Investing in the stock market has never been easier, thanks to platforms like Raiz that allow people to build diversified portfolios with the click of a button or tap of a screen.

Over the years Raiz has expanded its offerings to include an impressive array of investment options, catering to a wide range of investment strategies and preferences.

Among these options are 30 different ASX-listed Exchange-Traded Funds (ETFs), Bitcoin, and a property fund, providing investors with the opportunity to diversify their Raiz portfolios across various asset classes and geographical regions.

Here is the entire list of what ETFs you can invest in through the platform.

Australian ETFs for Local Investors

For those who prefer to invest closer to home, Raiz provides a variety of Australian ETFs, including:

- STW – Australian Large Cap Stocks – Invest in the top 200 companies of the Australian market.

- RARI – Australian Socially Responsible ETF – Choose Australian companies with a responsible ethos.

- FAIR – Australian Sustainable Leaders

- VSO – Australian Small Companies

- VETH – Vanguard Australia‘s Ethically Conscious Australian Shares

- SYI – Australian High Dividend: Seek out Australian companies with high dividend returns

- IOZ – Alternative to STW that follows the ASX200

- QRE – Australian Resources Sector ETF that follows companies like Rio Tinto and BHP

- VAP – Vanguard's ETF that targets the top 300 REITs in Australia or companies that own commercial, residential and industrial property

- VAS – Most popular ETF in Australia that holds the top 300 companies on the ASX

Global Reach with ETFs

For those looking to invest beyond Australian borders, Raiz offers a selection of global ETFs that cover some of the world's most influential markets and sectors.

These ETFs include:

- IOO – Global 100: Gain exposure to the 100 largest global companies.

- IAA – Asia Large Cap Stocks: Tap into the growth potential of Asia's largest companies.

- IEU – Europe Large Cap Stocks: Invest in Europe's leading companies.

- IVV – US Large Cap Stocks: Get a piece of the largest U.S. companies.

- ETHI – Global Socially Responsible: Make an impact with investments in socially responsible global companies.

- NDQ – Nasdaq 100: Focus on technology and innovation with the top 100 non-financial companies listed on the NASDAQ.

- VGE – Emerging Markets: Explore the growth potential in emerging markets.

- WDIV – Global Dividend Fund: Target global companies with a strong dividend yield.

- QUAL – International Quality: Select companies based on their long-term stability and profitability.

- IWLD – World Markets excluding Australia: Diversify with international markets while excluding Australian stocks.

- ERTH – An ETF that targets companies who focus on climate change innovation

- SPY – An alternative to IVV with a fund that tracks the S&P500

- VEFI – A Bond option that is globally consious

- VESG – Similar to ETHI, Vanguards version of an ethically conscious international shares fund

- VEU – Emerging markets options that covers companies from India, Brazil and more developing nations

- VGS – A broad international ETF that covers the biggest company globally excluding Australia

Fixed Interest and Cash Options for Stability

For those who value stability or are looking for less volatile investment options, Raiz offers several fixed-interest and cash ETFs:

- AAA – Cash ETF

- IAF – Australian Bonds

- RCB – Australian Corporate Bonds

- VEFI – Ethically Conscious Global Bonds: Access global bonds through an ethically conscious lens.

- VACF – Australian Corporate Bonds: Further diversify with more options in Australian corporate bonds.

Trend, Themed, and Sector-Focused ETFs for Specific Interests

Investors with specific interests or beliefs in certain trends and sectors have a variety of ETFs to choose from:

- IXJ – Global Healthcare: Tap into the healthcare sector across the globe

- IFRA – Global Infrastructure: Invest in the backbone of global economies with a focus on infrastructure.

- ERTH – Climate Change Innovation: Support companies driving innovation to combat climate change.

- HACK – Global Cybersecurity: Protect your portfolio with companies specializing in cybersecurity.

- ACDC – Battery Tech & Lithium: Charge your investment with the growing battery technology and lithium sector.

- QAU – iShares Gold Bullion: Hedge against market volatility with gold bullion holdings.

- RBTZ – Robotics: Embrace the future with investments in robotics.

