Leveraged ETFs have become a popular investment option for those looking to gain amplified returns to stock market performance. They are promoted as a way to earn 2x or 3x what traditional ETF returns might provide.

Sounds like a dream BUT it's not a tool that you can use for set and forget returns. These are different types of ETFs and based on what I've learnt from investing in them the last year there is a bit to know.

In this article, I'll explain what leveraged ETFs are, the different types available, and how to invest in them. I'll also share what I've learnt myself from directly investing in some of them in recent years.

Investing in Leveraged ETFs is a high-risk investment for the brave. It is a short-term, very active investment strategy to implement. As an investor, you need to be confident in your decision-making so you know what to use leverage to capture great gains or else will suffer big losses. I would not suggest this become a core part of their investment portfolio, but for those who are willing to fail fast and learn how leveraged trading is a different way to build wealth.

What are leveraged ETFs?

Leveraged ETFs are a type of investment that aims to increase the potential returns of a stock market index. They use financial tools and borrowing to magnify the gains of the companies within the leveraged ETF each day. They're designed to deliver a multiple of the performance of the underlying asset on a daily basis.

These ETFs typically have leverage ratios of 2x or 3x, meaning that for every dollar invested, the ETF borrows an additional dollar or two to invest in the underlying assets (companies) within the index it tracks.

For example, a 2x leveraged ETF that tracks the S&P 500 index will aim to deliver twice the daily returns of the index. If the S&P 500 rises 1% on a particular day, the leveraged ETF would invest 2x into that index to return 2% on the same day.

Leveraged ETFs are traded on stock exchanges, like regular ETFs, and can be bought and sold throughout the trading day. They offer an easy way for investors to gain leveraged exposure to a wide range of assets, including stocks, bonds, commodities, and currencies.

What exactly is leverage?

In investing, leverage refers to the use of borrowed funds to amplify the potential return on investment. When an investor uses leverage, they borrow money to increase their purchasing power and invest in assets that they might not be able to afford otherwise. Leveraged ETFs provide a way for you to invest in money that has been borrowed by the ETF provider.

Prior to Leveraged ETFs, you could have found stock market leverage through a margin loan. For example, if you have $1,000 to invest and you want to buy a stock that costs $1,000 per share, you can buy one share with your own money. If you used a margin loan, you could borrow an additional $1,000 from your broker and buy two shares of the stock.

The risk there is that you need to pay off the loan and with no guarantee, you will make money there is a chance you need to pay back that $1,000 or whatever you borrowed without much to show for it.

Another example of using leverage to invest is for real estate. There you provide a deposit and use a mortgage to cover the remaining cost of the property. In an instance where the deposit or downpayment is 20% your leverage would be around 5x that (5 x 20% = 100% of the property cost). That means you can gain growth from 5x what you put into the property.

Leveraged ETFs give you the opportunity to leave the process of borrowing money to invest in someone else. You can get instant leverage of 2x or 3x the daily performance of an index without needing finance or large amounts of money.

