As someone who has chopped and changed banks over the years, I think I have a pretty good grasp on what to look for in a quality everyday banking experience.

You don't just want “a bank”, but a tool that gives you easy, low-cost access to your money when you need it. The speed to move it around and a nice interface to do it all in.

Comparing banks by numbers such as how much interest they pay is one way to determine which online bank you should use, but there are many more factors that play a part in what's best.

This article will compare two of the most digitally savvy banks in Australia – ubank, and UpBank. These are two of the last neo banks that have emerged over the last years as competitors to traditional banks.

Referral codes for ubank and Up Bank (April 2024)

- For uBank, get a $10 bonus when you download the app to create a free account here using code PM5BLA6 and make 5 purchases within 30 days

- For Up Bank, receive a bonus of $15 when you create an account here

Introducing ubank and UpBank

Both these banks are what you can call modern “neo” banks. App-based products are trying to offer better banking in a non-traditional way.

Up Bank is a spin-off of Bendigo Bank which owns the bank, but you'd never know as the appearance and brand is completely unique.

It has a focus on building banking from the ground up and trying to be different but improving the way you like to manage your everyday money.

ubank has been around longer and is owned by Nab. In 2022 it merged with 86400 which was a banking startup. The combination of original uBanks competitive fees and rates along with 86400 fintech stack make it a really cutting-edge banking tool.

I personally hold accounts for both these banks, using uBank for years and UpBank more recently. I've spent a bit of time exploring all the features and using it as a regular Joe on an everyday basis to see if they really do offer better banking experience.

One thing they both do really well is offer great rewards to those that open new accounts

Get money when you create an account with Up Bank or uBank.

Both banks offer cash incentives to create an account

- For uBank, get a $10 bonus when you download the app to create a free account here using code PM5BLA6 and make 5 purchases within 30 days

- For Up Bank, receive a bonus of $15 when you create an account here

ubank vs Up Bank: Features

Both uBank and Up Bank have your standard banking features. You have the ability to create a transaction account with attached debit card and savings accounts that pay interest. There are no fees to open and hold an account, while both banks are digital only – meaning they don't have physical branches.

While the core banking features are similar, each bank has their own unique features on top.

Up Bank offer a 100% app only experience, which additional features such as:

- Automatic spending categorisation (to track your spending)

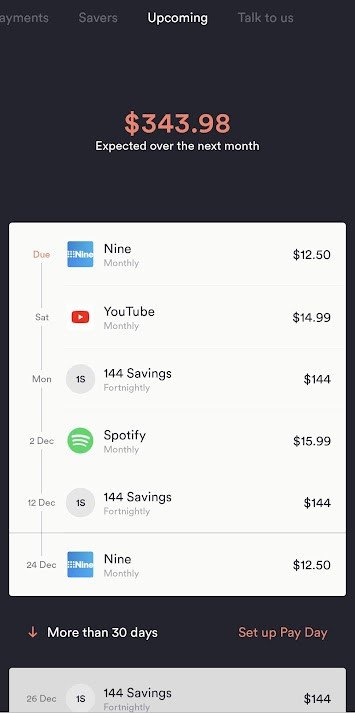

- Bill prediction (knowing when your regular bills might be due and for how much)

- Purchases made show logos next to them (rather than just a label of the business)

- Transaction and balance notification

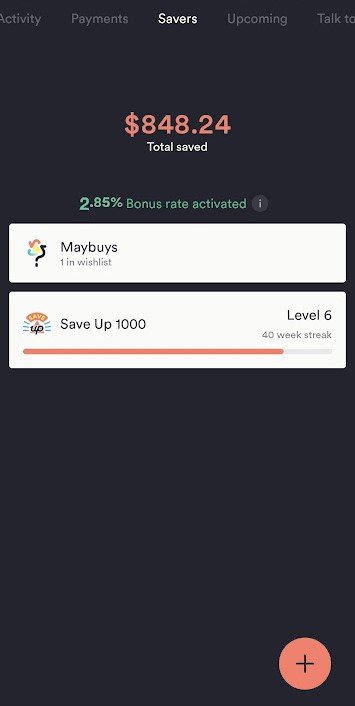

- MayBuy – Share a product with the Up app and it will save it there so you can save money for it.

