When it comes to ETFs, the old adage “knowledge is power” definitely applies. The more you know about how to research an ETF you're investing in, the better you'll be able to choose the right ones for your portfolio.

And don't worry if you're new to the game – I can help break down everything you need to know in so it becomes easier to make your next investing decisions.

From understanding the basics of ETFs to evaluating providers and monitoring your investments, this article will take you through the process.

If you're wondering how to research an ETF, the process involves looking into important details like what the ETF invests in and its associated costs. By learning more about the ETF you are considering, you can make sure it matches your investment goals and risk tolerance. This can give you the confidence to invest your money and help you feel good about your decision.

Understanding Your Investment Goals

Before investing in ETFs, you need to understand your investment goals. Knowing your investment objectives can help you choose an ETF that aligns with your investment goals and risk tolerance. There are various types of ETFs available, each with different investment objectives, asset classes, and risk levels.

Some ETFs invest in shares of Australian companies, while others invest in international shares or commodities like gold. Some ETFs track an index, while others follow an active investment strategy. Consider your time horizon, and risk tolerance to determine which type of ETF is right for you.

For example, if you're looking to grow your wealth over the long term, you might consider ETFs that offer exposure to stocks with long-term growth potential. If you're seeking a steady stream of income, you might consider ETFs that invest in bonds or other fixed-income securities.

By identifying your investment goals before researching ETFs, you can focus your research efforts on ETFs that are most likely to help you achieve your objectives.

Here are some examples of common investment themes that might help you when researching ETFs:

- Long-term wealth growth

- Capital preservation

- Income generation

- Retirement savings

- House deposit

- Tax efficiency

- Diversification

- Sector or market exposure

- Environmental, social, and governance (ESG) considerations

Personally, I am looking at long-term wealth growth outside of super so am focused on ETFs that provide that. I'll explain how I do that as we go on.

How many ETFs should I own as a beginner?