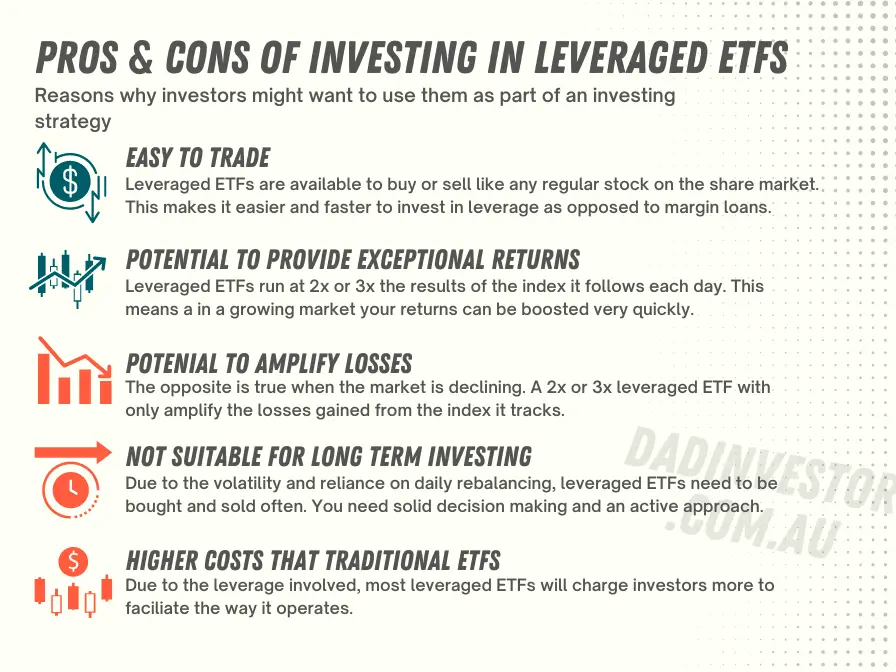

Advantages and Disadvantages of Leveraged ETFs

Before investing in leveraged ETFs, it's important to understand the advantages and disadvantages.

Advantages:

- Can provide amplified stock market returns in a short period of time

- Easy and convenient access to various asset classes or companies (like traditional ETFs do)

- Traded on stock exchanges, providing liquidity and flexibility

- An affordable way to gain leverage in the stock market as an alternative to a margin loan (but are not the same thing)

Disadvantages:

- Potential for amplified losses, which can be significant

- Daily rebalancing and compounding can lead to tracking errors (how much the ETF sticks to the index it follows)

- Higher volatility and risk of losing principal

- Not suitable for long-term investment strategies (buy and hold not suitable)

- High expense ratios compared to traditional ETFs

Why would you be investing in Leveraged ETFs?

They can make you money very quickly. When the market is trending up you can have a leveraged ETF that uses 2x or 3x leverage to multiply the earnings from what the index it follows is providing. It's not uncommon to see leveraged ETFs jump 10% or more in a trading day. The opposite can happen though, and you lose just as much so it's not for the emotionally insecure investor but someone who is well-researched and comfortable with volatility.

Are leveraged ETFs a good investment?

Leveraged ETFs can make you rich, but they can also make you poor. They are high-risk investments that can offer the potential for high returns. However, the risks involved make them unsuitable for the average investor. If you'd prefer to ride a rollercoaster to work instead of a car or train then leveraged ETFs may be for you. Even then you need to be fully aware of the risks and volatility that leverage brings to investing.

Experienced investors with a high-risk tolerance may consider leveraged ETFs, but it is important to thoroughly research and understand the underlying assets and risks involved before investing.