- SEMI – Semiconductors: Tap into the core of modern technology with semiconductor companies.

- ROBO – Robotics and Automation: Further invest in advancing robotics and automation technologies.

- FANG – Follow the 10 hottest tech stocks from META to TSLA, Apple, Netflix all in the one ETf

Bitcoin and Property for Alternative Investments

Beyond the ETFs above there are two more options for those looking to branch out into alternative investments:

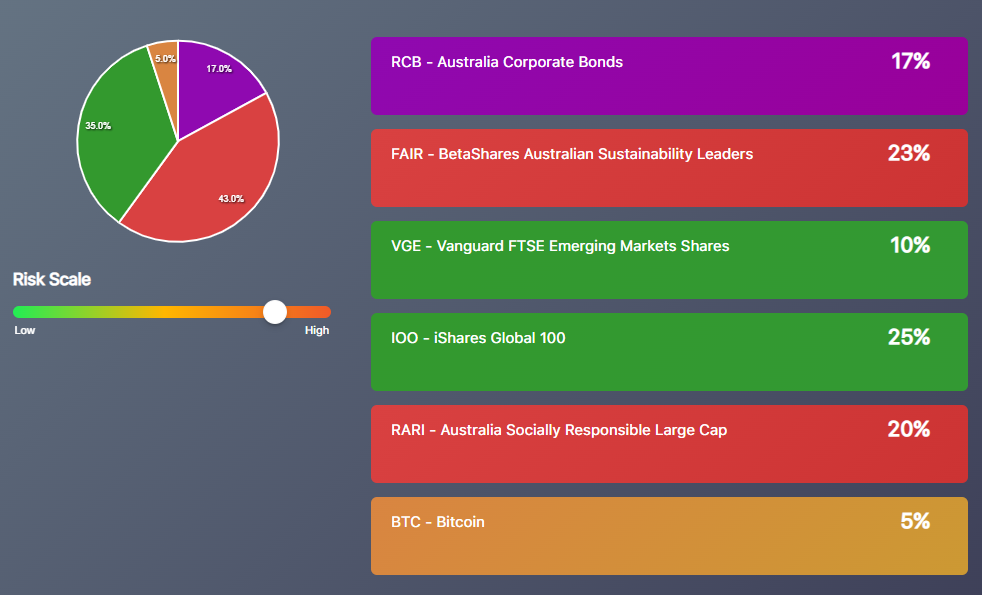

- Bitcoin: Raiz allows for investment in Bitcoin but limits it to no more than 5% of the overall portfolio, acknowledging its potential while also recognizing its volatility.

- RPF – Raiz Property Fund: This option, although not a listed ETF, provides investors with the opportunity to invest in the property market, adding another layer of diversification to their portfolios.

With Raiz's extensive range of ETFs and investment options, individual investors have the ability to tailor their investment strategy to match their financial goals, risk tolerance, and personal interests.

Whether you're a seasoned investor or just starting out, Raiz's platform simplifies the process of building a diversified portfolio.

Customization and Control

The inclusion of such a wide variety of ETFs in the Raiz Plus portfolio allows investors to customize their investment mix with precision.

From focusing on large-cap stocks that offer stability to venturing into thematic ETFs that align with future trends, the choices are abundant.

The platform's user-friendly interface makes it straightforward for investors to adjust their holdings, track performance, and rebalance their portfolios as needed.

Strategic Investment with a Conscious Approach

Increasingly, investors are looking to make a positive impact with their money.

Raiz addresses this demand by offering several socially responsible and ethically conscious ETFs.

These funds are designed to invest in companies that meet certain environmental, social, and governance (ESG) criteria, allowing investors to support practices and industries that align with their values while pursuing financial returns.

The Raiz experience

Raiz's approach to investment is not just about offering a wide range of ETFs.

It's also about accessibility and education.

The investing app platform provides resources and tools to help investors understand market dynamics and make informed decisions.

Additionally, features like round-ups and recurring investments encourage consistent investing habits, which can be beneficial for long-term wealth accumulation.