After years of owning many, many ETFs I've come full circle and found that the only way for me to be a simple, savvy investor is to own one single ETF.

This isn't to say that this is the ETF everyone should be buying, but that in my opinion it's the best one and only one I want to own.

I'm going to expand on that and explain why I came to that conclusion, what the ETF is, and how it compares to other popular choices in the market.

I know I like reading the strategies of others so I'm just someone who wants to explain my own personal position on the investment decisions I make. It may help you if you are trying to understand why ETFs are worth investing in or what ETF is the right choice for you.

The best ETF in Australia?

The only ETF on the ASX I currently own is the iShares Global 100 ETF or IOO.

I've owned it on and off for a while but now plan to buy and hold it ongoing as a core part of building my share portfolio.

Now, this is what I've picked based on my nearly 20 years of investing in the share market. I've come a long way and finally found what I think is a sweet spot of simplicity, performance, and low-cost investing that I can easily stick to for a very long time.

Years ago I started stockpiling ETFs like they were collectibles. I had one for every kind of theme – batteries, cybersecurity, healthcare, emerging markets, local small caps – and many more. I go to a stage where I would need to remind myself what I was actually investing in.

Recently I've worked towards becoming a more minimal, focused investor. For now, I'll be sticking to this one ETF, buying into it monthly through Stake and doing that for longer than most people.

What is iShares Global 100 ETF?

The iShares Global 100 ETF is an exchange-traded fund that aims to track the performance of the S&P Global 100 Index. This index is made up of 100 of the largest companies in the world and is designed to provide exposure to global stocks or shares of these companies. The ETF is managed by BlackRock and is traded on stock exchanges around the world under the symbol IOO.

From an Australian perspective, the iShares Global 100 ETF is listed on the ASX under the ticker symbol IOO. It is available for trading on the ASX during regular market hours and can be bought and sold like any other stock.

Inside the ETF is a diversified portfolio of global blue-chip companies with a focus on developed markets such as the US, Europe, and Japan. These holdings are weighted by market cap (which is the size of it in terms of dollar value).

The largest companies represent a larger portion of the fund than smaller companies. This means you'll see some of the biggest most valuable companies included in it such as Apple, Microsoft, Amazon, and Facebook.

What index does IOO track?

IOO tracks the S&P Global 100 Index which includes the 100 largest, most traded companies in the world, across multiple sectors and industries.

These companies are selected based on how often they are traded, their size, and their ability to operate across the globe.

The S&P Global 100 Index is made up of companies from developed markets including the United States, Europe, and Japan, and also includes companies from emerging markets like China (Tencent) and South Korea (Samsung).

You would call this a broad-market benchmark and one that covers global shares or stocks in particular.

It's a bit different to say the S&P 500 which is purely US listed companies and I believe is a nice spread of how the world market is made up.

What is IOO made up of?

Inside the iShares Global 100 ETF, you'll find a diversified portfolio of global blue-chip companies that are included in the S&P Global 100 Index.

The fund's holdings are weighted by market capitalization, with the largest companies representing a larger portion of the fund than smaller companies.

Some of the top holdings of the iShares Global 100 ETF include Apple, Microsoft, Amazon, and Facebook.

A common thought is that the Global 100 is the biggest 100 companies in the world, which is not entirely true.

There is a bit of screening that happens for companies to be able to make it.

To make it in this index and ETF you need to pass these criteria:

- Must have global exposure which means

- 30% of revenue comes from outside the country it bases itself and

- 30% of its assets are located outside of its home country

- Revenue must come from three regions including North America, Europe, and Asia/Pacific

- Size of the company must have a market cap of at least $5 billion

These are the main criteria that will weed out the vast majority of companies that qualify, from there it's about how big the company is, and that determines the top 100.

It's also why you won't see companies like TSLA, META or COSTCO in the Global 100 as they don't either make those revenue numbers or have enough assets outside of its home region.

To me, this adds some reasonable intention to how the ETF is put together.

It's not just the top 100, but 100 of the most well spread and known businesses across the globe.

Does IOO pay dividends?

Yes, the iShares Global 100 ETF (IOO) pays dividends to its shareholders.

As is the way ETFs work, IOO holds a portfolio of underlying company stocks, and those stocks pay dividends to the fund.

The dividends that the fund receives are then distributed to the ETF's shareholders on a regular basis, which is semi-annually or twice a year for the ASX version of IOO.

As of July 2024, the trailing yield was under 1% at .93%.

The number of dividends paid to shareholders will depend on the dividends received by the underlying stocks held by the ETF.

How can I invest in IOO?

In Australia, there are a few different ways you can invest in IOO and similar ETFs

It all depends on how often you want to buy the ETF and what amount you will put in.

Here are three ways to buy IOO in Australia:

- Buy manually through a traditional online broker (like Stake) – This is where you can for those who want to invest a larger amount (more than $500) when they like and pay for the cost of that each time they trade. Stake costs $3 to buy or sell IOO. This is the option I take personally and invest on the first Friday of each month adding money into Stake and buying IOO through there.