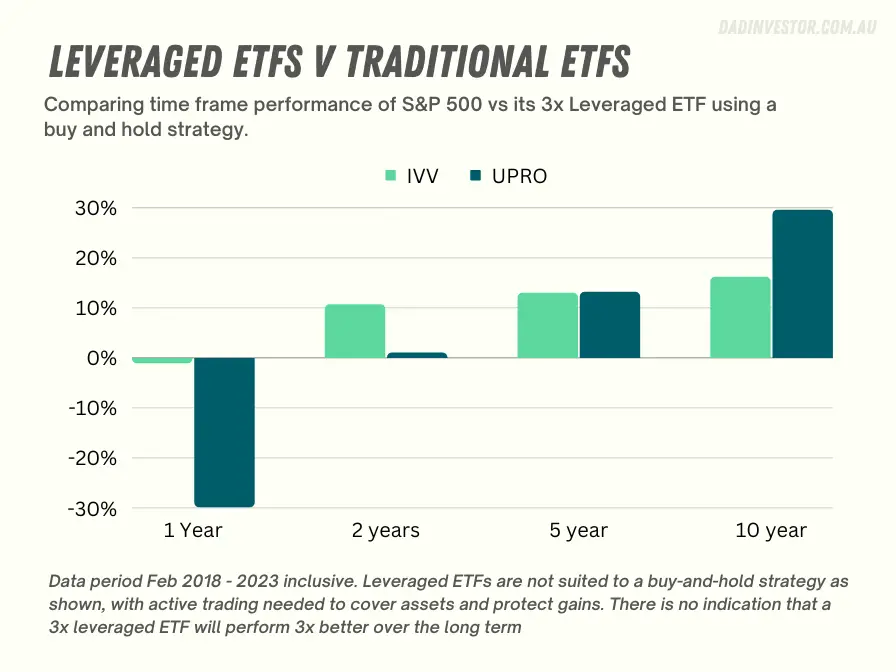

Are Leveraged ETFs Good for Long-Term?

Leveraged ETFs are not suitable for long-term investment and are not to be used in a “buy and hold” strategy. These ETFs are designed for short-term trading and should be used as such. Holding leveraged ETFs for an extended period can result in significant losses due to the compounding effect of the leverage ratio. It is recommended to hold leveraged ETFs for no more than a few days or weeks.

Most guidance for investing in the stock market can be thrown out if you are investing in leveraged ETFs. You don't want to sit back and hold onto what you bought. You don't want to spend little time moving between stocks. All those lessons you might have heard are not applicable when using leveraged ETFs. It's a highly active, highly volatile space to be investing in.

Do Leveraged ETFs Pay Dividends?

Leveraged ETFs typically do pay dividends. Consider that the role of a Leveraged ETF is to amplify the growth of its price, most of it's this gain would come in the form of capital gains rather than dividends. These ETFs are designed for short-term trading and do not focus on long-term income generation.

Can Leveraged ETFs Go to Zero?

Yes, Leveraged ETFs can go to zero. If the underlying assets or companies within an index the ETF follows perform poorly, the losses are amplified by the leverage ratio, and the value of the ETF can quickly drop to zero. This is different to traditional ETFs where it would take underlying assets (companies within) essentially need to fail and go bankrupt for it to go to zero.

Throughout the year, depending on the performance of the leveraged ETFs you will find that they either split or reverse split. This is a technique used by the ETF for a few different reasons:

- If a leveraged ETF grows exponentially then a stock split might occur to keep the cost of the ETF lower

- If a leveraged ETF drops or loses money over time a reverse stock split might occur to keep the price of the ETF above zero (or closer to its target average price)

These are examples of why leveraged ETFs are different to regular ETFs and need investors of them to pay attention and keep a top of changes.

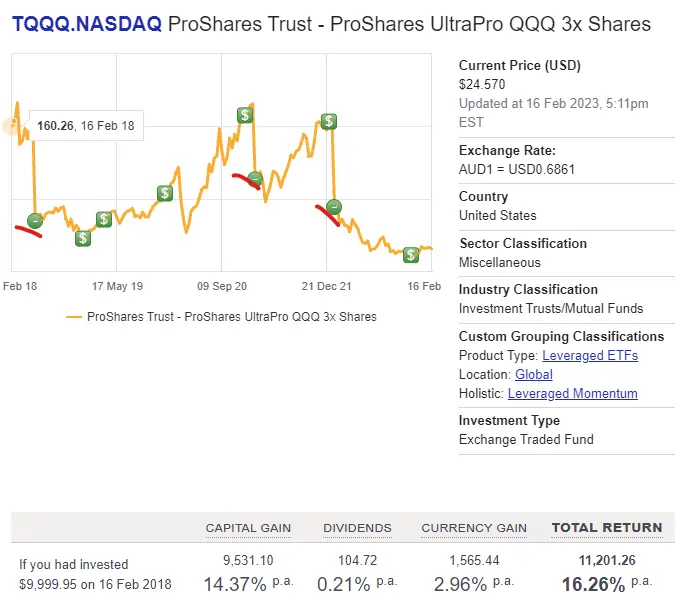

Below you can see the results of popular leveraged ETF TQQQ and how it split stock over time to reduce of ongoing price after significant gains.

