Have you considered exploring the world of International ETFs? These investing options allow you to access a basket of stocks from markets outside your home country, providing a wider range of companies and industries to invest in.

I've found that some of the best ETFs on the ASX are global or international ETFs and think they are one of the easiest and simplest ways to become a successful, savvy investor.

This article is here to help you understand the potential benefits of including International ETFs in your portfolio. I'll share how Australian investors can benefit from this type of investment and provide all the information you need to make an informed decision.

What are International ETFs?

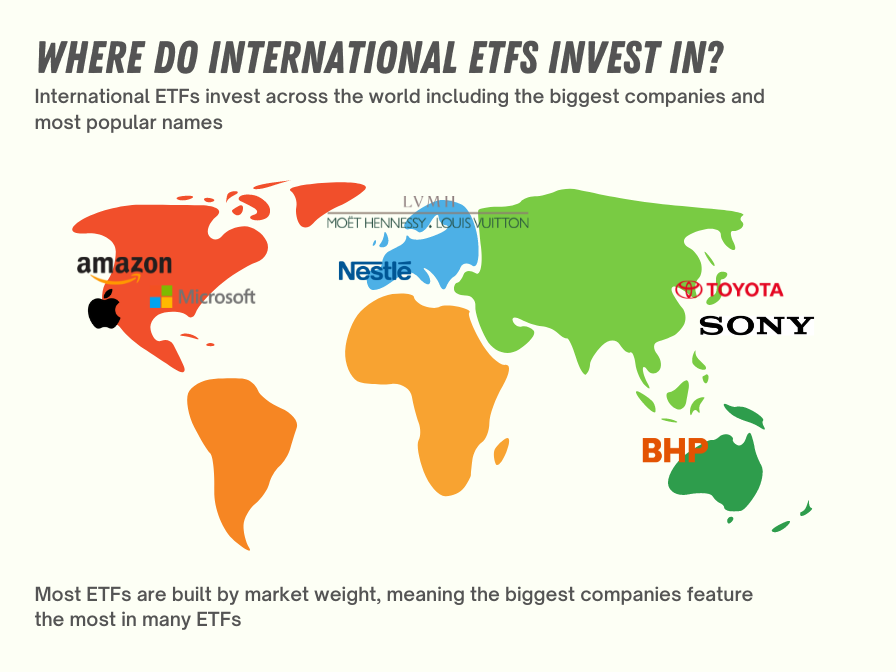

An International ETF, or Exchange-Traded Fund, is a type of investment fund that tracks a basket of securities, such as stocks, bonds, or commodities, from markets outside the investor's home country. These ETFs provide exposure to a range of different markets and sectors, giving investors the opportunity to diversify their portfolios and potentially achieve higher returns.

The history of ETFs dates back to the early 1990s, when they were first introduced to the market as a new way of investing. Since then, they have become increasingly popular due to their ease of use, low costs, and versatility. ETFs have grown in popularity as a way for investors to access a wide range of markets and sectors, both domestically and internationally.

International ETFs differ from other ETFs in that they provide exposure to markets and sectors beyond the investor's home country. For an Australian like myself this means options to invest in all the other regions outside of the nation.

When investing in international markets, it's important to be aware of the added risks. Different countries have different economies and financial markets, which can lead to bigger risks. Before investing in international ETFs, make sure you think carefully about the possible risks involved.

Why Invest in International ETFs?

Investing in International ETFs can offer a range of benefits for Australians looking to diversify their investment portfolio and potentially earn higher returns. One of the key benefits of investing in International ETFs is the diversification it offers to a portfolio. Having a mix of investments across different regions, countries and industries can help to reduce the impact of market fluctuations in any one particular area.

For example, an International ETF may include companies like Amazon, Microsoft, and Alphabet (Google) which are leaders in their respective industries. This diversification can help spread risk and potentially provide higher returns compared to a more concentrated portfolio of just Australian companies.

It is important to note that while investing in International ETFs can offer these potential benefits, it also comes with its own set of risks, and it is important to conduct thorough research and due diligence before making any investment decisions.

Are International ETFs a Good Investment?

Investing in international ETFs can offer a number of benefits to investors, including:

- Diversification: International ETFs is the ability to instantly diversify your portfolio. By investing in stocks outside of your home country, you can spread your risk and potentially reduce the impact of market volatility in one country on your overall portfolio.

