As typical as an online broker can get, Selfwealth claims itself as a low cost option for Australian investors.

Is it the best online broker in Australia? Well I use I'll give you my perspective.

I will show you some of the more helpful and usable features available in the tool.

The best news? There's plenty to offer for both new and seasoned investors, going you the ability to build some serious wealth.

Read on and I'll show you how SelfWealth works.

Getting starting with stocks and online brokers in Australia

It's one of the most common questions I hear new investors ask – what broker do I use?

Stock broking has changed so much since I started.

Back in the early 2000s there were no smart phones, email was only catching on and most websites would be unusable in todays environment.

I started off using the St George directshares platform, only because it was attached to my Westpac Banking accounts. I didn't really put too much effort into working out which broker was best as it was mostly the big banks that offered online trading, so going with whatever was aligned with your bank made sense.

Now I know picking the right online broker might seem like a massive decision you need to make, like buying a car.

To me it's like picking a bank – easy to set up and easy to change if there is a better deal around.

Here is what I find important to know before going all in on a broker.

What's really important when picking an online broker?

Technology changes fast and there are new tools, features and apps popping up demanding we pay them attention.

With that brokerage has changed a heap over the last 10 years.

Most features are nice to have, with only a few areas of the product I would say are actually influential to your decision on using them.

Like these:

How much it costs

Every time you buy a share, it costs money.

It could be a flat fee (like $20) or a percentage (like.2% of the trade value).In working out the value of these costs I have a think about how much I'm going to invest and how often.

You need to consider the frequency of your trading, not just buying but also selling.

The cost of trading is one way to come out poorer because of frequent trading at a high expense.

For flat fee's I would say $30 is on the higher end, with $10 or under per trade being the cheaper option.

The reporting features

Online brokers consider themselves more than just trading platforms. They want on you the site looking at your performance and paying attention to what the market is doing.

The ability to capture and display many market data, your stock portfolio performance and research information is a real divider between different investing platforms.

I find this aspect very underrated but rate it very important.

While I think you should understand how you can visualise and track your portfolio through a broker, Sharesight is the best tool in my mind to report and manage your portfolio away from a trading tool.

User experience

I tried to find a screenshot of what my old broker looked like 10 years ago, but even I don't have stuff that old.

Trading back then wasn't pretty. Small fonts, weirdly labeled buttons, and constant clicking just to trade.

What you need to a place that's like a shop. You walk up to the counter, ask for a certain product, pay, get the receipt, and be on your way.

What you don't need is an IKEA type platform that pushes you around, distracting you with what you didn't come for.

Clear and obvious not clever and flashy is what you need.

Trading options

I definitely wouldn't consider myself a ‘trader'.

That would be someone who is online trading often and using advanced features to make profits more often.

Unlike me who turns up, buys the stock, and leaves – traders are looking to set limits and parameters so that if the market moves they can trigger sales of shares.

Conditional orders like limit, stop, stop-limit and contingent orders and more prominent in the brokers with higher fees.

On top of the types of trading you can do, what you can trade in is also expanding.

Selfwealth now offer the ability to trade on the US markets. This gives you one place to cover some of the most prolific companies and ETFs in the world in the one place.

I'll explain more on how this works later, but this is another feature that has a great variety across brokers.

Online trading basics

Before look into the SelfWealth options, let's run through some terms I'll mention or point to as I talk about the platform.

These are not just relevant to SelfWealth but most online brokers so get across these if you're not sure.

Stock

Also called a share. On the SelfWealth order screen at least they refer to them as stocks. This could also include ETFs, so when you search for a stock you are looking up for shares or ETFs as well.

Stocks in groups (when you have more than 1 type) can also be called holdings.

Order

You place an order to buy or sell shares. With online brokers there should be a Place Order screen where you set parameters for how you want to buy and sell a certain stock.

Units

A unit is the equivalent of a share. When trading you will be asked to either nominate how many units or what value of the stock you want to buy.

For example, you can buy 200 units for a $10 for $2,000. 200 is the number of units and $2000 is the value

Price type: limit

You can set a maximum limit for how much you want to buy or sell your shares.