- Savings challenges – helping you save each week when you can or want to

- No fees on international purchases, or added conversion fees

- Pay splitting – Send specific percentages of your pay into savings accounts automatically

- Digital card, Apple Pay and Google Pay connectivity

- Ability to Bank @ Post – deposit a cheque or withdrawal cash directly with your post office

- A live and vibrant brand

- Complete transparency on what they offer and what they will build (see the roadmap)

- Weekly and monthly spending summaries

As you can see there are plenty of extras that Up bank offer. It's best to experience them in the app themselves and you may not be using them all but it does mean there is plenty to offer depending on your stage of life.

I would say that the current setup of features for Up is aligned to younger adults and those that need help saving to sticking to budgets.

Oh, and their primary colour is bright orange – which is the obvious on the debit card you will get.

uBank also have a fair few feature that take it beyond the everyday bank. It does all this using bright neon teal as its main colour (colours are important cause you'll be spending a lot of time looking at them in the app):

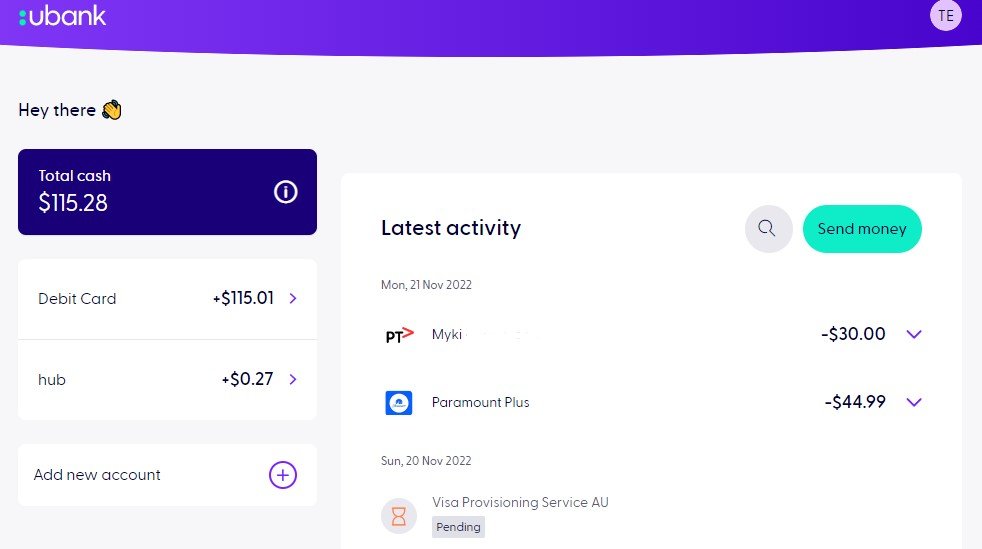

- Connect with other banks to see the big picture of your finances in the one app

- Access your account from any devices – desktop or mobile

- Competitive home loan rates

- One of the best interest rates for savings accounts, changing quickly after RBA announcements

- Savings charts and graphs of how your accounts are growing

- Summaries of how much money goes in and out of your account each month

- No international fees for overseas or online payments

- Spending insights and predictions – knowing when your subscriptions are due

- Digital card using Apple Pay or Google Pay

- Get a welcome bonus of $20 when you spend 3 times on your new account

- Spending footprint – see how much you're spending at your favourite stores and food spots

- Spending search

- Set savings targets

- Turn notifications on and off for things like when you get bonus interest rates or pay day

Ok thats another long list of features.

uBank seems more traditional than Up Bank but they are plenty savvy with their tech and do provide convenience along with really good interest rates if you have a home loan or just want more when you are saving.

