Investing in ETFs can be an easy to manage, low-cost option for investors new and experienced.

They are a great way to start investing in the stock market or just make it simpler to manage what you invest in. I know this as I've used ETFs to invest this way (starting out and simplifying) and continue to do so which has made a big impression on how you can build wealth over time.

Knowing that you want to invest in ETFs is one thing, but what about working out which of the 100s of ETFs available to choose from?

It can be really confusing to be making the decision of “which one” especially if a beginner, but no need to stop the momentum now. This guide will give you a better understanding of what all the lingo means, some ideas on specific ETFs you can pick from, and how to make a confident decision.

It's a bit like picking what brand of car. They all have similar features, but sometimes you'll find there is one that just feels more right. I've taken most of the ETFs I'm about to mention for a test drive and have been an owner in most either previously or currently.

How do I choose my first ETF?

When choosing your first ETF, think about your investment goals and the amount of risk you are comfortable with. You may also want to consider the fees associated with the ETF and the past performance of the fund. A good place to start is by looking at ETFs that track a broad market index, such as the S&P 500 or ASX200.

Another thing to consider is the type of ETF you want to invest in. Some ETFs focus on specific industries, such as technology or healthcare, while others focus on specific regions, like the USA or Europe. This is useful to think about because it will help you choose an ETF that aligns with your goals and comfort level.

The last thing you want to do is pick and ETF then follow its journey and realise you don't like to invest in Australia, Europe, Technology or healthcare for example. This is also whey it's handy to start small and not go all in with your life savings early.

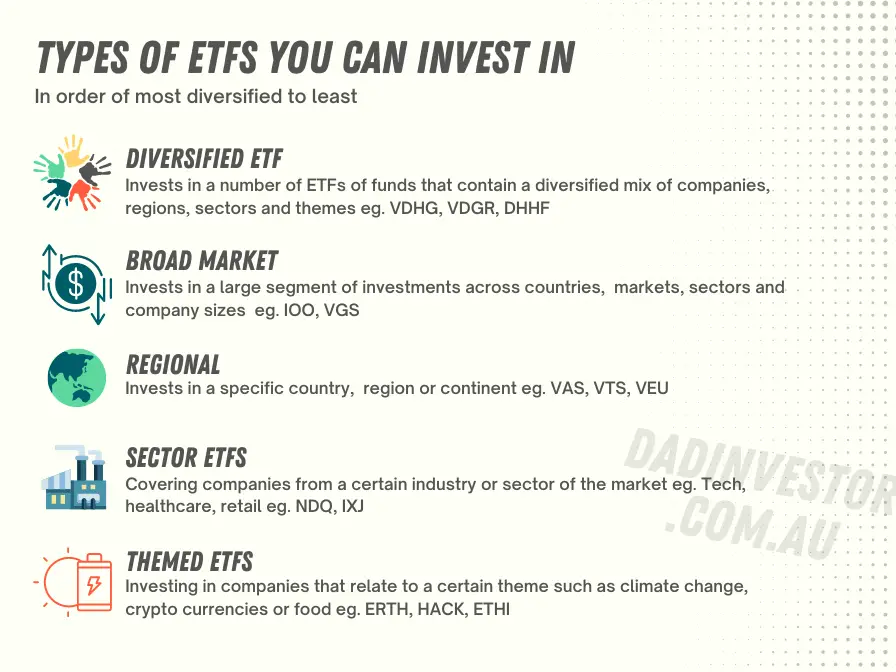

What type of ETFs are there?

There are many types of ETFs to choose from including broad market, sector or country. Broad market ETFs cover a wide range of companies across multiple countries and sectors giving you great diversification and some of the most popular like IVV, VGS or IOO. Sector ETFs hold stocks from a specific industry or sector like technology (NDQ), healthcare (IXJ), or energy while region-focused ETFs hold stocks from a specific country, like the United States (VTS) or China (IZZ).

Another type of ETFs you might see in titles is large-cap, mid-cap, and small-cap ETFs. These focus on companies that are a certain size in terms of value, with Apple or Amazon being examples of large caps and lesser-known companies in the mid and small-cap ranges. This can be useful if you want to focus on a specific market size as some smaller companies have a bigger potential to grow but then large caps have a better track record.

Which ETF to buy for beginners?

For beginners, it's a good idea to start with an ETF that tracks a broad market index like the ASX200 (VAS), or a diversified ETF (VDHG) that holds a mix of different stocks, bonds, and other investments. This way, you can get a good idea of how the stock market is performing and you can also diversify your investments, which means spreading out your money across different companies and markets. This can help lower your risk as you start out and understand how it all works.