For example you only want to pay at most $10 for each share of a company. If the stock is under $10 at the time you submitting this order, then the order ix executed immediately.

If the stock is say $11 then your broker will wait until the price comes down to $10 per share for the trade to complete. Each broker may have different rules to how long they keep this trade waiting for.

Price type: market then limit

The order will be placed as soon as possible at whatever price the market is offering the stock at. Could be $10, $10.01, $10.87, so you are in the hands of the market here.

This is the way I normally trade as the immediate cost of the stock is not an issue. I just want to own it.

Expiry date

Because it's a bit different to a shop where stock sits on a shelf waiting to be bought, you need to have someone willing to sell you stock you want to buy and vice versa when selling.

More applicable when you set limits, you can say to the broker you want the trade to expire at the end of the day or until the trade can be completed.

When you set an order to buy or sell you can tell your broker how long to try to complete the trade.

Trading day

The ASX runs 10am – 4pm most business days. These are the hours trades can be completed

Key features of SelfWealth trading

Selfwealth is similar to most online brokers in that you use to buy buy and sell stocks.

SelfWealth do things their own way though and overall its a nice clean way to trade on both the ASX and for US stocks.

Here's the biggest touch points you'll have as a new and regular user of SelfWealth:

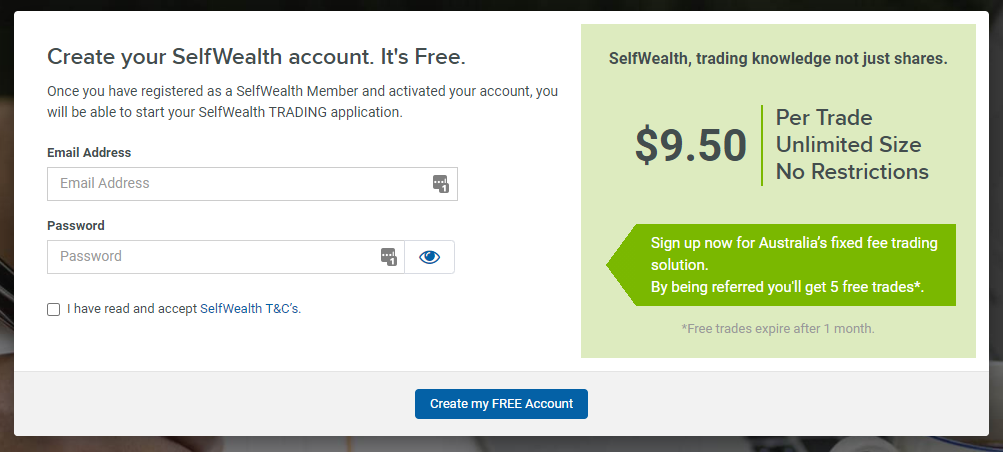

Setting up an account

These days setting up a brokerage account is very similar to starting a new bank account.

Sign up with Selfwealth is free. You'll need some personal identification to confirm that you are you.

Once you confirm all this you'll be given access to a dashboard and over the next few days verfiication will be done and you will be given trading accounts.

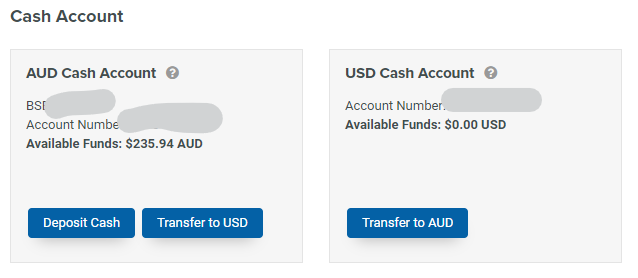

They will open a bank account for you to send money to. This is where you send money you will want to trade with.

As with most full-featured brokers, it's unlikely you will open an account and trade all in the same day.

When you sign up with SelfWealth you also get access to their premium account service for 90 days. I'll mention what I think of this later.