The bolded points are strictly unique to each bank or its app, showing some difference between the two.

I keep going back and forward between the two trying to find which one is better. We probably need to drill down even further to see how they compare on a regular basis.

ubank vs Up Bank: App, design and ease of use

Where both of these banks excel is through their functional and effective design.

Both Upbank and uBank have thought a bit about how you actually want to use their apps and how to present the information so it can help you manage your money.

Features like showing the logos of the companies you make purchases with are small but important additions. Even basic descriptions of transactions are better than most banks, for those instances where the company differs to the trading name.

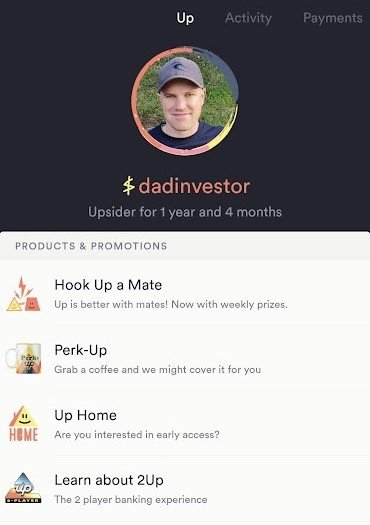

Up Bank is an app only bank so its literally the only way you can interact with them. They don't even need you to login to use most of the features in the app, which makes sense since you need to verify to unlock your phone if set anyway.

Getting around the app is a bit different as well. There is no menu, you just swipe left and right to get to the different areas of the tool, which is different but once you adjust it feels comfortable. It can be annoying though when you are on the first page of the app and need to get to the sixth, having to swipe five times to get there.

The pages or areas of the UpBank app include:

- Your profile page, containing news, alerts and settings

- Activity – for all your transactions and insights on spending

- Payments – where you can send money and your most recent direct transfers

- Savers – list of your savings accounts

- Upcoming – Up will remember your recurring bills or subscriptions and list when they are due

- Talke to us – Support and instant help (that I havent needed yet)

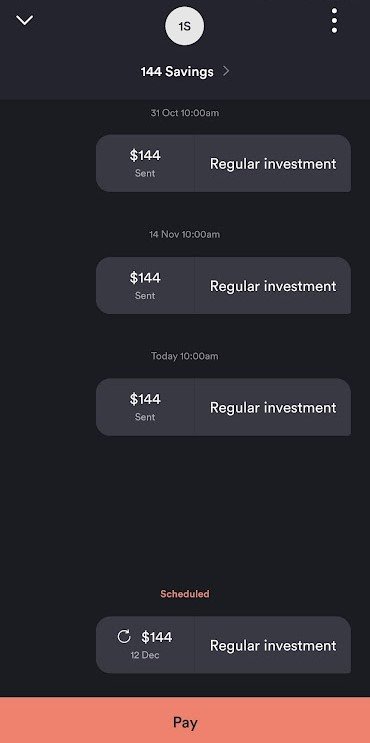

One unique feature that UpBank introduced with their app is their conversational type transaction history for transfers you make. It makes payments that come in (like your salary) and got out (like paying back a mate) look like your message history. Its easy to identify the time and amount moved, which is much different to your basic table format.

Overall the UpBank feels very different to any other traditional banking app, and with its orange and charcoal colour scheme will feel right at home on your phone. Hard to fault.