It's always a good idea to consult a financial advisor or professional before making any investment decisions, as they can help you understand the risks and benefits of different ETFs, and help you choose the ones that align with your investment goals and risk tolerance.

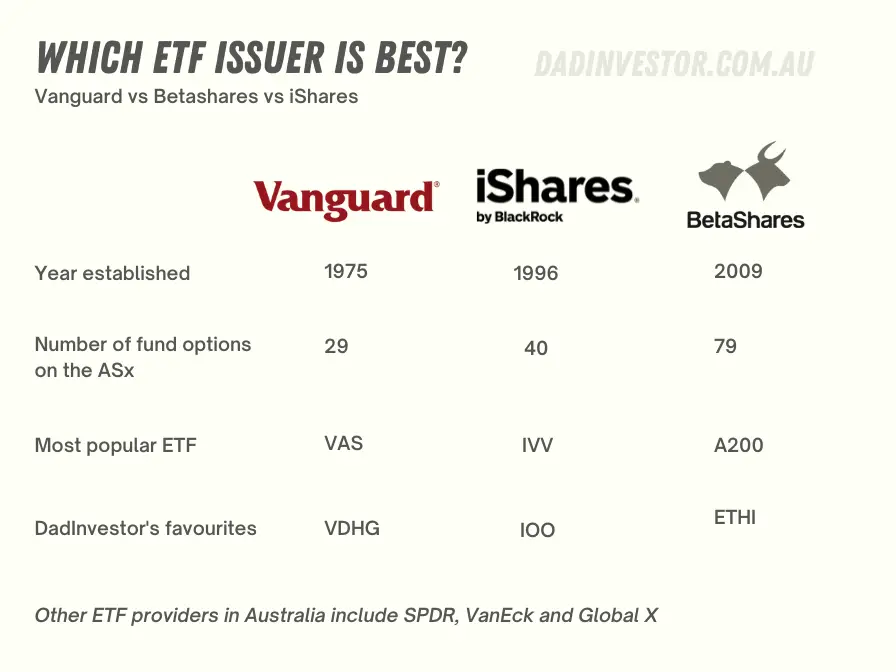

What are ETF providers or issuers?

ETF providers, also known as ETF issuers or ETF sponsors, are companies that create and issue exchange-traded funds (ETFs). These providers are responsible for managing the assets or companies that are inside an ETF, determining how much or what is in it, and issuing shares of the ETF to investors. Some of the major ETF providers in Australia include Vanguard, iShares, and Betashares.

These providers offer a wide variety of ETFs that track different indexes, sectors, and asset classes. Some providers may specialize in certain types of ETFs, such as sector-specific or international ETFs. They also vary in size and experience, some being large, well-established companies (like Vanguard) with a wide range of offerings, and others being smaller firms that specialize in niche products (like Betashares).

We can go down a rabbit hole pretty quickly of all the areas each of these ETF providers focus on, but for now, we will give you perspective. In some ways, the providers are like your supermarkets and within each is a range of products that they make and sell.

Who is the best ETF provider?

It's hard to say who is the “best” ETF provider as it can depend on individual factors such as your investment goals, risk tolerance, and personal preferences. Some investors may prefer a provider that has a wide variety of ETFs to choose from, while others may prefer a provider with low fees. You might feel that some provider's track record or reputation if a better reason to find the “best”.

For the major providers and Betashares vs iShares vs Vanguard, there are a few key differences that I'll point out.

Vanguard – the most trusted and established name in index funds offer some of the most popular ETFs on the ASX including VAS and VGS. These are broad market ETFs that cover local and international markets with good track records and low costs

iShares – Owned by Blackrock, iShares are more established overseas but offer the cheapest gateway to a solid ETF portfolio with the S&P 500 tracking IVV. This along with my favourite ETF IOO make this a good place to start if you are looking at ETFs that cover the globe.

Betashares – A newer challenger provider that offers more niche-type ETF options. They are trying to disrupt the ETF industry in Australia through targeted products such as NDQ (Nasdaq 100), FAIR (Australian sustainability leaders) or (USD) a US Dollar ETF. These and more are good options if you have something very specific to invest in like climate change, cyber security, batteries or leveraged ETFs which other providers don't offer.

Vanguard and iShares are both US organisations while Betashares is Australian owned and managed.

What happens if an ETF provider goes bust?

If an ETF provider were to go out of business or become bankrupt, it would depend on the circumstances the situation, and the regulations in place. In general, the money used to buy ETFs is kept separate from the company that makes them and is taken care of by another company (a custodian) that makes sure it stays safe. This means that if the company that makes ETFs ever has a problem, the money people invested in ETFs will still be safe.