If you are coming from another broker, you can also transfer across all your other stock holdings. This just takes an extra form and is worth considering.

Following signup there are a few emails Selfwealth sends you to welcome and guide on onboard.

Research and comparisons

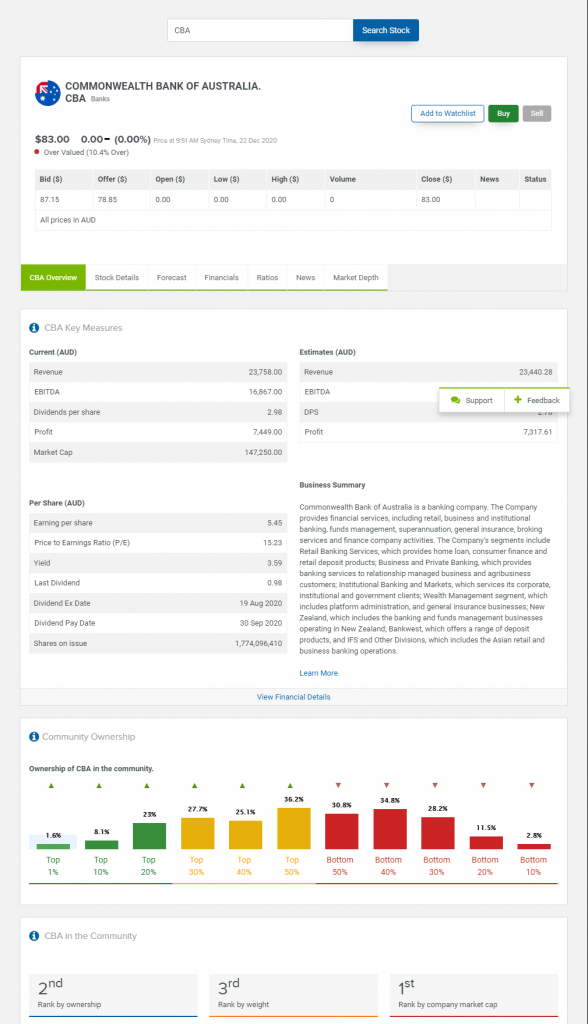

Inside the app or site, there is a bit of data you can access on an individual stock or fund.

Here is what a snapshot of CBA looks like

As you can see there is plenty of info for find on the CURRENT state of the stock.

There are some tabs you can click through to find how the pasy few months or years have performed.

Also notice down the bottom the coloured charts. This shows off one thing SelfWealth like to do and that is demonstrate what the community of other users are owning.

Community and social networking is big for SelfWealth trading and you'll find frequent signs of what other users are doing as you research and use the site.

Personally, I stick to Sharesight for most of my past performance research but this info is helpful for quick, light access to pricing.