- Use a subscription investing app (like Raiz) – An investing app like Raiz will charge you a monthly fee no matter how often you buy or sell. The beauty of this is that you can also add as little as $5 each time you invest. So if you are looking to invest small this is probably a better option. IOO can be found by using the custom portfolio option where you can select from a list of ETFs to build your own portfolio.

- Use an online broker suited to lower amounts (like CommSec pocket) – Similar to Stake, CommSec Pockets will allow you to buy IOO through its app but at a better price if you have less than $1000 to invest. It will only cost you $2 and the minimum you need to invest and buy IOO is the price of its share which varies but has been under $100 recently. This is suited to more infrequent traders.

IOO Performance

if you need something more solid to understand why I invest in IOO then let's look at the numbers.

Specifically, the cost, performance, and risk IOO offers compared to the popular ETFs on the ASX.

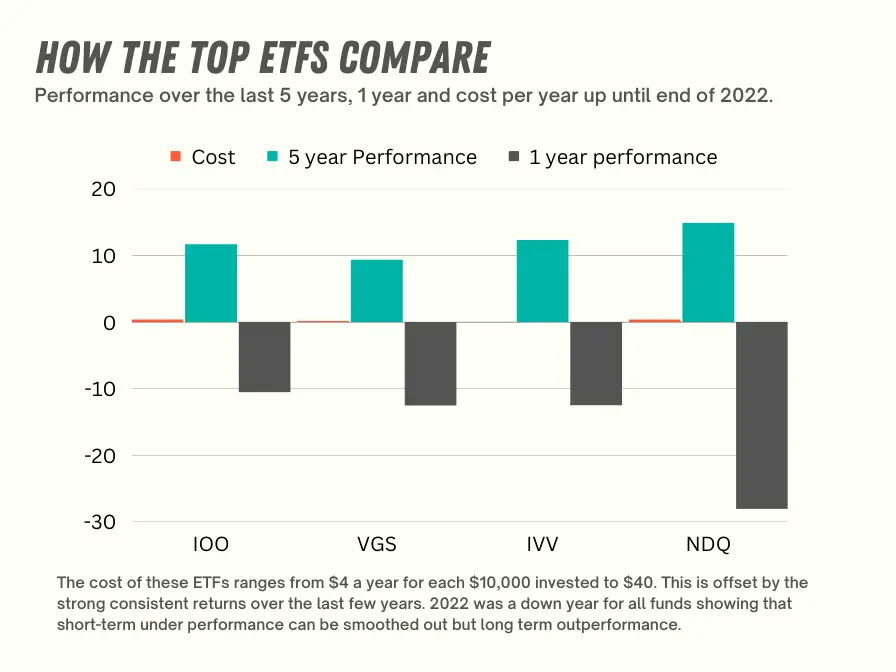

If you look at the graphic below, you'll see that IOO is one of the better-performing ETFs.

When I say performance, I mean not just the growth it has in good years but the drops it had in bad years.

In 2022, the market dropped significantly (compared to years of strong performance). IOO had a drop, but not to the extent that its peers did.

So while it can outperform during the good times, it smooths the ride when it's not so good which I like.

This is a review of the 2022 period.

IOO vs VGS

VGS is Vanguard's International Shares Fund ETF. It holds over a thousand stocks ranging from countries around the world.

It is a cheaper option though being nearly half the cost of IOO. In terms of risk, I use the standard deviation (SD) as a measure of that.

This isn't volatility per se but more the chance of you cashing out with less money than you put in.

A higher SD means a risker fund or asset.

Here IOO and VGS are near equal.

| ETF | Price | 5-year total return | Risk (Standard Deviation) | Holdings |

|---|---|---|---|---|

| VGS | 0.18% | 12.55% p.a. | 11.77 | 1465 |

| IOO | 0.40% | 17.12% p.a. | 11.91 | 100 |

With the biggest differences being price and holdings some investors may look to increase there diversification at half the price of IOO through VGS.

IOO vs IVV

IVV is one of the cheapest ETFs you can get in Australia.

At .04% you are only paying 10% of what IOO charges a year of $4 for every $10,000 you invest.

It makes complete sense to invest in IVV when you look at performance as well and with only around 500 companies inside the portfolio it's a solid mix of assets.

I used to own IVV, but for me it's more about thinking globally.

IVV is purely focused on the US markets, and yes they are the strongest in the world there are still some great companies that are not listed there.

Nestle, Samsung, BHP, Sony, and Toyota are all names found in IOO but will not appear in IVV which tracks the S&P 500.

You'll find the risk is also slightly higher with IVV over IOO, and for me, the risk is there investing in one country or region only.

Who knows how long the US markets remain the strongest?

| ETF | Price | 5-year total return | Risk | Holdings |

|---|---|---|---|---|

| IVV | 0.04% | 15.32% p.a. | 12.77 | 500 |

| IOO | 0.4% | 17.12% p.a. | 11.91 | 100 |

IOO vs NDQ

NDQ is a match in size for IOO as it also looks to invest in 100 companies within its fund.