If an ETF provider does ever go bust though, the ETFs would likely be delisted from the exchange and the ETF would be closed down. Shareholders would be able to sell their shares on the exchange until the delisting, but it would become harder as you need to sell them to someone who wants to buy them on the stock market. Shareholders of the ETF would receive cash or other assets based on the value of the underlying assets held by the ETF at the time of the ETF provider's insolvency.

It's more common for an ETF to close due to low demand. The ETF provider would announce this publicly and at some stage, it would liquidate your shares for you by a certain date if you do not do it yourself and return the funds to you.

This all sounds scary but note that ETF providers are also subject to strict regulatory oversight, so the risk of a provider going bust is considered to be low. The ETF providers I've mentioned are large, well-established financial institutions with significant resources and a good track record.

Picking an Australian market ETF on the ASX

The reasons to invest in the Australian market are that as a local you are investing in the economy of your region and the companies that make it happen, the performance of the ASX has been solid for decades and there are also tax benefits to receiving dividends from Aussie companies (which is known as franking).

Here we are looking for an ETF that covers the Australian stock market. This is commonly known as the ASX200 or ASX300 with the number representing the top 200 or 300 companies on the market (by size).

There are a few options to pick from including VAS, IOZ, A200, STW and even FAIR. FAIR is different as it tracks sustainability leaders from the market so screens out what it deems as unethical companies (such as the big 4 banks).

There are no shortage of ETFs in this space and most will cover the names you hear on the news – Telstra, CommBank, CSL, BHP and so on. For now, I'll look at three that are popular and easily available on many investing apps for brokers.

Comparison: A200 vs STW vs FAIR

I've picked these three to compare as they are all available via online brokers, Raiz or CommSec pockets.

With A200 and STW we have two near-identical ETFs that aim to include the top 200 companies on the ASX with the FAIR ETF which includes only 85 companies that are deemed sustainable and ethical (according to BetaShares).

Wait, where is VAS?

I know many bloggers and investors have a lover affair for VAS, but I don't. I love more concentrated funds. This means those with a higher number of companies miss out of my selections. VAS contains the top 300 companies as opposed to A200 and STW which includes the top 200 only.

BetaShares Australia 200 (A200)

- Size (TTM): $2.7 billion

- 3-year average total return: 6%

- Cost: .07%

- Year Founded: 2018

SPDR S&P/ASX 200 Fund (STW)

- Size (TTM): $4.8 billion

- 5-year average total return: 7%

- Cost: .13%

- Year Founded: 2001

Australian Sustainability Leaders ETF (FAIR)

- Size (TTM): $1.2 billion

- 5-year average total return: 5.1%

- Cost: .07%

- Year Founded: 2017

What the key differences?

For each comparison I'll try and find unique ways these ETFs are different even though they aim to cover the same markets or stocks.

- Cost – A200 cheapest at 0.07% a year, STW 0.13%, FAIR 0.39%

- Performance – FAIR has poorer track record while STW has the longest consistently higher returns.

- Risk – FAIR comes in marginally lower (I'm measuring this by the standard deviation listed which is an indicator volatility)

- Holdings (or companies within the ETF)- STW and A200 have 200, FAIR has around 85

- Size – STW in the billion at $4.7 billion making it faster to buy and sell

- Top sectors – For STW and A200 it's financial services then materials, FAIR healthcare then fin services.

Summary of Aus market ETFs

- FAIR – newest on the block, includes NZ and US stocks lowest standard deviation (15)

- A200 – Cheapest, but little track record compared to STW

- STW – Best performing over time, highest fund size, highest holdings, solid track record

While A200 is the cheapest on the block, STW has been around longer and has better liquidity right now (meaning it's easier to buy and sell). FAIR is an option I like as it's a selection of the more sustainably focused companies in the ASX200.

Picking an International ETF on the ASX

Now we move on to the global ETFs. Index funds that are focused on companies across global markets or really anything outside of Australia.

Which ETF is best for US stocks?

It's hard to say which is the best, but there are definitely some options of what's most popular if that's a guide. On the ASX IVV, VGS and VTS are popular choices for ETFs that have mostly US listed companies in them. VTS in particular has 3991 holdings at time of writing that are all from the USA markets.

Which ETF tracks S&P 500?

IVV is the ETF that tracks the S&P500, which includes 500 large companies from the US stock exchanges. It is one of the most popular and most recommended portfolios to invest in as its well diversified and has a large mix of tech, health care and consumer product companies. IVV is also one of the cheapest ETFs costing only .04% per year or $4 for every $1000 you invest.

