Navigating the world of investing can be daunting and confusing, especially for beginners. Amidst countless options like individual stocks, investing apps, and online brokers, using an ETF model portfolio to help you decide what to invest in is a popular and simplified approach.

An ETF model portfolio is a pre-built plan for investing using various exchange-traded funds (ETFs). You can even find model portfolios that copy the strategies of famous investors or big funds, like Warren Buffett or sovereign wealth funds. For example, you could follow a plan that mixes U.S. stocks, international stocks, and bonds, just like the big players do. By using these plans, you can learn from the pros and create a diverse set of investments, even if you're new to the world of investing.

Each portfolio consists of just one or a mix of ETFs that aim to provide exposure to different asset classes, such as equities, fixed-income securities, and real estate, making them an excellent option for beginner investors who want to build a diversified investment portfolio.

In this article, I'll take you through a few examples of ETF model portfolios that cater to different investors.

Finding the Best Investment Portfolio

When it comes to finding the best investment portfolio, there's no one-size-fits-all solution. A typical investment portfolio usually consists of a mix of different investments – whether that's stocks, cash in the bank or property. What makes a good investment portfolio for you will depend on what your individual financial goals are, how much risk you want to take on, and how long you'll be investing for.

But if you want to build up or create an ETF investment portfolio what a good one? Here are some characteristics I like to look for:

- Diversification: The portfolio might have a mix of asset classes, such as stocks, bonds, cash and real estate, to spread out the risk. In those classes you might also diversify again by region, sector or theme.

- Risk Tolerance: The portfolio should match your risk tolerance, which is how much risk you can tolerate without losing sleep. Stocks or ETFs are higher risk but higher reward. The opposite is the case for cash in the bank (safer but slower to grow).

- Time Horizon: The portfolio should align with your investment time horizon, which is how long you plan to invest your money.

- Cost: The portfolio should have low fees to ensure you're not losing out on your returns. This includes the ETFs fees, trading costs and/or monthly fees for the tool you may use to invest.

- Simplicity: The portfolio should be simple to understand and manage, so you don't have to spend too much time managing it.

Everyone will come to a different conclusion as to what is the best investment portfolio for them. That's why I've built the list below of examples and ideas that can be considered when thinking about that portfolio might be. You'll need to do your own research for each but consider these factors above when doing that.

What is risk appetite?

Risk appetite refers to how comfortable you are with taking risks in your investments. If you have a high-risk appetite, you may prefer investments with greater potential rewards but also higher chances of losing money. If you have a low-risk appetite, you'll likely lean towards safer investments with lower returns but reduced chances of loss. Your risk appetite is determined by your personal preferences and financial situation.

Standard deviation is a measure of how much the returns of an investment deviate from its average return. For ETFs, a lower standard deviation means that the returns are more stable and less prone to extreme fluctuations, reducing the overall risk.

| Factor | 5-Stock Portfolio | 10-Stock Portfolio | ETF Portfolio |

|---|---|---|---|

| Diversification | Low | Moderate | High |

| Standard Deviation (Risk) | High | Moderate | Low to Moderate* |

| Company-specific Risk | High | Moderate | Low |

| Sector-specific Risk | High | Moderate | Low to Moderate** |

| Market Exposure | Limited | Moderate | Broad |

| Management Effort/Complexity | Moderate | High | Low |

*The standard deviation (risk) of an ETF portfolio can vary depending on the specific ETF chosen. Some ETFs may be more focused on a certain sector or have higher inherent risks.

**Sector-specific risk for an ETF portfolio depends on the ETF's focus. If it's a broad-market ETF, the sector-specific risk is low to moderate. However, if the ETF is focused on a specific sector, the risk may be higher.

Please note that the above table is a general overview and not a definitive guide. The actual risk and diversification levels of a specific stock or ETF portfolio depend on the individual assets included in the portfolio. It's essential to thoroughly research and understand the stocks and ETFs you're considering investing in to ensure they align with your risk appetite and investment goals.

The Importance of How You Invest (and Sticking with It)

Investing habits and consistency are crucial when building wealth. Investing regularly and avoiding emotional investing decisions can help you stay on track and achieve your financial goals. I've found a key to successful investing is to establish a disciplined approach and stick with it. Consistency is critical, whether you're investing a small amount regularly or investing a lump sum all at once.