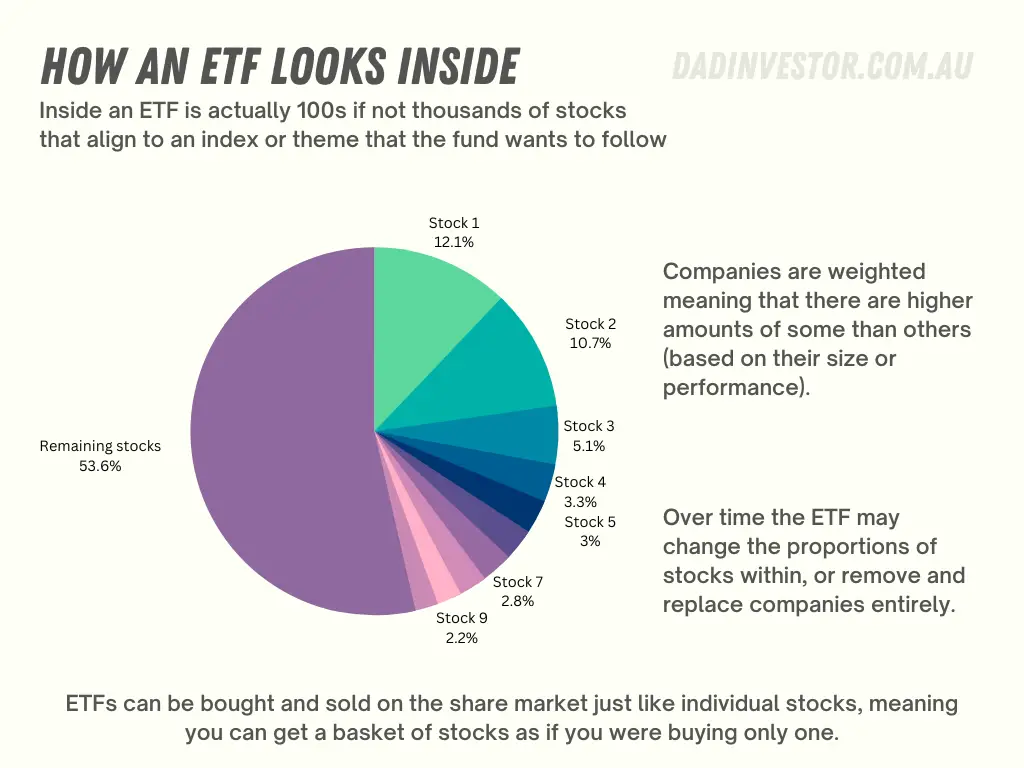

As a beginner, it is recommended to start with a few ETFs that align with your investment goals and risk tolerance. Holding three to five ETFs can provide sufficient diversification while keeping your portfolio manageable. The term diversification gets used a lot but even holding one ETF means you are being diversified due to it having tens, hundreds, or thousands of companies within.

The number of ETFs you should invest in depends on your investment goals and risk tolerance. Some famous investors suggest investing in a few ETFs to build a diversified portfolio that aligns with your investment goals.

- Warren Buffet suggests investing in a low-cost index fund that tracks the S&P 500.

- Jack Bogle, the founder of Vanguard, suggests investing in three to five broad-based index funds that provide exposure to different asset classes, such as stocks, bonds, and real estate.

Ultimately, the right number of ETFs for your portfolio depends on your investment goals and the level of diversification you need. For me, I invested in a lot of ETFs early and ended up with nearly 20 at one stage. It was just too much to keep on top of and manage, especially when working out what to buy more of.

How long should you hold an ETF?

The holding period for an ETF depends on your investment goals and market conditions. Generally, holding an ETF for at least three to five years can help you ride out short-term market fluctuations and potentially benefit from long-term market growth. Some more specific ETFs that target an industry (tech) or corner of the market (lithium batteries) might need more time for their potential to be realised in share price growth.

Do ETFs pay dividends?

Yes, ETFs can pay dividends. The amount and frequency of dividends can vary depending on the ETF's holdings and investment strategy. The frequencies of dividends paid are usually either quarterly, twice a year, or semi-annually and annually. Australian listed companies tend to deliver higher yields compared to around the world and you will see ETFs covering the ASX200 have a higher dividend compared to global ETFs.

How many ETFs are enough?

The number of ETFs you hold depends on your investment goals and risk tolerance. Holding a few ETFs that provide diversification can be sufficient, but you may choose to hold more or fewer ETFs based on your preferences and investment strategy.

Analyze the ETF (what should I look for?)

Analyzing an ETF involves reviewing aspects of the fund such as its objective, holdings, and fees. These can all be easily found via the product page and fact sheets that the ETF providers are obliged to provide potential investors.

Understanding these factors can help you determine if an ETF is a good investment for you.