- Potential for higher returns: Investing in international ETFs also provides investors with the opportunity to benefit from the growth of economies outside of their home country. For example, if the economy of a country like China or India is growing faster than the economy of your home country, investing in an international ETF that includes stocks from those countries could potentially provide higher returns for your portfolio.

- Ease of investment: Another benefit of investing in international ETFs is the ease of investing. ETFs trade like stocks on a stock exchange, making it easy to buy and sell shares. Online brokers and micro-investing apps, such as Raiz, Spaceship or Stake offer international ETFs as investment options, making it easy for beginner investors to get started.

However, as I keep mentioning there are some risks associated with investing in these ETFs.

- Market volatility: International ETFs can be subject to greater market fluctuations compared to domestic ETFs due to the wider range of investment opportunities.

- Currency exchange rate fluctuations: Investing in international markets also involves currency exchange rate fluctuations, which can impact returns.

Despite these risks, many investors still consider International ETFs to be a valuable investment option. By diversifying investments across global markets, investors can potentially reduce the impact of market downturns in their domestic market and increase their overall returns.

How investing in International ETFs Works

Investing in International ETFs is a straightforward process that involves buying shares in a fund that holds a diverse portfolio of international stocks.

Here is a step-by-step explanation of how International ETFs work:

- Choose an International ETF: There are many International ETFs available on the ASX, each with a different investment focus and portfolio. It's important to spend some time to research the options and choose a fund that aligns with their investment goals and risk tolerance. Go to the sites of ETF providers like Vanguard, Betashares or iShares to explore their options.

- Buy shares in the ETF: Once you have chosen an International ETF, you will need to open an investment account with an online broker like Stake or Selfwealth or a micro-investing app like Raiz or Spaceship.

- Hold the shares: As a shareholder in the International ETF, you have a stake in the underlying portfolio of stocks. Your investment will rise or fall in value based on the performance of these stocks. At this stage you will need to spend time tracking the performance if you want to keep informed.

- Sell shares: When you are ready to sell your shares in the International ETF, you can do so through the same process as buying.

The ASX provides a platform for investors to buy and sell shares in International ETFs. Using an online broker or micro-investing app gives you access to invest in ASX listed ETFs.

ETFs listed on the ASX must comply with Australian regulatory requirements, providing investors with a level of protection.

Vanguard International ETFs

Vanguard is a leading investment company that has built a strong reputation over the years for its commitment to providing investors with high-quality, low-cost investment options. With a focus on long-term investments, Vanguard has become a trusted name among investors looking to build wealth over time.

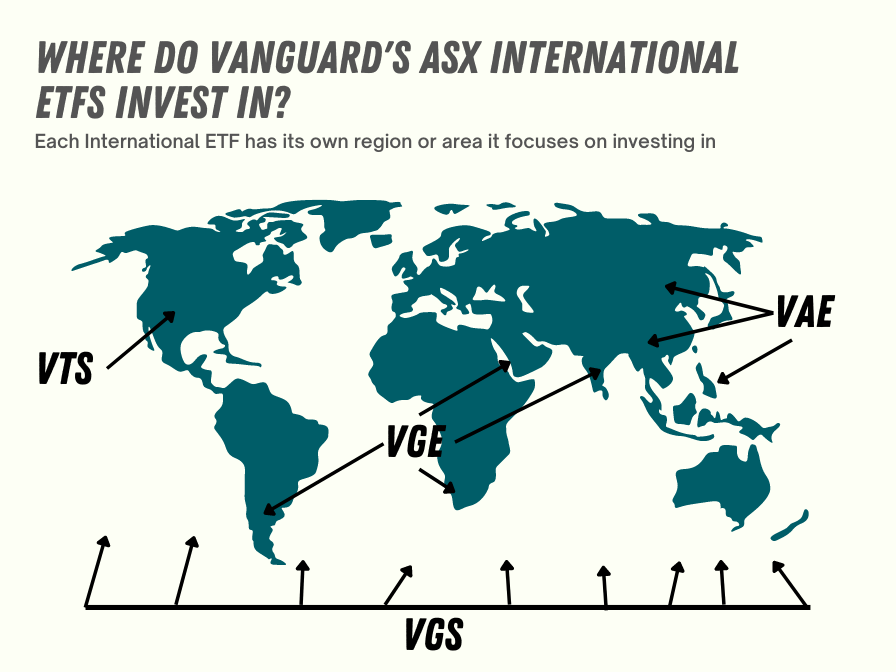

They provide a few International ETFs for the ASX, including VTS, VGE, VAE and VGS.

