Disclosure: I am not affiliated with this product in any way and receive no incentives to write this review. I am not licensed to provide financial advice in Australia and this information should be taken as educational only. Read more.

Investing can seem overwhelming, especially if you're new to it. That's where investing apps like Spaceship come in – they simplify the process and make it easy for anyone to get started.

When I first heard about Spaceship, I was unsure whether the concept of it's “invest where the world is going” ethos would be any good. But as I learned more, I realised that it offered a unique and transparent investment experience that was worth exploring.

Now, as a user of Spaceship Voyager since 2020, I want to share my experience and help other beginner investors understand how it works. With Spaceship Voyager, you can invest in a portfolio that aligns with your values, and start with as little as $5. The app offers a clear and user-friendly interface, making it easy to navigate and invest in companies that are changing the world.

In this Spaceship review, I'll explain how the app works, what sets it apart, and how it can help beginner investors like you get started on your investing journey. Whether you're curious about investing or ready to dive in, Spaceship Voyager is definitely worth exploring.

A quick overview of Spaceship

Spaceship Voyager is a spin-off from Spaceship Super (which launched back in 2017).

Their philosophy is to look towards “where the world is going” so are big on tech companies across the world. You've all heard of these names Amazon, Adobe, IBM, Google, A2 milk, AfterPay, Tesla are all prominent.

They are very transparent in how they operate which makes it easy to understand their offer, which is that it's a managed fund of selected stocks.

Space ship Voyager combines an easy-to-use app with valuable information that helps you build your own investment. Investing platforms can be intimidating, however they are quite straightforward and the technology can be your personal financial adviser.

Tell me the purpose of Spaceship Voyager?

Since the successfully launch of their Super products a few years back, it seemed that the Spaceship business wanted to create a way for people to invest like Spaceship Super but in a pre-retirement post-tax way.

Basically what started as a super fund, turned into a super fund and an investing platform for your money outside of super.

Voyager mimics the philosophy of the Super product in that it offers simple portfolios of collective companies.

Who is it for

Investment in Spaceship Voyager targets a large audience. This app could be adapted for investors with minimal knowledge of investing or trading but also those with years of experience (like me) who want a simple, effective investing tool.

How to invest with Spaceship Voyager

The platform is very similar to Raiz in that you transfer in money to your account and it automatically gets invested on your behalf.

In terms of how money is transferred into Spaceship, you have two options:

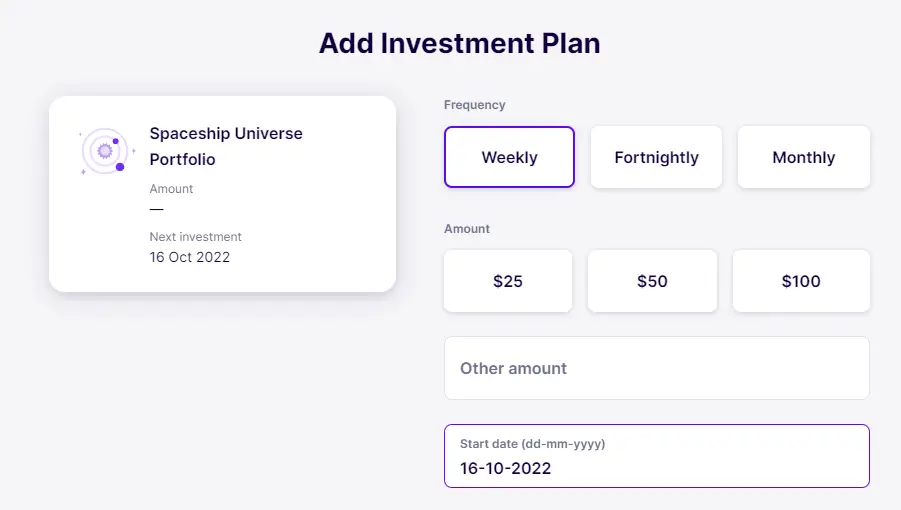

- A recurring or regular investment (eg. $100 a week)

- A manual transfer

All transfers in and our of Spaceship are setup via direct debit. That means you don't send money in via your bank. You use the Spaceship app to determine how much should be deposited or withdrawn. What that means is you need to agree to a direct debit arrangement.

There is no round-up option like Raiz.