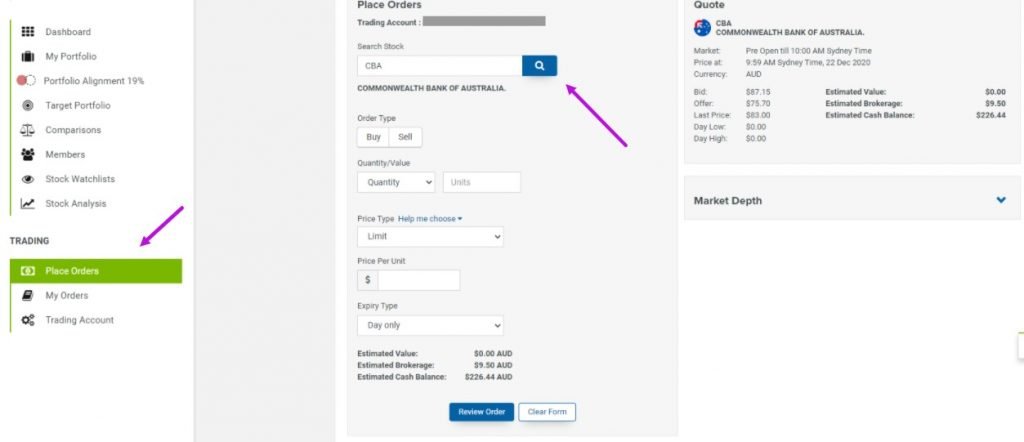

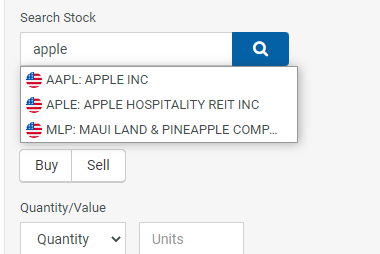

How to trade

Trading is the name of the game and this is what I use SelfWealth for 85% of the time.

What you are looking for is the Place Orders menu.

Youll then see this screen appear. All you need to do next is search for you stock of choice.

What happens next is up to you.

- Set weheter to buy or sell

- Say whether you will by a quanity of stocks or a set value

- Determine the price of limit of each stock you want

- Set the expiry either for that day only or until completed

On the right of the screen you will see a summary of the transaction as you change parameters.

You will need to have the money in your account ready to go PLUIS the $9.50 trade fee.

This is different to other brokers ike CommSec who can take trades without you having the full amount in your account.

You might need to play with some options here to get the transaction to look how you want. Changing the price of units bought or value invested can be tweaked until you see the right options in the summary.

Also, note that if you are using the market price then you will not be able to be 100% accurate in the price you get. You might want 200 units at $10 but the market gives you 200 units at $9.68. So while you expected to spend $2000 you ended up using only $1,936. This happens.

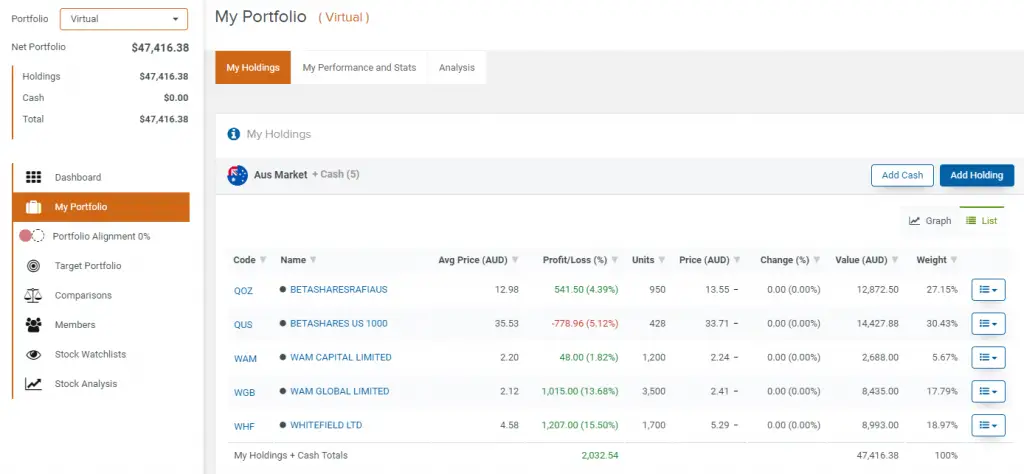

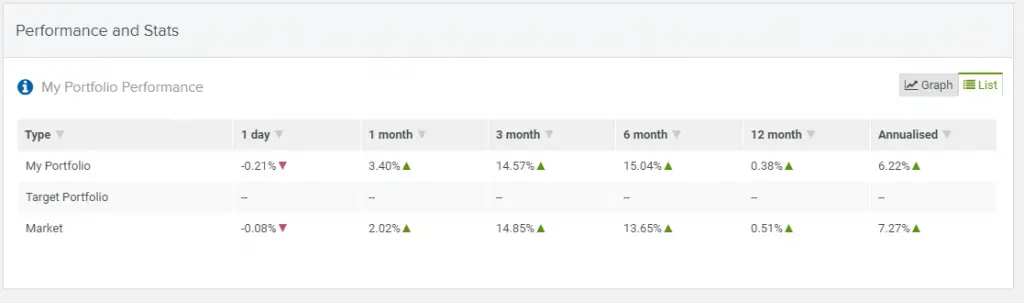

Post-trade management and performance tracking

Once you move or add holdings into SelfWealth then you can start to look at your portfolio.