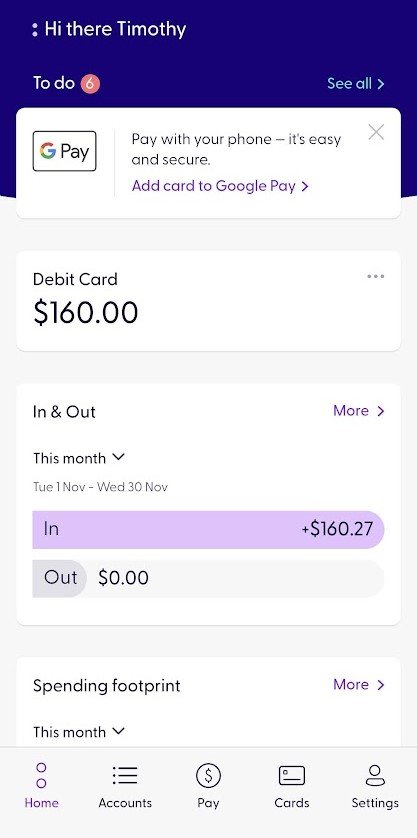

uBank's app and design look's bright and clear, showing that it is a mobile first bank.

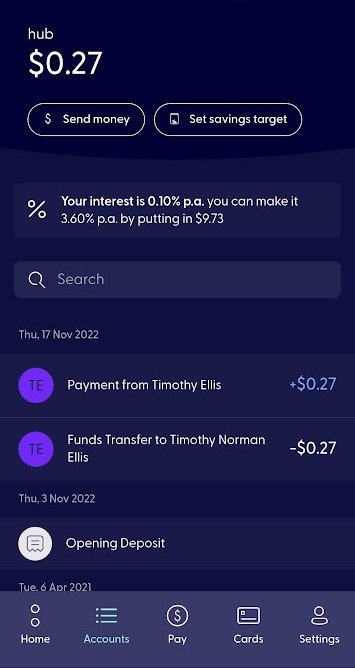

Every time you open the app you will need to verify, leading you to a summary page. This includes your balance (of any account you like) along with money gone in and out of your account for the month, making it quickly easy to identify activity.

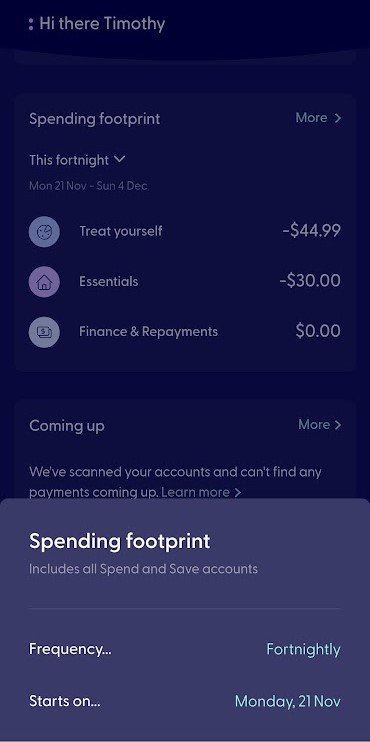

The page goes quickly into your “spending footprint” or what is uBank's way of categorising spending for you.

Other main pages of the app include

- Accounts page – where your transaction accounts and savings accounts can be accessed

- Pay – to send money to anyone

- Card – Access to your card details, lock it, change ping

- Settings – change to dark mode, setup Pay ID etc

uBank doesn't use gestures the way Up Bank does and after using UpBank's app for over a year, it is sometimes a bit odd to see a swipe not do anything when you try it. uBank has the traditional menu along the bottom of its app for you to move between areas.

A strength in uBank's app is that it allows you to add other bank accounts into it. Yep, you can your Comm Bank, Westpac, ING or ANZ accounts so they show up in the one place. This is read only access but if you want to use an app that combines all your accounts together so you get a good overall picture, then uBank's could be the one.

Another feature that uBank has over Up is that it has a full desktop website. Personally, I like paying bills and doing transfers on my laptop as I just find it eaiser to find emails, bills that way so can see the value in this being available.

Both uBank and Up Bank's app obviously have focused people working on them. They make it helpful and obvious to do the basic functions of banking with you needing to squint, wait for things to load or know how to get anywhere

ubank vs Up Bank: Transferring money

It's a simple task to send money but it's also something you do often so you want it to be easy.

