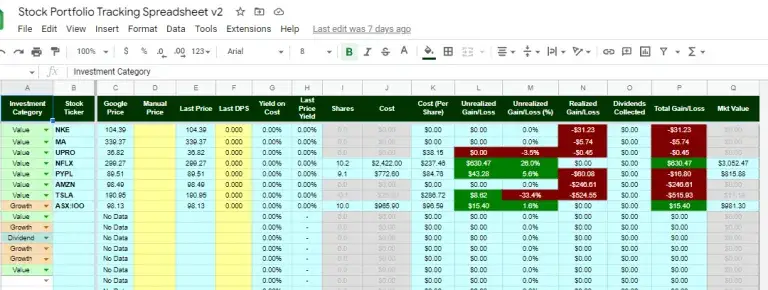

The manual way is spreadsheets.

Good old Excel or Google Sheets can be set up to do all the tracking we've just talked about.

Manual Tracking via Spreadsheet

Spreadsheets are like the pocket knife of personal finance—versatile, widely used, but not always the most efficient tool for the job.

You can absolutely set up a spreadsheet to track your true performance, upcoming dividends, and even do some asset allocation calculations.

Personally I don't use a spreadsheet anymore to track (more on that in a moment) but one I do see as good enough to do the job is this one – Free Stock Tracking Spreadsheet for Google Sheets (oldschoolvalue.com)

But unless you're a spreadsheet whiz, some of these tasks can become pretty complex and time-consuming.

And I'll be real: spreadsheets require regular updating, cross-referencing, and plenty of manual inputs.

It's a solid option, but a time-consuming one.

Automated Tracking

Then there's the automated way, using specialized portfolio tracking tools that take care of the heavy lifting.

These tools are designed to simplify and speed up the process, giving you more time to do what you actually enjoy.

You get all the data, analyses, and insights without spending hours keying in numbers and double-checking formulas.

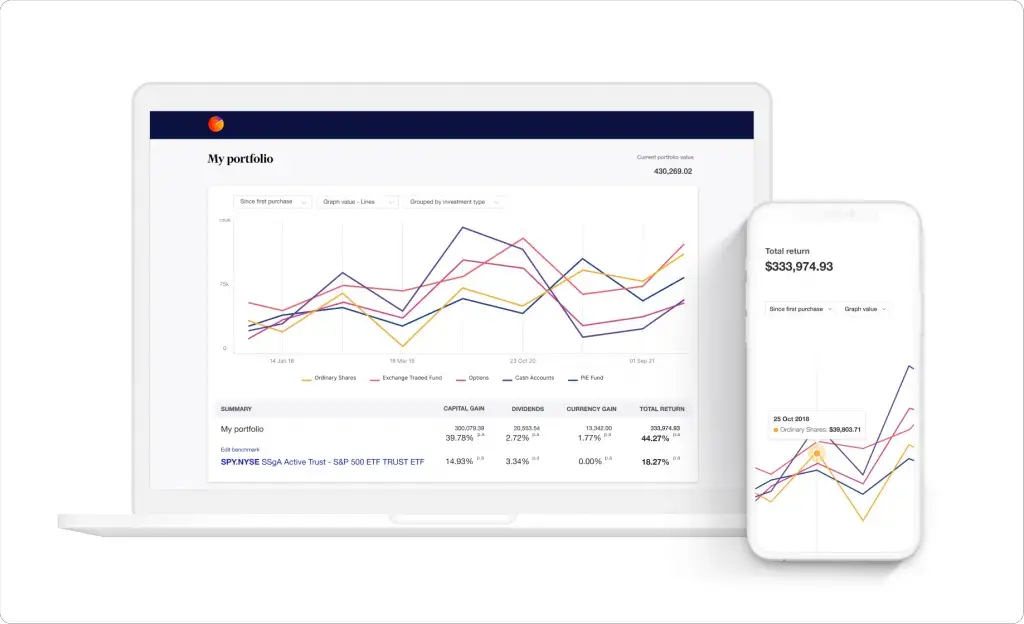

What I Personally Do: Sharesight

For me and for the last few years I've been using Sharesight.

It's a portfolio tracking tool that essentially automates all the tasks we've talked about.

- True Performance: Sharesight tracks not only the growth of my investments but also incorporates dividends and transaction fees. It gives me a crystal-clear view of my true performance.

- Upcoming Dividends: One of my favorite features is the ‘Future Income' tool. It shows all upcoming dividends, so I always know when the next “payday” is coming.

- Ongoing Research: While I still do independent research, Sharesight helps me keep tabs on market trends and news related to my holdings.

- Historical Performance: With Sharesight, I can see how my assets have performed over specific periods, which helps inform my future investment decisions.

- Asset Allocation & Diversification: The tool provides a visual breakdown of my asset allocation, making it easier to see where I might need more diversification or rebalancing.

- Rebalancing and Tax: Sharesight has built-in features for this too to easily show my tax liabilities, CGT results and how rebalancing would impact them.

- There's also plenty nicer to have features that just make things easier – like connecting your broker to it so it adds your trade the moment you do them.

Automating these tasks doesn't mean I'm hands-off with my investments.

It means I can be more hands-on with strategy, research, and fine-tuning my portfolio.

Sharesight essentially becomes the assistant that handles the routine, freeing me to focus on the game plan.

Literally just login and get up to the minute information on my entire portfolio.

It's sped up the process for my so I'm no longer managing cells in a spreadsheet or chasing news and updates on companies.

The platform has a really good free version where you can upload up to 10 holdings within it to manage. Stocks ETFs, Cash, property – most things.

The paid options are also great (as a user myself) and you can get 4 months free on any premium plan even if you create a free account to start with.

Create Sharesight AccountA key task of Investing is Management

Investing doesn't end when you click ‘Buy'; that's just the opening act.

The real work—or let's call it the real ‘art'—happens in the day-to-day management of those investments.

The beauty is, you've got options on how to go about it.

If you're into the nitty-gritty, a spreadsheet is like a blank canvas, ready for you to color in every detail.

But if you prefer to focus on the bigger picture—strategy, research, and so forth—then automating these tasks can be a lifesaver.

I've found my groove using Sharesight, but whatever method you choose, the key takeaway is this: managing your investments is non-negotiable.

It’s not the flashy part of investing, but it’s the one that ensures you're not just throwing your money into a wishing well and hoping for the best.

So, take the driver's seat in managing your investments.

Whether you're a spreadsheet aficionado or looking for a tool that simplifies it all, just make sure you’re actively involved.

Because when it comes to making your money work for you, management isn't just half the battle—it's the whole game.