Spaceship's portfolio options (there's three)

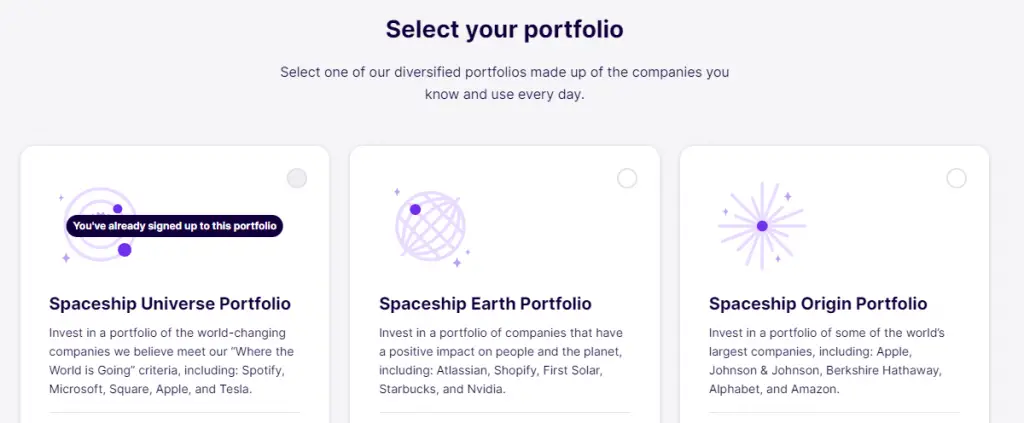

Once your money is transferred into Spaceship, it is automatically put into one of three investment portfolios. You pick which portfolio you'd like to add to initially when setting up your account and can change if you prefer at a later date.

Spaceship Voyager offers the option of choosing between three different portfolios. All three options commit to the “where the world is going” philosophy of Spaceship's investment strategy but allow you to be specific on the amount or type of companies included.

Each investment option is a collection of companies compiled around one central theme. Very similar to an ETF, LIC or managed fund. There are no options to add or remove companies from these portfolios as they are managed by the Spaceship team themselves (and area very transparent on this).

Spaceship Universe Portfolio

The original option provided by the fund.

This option is an actively managed fund, where companies are hand selected to be included or removed.

The typical make up of this fund is a mix of world (50-80%) and local (10-30%) companies that target long term capital growth.

The companies selected all need to match the “Where the World is Going” methodology that targets stocks with competitive advantages and future product or service growth potential.

Examples of companies included are Spotify, Microsoft, Square, Apple, and Tesla.

Spaceship Origin portfolio

This portfolio covers the top 100 Australian listed companies and top 100 listed international companies measured by market capitalisation.

Basically, its a more clear cut “top 100” type fund where companies are not actively hand picked (like the Universe portolio) but automatically added and removed pending how big they are.

I like this investment strategy and appreciate that you are investing into more of the winners of the stock market. Because if a company is big it means it has performed well.

Think of the likes of Spotify, Microsoft, Square, Apple, and Tesla internationally while the local list includes BHP, CommBank, CSL and NAB.

Spaceship Earth portfolio

This is Spaceship's most ethically focused option.

It's not so much what is included here but what is left out. Screening is used so that companies within this portfolio are not involved in things like fossil fuels, animal cruelty, human rights abuse, gambling, nuclear power, and more.

This portfolio has the smallest amount of companies included – around 40.

These companies are actively managed like the Universe portfolio, but each inclusion needs to have a positive impact on people, the environment and contribute towards the advancement of the UN Sustainable Development Goals agenda.

So while the Universe portfolio is a niche “Where the World is Going” offer, the Earth option is even more specific.

For me, the jury is out if the Spaceship Earth is a meaningful fund. It contains companies focused on supporting a sustainable planet, but their screening is questionable. For example, they screen out companies working on nuclear energy even though it is a clean, renewal energy source (a personal gripe of these “ethical investment” options I find). In a way, you need to confirm that your values of what is “ethical” aligns with any fund that labels itself so before investing.

Comparing all three Spaceship portfolio options

- Spaceship Universe Portolio includes around 100 companies that are hand-picked to be deemed to have competitive advantages and future product or service growth potential

- Spaceship Origin Portfolio includes the top 100 International Companies and top 100 Australian companies based on their size and value (market cap)

- Spaceship Earth Portfolio includes ~40 companies that are hand-picked to be known for having a positive impact on people and plants.

- Understanding what is in each portfolio.

The transparency with Spaceship is first class and you can see every single company included in their portfolios on the website. They will also provide regular updates for when they add or remove companies to them.

Can I choose more than one portfolio with Spaceship?

Spaceship allows you to pick more than one portfolio to invest in, meaning if you like all three then you can invest in all three. Previously you were limited to just one portfolio per account.