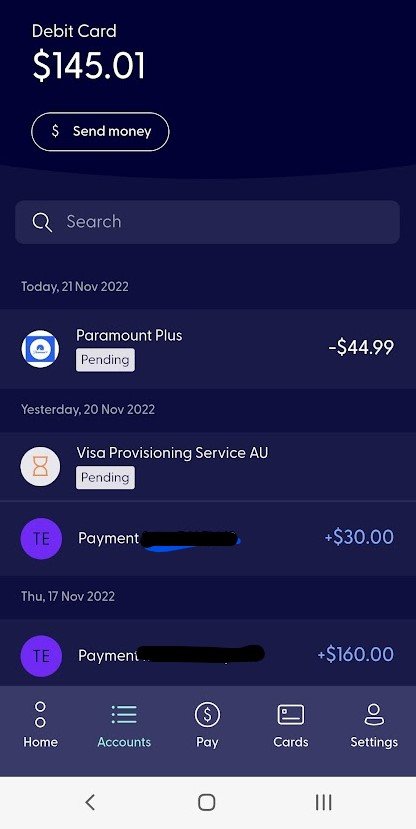

Both banks use their design to make it a clear and focused space to do this. Both dedicate a page o place in their app to do transfers so it isnt hard.

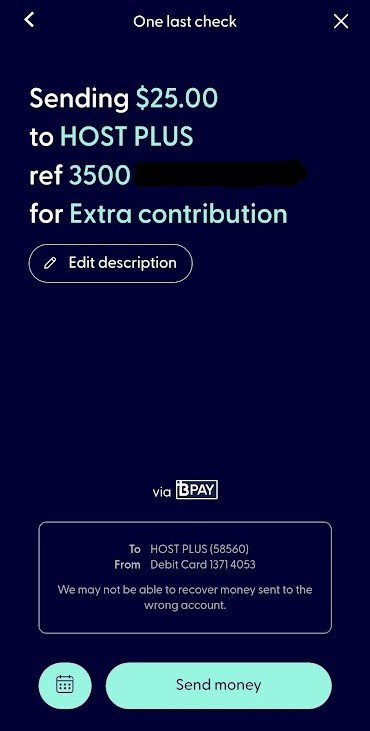

With Up Bank you go to the payments screen, click the plus icon to initiate a payment. The typical options to pay someone do a BPay are there but you can also request money who also has Up banking. This means they will get and notifcation you need them to maybe reimbuse or pay back some cash to you.

Another good feature of this page is a simple list of all transfers made in chronological order. Here you can tap on a payee or someone you paid and see the history of when you might have received or sent payments for that person. This is pretty handy and something that's not available at many banks, where you have to scroll through tables to see what had transferred from the one person or company.

uBank on the other hand has a similar payments page, where you can click on an icon to send money. Features here are pretty standard here for a bank, but they do present the screens in a big and obvious way, using great design to make simple banking easier.

For me, I do prefer the features or Up Bank, but uBank does the design of the process better.

ubank vs Up Bank: Tracking spending

With the rise of budgeting apps, both Up bank and uBank are aiming to add better insights toe their own app experiences.

UpBank has a summary of your spending in your “Activity” page. This includes everything you've done for the month.

Tap on that and you can see money in and money out – including a breakdown of that spending into categories. All your spending is automatically sent to a category like personal, home or transport. It's handy to give you an understanding of your spending habits.

uBank do the same, although they do have some more options to it. They present your money in and out on the first screen of the app. There is an area called spending footpring where you can see your recent spending.

They go further though and allow you to set the time period you want to look at your spending – like monthly, frontghtly or weekly. You can also compare that period to previous ones.

This is a much better way to look at your spending as you can align your spending with something like the frequency you get paid. You can then do a comparison to see if you spent more or less over a similar time frame. True awareness.