Here are some tips to help you create and stick to building a strong investment portfolio:

- Invest regularly, even if it's a small amount.

- Avoid emotional investing decisions, such as panic selling during market downturns.

- Stay informed about your investments and the market, but don't obsess over daily fluctuations.

- Rebalance your portfolio periodically to ensure it stays aligned with your goals and risk tolerance.

ETF Model Portfolio using ASX ETFs

Looking for inspiration to build your own investment portfolio? I've gathered some examples of popular investment portfolios made up of exchange-traded funds (ETFs) from the ASX. Please note that this is not financial advice, and you should always do your own research before making any investment decisions. The aim is to give you some ideas and show you what's possible with ETFs.

Each of the examples below can be built using ETFs on the ASX, which can be bought through an online broker like Stake or through a Raiz portfolio.

Simple All Stock Portfolios

All stock portfolios invest solely in stocks and provide investors with exposure to equity markets around the world. The three ETFs mentioned in this category – IOO, SP500, and VGS – offer investors access to companies from various regions and industries, enabling them to build a well-diversified stock portfolio.

These three examples are all you need for an instant investment portfolio using just one ETF.

1. IOO – iShares Global 100 ETF

Tracks the performance of the top 100 companies from around the world. Popular holdings include Apple, Microsoft, Amazon, and Alphabet (Google).

2. IVV – iShares S&P 500 ETF

Tracks the performance of 500 large-cap US stocks. Popular holdings include Apple, Microsoft, Amazon, and Facebook. Read more about how to invest in S&P 500 here.

3. VGS – Vanguard MSCI Index International Shares ETF

Vanguard MSCI Index International Shares ETF: Invests in more than 3,000 companies from around the world, excluding Australia. Popular holdings include Samsung, Alibaba, and Tencent. Here is my breakdown of international ETFs.

The main difference between these ETFs is the degree of diversification they offer. IOO and VGS are more diversified than IVV, which only includes companies from the US. By investing in a diversified portfolio, you can spread your investment risk across many companies and reduce the impact of any one company or sector on your overall portfolio.

Diversified Mix Portfolios

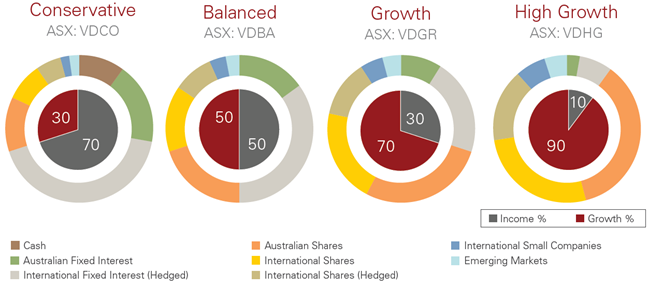

Vanguard diversified mix portfolios invest in a mix of asset classes, including equities, fixed-income, and listed property, offering investors a balanced approach to investing.

4. High Growth – Vanguard Diversified High Growth Index ETF (VDHG)

This ETF provides exposure to a diversified mix of Australian and international equities, listed property and fixed income, with a higher allocation to equities (85%) and a lower allocation to fixed-income securities (15%).

5. Growth – Vanguard Diversified Growth Index ETF (VDGR)

This ETF provides exposure to a diversified mix of Australian and international equities, listed property and fixed income, with a moderate allocation to equities (70%) and a lower allocation to fixed-income securities (30%).

6. Balanced – Vanguard Diversified Balanced Index ETF (VDBA)

This ETF provides exposure to a diversified mix of Australian and international equities, listed property, and fixed income, with a balanced allocation between equities (50%) and fixed-income securities (50%).

For example, with a high-risk appetite, you might choose a portfolio like VDHG, heavily invested in equities for potentially high returns but increased risk. With a low-risk appetite, you could opt for VDBA, balancing equities and fixed-income assets for more stable returns.

If you are looking to build a solid portfolio of ETFs or even individual shares, I highly recommend using Sharesight to track it all in one place.