Find the ETF product page

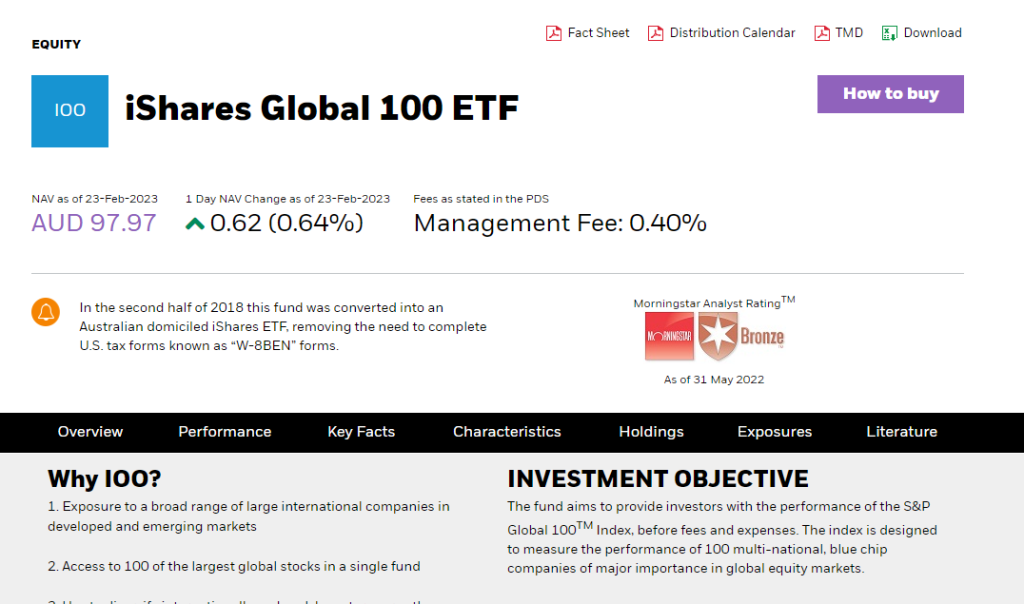

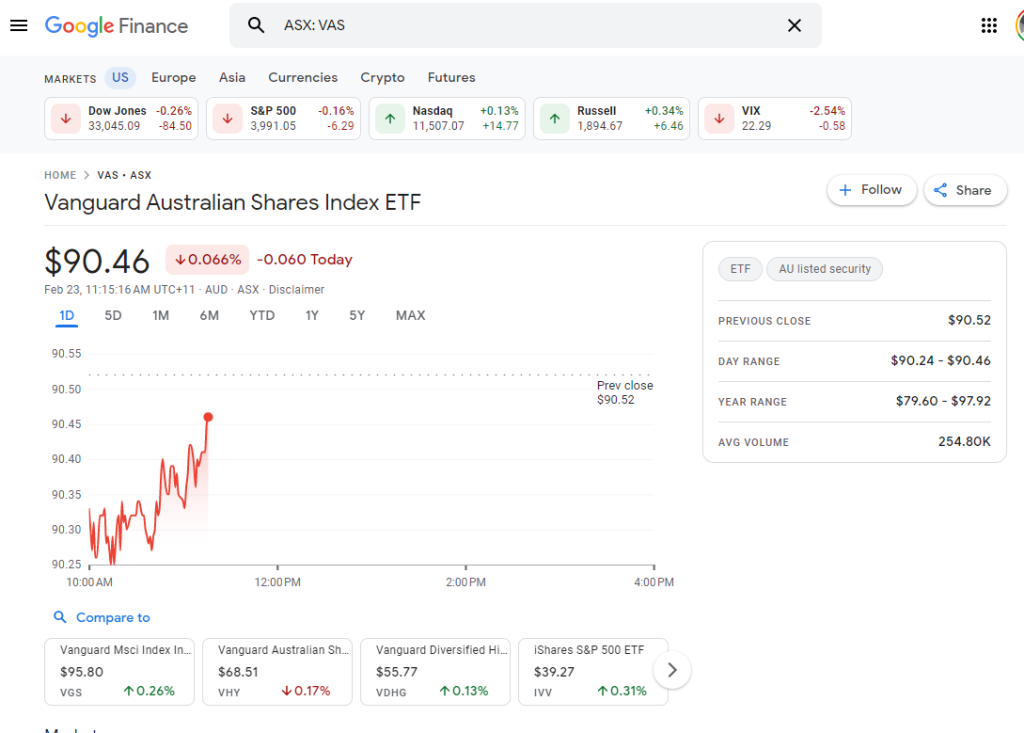

An ETF product page is a webpage that provides detailed information about a specific exchange-traded fund (ETF). These pages are typically hosted by the ETF provider, such as Vanguard, iShares, or BetaShares, and they provide valuable information that can help investors make informed decisions about whether to invest in the ETF.

Examples of ASX ETF product pages

- iShares Global 100 ETF (IOO)

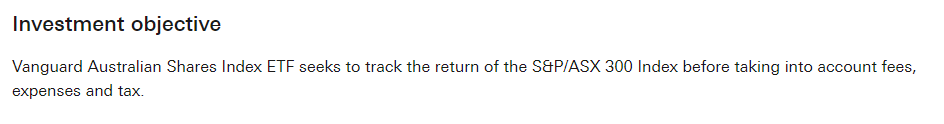

- Vanguard Australian Shares Index ETF (VAS)

- Diversified All Growth ETF (DHHF)

What should I research before buying an ETF?