The difference is that it focuses on one stock market within one country – the NASDAQ in the US.

The reason NDQ has become so popular is the focus on tech stocks.

This sector has been outperforming over the last few years and NDQ has nearly 50% of the companies it holds from that industry.

Tesla, and Meta are some popular companies feature in NDQ but not IOO.

If you look at performance NDQ as great up until the downturn in 2022.

After that it was one of the worst performers, losing 28% in that year.

For me, I can see the value of an ETF like NDQ when times are good but when they are not you are really pigeon-holed into a specific sector, market, and region.

That's why again I like IOO.

It's diversified in many ways – across the country. sector, market, and size.

Look how much the standard deviation jumps when you start niching down your investing into specifics like sectors, even with 100 holdings to spread that risk.

| ETF | Price | 5 year total return | Risk | Holdings |

|---|---|---|---|---|

| NDQ | 0.38% | 21.37% p.a. | 16.71 | 100 |

| IOO | 0.40% | 17.12% p.a. | 11.91 | 100 |

Risk Assessment: Volatility and Risk-Adjusted Returns

Understanding the risk profile of any investment is essential for making informed decisions.

Since I am slowing building a large amount of money with my investments, I need to make sure I'm not putting it at too much risk.

Doing your due diligence before owning anything helps you understand the likelihood of you gaining money over the longer term, which is how I view risk

For IOO and the comparative ETFs (VGS, IVV, NDQ), we'll can focus on two key metrics to gauge risk:

- Standard Deviation (Volatility): This measures how much an investment's returns fluctuate over time. A higher standard deviation indicates greater price swings, suggesting higher volatility and potentially higher risk.

- Sharpe Ratio (Risk-Adjusted Return): This metric evaluates an investment's return relative to its risk. It calculates the excess return earned per unit of volatility. A higher Sharpe ratio indicates better risk-adjusted performance, meaning investors are compensated more for the risk they are taking.

IOO's Risk Profile

Over the past five years (ending June 2024), IOO has demonstrated the following risk characteristics:

- Standard Deviation: 11.91. This indicates a moderate level of volatility compared to the other ETFs, suggesting potential price fluctuations but not extreme swings.

- Sharpe Ratio: 1.28. This is the highest Sharpe ratio among the compared ETFs, signifying that IOO has delivered superior risk-adjusted returns over this period. Investors in IOO have been rewarded well for the risk they've undertaken.

Comparative Analysis of ETF risk

| ETF | Standard Deviation (5-Year) | Sharpe Ratio (5-Year) |

|---|---|---|

| IOO | 11.91 | 1.28 |

| VGS | 11.77 | 0.97 |

| IVV | 12.77 | 1.10 |

| NDQ | 16.71 | 1.20 |

While IOO and VGS share similar volatility levels, IOO outperforms VGS significantly in terms of risk-adjusted returns.

IVV, tracking the broader U.S. market, is slightly more volatile than IOO, with marginally lower risk-adjusted returns.

NDQ, focused on the tech-heavy Nasdaq 100, emerges as the most volatile but also offers competitive risk-adjusted returns, though not as high as IOO.

Remember though

- Past Performance Is Not Indicative of Future Results: While these historical metrics are informative, it's crucial to remember that past performance doesn't guarantee future success. Market conditions can change, affecting investment outcomes.

- Individual Risk Tolerance: Each investor has a unique risk tolerance. Even with strong historical risk-adjusted returns, IOO's volatility may not align with everyone's comfort level. It's essential to assess your personal risk tolerance before making any investment decisions.

More considerations for IOO

Now even though IOO is my choice for ASX ETFs, I want to highlight some considerations to balance our this report.

- First off, this fund's totally focuses on large caps. At 100 of the largest companies in the world this means you're not getting any action from mid or small cap companies.

- More than three-quarters of this fund is invested in the US. It's like putting most of your eggs in one basket, region-wise but also consider that the US is one of the dominant markets in the world.

- Since there are only 100 companies in it a single company, like Apple, becomes a whopping 12% of your entire portfolio.

- There are many “more diversified” funds out there like VGS that include many more companies to spread your investments around. Personally, I feel diversification can be interpreted in a number of different ways so that would be up to you to consider whether more holdings are a benefit.

- The price at 0.40%. You could go for international shares funds, like VGS, which are less than half this price. I feel the price is justified in the long-term returns and also Sharpe ratio value.

Conclusion: I'm going to be investing in IOO for a while

I wanted to just open up my thought process a bit and explain to you why I own what I do I hope it helps.

Not to say you should go with IOO but to consider going through the amount of due diligence I do so that you can sleep at night knowing your money is working but also at the right level of risk.

As much as I like the thought of finding the next best thing, I think I've found it in IOO.

For me, it is the best ETF in Australia.

That's me though so consider your situation before investing in something like this.

There are many ETFs to pick from, and IOO may be for you or it could be 15 – that's up to you.