Australian Market Portfolios

Australian market portfolios invest solely in Australian companies and provide investors with exposure to the local equity market. This allows investors to build a well-diversified portfolio of Australian equities, including both large-cap and mid-cap companies. These ETFs are ideal for investors who are keen on the Australian market or who want to achieve a well-diversified portfolio of Australian equities.

7. ASX 50 – Betashares Australia 50 ETF (SFY)

This ETF tracks the performance of the top 50 Australian companies by market size. The reason why I believe this is a valid option is due to the size of the Australian market. The ASX has around 2,200 hundred listed stocks making the SFY hold the largest 2% of the market. By contrast the US NASDQ AND NYSE hold over 5,000 stocks combined so the S&P 500 would likely hold 10% of those markets

8. A200 – BetaShares Australia 200 ETF (A200)

This ETF tracks the performance of the top 200 Australian companies by market size.

9. VAS – Vanguard Australian Shares Index ETF

This ETF tracks the performance of the top 300 companies listed on the Australian Securities Exchange (ASX).

Why invest in the Australian market?

For Australian residents, investing in Australian companies can be beneficial because we get something called “franking credits”. This means that when the company pays out a dividend, they have already paid taxes on that money. So when you receive the dividend, you get credit for those taxes, which can reduce the tax you owe.

Also, many large Australian companies pay out high-yielding dividends, which means they pay out a lot of money to their shareholders. By investing in these companies, you can receive a steady stream of income. It's important to remember that investing in the Australian market should only be one part of a diversified investment portfolio.

ESG Stock Portfolios

ESG ETFs invest in companies that are committed to operating in an environmentally and socially responsible way. By investing in these companies, you can support positive change in the world while also potentially earning a good return on your investment.

ESG ETFs also often exclude companies that engage in controversial activities, such as weapons manufacturing, tobacco, or gambling. Investing in ESG ETFs is a way to align your investments with your values and make a positive impact on society.

10. ETHI – BetaShares Global Sustainability Leaders ETF (ETHI)

This ETF invests in a diversified portfolio of international companies that meet strict sustainability and ethical standards. The fund screens companies based on their environmental, social, and governance (ESG) performance and invests in those with the highest scores.

11. FAIR – BetaShares Australian Sustainability Leaders ETF (FAIR)

This ETF invests in a diversified portfolio of Australian companies that meet strict sustainability and ethical standards. The fund screens companies based on their ESG performance and invests in those with the highest scores.

12. Raiz Emerald – Raiz Invest Emerald Portfolio

This portfolio invests in a diversified mix of Australian and international companies that meet strict sustainability and ethical standards. The fund uses a combination of ESG ratings and expert analysis to identify companies with strong ESG performance. The portfolio is managed by Raiz Invest, an Australian investment platform that specializes in micro-investing.

Famous Investor Portfolios

Many people look up to successful investors for guidance on how to invest their money. These investors have often made a lot of money in the stock market, so they are seen as experts. By reading through their investment strategies and following their suggestions, some people hope to achieve similar success in their own investing.

13. The Warren Buffett (suggested) Portfolio

This portfolio is a simple and effective approach to investing, consisting of 90% iShares S&P 500 ETF (IVV) and 10% Vanguard Australian Government Bond Index ETF (VGB). The strategy is based on the philosophy of legendary investor Warren Buffett, who emphasizes investing in broad market index funds and holding for the long term.

- 90% iShares Core S&P 500 ETF (IVV)

- 10% Vanguard Australian Government Bond Index ETF (VGB)

14. Barefoot Breakfree Portfolio

The Barefoot Breakfree Portfolio is a popular investment strategy offered by Scott Pape, also known as the Barefoot Investor. The portfolio is a simple and diversified mix of ETFs that includes STW, VSO, IOO, VAP, and VAF. The portfolio is designed to be low-cost and easy to manage, with a focus on long-term growth and stability.

- 35% SPDR S&P/ASX 200 Fund (STW)

- 15% Vanguard MSCI Australian Small Companies Index ETF (VSO)

- 20% iShares Global 100 ETF (IOO)

- 20% Vanguard Australian Property Securities Index ETF (VAP)

- 10% Vanguard Australian Fixed Interest Index ETF (VAF)

15. Swensen Portfolio (Yale Endowment Fund Portfolio):

This portfolio was developed by David Swensen, the chief investment officer of the Yale Endowment Fund. It consists of VAP, IVV, VAS, VGE, VGB, and IGB. The Swensen Portfolio is a well-diversified mix of asset classes that aims to deliver consistent returns over the long term.