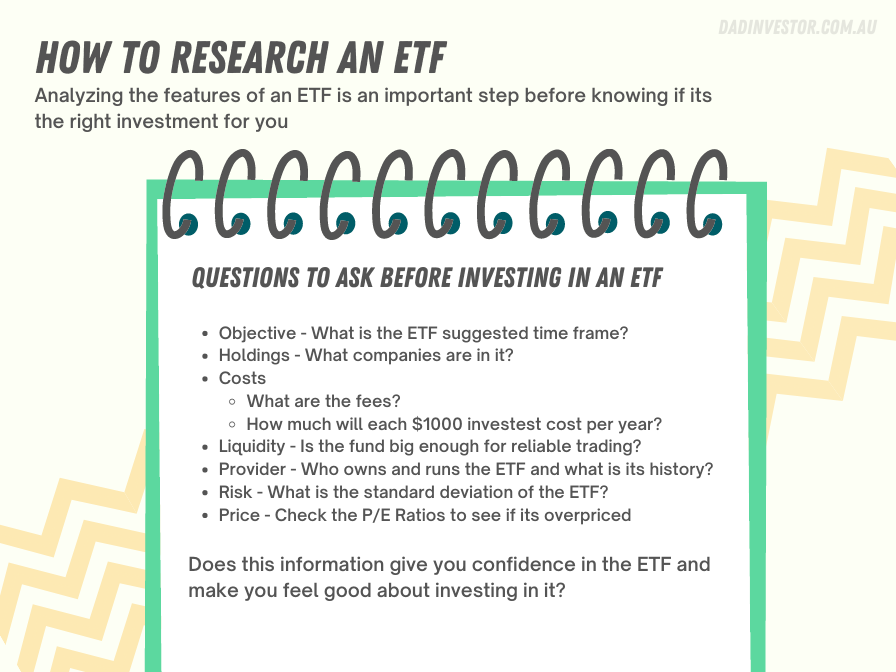

When researching an ETF, you should consider several factors to help make your decision on what to invest in. These include the fund's investment objective, holdings, fees, liquidity, and performance. These metrics can help you compare ETFs and evaluate their risk and return potential.

The information you can find on an ETF product page can vary depending on the provider and the specific ETF. Here is an explanation of each of the metrics you may find (in order of what I think is important):

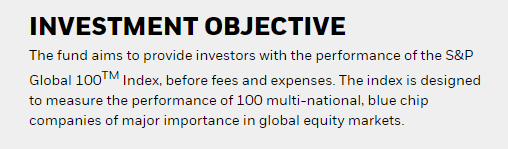

Objective: Understand the ETF's investment objective and how it aligns with your investment goals.

ETF objectives can vary widely, depending on the type of ETF and the underlying assets it holds. Depending on what the holdings are in the ETF will depend on what a suggested time frame to invest in them would be. This information should be mentioned by the ETF provider on the product page Here are a few examples of ETF objectives:

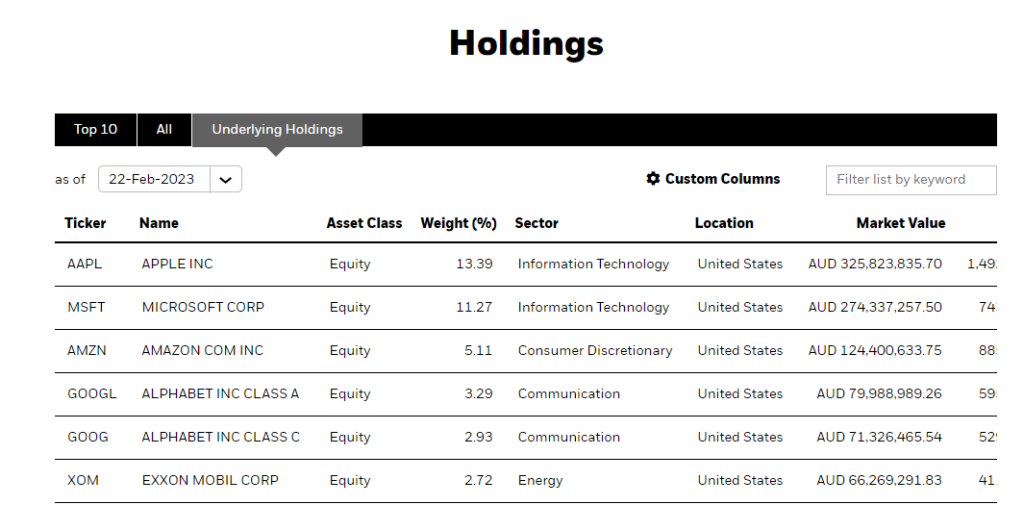

Holdings are the securities or companies that the ETF holds in its portfolio. Understanding the holdings of an ETF can help you determine its level of diversification, exposure to specific sectors, and potential concentration risk. Analyze the ETF's holdings to determine its level of diversification, exposure to specific sectors, and potential concentration risk.

Fees are the costs associated with investing in the ETF and include management fees, transaction fees, and other expenses.

Evaluating the fees of the ETF can help you determine if it is a good value for your investment. Liquidity is the ease of buying and selling the ETF in the market. Evaluating the liquidity of an ETF can help you ensure that there is enough trading volume and that you can buy and sell the ETF when you need to. ETFs charge a management fee for their services. Analyze the fees of the ETFs you're considering to determine which ones offer the best value for your investment.

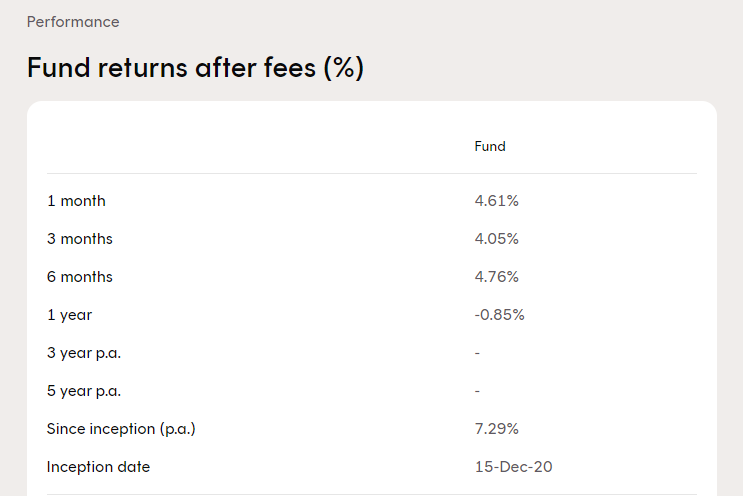

Performance is a critical metric when evaluating an ETF. You can measure performance by looking at how the ETF has performed relative to its benchmark index and other ETFs with similar investment objectives. You can also look at the ETF's total return, which includes both price changes and any dividends or distributions paid to investors.

Liquidity: Look at the ETF's liquidity to ensure that there is enough trading volume and that you can buy and sell the ETF when you need to. Less popular ETFs have lower liquidity meaning not many people own them or trade them. This is only a problem when the provider shuts down the ETF due to lack of investor interest or you want to see it for a good price and no one is buying.

Provider: Evaluate the provider of the ETF, including their reputation, experience, and fees. Examples here include Vanguard, iShares, and Betashares along with smaller providers VanEck and Global X.

Risk is another essential factor to consider when evaluating an ETF's performance. You can assess risk by looking at the ETF's what's labeled as standard deviation, which measures the degree of fluctuation in the ETF's price over time. A lower standard deviation indicates less volatility and lower risk, while a higher standard deviation indicates more volatility and higher risk.