Can you lose more than you invest in leveraged ETFs?

Yes, it's very possible to lose more than your initial investment in leveraged ETFs due to the amplified returns and volatility. This is why it's important to manage risk and not hold leveraged ETFs for long periods.

How much can you lose in a leveraged ETF depends on the degree of leverage and the volatility of the underlying asset. In some cases, leveraged ETFs can lose up to 90% of their value in a short period of time. That's why they are best suited for active traders who can manage the risks associated with them.

Take TQQQ again and see it's performance over 2022 where it dropped 50%+

Types of Leveraged ETFs

Leveraged ETFs are still very new the investing landscape, with the first being released back in 2006. Since then the market has expanded to have ETFs provided in the US markets as well as the ASX.

US Market Leveraged ETFs

- ProShares UltraPro S&P500 (UPRO) is a popular 3x leveraged ETF that seeks to provide 3 times the daily return of the S&P 500 index. Other leveraged ETFs that track the S&P 500 include the Direxion Daily S&P 500 Bull 2X Shares (SPUU) and the ProShares Ultra S&P500 (SSO).

- ProShares UltraPro QQQ (TQQQ) is a 3x leveraged ETF that tracks the NASDAQ 100 index, which is heavily weighted toward technology stocks. Other leveraged ETFs that track technology stocks include the Direxion Daily Technology Bull 3X Shares (TECL) and the ProShares Ultra Technology (ROM).

- MicroSectors FANG+ 3X Leveraged ETN (FNGU) is a 3x leveraged ETF that tracks the NYSE FANG+ Index, which consists of 10 highly traded technology and internet companies. These include Alphabet, Amazon, Apple, Netflix, NVIDIA, Tesla and Meta amoungst others.

There are also different types of leveraged ETFs available to investors who want more specifics, including:

- Leveraged ETFs on gold, such as the Direxion Daily Gold Miners Index Bull 2X Shares (NUGT)

- Leveraged ETFs on bonds, such as the Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF)

- Leveraged ETFs on agriculture, such as the Teucrium Corn Fund (CORN)

- Leveraged ETFs on factors, such as the Direxion Daily Financial Bull 3X Shares (FAS)

ASX Leveraged ETFs

In Australia, there are several leveraged ETFs available to investors seeking leveraged exposure to Australian equities.

The BetaShares Geared Australian Equity Fund (GEAR) is a leveraged ETF that aims to provide investors with returns that are correlated with the Australian share market. The fund's exposure could vary from 200% to 286% of the S&P/ASX 200 Index on any given trading day.

Another Leveraged or Geared ETFs provided by Betashares is the Geared U.S. Equity Fund – Currency Hedged (hedge fund) (GGUS) which is similar to GEAR but covers the US S&P500. This trades on the ASX and have found that its not as effective for leveraged as investing in the same market the underlying ETF is in – which is why I buy UPRO via Stake.

Take note the differences in how returns of Leveraged ETFs work (which are different to traditional ETFs)

Leveraged ETFs aim to provide returns on a daily basis, which means that they reset their leverage and exposure to the underlying asset at the end of each trading day. This daily reset can cause the leveraged ETF's returns to deviate from its underlying index over longer periods of time, which is known as compounding or decay.

This is one of the key differences between leveraged ETFs and traditional ETFs, making the strategy and ability to invest in them different.

For example, if a 3x leveraged ETF had 15% of its fund in Apple, and that day Apple jumped 10% then its return in the ETF would be inflated to 30%. It's weight in the ETF might jump to 20%. That may not align with the index the leveraged ETF is following (such as the S&P500) so at the end of the day the ETF is rebalanced back to match the index it follows. This might then take Apple back to its original 15% weight.