It’s helpful that they are transparent as they outline all the stocks included in each option on their website. You can look at the performance for each pick in a nice-to-digest way (good for when you research).

Note that all portfolios are 100% stocks. There is no defensive component which means it is more aggressive/risky than holding a balanced portfolio that includes fixed interest and bonds as Raiz does.

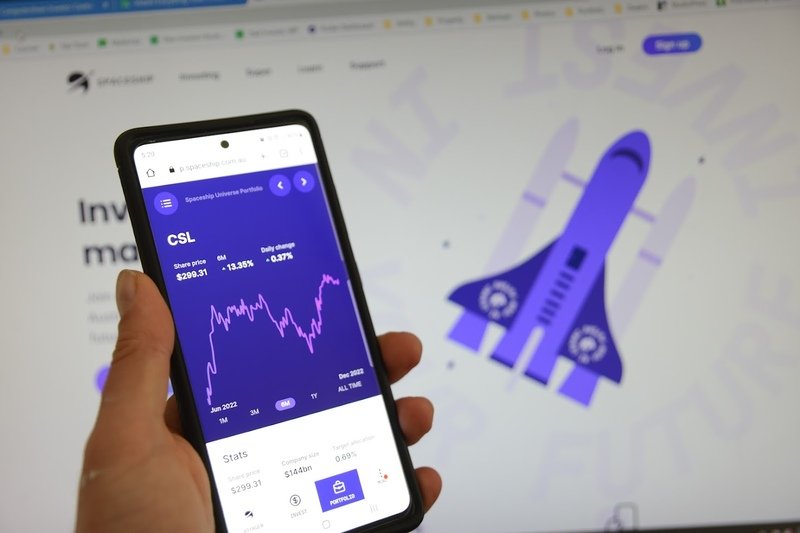

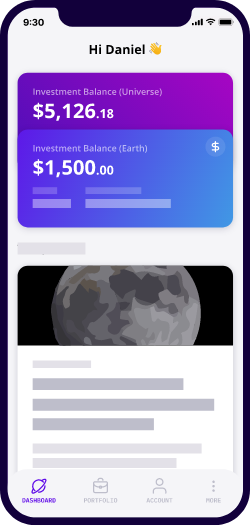

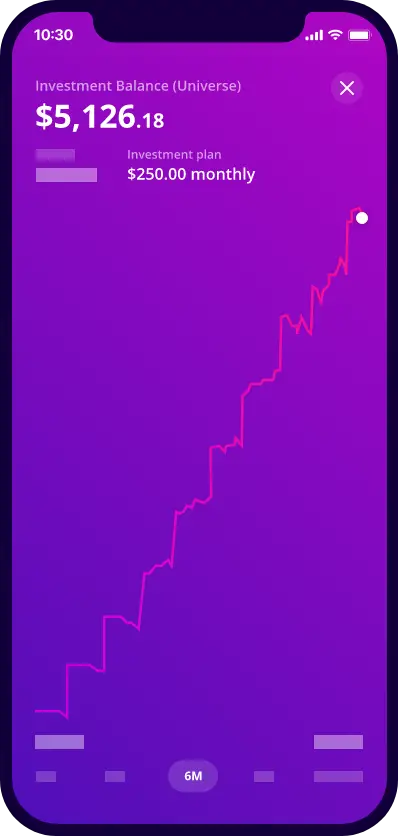

Performance tracking and management of the Spaceship app

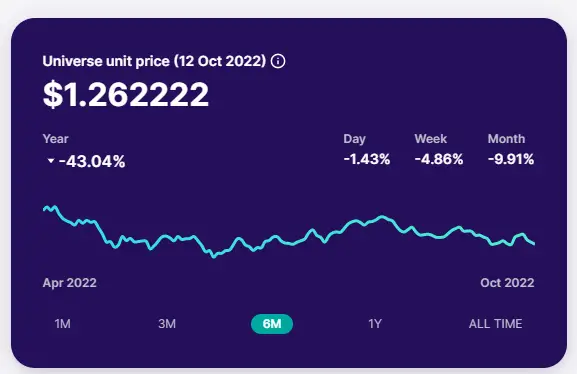

Reviewing your investment performance is easy enough. You log into the website or app and it's there right in front of you.

It'll show you how much money you have and a nice obvious chart on how it's performed recently. You can select different time periods to see how its grown (or shrunk) over years or months.

Neat and clear you'll be able to tell what's happening.

This chart shows your money's performance

The way you'd realistically look at performance is as if it was like a savings account. You check how much money is in it. Unlike a savings account though your money will jump around a lot.