Here you can see the overall perfomance of your portfolio.

Here I have a screenshot of a virtual portfolio. This is something you can add as a way to simulate building something without the necessary funds.

You can see a good overall high-level view of your stocks in a few different ways.

Transaction history

Useful for tax time or looking back at your history the track.

There is a full list of everything youve bought and sold in a nice clean view.

It'll also show you cancelled or failed trades that didn't end up going through.

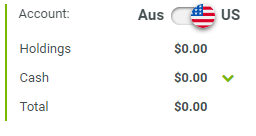

Yes you can trade US stocks with SelfWealth

I also trade US stocks using Stake, which you can read about here.

You'll notice a little toggle in the top left of your account area.

Click on this to flick between your ASX stocks and US ones.

Before you start thought you will need to setup an account for US trading, which can be done all in the SelfWealth account area.

Trading is $9.50 USD and you will need to operate within the US time zones which means here in Australia you will need to be awake from around 11pm to 6am on the east coast to actively trade (unless its a limit order).

To start trading in US stocks you will need to transfer currency to your USD cash account so that it shows in your newly created trading account.

It can take a couple of days for everything to move around, but doing it once will give you an idea to the effort required.

Best way to use SelfWealth as an online broker

Ok, so now you have an account and can pull the trigger on trades. How might you want to use the tool?

Here's a couple of ways I use it to buy and sell.

Drop in a lump sum

A lump sum is a large amount of maybe an odd amount of cash you have available to invest. Odd being that its not something you get often.

Could be a tax return, bonus or gift.

I infrequently receive these and might look to invest this in shares with some or all of it.

All I need to do is transfer the money to the platform and execute a trade.

Could be one trade, could be multiple.

I spend a bit of energy finding the right investment at that time. Could be adding more of what I already have or going in on something Ive been watching for a while.

After I'm done I move on and leave that lump sum invested and hopefully growing.

Regular investing

A more automatic way to invest is regularly. While you cant easily set a trade to happen at a regular interval the way investing apps can, you can automate money being sent to your trading account.

What I've done before is set an automatic transfer from my bank account to my SelfWealth trading account.

When my trading account fills up to a certain account, I would then hop in and complete a trade. This is to keep costs down of frequent trading.

For example – I send $250 a month to my SelfWealth account. After 4 months I have $1000 ready to invest. I invest $1000 in an ETF. It costs 9.50 and Im done for another 4 months.

Over the year I save $250 a month, Invest $1000 3 times and spend 28.50 in trading or .95% as a percentage of your $1000 investment.

If you traded every month instead then you would have had to pay $9.50 each trade. That’s $114 in total over the year. So yes your money is not invested as long if you do infrequent trading but you are saving on the costs of trading.

You will also need at least $500 to trade on SelfWealth so filling up your trading account with regular transfers (consider it like saving) helps.

Taking SelfWealth to the next level

So you can use SelfWealth trading as a lean, capable online broker. There are also a few features you can use if you want to or have more time.

Think of these options like grabbing something at the convenience store after filling up your car (if filling up your car was the equivalent of investing).

Virtual Portfolio

These are fun to use in a number of ways.

You can setup a virtual portfolio where you can build up and “manage” investments as if you owned them.

It’s an interesting way to look at stocks or investing, in particular if you want to practice “owning” them.

I setup a virtual portfolio of a few stocks I liked the look and put $10,000 into each. What I could do over the next few months is see how they tracked as if I owned them. Looking at the graphs, the numbers and returns.

It’s probably not the best way to do research, or a good guide on what investment decisions to make but something you can setup as a benchmark for a target portfolio you might have.