What this means is that you can't look at the historical performance of an ETF and think a Leveraged ETF will get you 2x or 3x that. You can't assume that an ETF that returning 15% for the over a year will return 45% if 3x leveraged. The results of leveraged performance are based on daily results, meaning you need to anticipate the return for the day and consider if that will be a positive gain or not.

Another impact of daily rebalancing can lead to compounding effects that cause the ETF's returns to deviate from its underlying index over longer periods of time. Translated, this means while you think you are investing in a leveraged ETF tracking the S&P500, the amounts of each company/asset owned are not as close to the index as a traditional ETF tracking the same one. This is because the frequent rebalancing can cause the ETF to buy high and sell low, which can result in losses that are amplified by the leverage.

As a result, leveraged ETFs are not meant to be held as long-term investments, as the daily rebalancing and compounding effects can cause their returns to deviate significantly from their underlying index over extended periods. Instead, they are designed for active traders who want to take advantage of short-term market movements.

Results of the leveraged ETFs I held and what I learnt.

It's time to reveal more about my exact experience investing in Leveraged ETFs.

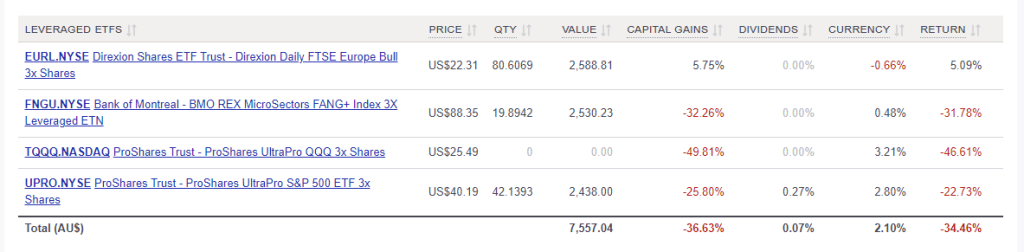

I started in 2021, and have only ever invested in four.

- UPRO

- TQQQ

- FNPU

- EURL

Reasons are they are fairly broad and cover areas that know reasonably well – tech, growth. It's important to be investing in things you understand especially when you need to be an active investor.

I bought and sold often, mostly at least weekly, depending on what the market was doing, what I was reading and a few indicators I kept track of (more of that in a bit).

In terms of exact results, here is how my returns have looked up to early-mid 2023.

It was not intentional, but I did start investing in leveraged ETFs the same time the market was peaking in early 2022 before a downturn.

At the time of writing, I have lost more than I've made but feel like most of the losses were an education into what I shouldn't be doing. Here are some quick thoughts I take away now that I have experienced the leveraged ETF side of investing.

It's a wild ride

Strap yourself in and get ready for something different to what you think ETF investing is. If a standard ETF is a monorail going around in circles, this is a constant rollercoaster. You do a quick lap and then need to decide if you want to keep going to get off.

It's a whirlwind of emotions as well. I went from excited to scared to pumped to anxious to calm accepting to slightly optimistic. I would check the stocks everyday and reckon each time I found a different emotion to feel.

It's completely different to regular investing

While its simple to buy and hold a standard ETF that covers the market without any leverage, once you get geared at 2x or 3x then you really need to be quick and agile in what you can do as well as what you know. I'm not going to say the concept is like gambling, but you need to be a responsible gambler and know when to walk away.

An ETF might jump 30% in one week but then drop 40% in the next. There is no correlation with the past as you are betting on each day rather than a long term horizon like regular ETF investing does.

You need to have some understanding of what's going on

This is really important. If you don't know when to investing in leveraged ETFs then its just a guessing game. The best time to own Leveraged ETFs is when the market is going up. But how do you know that? Well, there are a few indicators that help investors make those calls.

I used a mix of stock market indicators like the below to know when it might be a good day or week to be “in” leveraged ETFs. Google any of these examples to find out more:

- Moving Averages: Moving averages are a popular indicator that helps investors identify trends in the stock market. They average out the price over a certain period of time and can help determine whether the stock market is on an upward or downward trend.