- 20% VAP – Vanguard Australian Property Securities Index ETF

- 30% IVV – iShares S&P 500 ETF

- 15% VAS – Vanguard Australian Shares Index ETF

- 5% VGE – Vanguard FTSE Emerging Markets Shares ETF

- 15% VGB – Vanguard Australian Government Bond Index ETF

- 15% IGB – iShares Treasury ETF

16. The All-Weather Portfolio

The All-Weather Portfolio (also known as all-seasons) is a portfolio designed to perform well in any economic climate. his portfolio is based on the investment philosophy of Ray Dalio and aims to provide stability and balance by investing in a mix of assets that have low correlation with each other.

- 40% IGB – iShares Treasury ETF

- 30% IOO – iShares Global 100 ETF

- 15% VGB – Vanguard Australian Government Bond Index ETF

- 7.5% GOLD – Perth Mint Gold ETF (AAAU)

- 7.5% Commodities (FOOD or OOO)

17. John Bogle’s Portfolio / Three Fund Portfolio

The Three Fund Portfolio is a simple and effective approach to investing developed by John Bogle, the founder of Vanguard. It consists of VGS and VGB. The portfolio aims to provide exposure to global stocks and bonds while keeping fees low and minimizing risk.

- VGS – Vanguard MSCI Index International Shares ETF

- VGB – Vanguard Australian Government Bond Index ETF

This strategy believes in a hands-off, diversified approach to investing.

The idea is to cover the broad market by investing in three sectors: domestic stocks, international stocks, and bonds.

The traditional allocation approach Jack recommended was to set your “age in bonds,” suggesting that the percentage in stocks should roughly equal “100 minus your age.”

So if you are 40 years old your allocation would be 60% VGS and 40% VGB.

This ensures a gradual shift towards a safer asset class (bonds) as one ages.

18. Permanent Portfolio

The Permanent Portfolio is a time-tested investment strategy that aims to deliver consistent returns across all economic conditions.

The portfolio was originally developed by Harry Browne, a renowned investment analyst and libertarian politician, in the 1980s.

The Permanent Portfolio is based on the idea of holding a well-diversified mix of assets that can withstand changes in the market and economy.

By investing in a balanced mix of stocks, bonds, cash, and gold, the portfolio aims to provide stable returns with minimal volatility.

The Permanent Portfolio consists of four asset classes: stocks, bonds, gold, and cash. The allocation is as follows:

- 25% – Vanguard Australian Shares Index ETF (VAS)

- 25% – iShares Core Composite Bond ETF (IAF)

- 25% – Perth Mint Gold ETF (PMGOLD)

- 25% – BetaShares Australian High-Interest Cash ETF (AAA)

19. Ultimate Buy and Hold Portfolio

Paul Merriman is a well-known investor who has developed several portfolios based on his investment philosophy.

One of his most popular portfolios is the Ultimate Buy and Hold Portfolio.

This portfolio is designed to provide a high level of diversification across different asset classes.

The Ultimate Buy and Hold Portfolio consists of the following asset classes and ETFs:

- 10% – Large Cap Blend (IVV)

- 10% – Large Cap Value (VVLU)

- 10% – Small Cap Blend (IJR)

- 10% – Small Cap Value (IJR)

- 10% – International Large Cap Blend (VEU)

- 10% – International Large Cap Value (VVLU)

- 10% – International Small Cap Blend (VISM)

- 10% – International Small Cap Value (VISM)

- 10% – Emerging Markets (VGE)

- 10% – Real Estate (VAP)

The Ultimate Buy and Hold Portfolio is designed to provide exposure to both domestic and international equities, as well as bonds and real estate.

This portfolio is well-diversified and provides exposure to both value and growth stocks, small-cap and large-cap stocks, and domestic and international markets.

Sovereign Wealth Funds

A sovereign wealth fund is like a big savings account, but instead of being for a person or a family, it's for a whole country.