How do you know if an ETF is overpriced?

An overpriced ETF means that the price of the ETF is too high compared to what it is worth. This can happen if there is too much demand for the ETF or if people are willing to pay more for it than it is worth. It's essential to pay attention to the price of an ETF before investing because an overpriced ETF may not offer good value for your investment.

The P/E ratio, or price-to-earnings ratio, is a way to measure how much investors are willing to pay for each dollar of earnings that a company or ETF generates. A high P/E ratio means that investors are willing to pay more for each dollar of earnings, which may indicate that the company or ETF is overvalued. A low P/E ratio means that investors are paying less for each dollar of earnings, which may indicate that the company or ETF is undervalued.

How do you measure the risk of an ETF?

To measure the risk of an ETF, review the standard deviation of its returns. Standard deviation is a measure of volatility and reflects how much the ETF's returns vary from its average return. A higher standard deviation means greater risk, and a lower standard deviation means lower risk. Reviewing the standard deviation of an ETF can help you understand its level of risk and make informed investment decisions.

How do I monitor an ETF?

You can monitor an ETF by tracking its performance, watching its holdings, and staying informed about market trends. You can monitor an ETF by tracking its performance and staying informed about market trends. Google Finance lets you add stocks or ETFs to its dashboard allowing you to connect with its price movements, performance, and related news.

If you own the ETF you can use a portfolio tracker like Sharesight can help you keep track of your ETF's performance and make informed investment decisions. Sharesight provides an online platform to manage your portfolio, view your investment performance, and track dividends and other income. It's what I use but you can also use a simple tracking spreadsheet.

DadInvestor's Take

Sharesight is a helpful tool for tracking and analyzing your investments. It shows your portfolio's performance, taxes, and dividends all in one place.

- Key features: Aggregation of investments, share tracking, live updates

- Best for: Replacing spreadsheet to track shares, tax reporting on investments, researching growth, dividends, and total returns of stocks

- Price: Free $0 plan up to $49 per month (depending on features and number of holdings)

Evaluating ETF Providers (Vanguard vs Betashares vs iShares)

Evaluating ETF Providers is another step to take when researching ETFs. While there is no way to define which provider is “best” you can find one that is going to be most aligned with your needs or values.

Consider the following factors when evaluating ETF providers:

- Reputation and Track Record: Look for a provider with a proven history of managing ETFs successfully and delivering strong investment returns to investors. Check the provider's regulatory history and any disciplinary actions taken against the company.

- Management Team Experience and Expertise: Look for a team with deep experience in the asset class or sector that the ETF covers. The management team should have a strong understanding of the market and be able to make informed investment decisions to maximize returns and manage risk.

- Fees: Look for providers that offer competitive fees relative to their peers. Low fees can help you keep more of your investment returns and increase your overall investment performance.

- Customer Service and Support: Look for providers that are responsive to investor inquiries and provide helpful resources to help you make informed investment decisions.

- ETF Selection: Consider the range of ETFs offered by the provider and whether they provide enough diversification for your portfolio. Check whether the provider offers ETFs that cover different regions, sectors, and asset classes.

- Tracking Error: Look at the historical tracking error of the provider's ETFs, which measures how closely the ETF tracks its underlying index. Lower tracking errors indicate better performance relative to the index.

By choosing the right provider, you can help ensure that your investment is well-managed and has the best chance of delivering strong investment returns.

I can confidently say that investing in ETFs is a powerful strategy for building long-term wealth. ETFs offer diversification and flexibility making them a popular choice for many investors.

To get started you should identify your investment objectives and understand the different types of ETFs available. This will help you choose the right ETFs for your portfolio and ensure that they align with your investment goals. Once you've selected your ETFs, it's important to monitor your investments regularly to ensure that they continue to meet your objectives.

Remember that investing in ETFs is a long-term strategy that requires discipline and patience. Market fluctuations and short-term volatility are a natural part of investing, but by staying focused on your investment goals and remaining disciplined, you can build a portfolio that delivers long-term growth and stability.