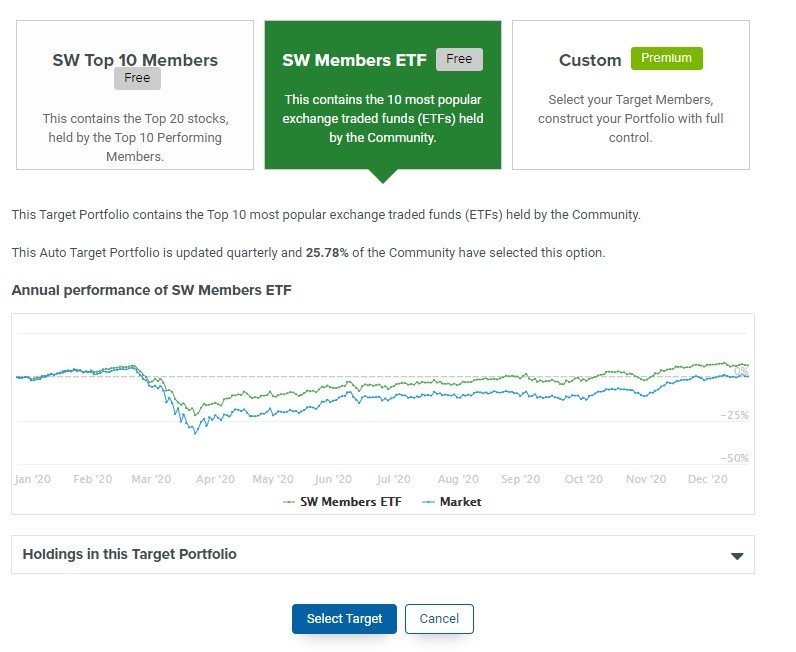

Target Portfolio

This is where the social aspect of SelfWealth premium kicks in.

You can set a target portfolio that you want to aim for. IF you set this SelfWealth will show you what you need to buy and sell to get closer to this portfolio mix.

This seems to be a popularity thing, where you match your portfolio with what others are doing. Not the best way to make investment decisions but is a potential options that some do (copy the winners).

With a premium account you can set a custom allocation of stocks you’d like to reach which is actually pretty useful.

What this would do is guide you every time you wanted to trade so that you know exactly what to buy or sell. It avoids you needing to think if you want to automate the investing process, with less decisions to be made for each trade.

Social Networking and the premium product

Speaking of premium accounts, there are membership options for all SelfWealth users.

You start off with a free account and 90 day trial to a SelfWealth premium membership.

This normally costs $20 a month.

Personally, I don’t have this membership as I most of the features I use through Sharesight in my paid membership there.

Sharesight is big on the social sharing aspect, so in SelfWealth premium you can research other members and see what trades they are doing.

I find this kind of info a bit distracting. It’s not helpful for me to know what other random, anonymous members are doing. I keep my research and strategi thinking outside of the trading platforms I use.

You also get access to “advanced” stock research. This space is competitive, so while you can opt in there is also Sharesight like I mentioned and tools like Morningstar that you can pay for.

If you want to be involved in a more social trading platform, then SelfWealth is ready for you.

Premium accounts also might be tax deductible.

So while they want to hook you in with low cost trading, they really want you to trade knowledge as well as shares.

SelfWealth Kids Share Trading Accounts

Playing into the hands of the many many parents that want a way to invest for their kids, this is no doubt was an in demand feature that SelfWealth have released.

You the adult will then be the trustee and that account will function as normal like any SelfWealth share trading account.

The difference is that when the child turns 18, the shares held in the name of the trustee (you) can be sent to the child (who is now an adult).

There are tax implications to consider, but this is a much easier and more convenient way to start investing for your kids.

Conclusion

There is what you need to know about SelfWealth and how to get going. It's a cheap, well featured online trading platform that I use and am happy to recommend.

Be sure to pick up your 5 free trades if you don't have an account yet, which can save you $47.50.

For me, since its my main broker that I use for direct ASX and US trading I think its one of the best online brokers in Australia.

Bu if online brokers seem a bit daunting for you there are always investing apps that can help you get onboarded a bit easier.

If there's anything I've missed in this SelfWealth review then let me know

Thanks for the review Tim! Great to have you as a member!