What ETFs mirror the Nasdaq?

While the S&P500 covers stocks on both the NYSE and NASDAQ, NDQ (from Betashares) invests in 100 companies from the NASDAQ only. This means you get a portfolio that heavily skewed to tech and software companies that are well known like Tesla, Apple, Amazon and Nvidia.

Comparison: IOO vs IVV vs ETHI

If we stick with the supermarket analogy – we are comparing apples with oranges and pears. They are all fruit (or in this case international focused ETFs) but they do vary in shape and size. We have IOO which is simply the top 100 companies in the world based on size. IVV which is focused entirely on the US markets and ETHI which is another sustainable option.

These ETFs are all available to invest in via Raiz, CommSec Pockets or Stake.

iShares Global 100 ETF (IOO)

- Size (TTM): $2.4 billion

- 5-year average total return: 12%

- Cost: .40%

- Year Founded: 2007

iShares S&P 500 (IVV)

- Size (TTM): $4.9 billion

- 5-year average total return: 12%

- Cost: .04%

- Year Founded: 2000

BetaShares Global Sustainability Leaders ETF (ETHI)

- Size (TTM): $2.2 billion

- 5-year average total return: 15%

- Cost: .49%

- Year Founded: 2017

How do they compare?

- Costs (or expense ratio)– IVV is easily the cheapest at 0.04% compared to IOO at .39% and ETHI at 0.59%. As you can tell the more basic the parameters are for including the companies, the cheaper it is

- Performance – all have made over 10% a year recently, with ETHI being new so only have a track record for 3 years but being the strongest in that time

- Risk – is all very similar with an 11-12 standard deviation number

- Holdings – Both ETHI (200 holdings) and IOO (100) have a smaller assortment of companies compared to the S&P 500 (as the name implies)

- Inception – ETHI is the newest while IOO 14 years and IVV 21

- Size – all in the billions, with the newer ETHI the smallest (but growing fast!)

- Top sectors – ETHI has 26% fin services mostly then 26% tech, IOO and IVV are similar – 22/28% tech then 12/13% healthcare. IVV is all US stocks with others 70% US

Summary of the three global etfs

- IVV – cheaper, more holdings, longest tenure, all US stocks

- ETHI – Newest, highest short-term performance, heavy in financial services, higher dividends

- IOO – smallest number of holdings, lowest risk (marginal)

What you pick here might depend on whether you want the cheapest (IVV), strong, long-term performance (IOO), or a good recent performance from a more sustainable focused product (ETHI). All will provide very good global exposure.

Want to get started investing ETFs? Have a think about using Stake

More ideas for ETFs to invest in

While the Local and international shares are big and good enough to be all you need when investing in ETFs, there is room to look at more focused or specific funds to help you diversify more or add in something more to your interests.

Note that the more specific your ETF gets, the chance of it costing more increases. There is also less to compare it to as it is very particular. But the longer the ETF stays running, the more opportunity it has to perform which will reduce fees and increase exposure to investors.

Here are some more popular ETF types you might want to consider.

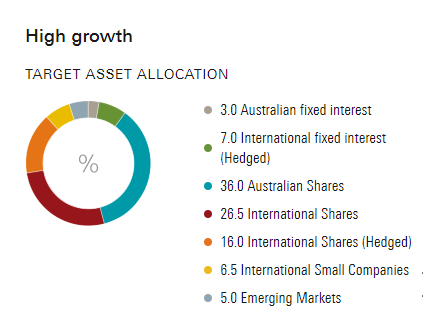

Diversified ETFs (like VDHG)

These are like a group of ETFs in one ETF.

On the plus side, it's all done for you the downside is you get little to no ability to configure what is in your investment. You have to like what is offered.

Some options for diversified ETFs are

- Vanguard Diversified Investments (like your VDHG, VDGR)

- Betashares Diversified ETFS (like DHHF or DGGF)

As you can see these ETFs have a number of funds within them that give you diversification within diversification.

Investing apps like Raiz and Stockspot offer portfolios that are the equivalent of diversified ETFs for you to pick from.

Sector-specific ETFs (like NDQ)

Sector-specific ETFs are a type of ETF that focused on companies in a specific industry or sector of the economy. These ETFs hold a mix of companies within a specific sector, such as technology, healthcare, energy, or financials. Sector-specific ETFs can provide investors with a way to gain exposure to a particular industry, which can be good for those who have a specific interest or believe that a particular sector will perform well.

These are unlikely to be diverse enough for you to go all-in on with your portfolio, but you can add some of these to compliment your mainstream ETFs.