Each working day at around 11am (Australian Eastern time) the balance will get updated and give you a new number. This is all based on the movements of the stock markets in your balance is invested in.

Both the desktop and Spaceship app have similar-looking experiences. There are more options within the mobile app.

Spaceship Voyager Fees

Spaceship Voyager charges a monthly fee of $2 for users with at least one portfolio balance of $100 or more, which covers all three portfolios. Additionally, there are management fees for each portfolio, calculated as a percentage of the net asset value, with the Spaceship Universe and Earth portfolios charged at 0.50% per year, and the Spaceship Origin Portfolio charged at 0.15% per year. All fees and costs are inclusive of GST and net of reduced input tax credits.

| Fee Type | Spaceship Universe Portfolio | Spaceship Earth Portfolio | Spaceship Origin Portfolio |

|---|---|---|---|

| Monthly Fee | $2/month | $2/month | $2/month |

| Management Fee | 0.50%/year | 0.50%/year | 0.15%/year |

It's important to note that the management fee is calculated as a percentage of the net asset value (your balance) for each portfolio.

In terms of what a good amount to have invested would be based on the ongoing costs, it's generally recommended to invest an amount that will provide you a return that exceeds the fees.

For example, if an investor has $1000 invested in the Spaceship app and is paying a management fee of 0.50% per year (Earth or universe portfolio), the cost of the portfolio would be $35 per year. Therefore, a good amount to have invested would be an amount that generates a return of more than $29 per year, which if you have $1000 invested would be 2.9% return.

Another way to say this is that if you had $1000 invested in Spaceship Earth or Universe you would need to make 2.9% to cover the cost of having the account.

To provide examples of how much fees might cost when investing $1000, $10,000 or $50,000, here is a breakdown of each portfolio's annual costs based on the management fees for each portfolio:

| Investment Amount | Monthly Fee (per year) | Annual Spaceship Universe Portfolio Fees | Annual Spaceship Earth Portfolio Fees | Annual Spaceship Origin Portfolio Fees |

|---|---|---|---|---|

| $1,000 | $24 | $5 | $5 | $1.50 |

| $10,000 | $24 | $50 | $50 | $15 |

| $50,000 | $24 | $250 | $250 | $75 |

As you can see the more you have the more it costs to have a portfolio in Spaceship. For me, the obvious choice here is the Origin portfolio which has the lowest fees and is still a good performing portfolio.

If you do the numbers for a $50,000 invested in Universe or Earth the percentage cost of fees, come to .548% which is starting to move out of the low-cost territory. I call anything under .50% per year as low cost.

Origin only costs .198% per year in fees so an easy call on what the cheapest Spaceship portfolio is.

Investment fees are non-refundable, but you may be able to claim then in your tax return.

What is the minimum investment?

Spaceship is perfect for those looking to start their journey into investing.

You can deposit as little as $5 and add as much or as little as you like at any stage. Note that you will not get charged fees until your reach $100 so in a way its a free trial of the platform until then.

The ability to set up a recurring investment into something that invests in the stock market allows you to build a ‘Set & forget' investment.

For example, you might want to set up a weekly transfer into Spaceship. Remembering that how much you add on a regular basis will outweigh the returns of your investment in the early days.

Concerns with Spaceship

For Spaceship Capital, the investment firm behind Spaceship Vogyager (and its super fund) the journey has been particularly challenging.

With regulatory hiccups ranging from penalties for misleading claims to top executives facing bans, the firm's journey offers an illustrative case study in the importance of regulatory compliance.

Here's a brief overview of the significant regulatory encounters that Spaceship Capital has experienced over the past few years.

Back in 2018, they were fined for misleading claims about their Spaceship Fund. They suggested they actively chose companies for investment when in fact they were linked to index-tracking ETFs.

In 2022, their former CEO, Paul Bennetts, was banned from providing financial services for six years. He'd had a company officer complete his course assessments for him, which ASIC considered serious misconduct.

A bit later, Spaceship's director, Paul Dortkamp, got a two-year ban for failing to correct a fault in their client onboarding system. However, this ban was overturned by the AAT at the end of 2022.

Recently, in June 2023, ASIC issued temporary stop orders on several Spaceship Capital funds due to problems with their target market determination. This marked the first time such an order was imposed on a super fund.

These mostly point to the way the company operates as opposed to the way the investments perform, track or are held.

I will note I have been a user of Spaceship Voyager since 2020 and remain so (through the universe portfolio).

More can be read on this at the Money Management website

Other features of Spaceship

Spaceship super

Spaceship originally launched as Spaceship super back in 2017.