So uBank does banking insights a touch better, but it does depend on whether you want to use these features where are more informational than functional.

ubank vs Up Bank: Saving and interest rates

Intrest rates are a big influencer on someone changing or staying with a bank, so let's see how these two compare.

uBank at the moment provides a higher interest rate for standard savings accounts.

It's around .75% higher than Up Bank. uBank is also very quick in changing their rates when the RBA does, sometimes within the day.

So say you were getting 5.10% for your savings account in uBank, Up Bank at the same time would only provide 4.35% (as of Februsry 2024).

That's nearly 20% more interest at uBank.

There are requirements to get this rate for each

- uBank needs you to add at least $200 into an account each month

- Up Bank needs you to complete 5 transactions.

So something to consider, but if you are using the bank for the everyday then it shouldnt be a problem.

The good news for both banks is that the rate is applicable across all your savings accounts. This is a step up from some banks where bonus interest is only added to one account (like ING).

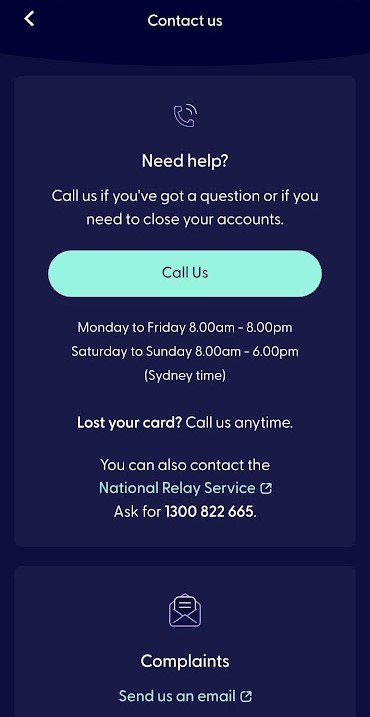

ubank vs Up Bank: Support

I'll touch on support that these banks give you even though I've never had trouble with either.

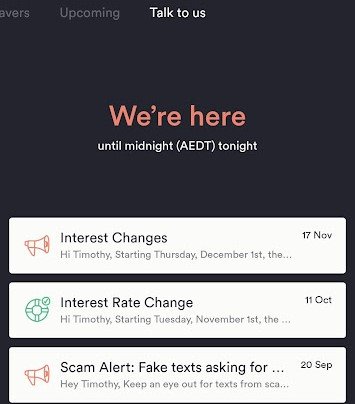

It's more the communication and messaging they provide.

For example, when the interest rates go up or down Ubank generally email you within a day. Up Bank take a bit longer.

uBAnk prefers to email you, while Up Bank will send you in app notifcations.

UpBank does have a nice little chat feature where you can send messages to support so its much more conversational there.

uBank doesnt promote their support as much and prefers you to call or email.

So while uBank has better outgoing communications, it seems easier to contact UpBank when you need.

ubank vs Up Bank: Final verdict

Choosing a bank today is more than picking from one of the big 4.

If you've banked with them before you've probably got a fairly standrad banking experience.

What both Up Bank and uBank do is try to provide you something more than that, and I think they do.

Both do the regular processes of everyday banking, but in a more thought out way. They have built their apps and tools to help you understand more about your money and how to move it around.

But which of these two should you pick if looking to create a new account?

uBank is closer to the more traditional banking experience, but provides better design, spending insights and has one of the best interest rates for savings accounts around.

Up bank is a much more experimental experience. Things seem a bit different, but you find that they work well, and they have some banking features that only they offer.

For me, you really need to hop in each and decide whether they feel right to your personal finance system. Everyone is different and it might even be that you prefer the blue of uBank over the orange of Up Bank!

The great news is you can create an account for either for free AND you can also get a cash credit when you join

- Join UpBank and get $15 when you create a new account

- Join ubank, get a $10 bonus when you download the app to create a free account here using code PM5BLA6 and make 5 purchases within 30 days