Popular ETFs in this category are:

- NDQ – BetaShares NASDAQ 100 ETF

- IXJ – iShares Global Healthcare ETF

- VAP – Vanguard Australian Property Securities Index ETF

- ERTH – Betashares Climate Change Innovation ETF

Dividend ETFs

A dividend ETF is a type of ETF that focuses on companies that pay dividends, or stronger than average ones. Dividends are payments made by companies to shareholders, usually on a quarterly or half yearly basis, as a way to distribute some of the company's profits. Dividend ETFs typically hold a mix of companies that have a history of paying dividends, and the ETFs are designed to provide investors with a regular income stream from the dividends.

There are some ETFs that do focus on higher dividend payments such as Vanguards VHY which is by far the biggest of this type in Australia.

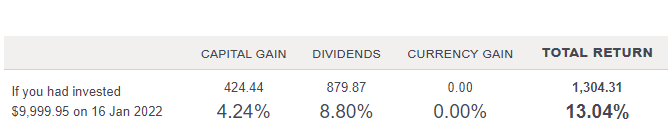

In 2022, the dividend yield for VHY was 8.8% on top of growth of 4.24% which is a nice juicy 13.04$ return for a years effort.

Note though that the standard ASX300 ETF VAS also delivered 8.64% in dividends so the reality is there is not much so say about VHY being that high in comparison.

I personally started my index fund journey via VHY and in hindsight wished I went for a more broader option. While dividends were nice, there was not as much growth which is what I'm after as an investor who doesn't need the income.

Ethical ETFs

An ethical ETF is a type of ETF that focuses on companies that have a strong environmental, social, and governance (ESG) profile. These ETFs typically hold a mix of companies that meet certain ESG criteria, such as those related to environmental impact, labour standards, and corporate governance. These ETFs can provide investors with exposure to companies that are considered to have a positive impact on society and the environment.

I've already mentioned ETHI and FAIR for ASX ESG ETFs, but there is also:

- RARI – A well established ETF or responsible companies

- VETH – Vanguards ethically consious ETF of Australian Shares

- ESGI – International Sustainable ETF

- WXZ – World Carbon Control Fund

As you can see there are ESG themes that cross over your broad market indexes. So if you wanted an Aussie ETF but also something ethical then these are options of a two in one.

I've explored more on what it is to invest ethically and some more options for investors in my guide on the topic.

What factors to consider when picking an ETF to invest in

As much as I can easily provide you more and more ETFs to consider, its important that you make your own decisions that you can stick with. Here is a list of a few considerations to make before you can ultimately land on an ETF to invest in.

- Ongoing charges: ETFs have ongoing charges, also known as expense ratios, which are the annual fees that are deducted from the returns you recieve to cover the costs of managing the fund. These charges can vary among ETFs, so compare the charges of different ETFs and consider how they will impact your returns over time.

- Fund age: The age of an ETF gives an indication of the ETF's track record and the experience of the provider or issuer. An older ETF with a longer track record may be considered less risky than a newer ETF with a shorter track record.

- Performance: Past performance is not a guarantee of future results (heard that before?), but it can give an indication of how an ETF has performed in the past and how it may perform in the future. I usually look at 5 year performance at a minimum .

- Sustainability: Consider if an ETF aligns with your personal values and if the criteria for determining which companies meet the ESG criteria align with your beliefs.

- Income: If income is an important factor for you, look for ETFs that have a focus on dividends or other forms of income, and to compare the income streams of different ETFs to determine which one is more suitable.

- Provider or issuer: A well-established provider or issuer with a strong track record and a good reputation can be considered less risky than a newer or less established provider or issuer. Also consider if the provider or issuer has any specific focus, such as ESG or a particular industry and if that aligns with your values.

How do I put together an ETF portfolio?

You can buy ETFs easily through an online broker or use an investing app to build a portfolio of ETFs. It all depends on how hands on you want to be:

- To buy ETFs on the ASX then consider SelfWealth

- To buy ETFs overseas via the US markets then look at using Stake

- To build a portfolio of ETFs you can use the custom portfolio option in Raiz

Moving forward with ETFs

There’s a breakdown a few ETFS available in Australia right now. As I've said, there is a lot.

When it comes to making a decision on your first one, then why not start broader and then get more niche as you get more experience. That's what I would suggest to anyone making a start with ETFs. Think big, get into the market, then if you're happy leave or or else go again.

It took me a while of buying and selling a few different types to find one I really wanted to own and hold.

Keep reading with my investment strategy guide, how to start investing or just join my course and let me guide you through it.