A government puts money into this fund, usually from selling natural resources like oil or gas, and invests it to make more money. The money in these funds is usually used to help pay for things like schools, hospitals, or other important things for the people in that country.

20. Saudi Arabia's Sovereign Wealth Fund

The Saudi Arabian sovereign wealth fund, officially known as the Public Investment Fund (PIF), has been actively investing in companies and assets around the world.

This fund invests both domestically and internationally in a variety of investments both listed and unlisted.

It includes ownership of Saudi Aramco, LIV Golf and many other companies.

It'd be near impossible to get close to mimicking the Saudi wealth fund due to the number of investments but here are some ETFs that can help you invest in a similar way:

- KSA – iShares MSCI Saudi Arabia ETF (NYSE fund)

- VGE – Vanguard FTSE Emerging Markets Shares ETF

- ICLN – iShares Global Clean Energy ETF (NASDAQ)

- XLK – Technology Select Sector SPDR Fund

- IFRA – iShares Global Infrastructure ETF

Here are also some individual companies it invests in across the world:

- Uber

- SoftBank

- Newcastle United

- Riyadh Air

21. Norway's Sovereign Wealth Fund

The Government Pension Fund Global, also known as the Norwegian oil fund, is a sovereign wealth fund of Norway.

Currently it is the largest sovereign fund in the world, which owns over $1.4trillion in assets and per citizen is worth around $250,000 to each of them.

It is invested globally in stocks, bonds, and real estate, and it is the largest sovereign wealth fund in the world.

Here are some ETFs that can help you mimic its investment allocation:

- 70% DHHF – BetaShares Diversified All Growth ETF

- 27% VAF – Vanguard Australian Fixed Interest Index ETF

- 3% VAP – Vanguard Australian Property Securities Index ETF

22. China's Sovereign Wealth Fund

China Investment Corporation (CIC) is a sovereign wealth fund responsible for managing part of China's foreign exchange reserves.

It invests in a variety of asset classes, including stocks, bonds, and real estate.

Here are some ETFs that can help you mimic its investment allocation:

- 35% VGS – Vanguard MSCI Index International Shares ETF

- 15% VGB – Vanguard Australian Government Bond Index ETF

- 10% IFRA – iShares Global Infrastructure ETF

- 10% VAP – Vanguard Australian Property Securities Index ETF

- 10% FOOD – Global Agriculture ETF

- 10% OOO – Betashares Crude Oil

- 10 % EAFZ – Asia Growth Fund (Hedge Fund)

- 2.5% AAA – Cash

The CIC fund has allocations toward public equity, fixed income and alternative assets.

The ETFs listed VAP, FOOD, OOO, IFRA and EAFZ are ETFs that are similar to themes that 45% of the fund are allocated towards that the CIC consider “alternative assets”.

There is no specific indication of what they are apart from the sectors or type of assets invested in.

Building your ETF investment portfolio

Ready to invest in? Here are some steps to guide you through the process:

- Choose a platform or investment product, such as Stake or Raiz.

- Open an account and complete the necessary steps, such as identity verification.

- Choose the portfolio that best aligns with your investment goals.

- Decide how much you want to invest and start investing regularly.

In Summary: ETF model portfolios can be a copy-and-paste way to start investing

Finding the best investment portfolio for you requires careful consideration of your individual financial goals, risk tolerance, and investment time horizon. There is no one-size-fits-all solution, and it's important to do your research and seek advice if needed. ETF model portfolios can be a great option for those who want a diversified investment portfolio without the need for extensive knowledge or experience in the financial markets.

Remember, investing is a long-term game, and it's important to stay disciplined and stick to your investment plan, even during market downturns. By investing regularly and avoiding emotional investing decisions, you can potentially achieve your financial goals over time. Lastly, be mindful of fees and costs associated with investing, as they can eat into your returns over the long run. With careful planning and a disciplined approach, you can build a strong investment portfolio that aligns with your financial goals and risk tolerance.

Is there a comparison of each of these portfolios over a 3, 5 & 10 or even more yr period?

Hi Joe – Haven’t published that analysis yet, but you can easily do this yourself using with Sharesight to lookup ETF performance over periods of time.