- Relative Strength Index (RSI): The RSI is an indicator that measures the strength of a stock's price action. It can be used to determine whether a stock is overbought or oversold, which can be an indication of a potential reversal.

- MACD: The Moving Average Convergence Divergence (MACD) indicator is a popular momentum indicator that shows the relationship between two moving averages of a stock's price. It can help investors identify trend changes and potential buy or sell signals.

- Volume: Volume is a basic indicator that shows how many shares of a particular stock have been traded. A high volume can indicate strong investor interest and potential price movement.

- VIX: The Volatility Index (VIX) is a popular indicator that measures the level of fear and uncertainty in the stock market. It can help investors determine whether the market is in a state of panic or calm.

I use indicators to tell me if there is a chance the market could be heading up or down. If all the information I have tells me things will grow then I buy but if not then I sell.

These are definitely not fool proof and you still need to provide your own decision making and confidence in what you know. It is an effort though to be ahead of the market and no guarantee the extra effort will be rewarded.

It can be costly

If you are paying often to buy and sell, there may be brokerage costs involved. I benefited from Stake offering $0 brokerage prior to 2023, so that helped significantly. If you are trading weekly and making 2-3 trades when doing so that could add up over the course of the year and need to make sure you are making enough to cover that expense.

When it's good it's good

Oh yeah, it's fun when you make 15% in a day or 80% in a week. The reason I'm i these ETFs if because it's making opportunity of the fact that the stock market has way more good years than bad. I personally treat investing like a game so love to “play” with something so high risk and high reward.

I find its much better than crypto as there is more substance behind what I'm investing in (real companies) with the layer of leverage meaning if you get your research right you can win big.

When it's bad it's bad

It's no so fun the next week your leveraged ETFs drops in half. 2022 was a tough year but it would have been worse if I didn't sell and hold cash for most of it (instead of holding leveraged ETFs). There's every chance I would have lost 90% of what I had if I just sat and held ETFs throughout the year.

Trading Tips for leveraged ETFs

Leveraged ETFs are designed to be held for a short period of time, generally a few days to a few weeks. Holding leveraged ETFs for longer periods can result in returns that deviate significantly from the underlying asset's performance due to daily rebalancing and compounding effects.

It's important to keep in mind that leveraged ETFs are not meant to be buy-and-hold investments. They are designed for active traders who want to take advantage of short-term market movements. As such, investors need to be mindful of the risks and not hold leveraged ETFs for extended periods.

When trading leveraged ETFs, it's important to consider risk management strategies. Here are some tips I found out through experience when trading leveraged ETFs:

- Avoid buying and holding leveraged ETFs for long periods

- Use stop-loss orders to limit potential losses

- Keep an eye on daily tracking errors and rebalancing effects

- Consider diversifying with non-leveraged ETFs and other investment types

- Do your research and stay informed on market trends and news that can impact the asset you're invested in

Vanguard and their Leveraged ETFs

Vanguard decided to stop offering leveraged ETFs in 2013. The company cited concerns about the risks and suitability of leveraged ETFs for long-term investors. Vanguard's decision reflects the challenges and potential pitfalls associated with leveraged ETFs.

Conclusion – For thrill seekers only

Leveraged ETFs offer an easy and convenient way to gain leveraged exposure to various asset classes. However, they also come with amplified risks and are not suitable for all investors. It's important to understand the risks and consider risk management strategies before investing in leveraged ETFs. By keeping these tips and considerations in mind, investors can make informed decisions when trading leveraged ETFs.

My experience tells me that very few investors would be suited to these types of products. It's hard to remove emotions from the investing process and these types of investments will play havoc with them.

I'm still not sure if this is going to make me the type of money, I imagined they could before I started, but will continue to use them as a small, small part of my investing strategy and portfolio.