One of the key offerings of Vanguard is its range of International ETFs, which provide investors with exposure to a diverse range of international markets. These ETFs can be a great way for investors to diversify their portfolios, as they allow investors to gain exposure to markets that they may not otherwise have access to.

The following table provides a comparison of some of the different Vanguard International ETFs available to the ASX investors:

| ETF Name | ASX Code | Description | Expense Ratio |

|---|---|---|---|

| Vanguard MSCI Index International Shares ETF | VGS | This ETF invests in companies from around 23 different countries including the U.S, Japan, U.K, Canada, France, and Switzerland (but not any from Australia). | 0.18% |

| Vanguard US Total Market Shares Index ETF | VTS | The ETF invests in some of the biggest companies in the world that are listed in the United States. | 0.03% |

| Vanguard FTSE Emerging Markets Shares ETF | VGE | This ETF invests in rapidly growing economies such as China, India, Taiwan, Brazil and Saudi Arabia. | 0.48% |

| Vanguard FTSE Asia ex Japan Shares Index ETF | VAE | The ETF provides exposure to companies listed in Asia excluding Japan, Australia and New Zealand. This will include companies from China, India, Korea and Hong Kong predominately. | 0.40% |

In addition to Vanguard's International ETFs, other popular International ETFs include the iShares Global 100 ETF (IOO) and the Vanguard Total International Stock ETF (IVV). Both of these ETFs provide investors with exposure to a broad range of international markets, and have become popular choices among those looking to diversify their portfolios.

Choosing an International ETF

When choosing an International ETF, it is important to consider a few key factors to ensure you are making an informed investment decision. Some of the factors to consider include:

- Fees: ETFs typically have lower fees than traditional mutual funds, however, it is important to compare fees between different International ETFs to ensure you are not paying more than necessary. Some ETFs have higher fees than others, so be sure to research and compare the fees of the ETFs you are considering.

- Performance: The performance of an ETF is an important factor to consider, as it will determine how your investment grows over time. When researching ETFs, look at their past performance and compare it to other ETFs in the same category. This will give you an idea of how the ETF has performed in the past and whether it is likely to perform well in the future.

- Investment goals: Consider your investment goals and what you want to achieve through your investment in an International ETF. This will help you choose an ETF that aligns with your goals and provides the best potential for returns.

There are several online brokers and investing apps in Australia that offer International ETFs, such as Raiz, Spaceship, Stake, and Selfwealth. These platforms make it easy for beginner investors to invest in International ETFs, as they offer a wide range of ETFs to choose from and provide information and resources to help you make informed investment decisions.

Dividends in International ETFs

Dividends are payments made by a company to its shareholders, typically in the form of cash, as a way of sharing its profits. Many investors look for stocks or exchange-traded funds (ETFs) that offer a steady stream of dividends as a way to generate income from their investments.

To get a sense of the potential dividend yield of an International ETF, it's important to compare the dividend frequency and yield to those of Australian market ETFs. On average, Australian market ETFs tend to pay dividends on a quarterly basis, with a yield of around 4%. However, the dividend yield for International ETFs can be lower or higher, depending on the specific ETF and the markets it invests in.

To help you get started, here is a comparison of some popular International ETFs that offer dividends:

| ETF | Dividend Yield (12 months to Jan 23) | Frequency |

|---|---|---|

| Vanguard MSCI Index International Shares ETF (VGS) | 1.71% | Quarterly |

| iShares Global 100 ETF (IOO) | 2.02% | Semi-Annual |

| iShares Core MSCI World Ex Australia ESG Leaders ETF (IWLD) | 1.32% | Semi-Annual |

| iShares S&P 500 ETF (IVV) | 1.39% | Quarterly |

It's important to keep in mind that dividend yields can change over time, and the yield is just one factor to consider when choosing an International ETF.

Conclusion

International ETFs can be a worthwhile investment option for any investor ranging from beginner to experienced. By investing in International ETFs, you can potentially diversify your investment portfolio and increase your returns. However, it is important to keep in mind the potential risks associated with investing in the global market, such as market volatility and currency exchange rate fluctuations.

International ETFs can offer the potential for greater diversification and higher returns, making them a worthwhile investment option for beginner investors. So, take the next step and start exploring International ETFs today with the help of online brokers and investing apps.