Since then the super fund has expanded to provide an investment platform outside of super.

The concept is the same, with the super fund aligning its values with “where the world is going”.

The super industry is very, very competitive though and with Spaceship Super not having a track record of performance and charging higher than normal fees you can probably find a better fund. Voyager on the other hand provides a much cheaper option for investing outside your super but in a similar way.

Transparency

The information provided on the Spaceship Voyager website breaks apart what exactly you are putting your money into.

Many managed funds like to hide what they invest in leaving you guessing, but Spaceship put every single company they are investing in on their website. Each company can be viewed along with a chart of its individual performance. You won't find what how much of the fund owns each company as they are listed in alphabetical order.

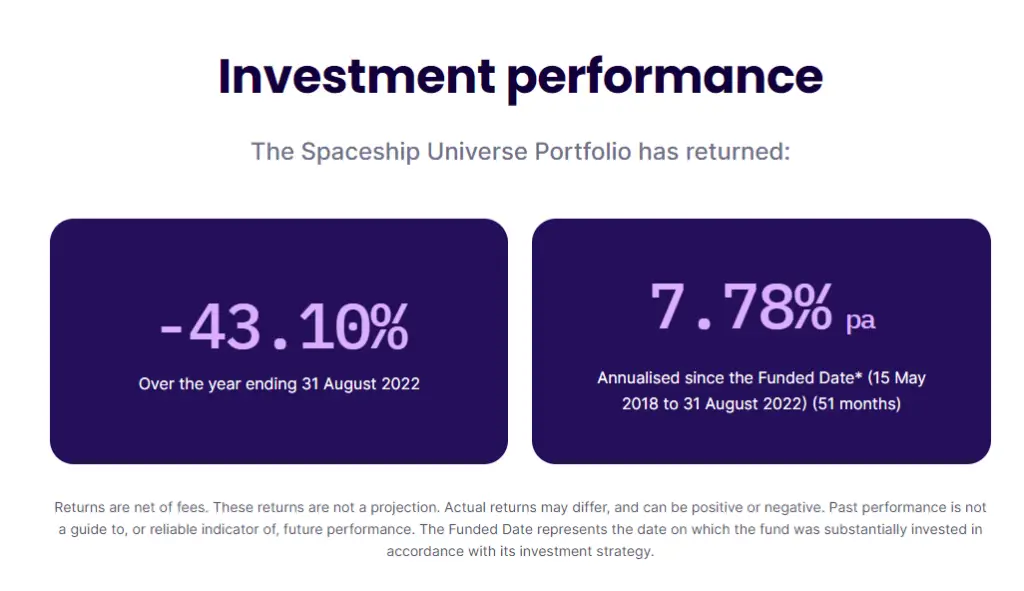

They also make it easy to find performance numbers! 2022 was a horrible year performance-wise, but Spaceship still provides returns in big bold numbers even though they are significantly negative.

Market Updates and education

Every so often Spaceship will publish an update on what and why they've added or removed from their active portfolios – Universe and Earth.

It's a really helpful understanding of what the team is doing to build a solid, reliable portfolio on your behalf.

The writing is also helpful in knowing what happens when you invest. It explains the ups and downs and why it's important to focus on long-term growth.

Spaceship in Summary

Benefits

Free for first $100 (try before you buy)

Low fixed ongoing fee(Origin portfolio only)

Simple three portfolios to pick from

Well diversified

Helpful content and education on investing

Can start with only $5

Interface and ease of use

Can be automated

Considerations

- Prices keep going up

You need faith in the Spaceship investment team

Options are actively managed rather than passively

Portfolios are 100% stocks

Spaceship may give you an idea of how best you can get into a stock market without having a lot of experience. Taking part in the stock markets became increasingly important but can also be costly and risky. Hence the existence of investing apps like Spaceship Voyager.

Uniqueness

- Two different portfolios featuring a hand-picked mix of stocks, both focused on the future and positive impacts

- A simpler index-type fund, containing 200 of the biggest companies in the world and Australia.

- Cheap and easy to get started and find beginner information on investing.

- Very transparent in the companies included in your portfolios

Spaceship Review: Conclusion

If you are looking to invest in an actively managed fund of growth stocks, then Spaceship is a great option.

I've been using Spaceship not long after they launched and find it's a simple, cheap and effective way to invest in stocks with minimal effort.

The fees are super low for what you get and it's a good alternative to an everyday savings account, with the ability to return you more on your money over the long term.

So why not give it a go and see if it is the investing app for you?